Behold! Tether unveiled its Q2 2025 Attestation Report, revealing a scandalous plunge in US Treasury bond purchases. Once gallantly waving $65 billion in Q1, now limping with a mere $7 billion! Oh, the drama of financial courtship!

While our hero diversifies—embracing Bitcoin, gold, and some corporate dalliance—its “cash equivalents,” those loyal but less flashy bonds and repurchase agreements, barely twitched. Compliance with the GENIUS Act, that fickle mistress, might prove a challenge indeed.

Why Has Tether Fallen Out of Love with US Treasuries?

The grand stablecoin sovereign, Tether, once wooed US Treasury bonds passionately, funding over 120 ventures. Yet, in this latest chapter, it claims a modest uptick in Treasury holdings, as if to say, “I’m here, but just barely.”

Tether just dropped its quarterly attestation for Q2 2025.

Highlights as of 30th June 2025:

* 157.1B USDT tokens fluttering in the wild.

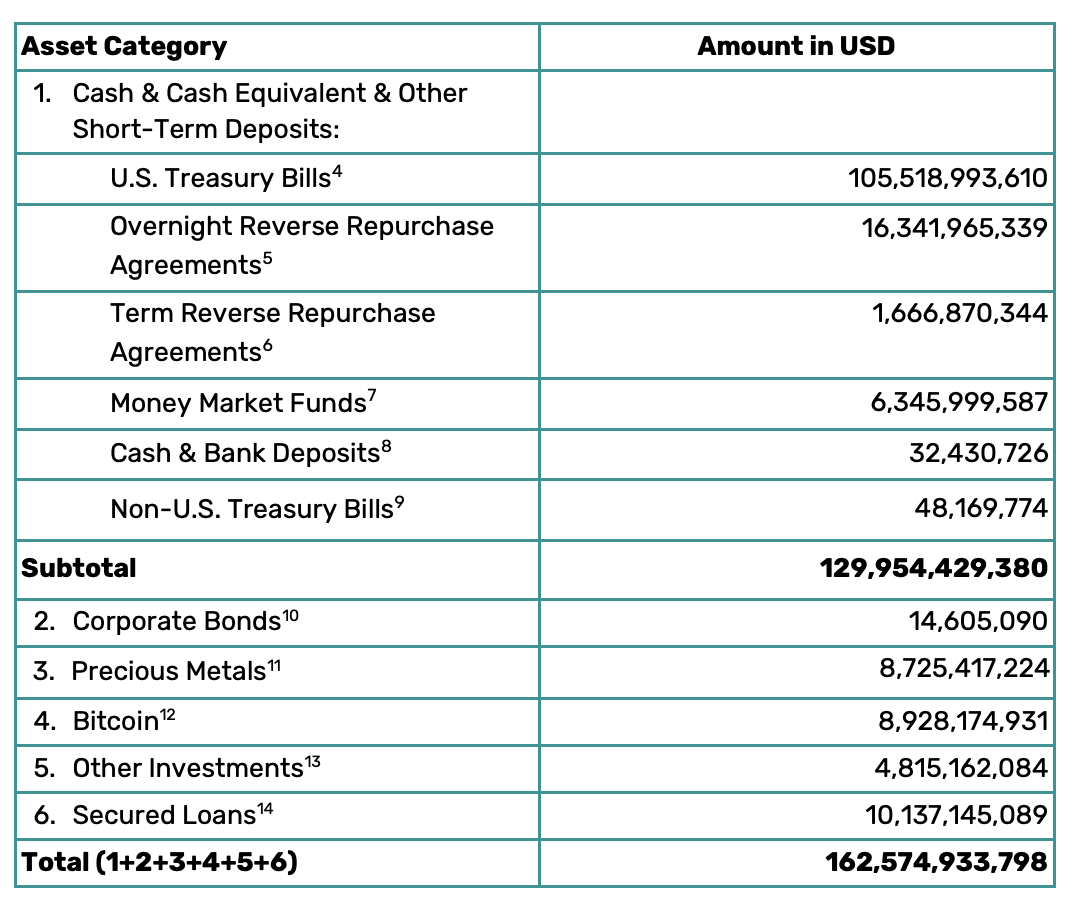

* 162.5B in total assets/reserves—oh, the riches!

* 5.47B excess reserves, atop the 100% liquid asset fortress backing all issued tokens…— Paolo Ardoino (@paoloardoino) July 31, 2025

Currently, Tether clutches $105.5 billion in US Treasuries, with an additional $24.4 billion sneaking through indirect channels—Overnight Reverse Repurchase Agreements and foreign bonds, perhaps European love letters to MiCA compliance.

The reason? Regulations! The dreaded GENIUS Act demands stablecoin monarchs keep treasure chests brimming with US Treasuries. A noble cause, but a thorn in Tether’s side.

Yet, Tether, ever the cunning suitor, lobbied vigorously for this very law—perhaps knowing the dance steps all too well.

Since MiCA’s debut, Tether’s appetite for Treasury bonds grew monstrous: $33 billion in Q4 2024, then a jaw-dropping $65 billion in Q1 2025.

But alas, the latest report tells a quieter tale—less than $7 billion added in all of Q2. A hint of fatigue or a new strategy brewing?

Meanwhile, its non-US Treasury stash shrank by a hefty $17 billion, and other “cash equivalents” barely moved—less than a billion here or there. Diversification or distraction? Bitcoin and gold beckon, but the Treasury romance cools.

What to make of this? CEO Paolo Ardoino proudly notes Tether has issued over $50 billion more USDT tokens than US Treasuries held. Future GENIUS Act compliance might just be the cliffhanger we never saw coming.

Bond market woes? Strategic pivot? The plot thickens, dear reader. Stay tuned for the next episode in the saga of Tether’s treasury tango. 💃📉

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- How to Build a Waterfall in Enshrouded

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

- Meet the cast of Mighty Nein: Every Critical Role character explained

2025-07-31 21:56