- Seeing a solo miner claim a big reward might trigger a psychological effect on other Bitcoin holders.

- It could potentially alter the landscape of mining in the long-term.

As an analyst with years of experience navigating the tumultuous waters of cryptocurrency markets, I can confidently say that the solo miner’s recent big win has sent ripples through the Bitcoin community. This unexpected event serves as a stark reminder of the unpredictable nature of this market and the potential for massive rewards for those who dare to venture into it.

Amidst the volatile “high-risk” market, where cautiousness rather than greed seems to be the prevailing sentiment among Bitcoin [BTC] investors, I’ve noticed that one particularly fortunate individual managed to cash out, not due to market anxiety but purely by chance.

At a price of $97,475 per Bitcoin, this miner successfully claimed 3.195 Bitcoins, resulting in a total revenue of approximately $311,432 upon exit. The surprising part? Contrary to expectations, this wasn’t a large-scale investor or an institution – it was an individual miner operating independently.

Typically, miners tend to swiftly withdraw their investments when Bitcoin experiences heightened fear, uncertainty, and doubt (FUD), thereby pocketing any gains from their mining expenses. However, an unconventional action taken by a solitary miner has sparked intrigue at AMBCrypto.

Sell-the-news event?

It’s not surprising at all – mining a single Bitcoin block isn’t a simple task. It demands considerable computational resources, top-notch equipment, and substantial electricity costs, which can accumulate rapidly.

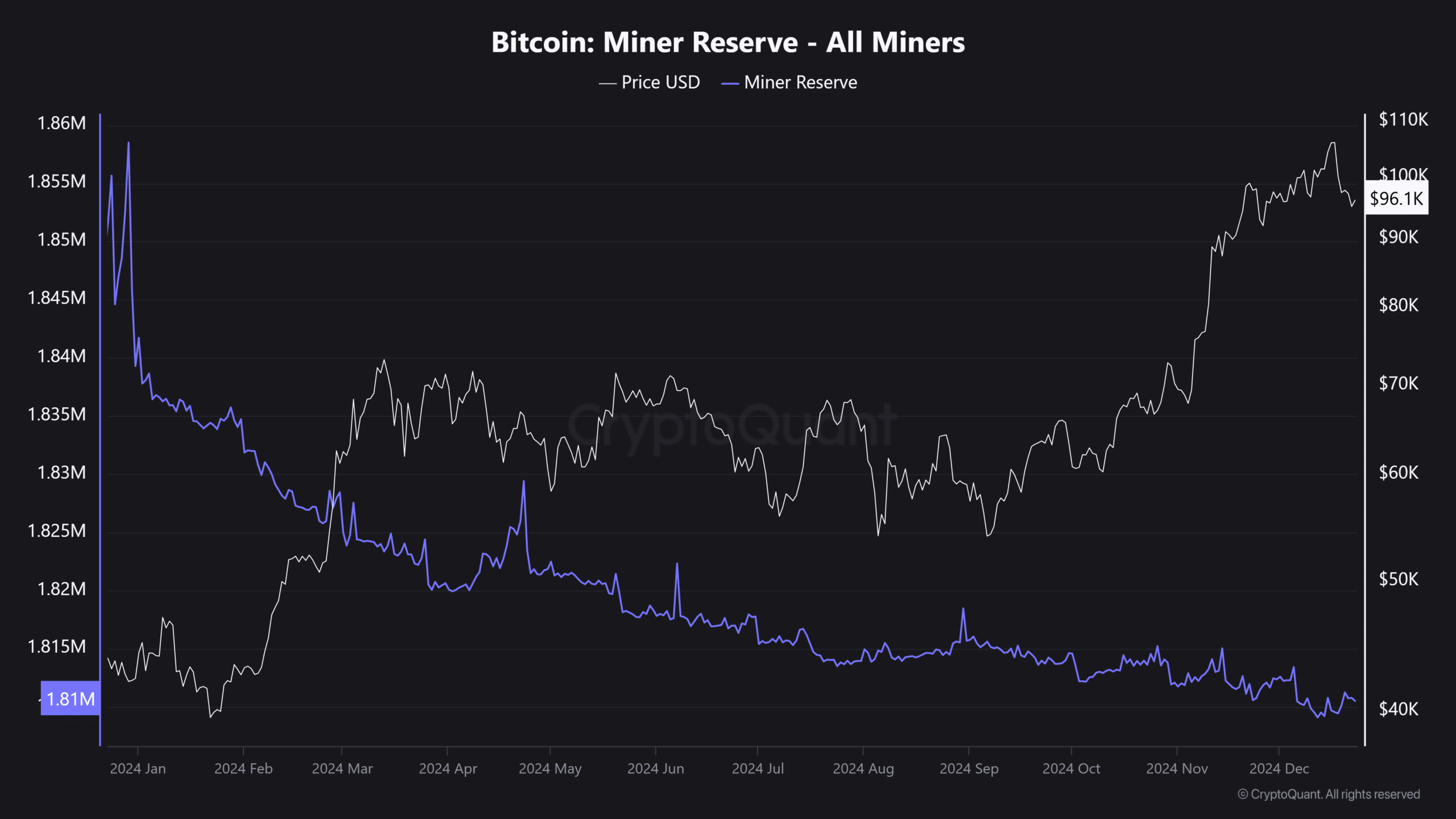

Ever since Bitcoin was first introduced, mining it has grown progressively more challenging. Every newly created block results in an increase of its mining difficulty, which narrows the profit margin for miners significantly. Consequently, the amount of Bitcoins held by miners has reached a 12-month low.

Source : CryptoQuant

Upon examining the graph, it’s evident that there’s a consistent trend: whenever Bitcoin reaches a new peak, miners tend to noticeably decrease their holdings; conversely, when prices decrease, their holdings increase.

When an individual miner stumbles upon a significant windfall by mining a block and receiving a six-figure payout unexpectedly, it raises the question: Could this be an instance of “cashing in on the news” happening?

Or could there be more surprises ahead? As solo miners lock in massive gains.

Bitcoin’ centralization at risk due to solo miners?

The mining industry is the backbone of Bitcoin. Without it, no BTC would be transacted. That’s why examining this narrative is so critical. But beyond the technical aspects, miners hold a significant chunk of the total BTC supply.

As a crypto investor, I’m noticing that solo miners are consistently reaping significant rewards. If this trend continues, it might tilt the market balance, leading to a disproportionate supply and demand situation.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On one side, the prospect of significant returns might attract more individual miners, thereby enhancing the network’s decentralization. In simpler terms, this could foster a sense of fear of missing out (FOMO) or concern about market instability, leading some traders to either invest more or sell off their holdings.

Conversely, this transition might also bring about increased security threats, presenting a fresh set of difficulties.

It’s important to find a careful equilibrium between the two aspects. Considering these victories as occasional fortunate events might help manage fluctuations, but they’re definitely something worth considering over time.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-12-24 04:07