- Bitcoin is only entering the second, more aggressively bullish phase of the cycle, according to one metric.

- The security and network fundamentals remained intact, bolstering confidence.

As a researcher with extensive experience in the cryptocurrency market, I strongly believe that we are only at the beginning of the second, more aggressively bullish phase of the Bitcoin cycle. The recent all-time high against the U.S. Dollar and other fiat currencies is a clear indication that Bitcoin’s value is increasing rapidly and that it is becoming an increasingly attractive inflation hedge.

On March 14, 2024, Bitcoin (BTC) achieved its peak value against the U.S. Dollar, reaching an astounding price of $73,777. Prior to this record-breaking achievement, Bitcoin’s highest value was recorded on November 10, when it hit $69,000.

Amongst other fiat currencies, Bitcoin has reached its maximum value to date. This includes the Turkish Lira, Argentine Peso, Philippine Peso, and Indian Rupee as some examples.

As a crypto investor, I’ve noticed that the US Dollar has experienced lower inflation rates compared to some other currencies. This observation implies that Bitcoin could become an even more attractive inflation hedge in the future.

The reason behind the belief in Bitcoin

A recent analysis by AMBCrypto focused on the Thermocap Ratio metric of a certain network. According to their investigation, the network’s fundamental strengths were evident and the amount of value being injected into it had been consistently increasing.

I observed a concerning trend as well: the Network Value to Transactions ratio for Bitcoin was decreasing. This indicated that the transaction volume wasn’t sufficient to warrant the current price levels. However, there were two factors that could potentially explain this discrepancy. Firstly, investor confidence had been on the rise, suggesting increased faith in the cryptocurrency market. Secondly, the “inflation hedge” argument had gained traction, implying that investors saw Bitcoin as a safe haven against inflation, further driving up prices. Despite these developments, it was essential to keep an eye on the transaction volume to ensure its continued alignment with network value.

A recent report indicated that those involved in the futures market kept a low profile, while the funding rate exhibited a modest level of activity.

As a crypto investor, I’ve been eagerly waiting for some solidly bullish news to jolt Bitcoin out of its sluggish phase. And voilà! On the 4th of June, an astounding $886 million influx into U.S. Bitcoin ETFs was announced. This game-changing development injected a much-needed energy into the market, leaving me feeling optimistic about the future of my investments.

Examining on-chain metrics to understand the bull run

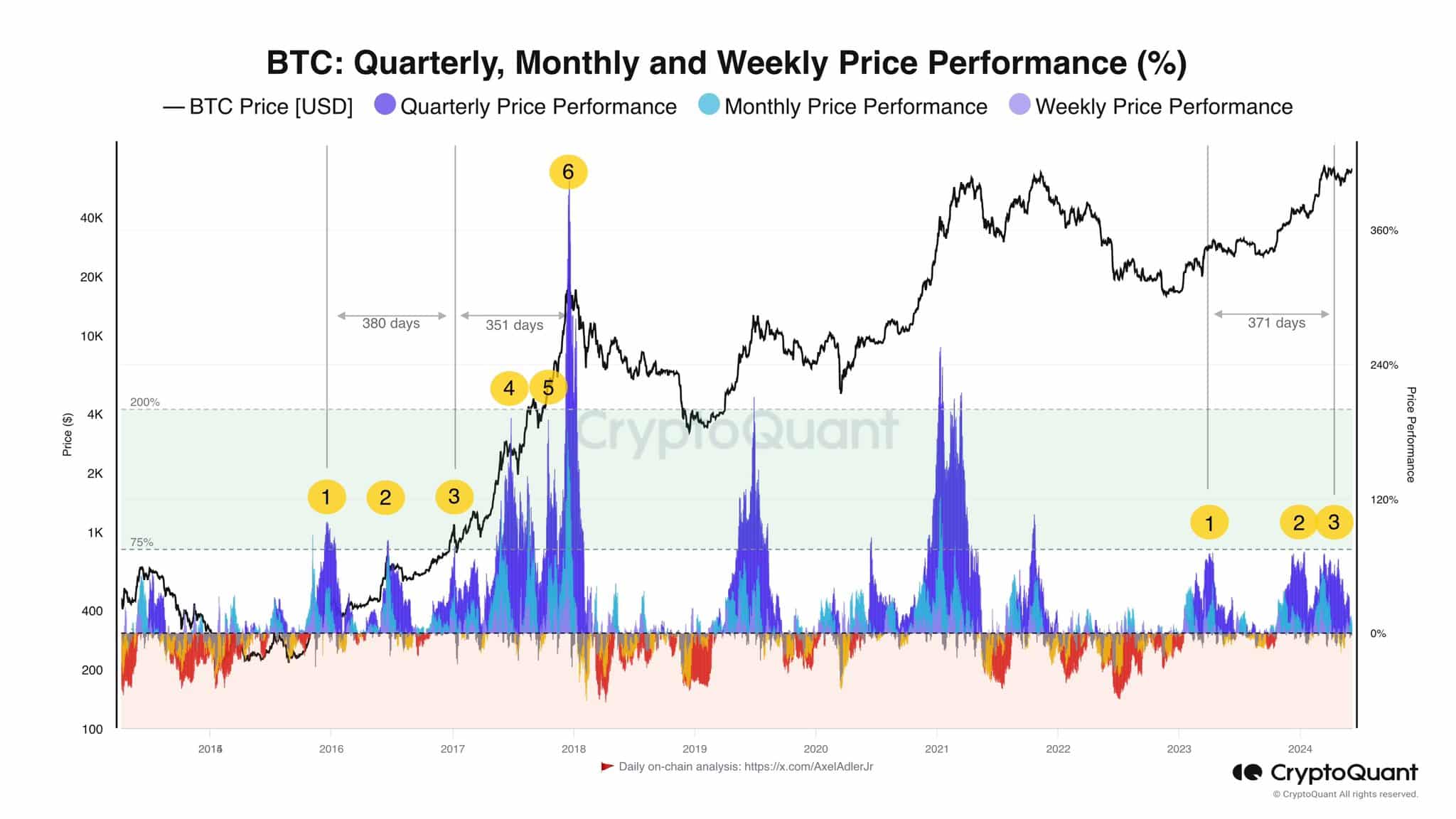

On his recent post, crypto analyst Axel Adler noted on X (previously known as Twitter) that Bitcoin’s price growth on extended time frames hasn’t displayed the characteristic exponential increase, which is typical of a parabolic trend.

During the 2017-18 period, there were 380 consecutive days of gradual increase, which was then succeeded by a 351-day phase of rapid upward trend.

If it repeats, BTC could see another 12 months of uptrend.

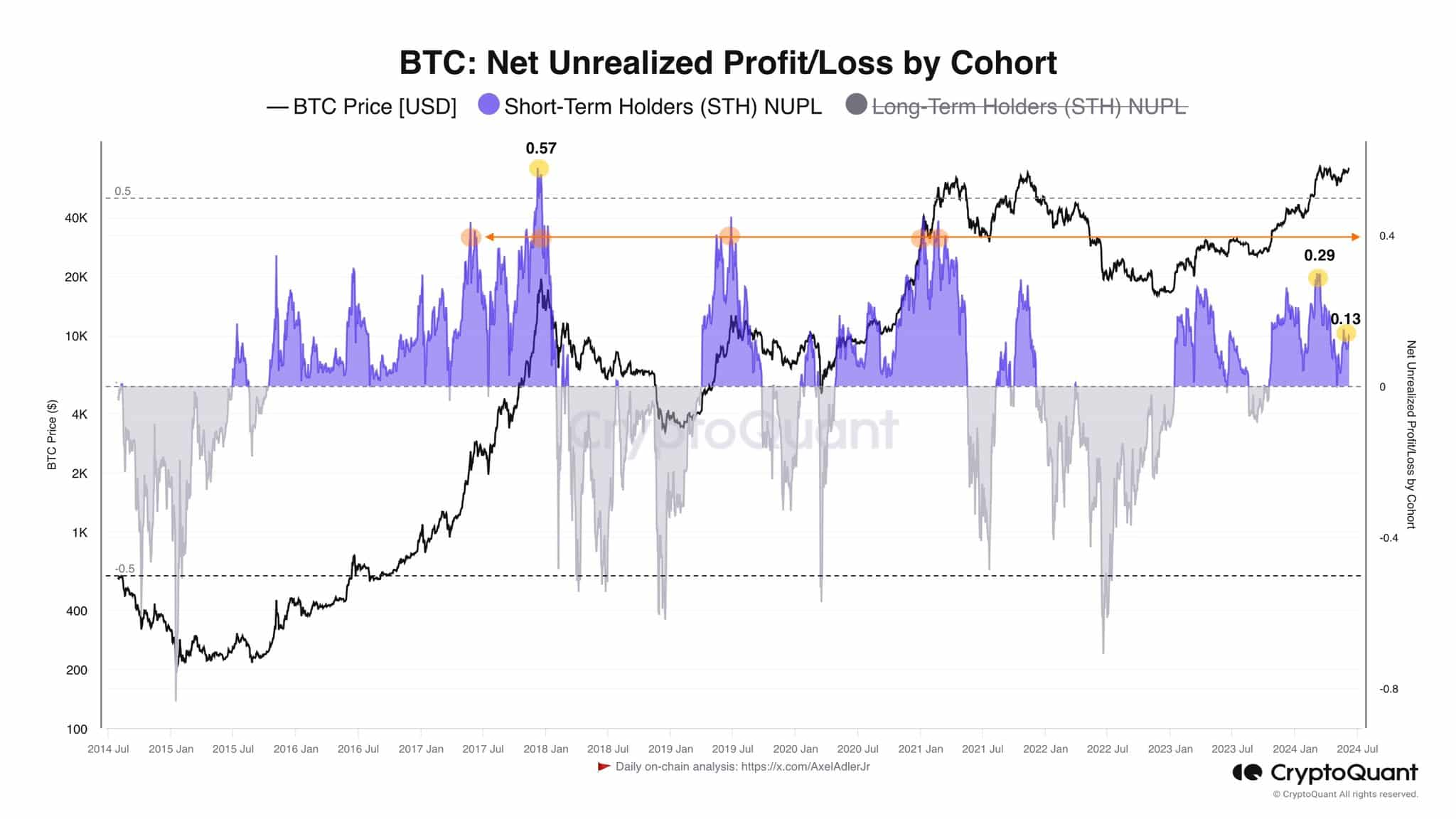

As a researcher studying market trends, I’ve observed that the Short-Term Holder (STH) Net Unrealized Profit/Loss (NUPL) has yet to reach its peak. Based on my analysis, for the current bull run to come to an end, the STH NUPL would need to rise above 0.4.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The peak it reached was 0.29 in March, after which Bitcoin underwent a significant adjustment during the previous two months of consolidation.

Therefore, the Bitcoin all-time high is very likely only a matter of time from here on.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-06-07 08:07