- Tether might just be nudged into selling a cool $8B in BTC to placate the U.S. regulators, all thanks to Mr. J.P. Morgan’s delightful commentary. 💸

- Tether’s ever-so-confident CEO assures us that the firm is not drowning but rather swimming in liquidity with a charming $20B tucked away. 👔

Our dear Paolo Ardoino, Tether’s rather dapper CEO, has taken it upon himself to wipe the floor with J.P. Morgan’s recent report, which suggested his firm might be caught off-guard by pesky new U.S. regulations if they come into play. Oh, the drama! 🎭

Paolo, with a wink, called J.P. Morgan ‘salty’—honestly, it’s as if they just found out their beloved pet was a cat and not a dog. He confidently asserted that Tether is not merely afloat; it’s practically a luxury liner with +$20B in its cash reserves, more than enough to handle proposed new legislation. 🛳️

The illustrious Tether executive added that further revelations regarding the bills and some splendid consultations are just around the corner, darling!

J.P. Morgan Lifts the Veil on Tether’s Reserves

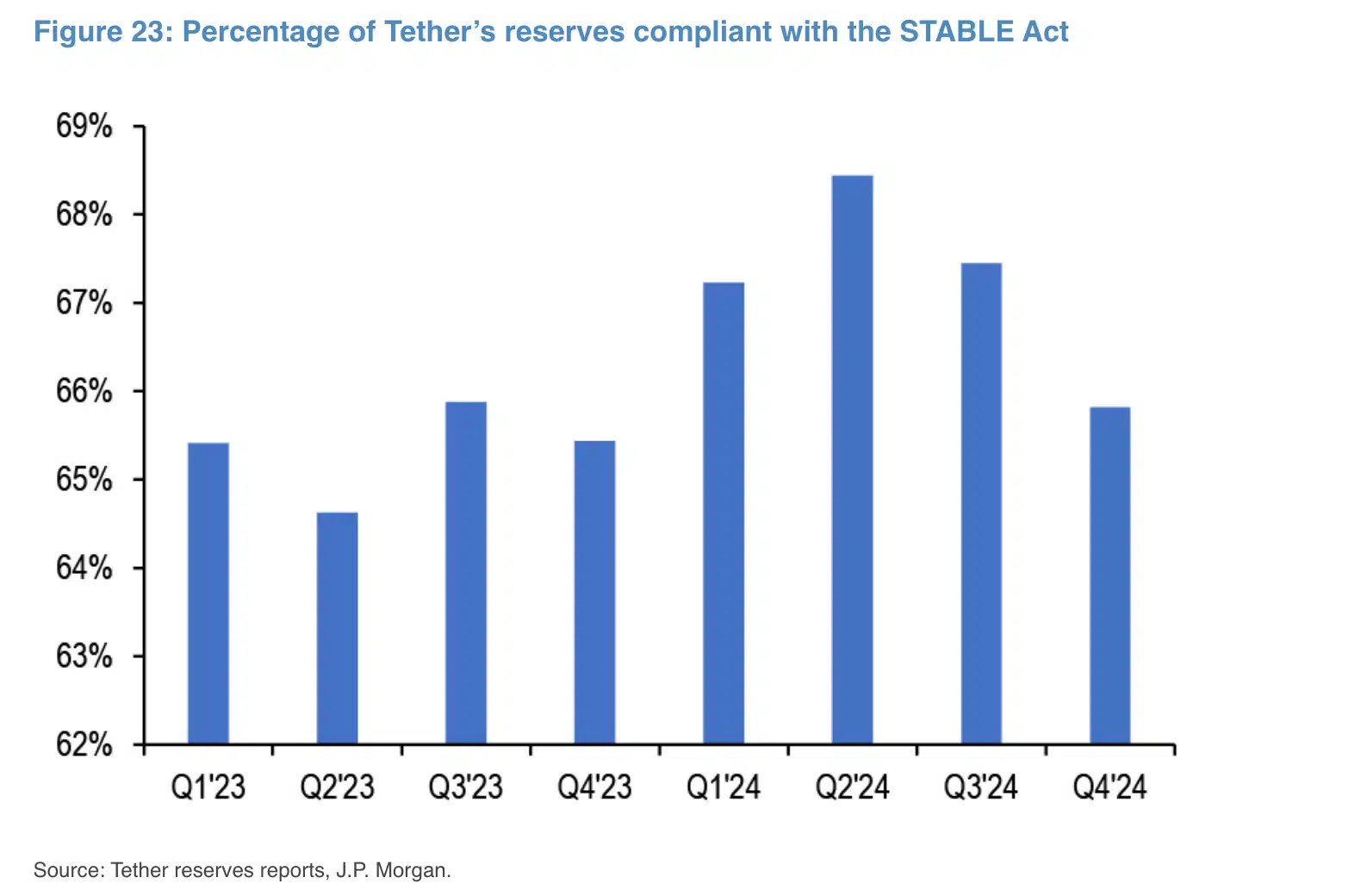

According to the delightful folks at J.P. Morgan, a mere 66%-83% of Tether’s reserve assets might meet the standards set forth by the oh-so-serious GENIUS Act and STABLE Act. It’s like showing up to a dinner party without a tie—utterly unacceptable!

“Under the House’s STABLE Act, only 66% of Tether’s reserves are compliant, while under the Senate’s GENIUS Act, 83% meet standards,” expressed J.P. Morgan, quite theatrically.

Analysts—those perennial party poopers—note that the STABLE Act demands stricter reserve requirements for potential stablecoin issuers, enforceable at the state level. Meanwhile, the GENIUS proposal plays a more generous hand, albeit under federal jurisdiction. One can’t help but adore the chaos! 🎉

Nevertheless, it seems compliance has gone a tad off-script since last quarter—oh dear, the complications for Tether have only just begun!

Meanwhile, several crypto exchanges across the E.U. have chosen to break up with Tether’s USDT, allowing Circle’s USDC to dance its way into the spotlight.

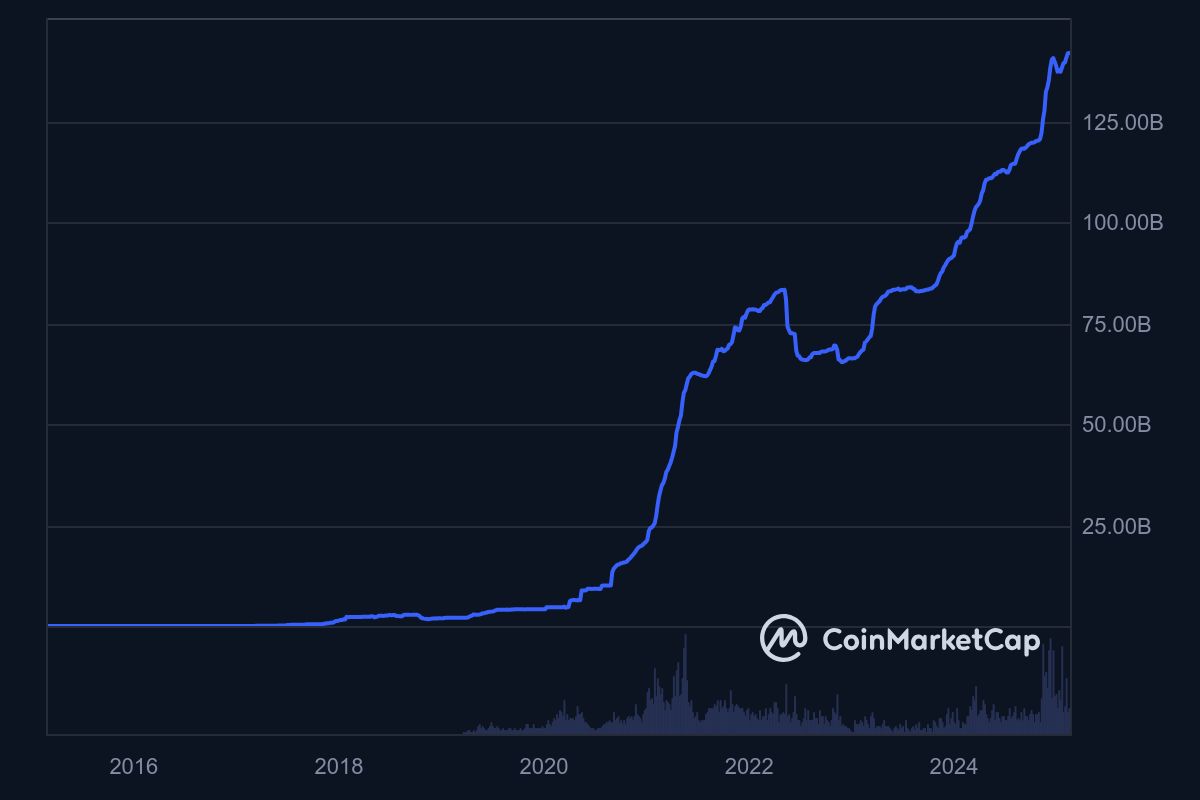

But fret not, dear readers! USDT’s market size remains hardly dented, thanks to its enormous sway in the U.S. and other marketplaces. In fact, USDT just eclipsed an all-time high of $141 billion. Bravo!

However, analysts speculate that Tether may have to auction off a bit of its non-compliant reserve assets to meet the whimsical regulatory whims set by the two charming stablecoin proposals. 🥂

This delightful dilemma could impact Bitcoin, those shiny precious metals, and secured loans—quite the cocktail party conversation starter!

Currently, Tether holds a staggering 83.7K BTC, a mere $8B in value, just gathering dust! 🤑

Market analysts, including the thoughtful Alex Kruger, have raised the alarm that failure to comply with U.S. stablecoin norms could spell disaster for the entire market. In response to the J.P. Morgan report, he quipped,

“This actually makes sense – something to follow closely as would be very bearish,”

which sounds awfully serious—like a hearty stew, best savored with caution!

With the two bills potentially on the docket later this year, the stage is set for Tether’s next act. It will be positively riveting to see how they ‘re-adjust’ to meet compliance expectations. Stay tuned for more delightful theatrics!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-02-14 15:10