-

AAVE to hit $200 if it breaks key resistance.

TVL rising, highlighting increasing adoption.

As a seasoned analyst with years of experience navigating the cryptosphere, I have seen the ebb and flow of market trends like a sailor weathering stormy seas. And let me tell you, Aave [AAVE] is not just another wave; it’s a tsunami that’s about to hit $200 if it breaks its key resistance.

In the present market situation, Aave [AAVE] is flourishing, surpassing several other cryptocurrencies as the market rebounds following the slump on August 5th.

The cost of Aave keeps climbing steadily, and its latest movements have it trading over $154, a significant barrier for price growth.

For Aave’s price to convincingly surpass its 800-day range, it should sustain itself above that threshold over a significant duration. As evidenced on the weekly graph, Aave is nearing this resistance level again, this time fueled by strong bullish energy.

Using the Wave Trend Momentum Oscillator (WTMO), it suggests a robust upswing, thereby elevating the chances of surmounting the current resistance level.

If Aave consistently sets new highs followed by new lows, a subsequent test of these levels might confirm that $200 is the next significant milestone for the mid-term price movement.

Maintaining a position above the $154 mark is essential to sustain the current bullish trend, as suggested by the Worked Time on Mean Price (WTMO) indicating robust energy to drive prices upwards.

Aave’s growing adoption driving price higher

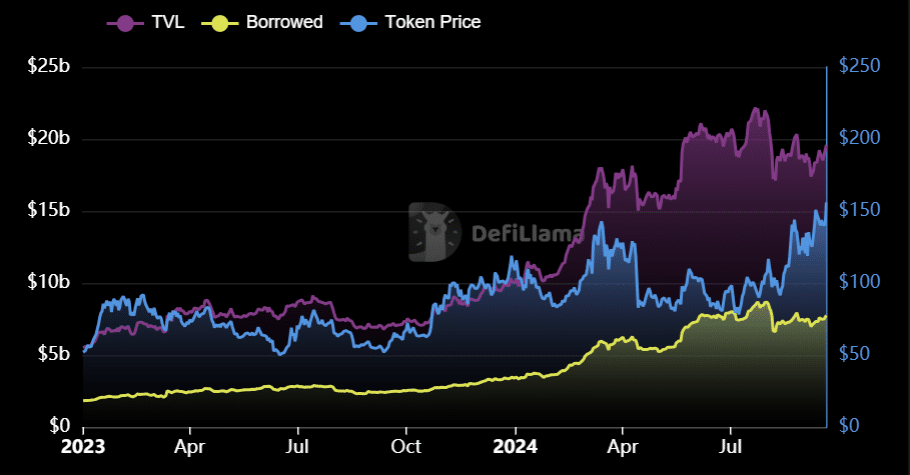

Aave’s achievement isn’t only evident through its price fluctuations; instead, its Total Value Locked (TVL) has consistently increased since the start of this year.

Despite a pause in growth from April to July, the Total Value Locked (TVL) in Aave is surging once more. Right now, the TVL has climbed up to a whopping $19.6 billion, while the cumulative loans taken through Aave’s platform have soared to an impressive $7.748 billion.

As a crypto investor, I’m truly impressed by the robust growth we’re seeing with Aave, solidifying its status as a dominant force within the Decentralized Finance (DeFi) sector. The surge in Total Value Locked (TVL) and borrowed assets clearly indicates a growing adoption and trust from the community, making me more optimistic that its price could potentially hit $200 by year’s end.

Beyond robust market activity and escalating Total Value Locked (TVL), large investors or “whales” are progressively purchasing more, thereby exerting substantial upward force on its price. As per Hyblock Capital’s analysis, the current disparity between whale and retail buying activity stands at 74%, suggesting that whales are accumulating Aave at an accelerated pace compared to regular investors.

Additionally, the fact that the net long short delta stands at 84% suggests a strong possibility that Aave could hit the $200 mark by the end of this year.

The convergence of whale buying activity and strong net longs indicates a bullish sentiment surrounding Aave.

Address activity

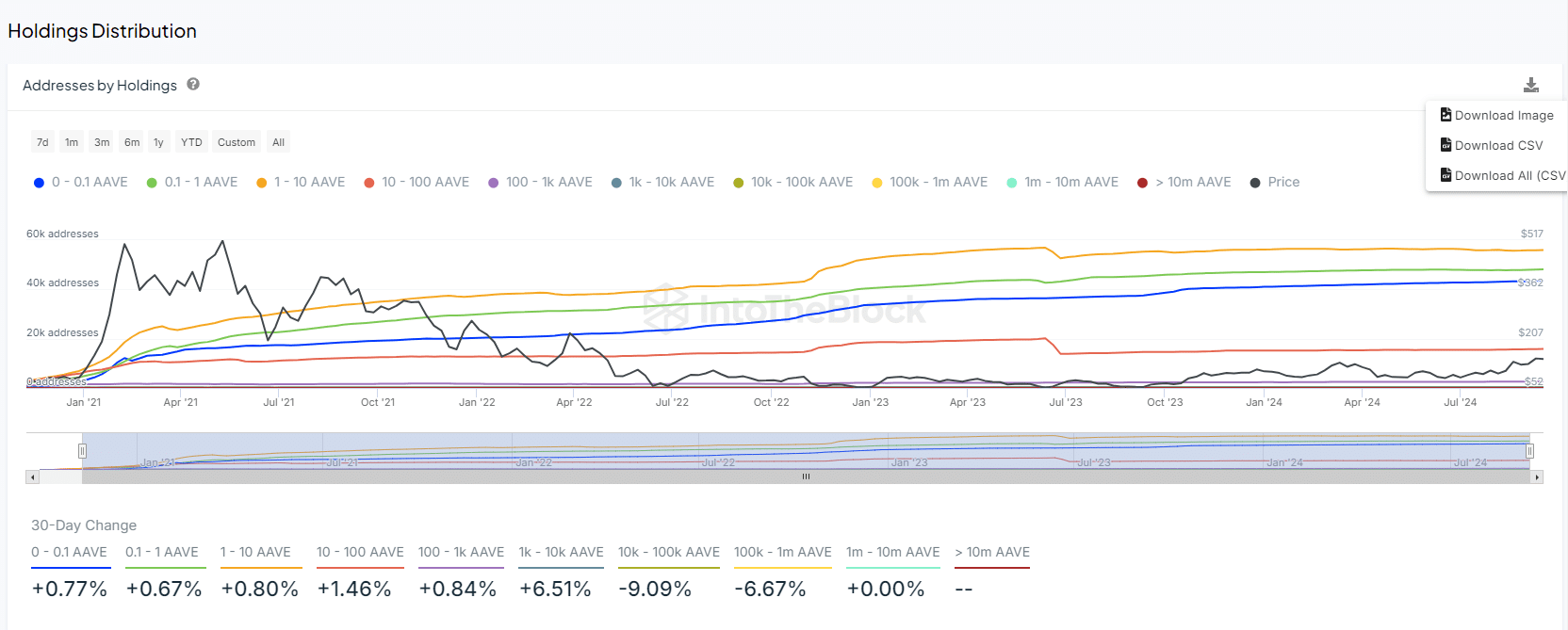

To conclude, there’s been consistent growth in the number of wallets holding Aave tokens. This trend is noticeable among both retail investors and large whale investors, as well as among long-term and short-term token holders.

Over time, it’s noticeable that the number of addresses linked to each holding is steadily increasing, with some fluctuations. Notably, those who own between $10K and $100K, as well as those possessing between $100K and $1M in Aave, experienced slight decreases at certain points.

Read Aave’s [AAVE] Price Prediction 2024–2025

These categories saw a decrease of 9.09% and 6.67%, respectively.

Regardless of temporary setbacks, Aave’s overall progress remains optimistic, as the number of users adopting Aave keeps climbing. This escalating adoption, coupled with large-scale purchases by ‘whales’, rising Total Value Locked (TVL), and bullish market behavior, hints that Aave is moving steadily towards surpassing the $200 million mark.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-21 11:04