- Aave broke past the $150 price to make a new yearly high.

- True retail longs and Open Interest were moving up as well.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. However, the current momentum of AAVE is something that catches my attention. The recent break above $150 and the subsequent yearly high is a strong signal of the coin’s potential for growth.

Aave [AAVE] has recently broken through the $150 price level, marking a new cycle and yearly high.

Experts predict that if Aave maintains its value above $154, it may experience rapid growth and could possibly climb up to $260. This jump would signify a significant increase of approximately 75% compared to its current value at the time of printing this statement.

Initially, Aave seemed reluctant to exceed the $154 mark, but such behavior is common at significant resistance levels. However, the robustness of Aave’s price movements implied it was merely a temporary halt, indicating potential for further price increases in the near future.

In simpler terms, the MACD signal line, previously suggesting a downward trend since August, has recently turned positive, pointing towards a possible market uptick. Meanwhile, Aave saw a robust start in September, reaching a new peak for the year 2024.

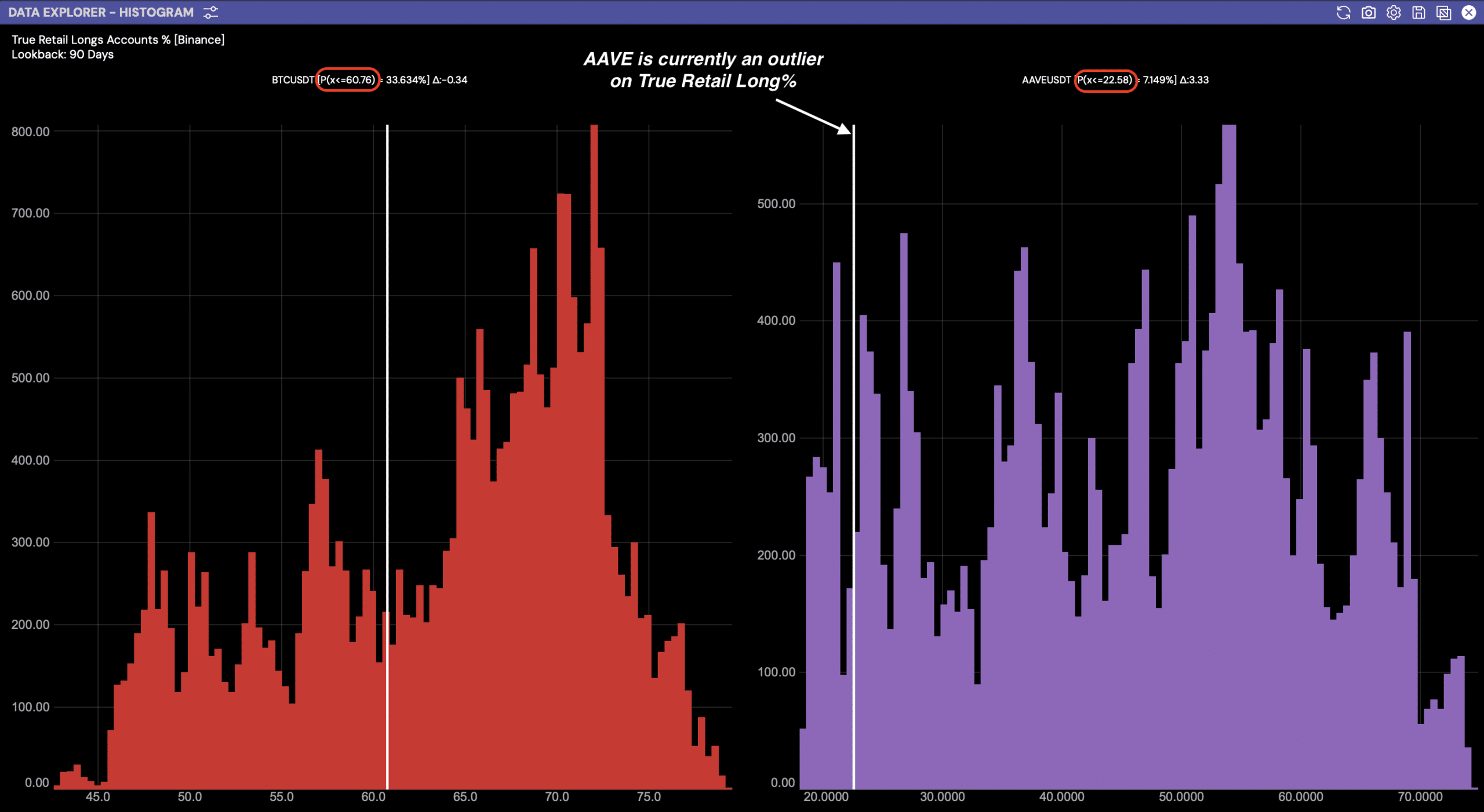

True retail longs accounts percentage

AAVE’s performance is particularly notable when juxtaposed with the proportion of Bitcoin/Tether and Aave/Tether holdings among retail investors, according to Hyblock Capital’s data comparison.

At the point of reporting, I noticed that just about a fifth (22%) of retail accounts were holding long positions. However, there was a notable increase in Open Interest, suggesting growing engagement in these positions.

This ratio, similar to one seen prior to a market upturn, signals that long-term investors might be dominating short-term ones. It hints at the possibility of AAVE experiencing another price increase in the near future.

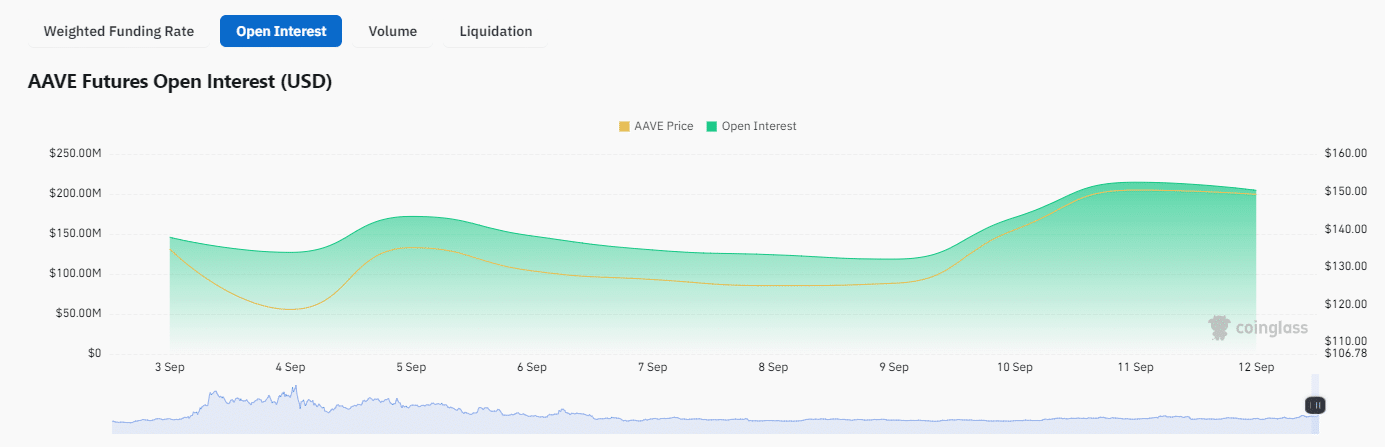

Open Interest on the move

Analysis through Coinglass showed a consistent increase in Aave’s Open Interest, noticeably so in the month of September.

Based on recent figures, the Open Interest for AAVE currently stands at approximately $204.58 million, with each token valued at around $149.26. This high level of interest suggests a potential increase in the token’s price in the upcoming time frame.

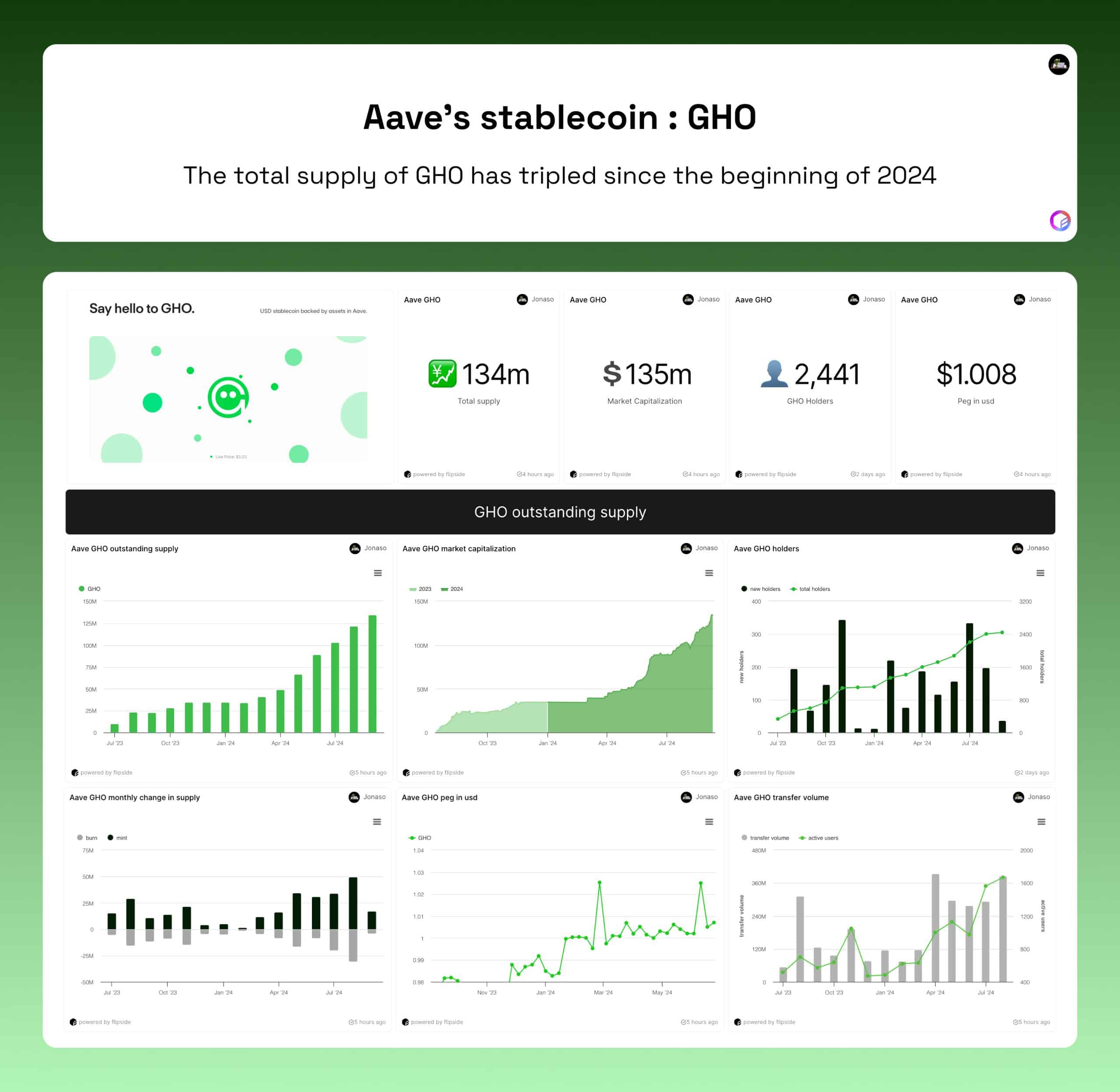

Aave’s GHO growth is strong

In the present moment, the circulation of Aave’s built-in decentralized stablecoin, called GHO, is showing robust expansion. Currently, the total supply of GHO has grown to 135 million tokens, which equates to a market capitalization of $135 million.

Additionally, the maximum number of token holders ever recorded was surpassed, totalling about 2,400 individuals. Interestingly, around three-quarters (76%) of GHO’s total supply or roughly 103 million tokens were secured by 1,590 stakers.

The value of GHO consistently stayed close to that of the U.S. dollar, showing minimal fluctuations, which suggests a high level of stability.

Additionally, the creator of Aave has suggested broadening the usage of GHO (Ghoochain’s Own DeFi Protocol) on other blockchain platforms. At present, Aave V3 is operational across various networks, such as Ethereum [ETH], Arbitrum [ARB], Binance Smart Chain (Base), Avalanche [AVAX], Polygon [MATIC], and Optimism [OP].

Yet, GHO is currently implemented solely on Ethereum and Avalanche, implying potential growth opportunities on other blockchain networks, as per Stani Kulechov’s statement in his recent post.

“This leaves significant room for GHO to expand across additional networks.”

The possibility of this extension might fuel more development for both Aave and GHO, potentially leading to increased prices due to enhanced stability.

Read Aave’s [AAVE] Price Prediction 2024–2025

All things considered, there’s a good chance that Aave’s value will continue to climb. This optimism stems from increasing Open Interest, favorable technical signals, and an uptick in the use of the GHO stablecoin, which suggests potential for increased value.

If market conditions remain favorable, AAVE might see significant gains in the coming months.

Read More

2024-09-13 01:12