- Aave has surged by 3.79% over the past 24 hours.

- With a bullish crossover and strong buying pressure, Aave is positioned to hit $200.

As a seasoned researcher with over a decade of experience in analyzing cryptocurrency markets, I have seen my fair share of market fluctuations and trends. The recent surge in Aave [AAVE] is indeed intriguing, given its strong upward momentum and buying pressure.

Over the past few days, Aave [AAVE] has seen a robust increase, climbing from its recent low of $153 to reach a new high of $184.

Currently, at the moment, Aave is being traded for approximately $181, representing a 3.79% increase over the past 24 hours. Moreover, it has also shown growth on both the weekly and monthly charts, rising by 8.25% and 24.52% respectively.

Despite this price pump, Aave still remained approximately 72.89% below its ATH of $666.

Given the present market scenario, it’s reasonable to wonder if the ongoing price increase is a lasting recovery or simply a temporary adjustment.

What Aave’s charts say

Based on AMBCrypto’s examination, Aave is showing a robust uptrend as a result of increasing purchasing interest. This bullish trend is indicated by a crossover on the Stochastic Relative Strength Index (RSI).

For the last two days, the Stochastic Oscillator has shifted towards 41. This implies that buyers appear to be in control of the market, potentially leading to an increase in prices in the near future.

This bullishness is further confirmed by the Relative Strength Index (RSI).

In the last day, the Relative Strength Index (RSI) reading of 58 indicates a continuation of the upward trend. This is supported by the RSI’s moving average crossing over at 54, suggesting increased buying pressure, reinforcing our earlier observation.

Similarly, the positivity of this upward trend is reinforced by the DMI, with +DMI at 23 and consistently higher than -DMI. This indicates that the bullish energy was robust, while any bearish trend seemed to have run its course.

Glancing ahead, it appears that Aave investors are demonstrating a strong sense of optimism. This optimism is evident through the significant withdrawal of funds from exchanges.

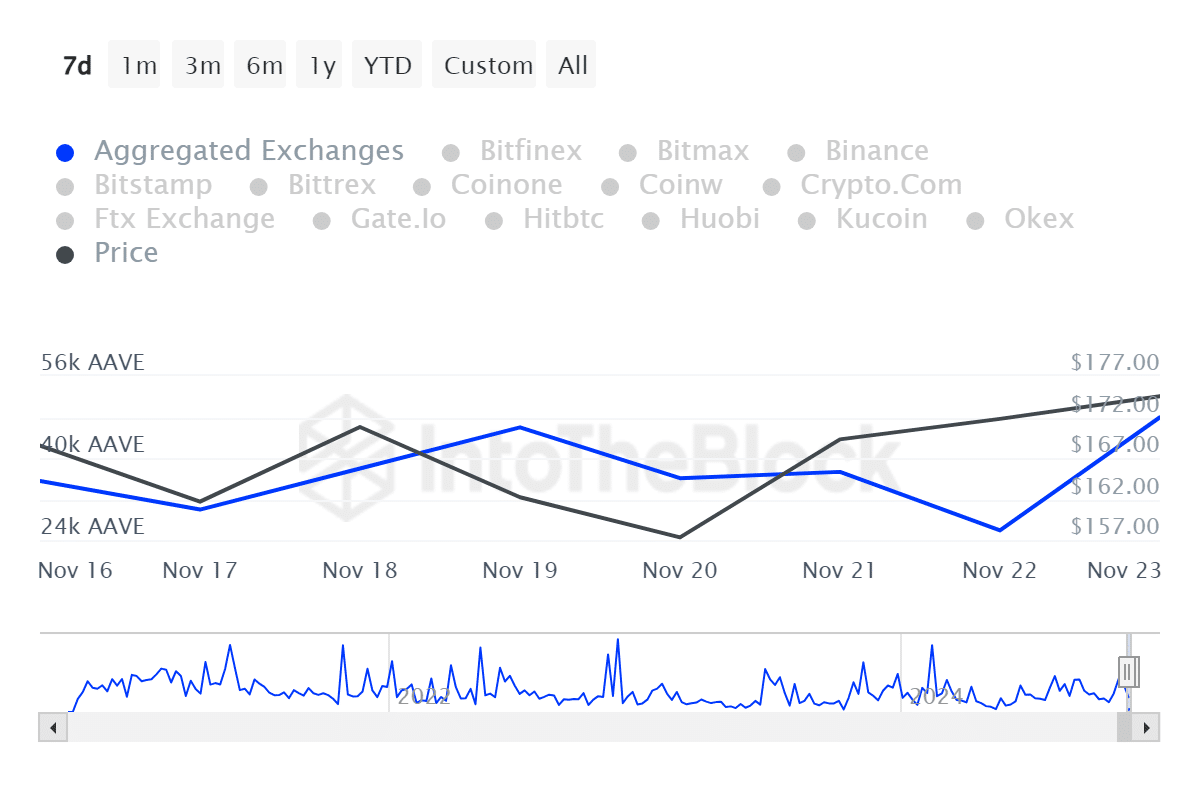

Based on data from IntoTheBlock, the volume of tokens leaving exchanges has reached a new weekly peak of approximately 47,950, indicating that investors are transferring their assets to personal wallets and cold storage at high rates, demonstrating their growing confidence in the market.

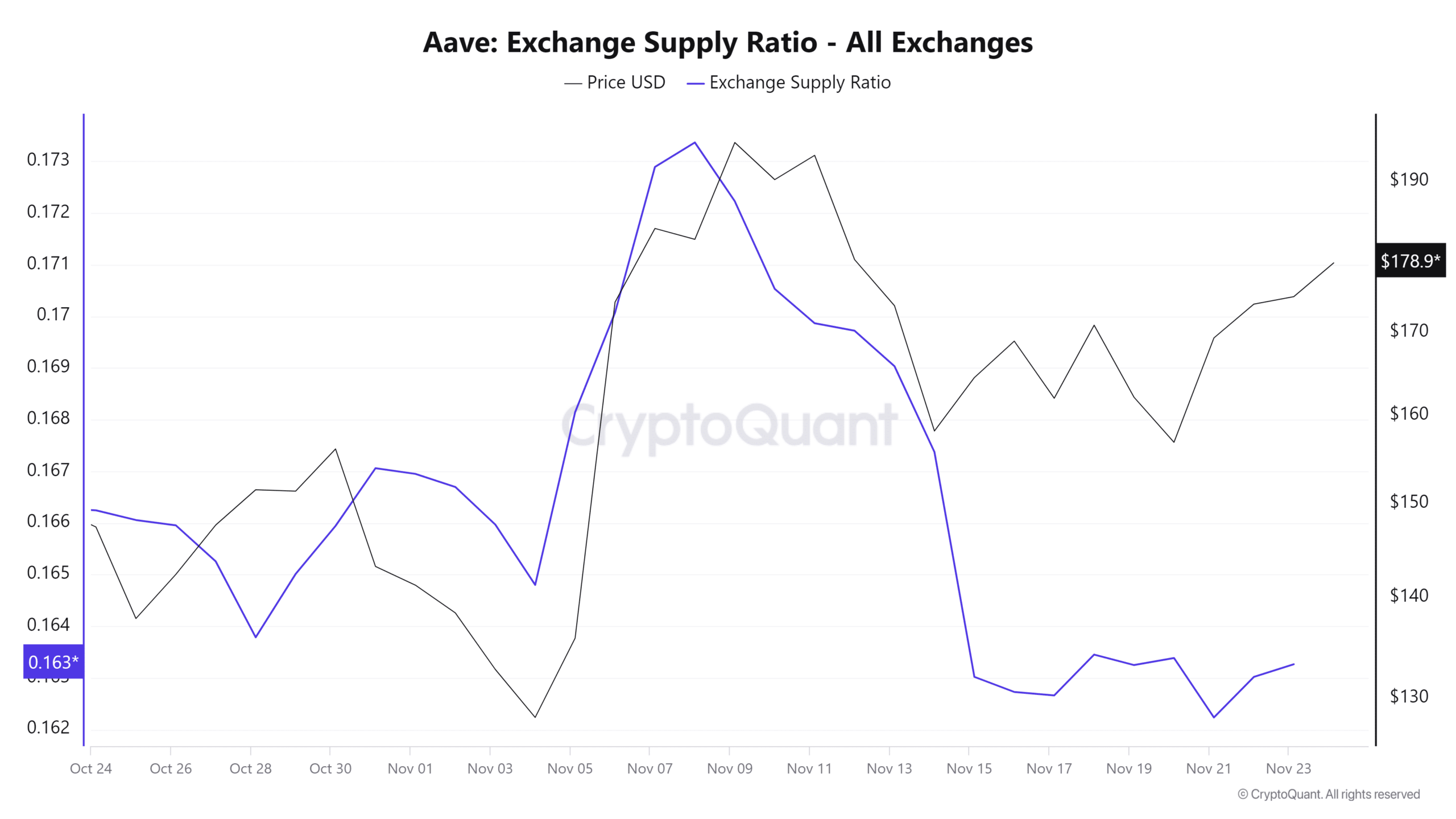

This occurrence can also be supported by a decrease in the ratio of supply to transactions on exchanges. As shown by CryptoQuant’s data, this ratio has dropped significantly over the last two days, reaching its lowest point for the month.

Such developments suggest that investors are withdrawing more Aave from exchanges than deposits.

Read Aave’s [AAVE] Price Prediction 2024-25

Ultimately, it’s clear that the increase in price isn’t due to market speculation but rather robust on-chain activity.

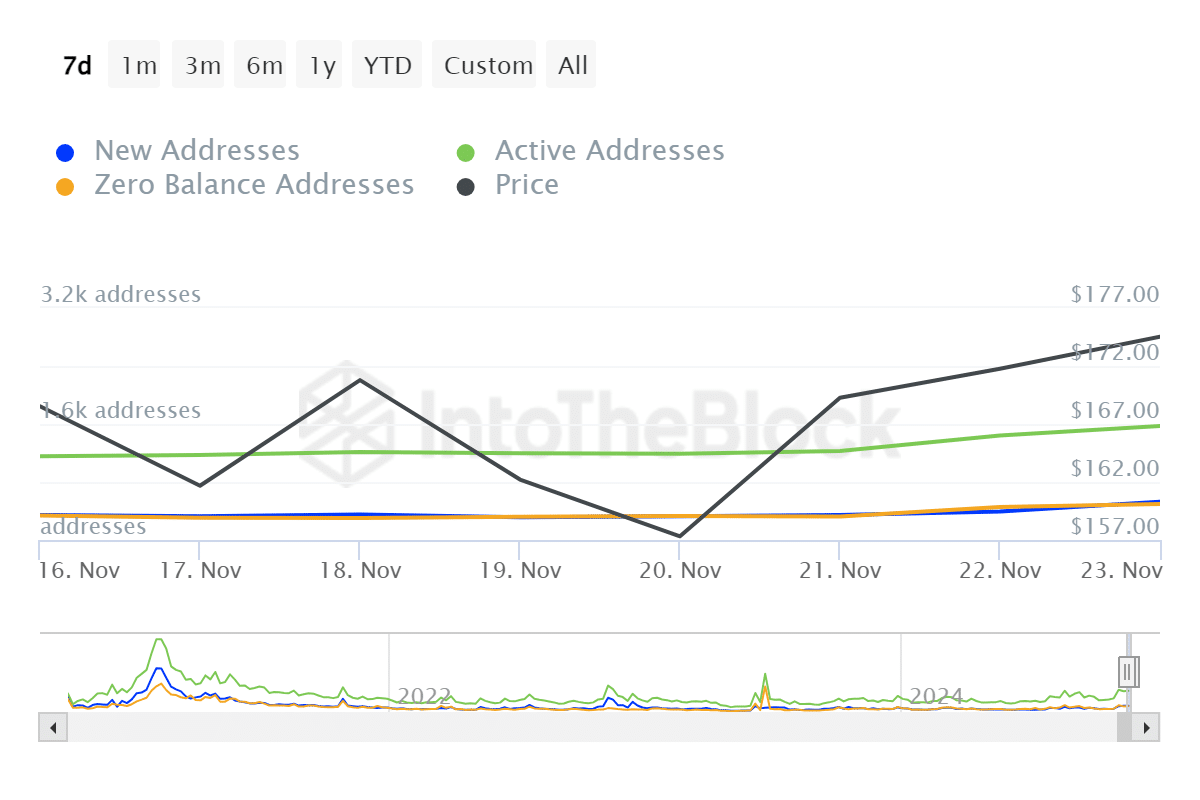

It’s clear that Aave has seen a significant increase in usage lately, as its active addresses have reached a two-week peak of 2.6K. This growth suggests growing interest, acceptance, and involvement, all key factors driving up the price.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-24 18:15