-

Several key metrics underpinned AAVE’s expected rally, although its success hinged on overcoming a major resistance level in its third attempt.

Failure to surpass this resistance could see the price plummet to as low as $116 or $113.5.

As a seasoned crypto investor who has witnessed the rollercoaster ride of digital assets, I find myself optimistic about AAVE‘s future prospects. With its latest surge of 6.63% over the past 24 hours, AAVE seems to be gearing up for a significant rally. Having closely observed the crypto market for years, I can sense the bullish sentiment brewing around AAVE.

Currently, Aave (AAVE) has seen a 6.63% increase within the last day, even though its weekly performance has been somewhat unpredictable.

Keeping up this pace might erase this week’s setbacks and set AAVE on a path toward a steeper ascent compared to the previous two weeks.

What’s next for AAVE? Is a significant rally on the horizon, or is it still some way off?

AAVE’s rally appears imminent

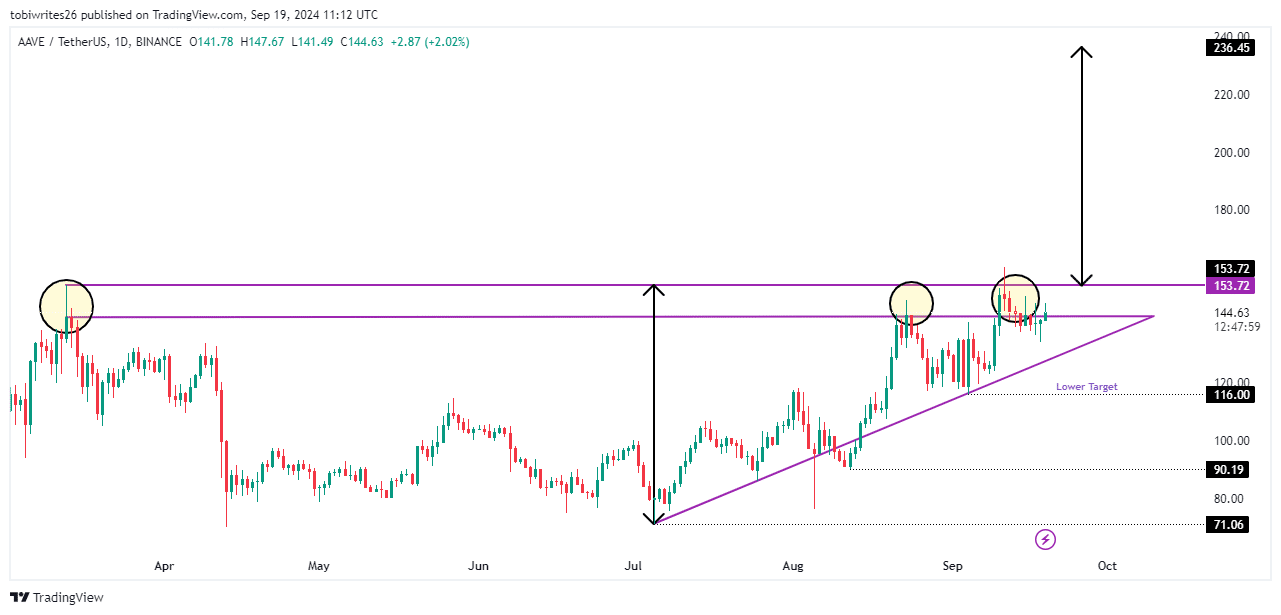

Currently, AAVE is making progress in attempting to surpass the barrier at $153.72, a point where strong selling forces have historically caused the price to drop on three different instances.

Should we manage to break through this current resistance, the potential new price level for AAVE could be around $236.45. This area on the chart shows a significant grouping of liquidity.

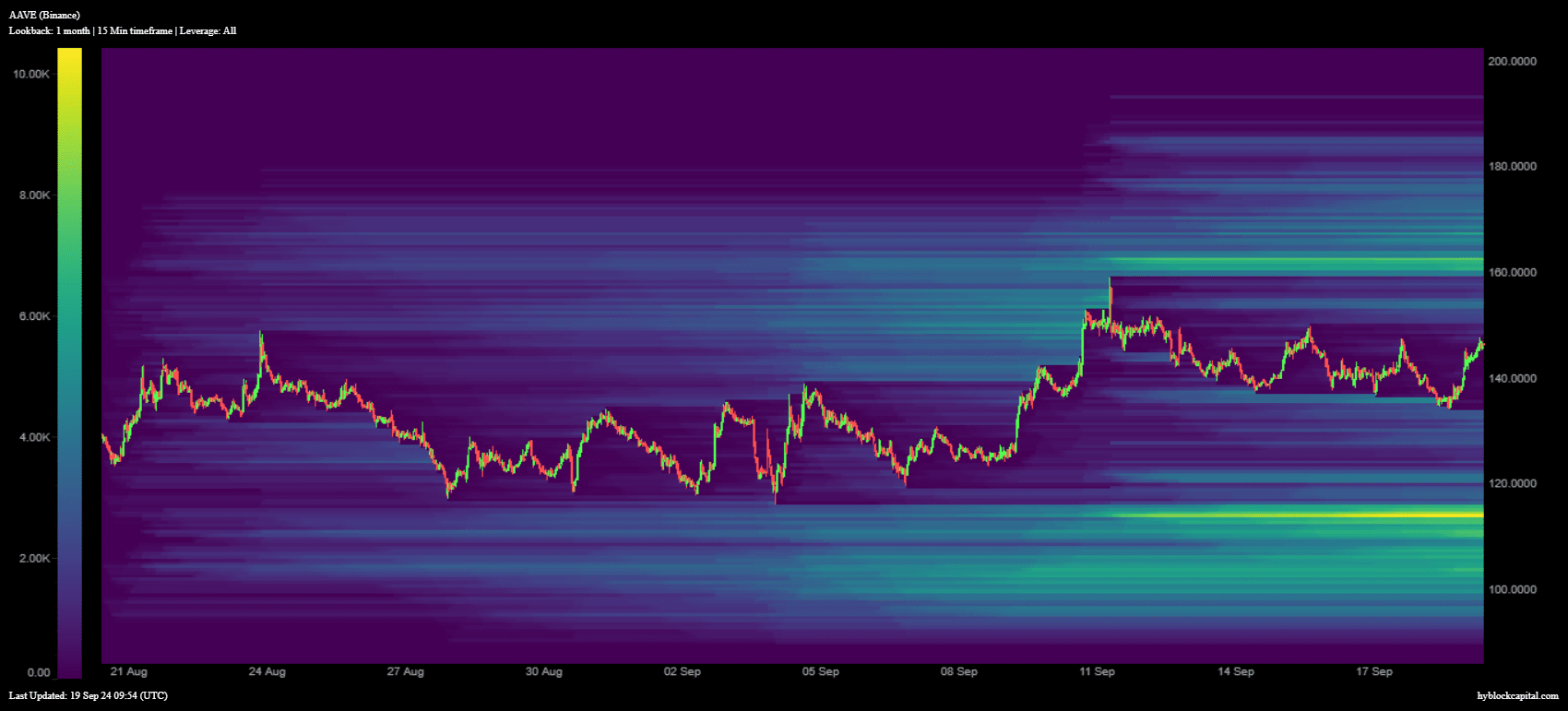

A more achievable goal is found at $162.60, a point marked by Hyblock as having significant liquidity nearby.

If AAVE doesn’t manage to draw in traders right now, its price could potentially drop to $113.50, a location that has a significant amount of liquidity.

Profitable traders set to maintain buying pressure on AAVE

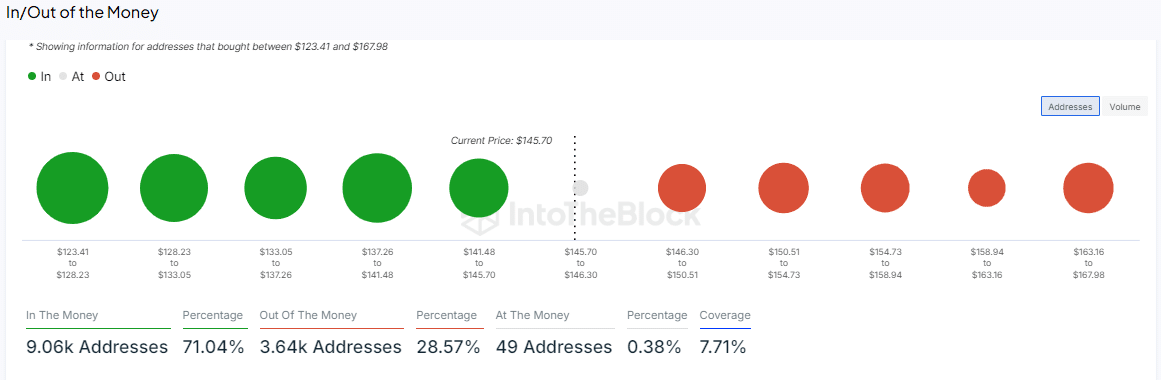

As reported by IntoTheBlock, the “In/Out of the Money Around Price” indicator suggests that a significant number of traders currently stand to make a profit by holding AAVE, as they bought it at prices higher than its current value.

As of now, approximately 9,060 AAVE address holders have earned profits, making up about 71.04% of all AAVE investors. This could imply that these investors will likely drive the price higher in the near future.

As a crypto investor, I found the 46.48% decrease in active addresses to be a positive sign, indicating that fewer investors are keen on selling their cryptocurrencies. Instead, it appears that they’re choosing to hang onto their assets, which could potentially lead to increased demand and higher prices.

The drop in AAVE‘s available supply on cryptocurrency exchanges over the past day supports this trend, indicating that investors are holding onto the asset tightly.

Potential fall to $116 threatens growth

Over the past month, AAVE has achieved a 12.84% growth, as reported by CoinMarketCap.

Nevertheless, the advancement has encountered an obstacle, as it hasn’t managed to surpass a substantial resistance zone spanning from approximately $142.69 to $153.72 during its third effort.

As of press time, AAVE was preparing for another attempt to breach this critical level.

According to AMBCrypto’s analysis, it appears that the value of AAVE could potentially break through a significant threshold, given its current position within an uptrend formation known as an ‘ascending triangle’. This pattern is often associated with favorable outcomes for investors, indicating a possible upward trend.

If the ascending triangle pattern successfully breaks out, it may follow the same path as its past rise from the base to the top of the ascending channel, possibly peaking at around $236.45 (indicated by the black arrow on the diagram).

Read Aave’s [AAVE] Price Prediction 2024–2025

If the upward trend line (ascending channel) breaks down, it’s possible that AAVE could experience a drop in price, potentially reaching around $116. This value is quite near to the $113.50 mark, which is significant because it’s the highlighted liquidation point on Hyblock’s charts.

AAVE is striving towards a goal of $236, but it’s encountering significant resistance at the price level of $153.72. Explore information about its promising upward tendencies and critical resistance thresholds, which play a significant role in shaping its market path.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-20 03:04