-

A popular analyst noted a sell signal for AAVE that could result in an average of 27% price drop.

On-chain metrics showed that the asset is overvalued.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear runs. The current situation with Aave [AAVE] is intriguing, to say the least.

In recent times, there’s been a significant increase in large-scale purchases of Aave [AAVE]. As noted by Lookonchain, these ‘whale’ investors have been accumulating millions of dollars’ worth of Aave since August 20th.

One whale, in particular, has bought AAVE worth $10.4 million in under a day.

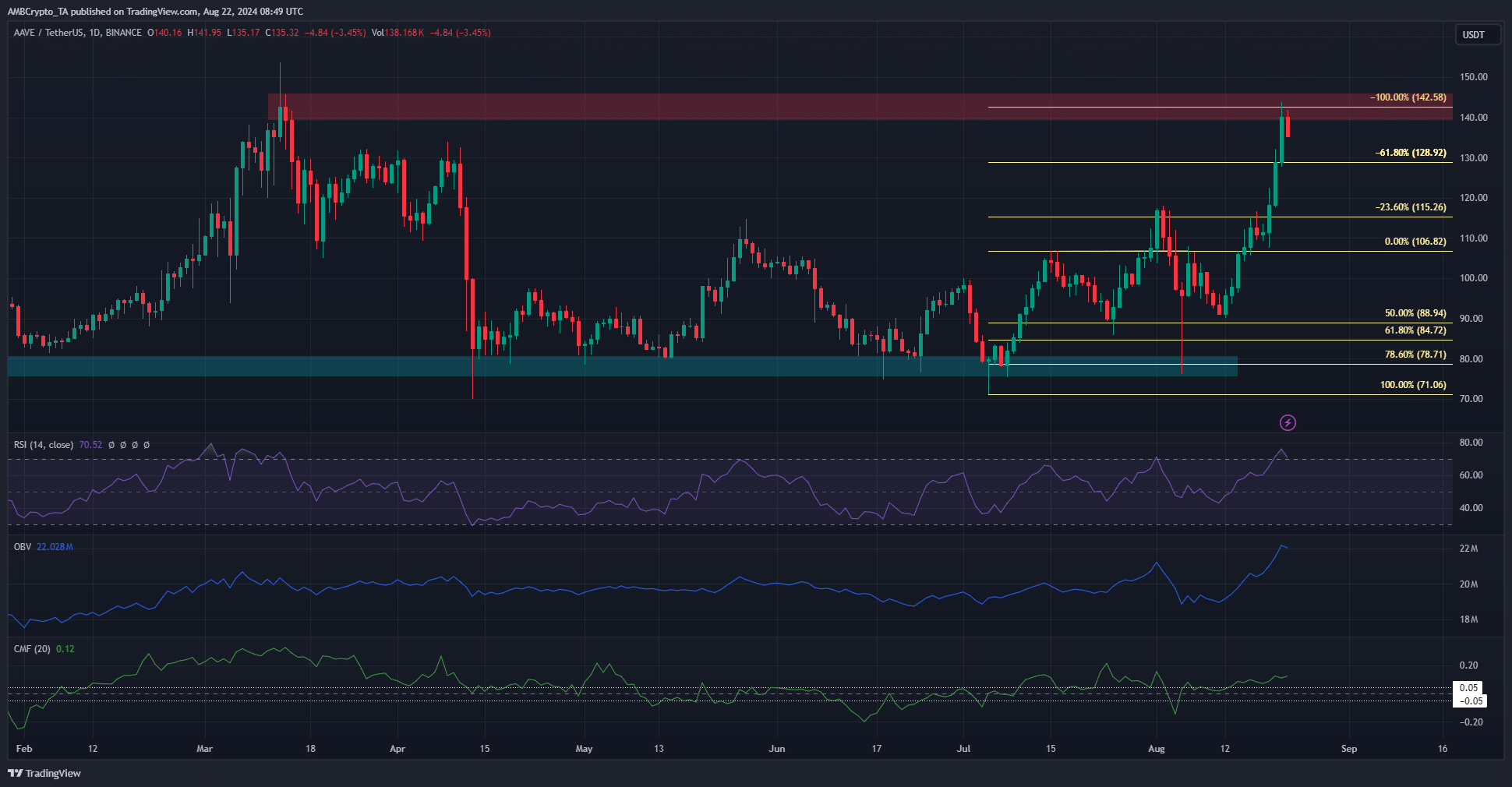

The increase in the number of AAVE addresses indicated a favorable development. However, despite this, the price encountered a refusal at the $140 resistance area, which had previously peaked in March.

A deep retracement is likely

crypto expert Ali Martinez recently shared on his platform (previously known as Twitter) that the TD Sequential signaled a potential sell for AAVE‘s daily chart, which historically leads to an approximately 27% price decrease.

If such a correction plays out, Aave would drop to the $100 mark.

On a day-by-day basis, we witnessed a robust upward trend and growing momentum, suggesting a bullish pattern. Additionally, the On Balance Volume (OBV) reached a new peak, signaling substantial buying activity fueling the surge.

Nevertheless, even though there are encouraging indicators, the value of AAVE cryptocurrency halted when it reached the $140 resistance level, which coincided with the previous highs from March.

Following the surge in July, a series of Fibonacci levels were drawn up. These levels indicated that $142.58 represents a 100% extension of that movement, further emphasizing the robustness of the resistance at this point.

AAVE’s mixed signals, explained

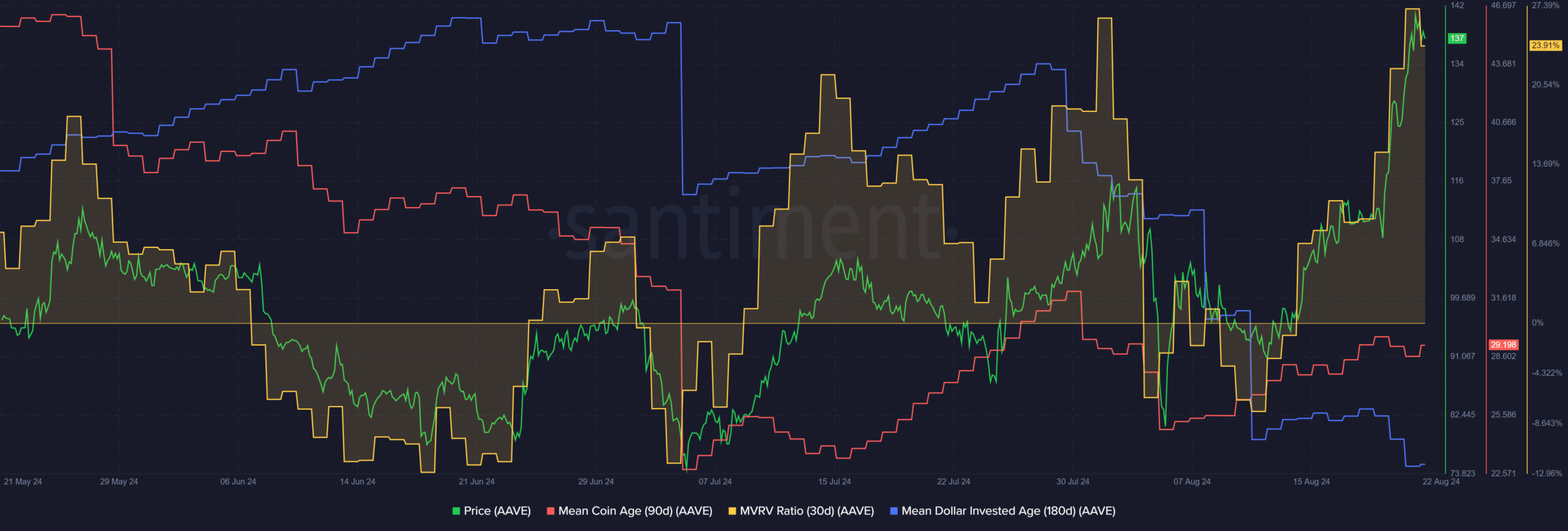

Over the last month, the 30-day MVRV (Maker Value Ratio) reached its highest point since late March, indicating that short-term holders have been making profits. This could potentially cause increased selling activity due to profit-taking. Unfortunately, the average age of coins has shown an inconsistent pattern during this period.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

Conversely, the decreasing average age of dollars invested presents a substantial advantage. This trend suggests higher token circulation and new investment inflows, making it an optimistic sign for the market.

Therefore, a retracement toward $105-$115 followed by a rally appeared likely for Aave.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-23 07:03