- High trading volume and intense momentum spurred Aave crypto higher.

- The token is primed for a move beyond the psychological $200 level soon.

As a seasoned crypto investor with a knack for spotting trends and interpreting technical analysis, I find myself increasingly optimistic about Aave [AAVE]. The rapid surge since October 5th, fueled by high trading volume and intense momentum, has caught my attention. It’s not every day that a token like AAVE breaks its daily chart structure on such strong bullish sentiment.

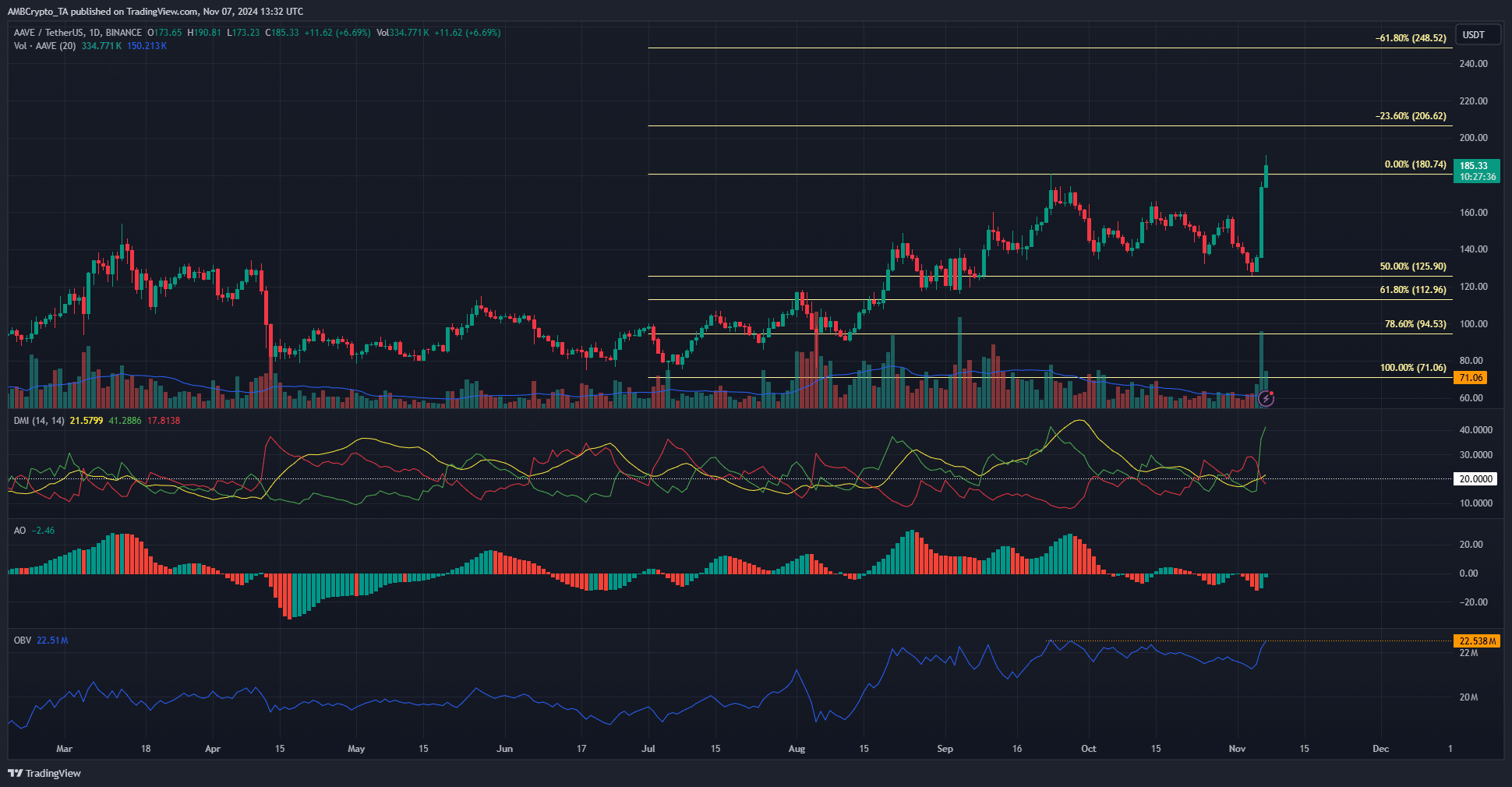

Starting from October 5th’s opening, AAVE (AAVE) has surged by an impressive 44.9%. This surge follows a brief test of the 50% retracement level which occurred at approximately $125 the previous day.

Previously, a report from AMBCrypto noted that the long-term price movements suggested a strongly bullish outlook for AAVE.

However, the quickness of this bullish reaction wasn’t anticipated.

It seems that the Decentralized Finance (DeFi) market has been boosted over the past few days due to the upcoming pro-cryptocurrency U.S. presidency, with DeFi tokens experiencing increases of 30% or more.

Aave breaks structure on high volume

If today’s trading finishes above $180.74, it would indicate a significant shift in the market trend on the daily chart for AAVE, suggesting a potential breakthrough of the bullish market structure.

Following a decline towards $125 from mid-September, and without a subsequent rally as Bitcoin [BTC] continued to rise, this break may serve as confirmation of the HODLers’ belief in their investment.

In simpler terms, the Awesome Oscillator indicated that the overall trend for the altcoin was slightly bearish due to a recent drop followed by an uptick.

Another encouraging sight was the OBV knocking on the doors of a local high from September.

As indicated by the Daily Movement Index (DMI), a robust upward trajectory is underway since the Average Directional Index (ADX, represented in yellow) and the Positive Directional Index (DI+, represented in green) surpassed the 20-mark. From a price action standpoint, potential sell points can be found at $245 and $290.

Consolidation phase for Aave crypto?

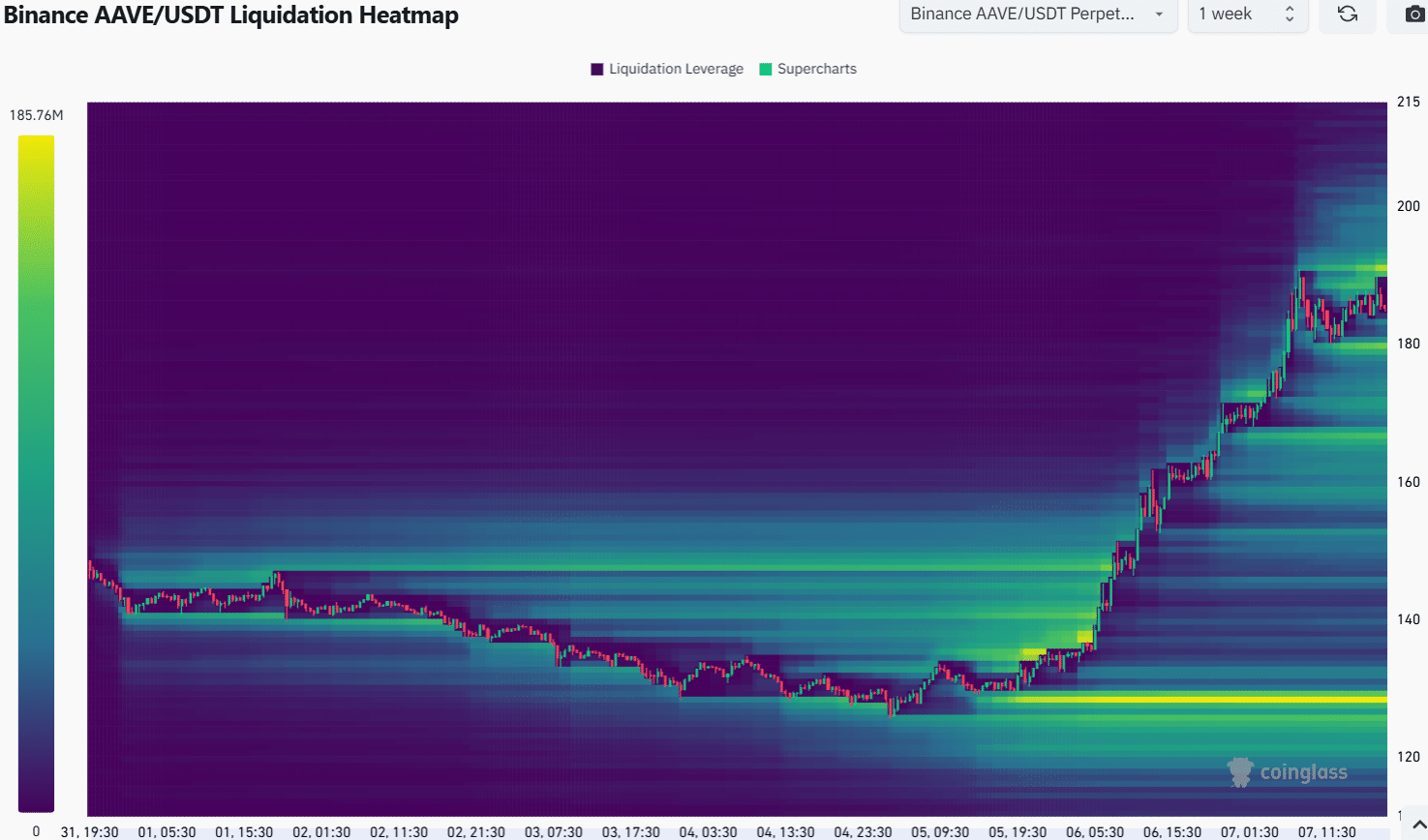

According to AMBCrypto’s analysis, the price drop to around $125 gathered a notable quantity of liquidity as seen in the 3-month chart. Interestingly, the price range around $103 remained unexplored.

According to AMBCrypto’s analysis, even though prices soared, the liquidity at $130 became denser over a three-day period.

As the market closed on November 5th, the price surge sparked an increasing number of traders to take a bullish position. This rapid advance surpassing two-month peaks led to fresh pockets of liquidity forming at $167, $179, and $191.

In simpler terms, the prices around $179 and $191 might create a temporary price band for Aave cryptocurrency. This could provide an opportunity for it to regain strength before making another upward push.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-08 12:07