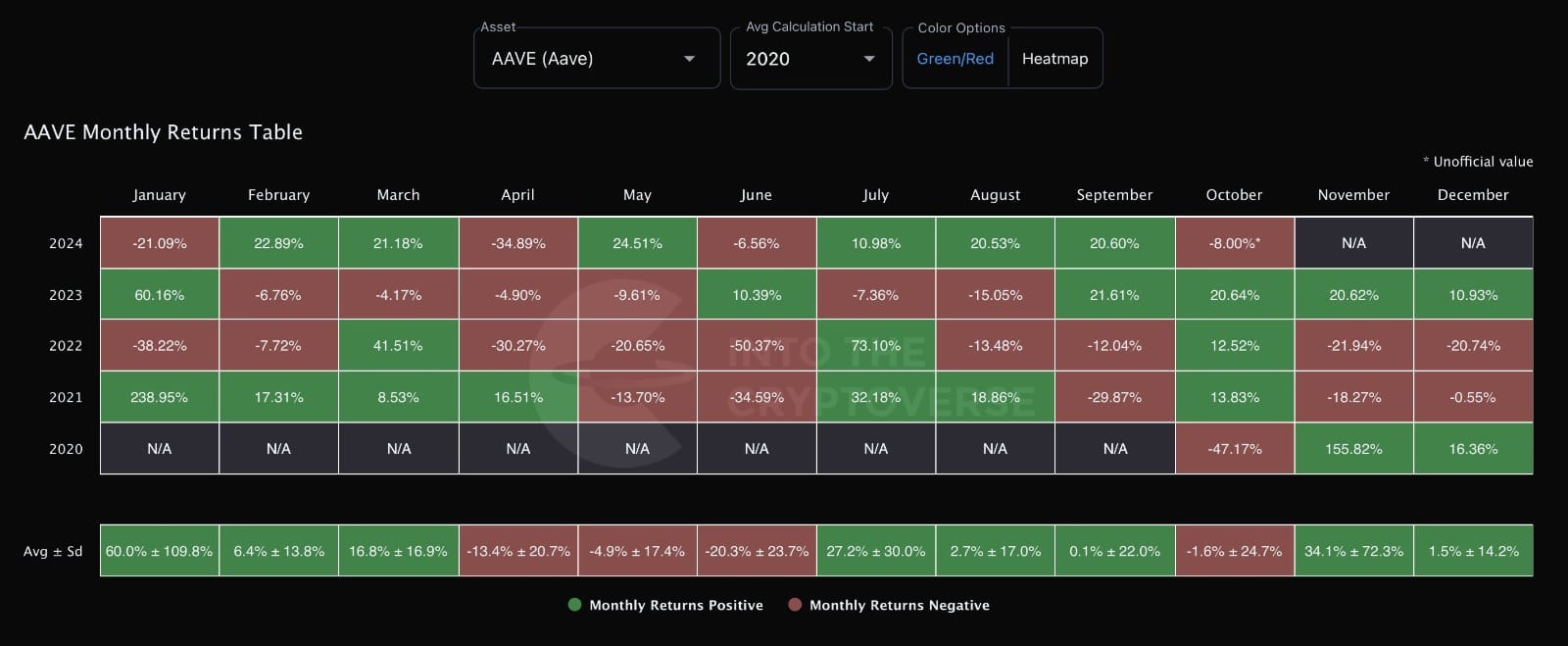

- As at press time, Aave was down 8% in October.

- Aave looks set to break out of a cup-and-handle pattern.

As a seasoned crypto investor with a knack for spotting promising opportunities, I find myself intrigued by the current state of Aave [AAVE]. After three months of impressive gains, it’s natural to see a correction like the 8% drop we witnessed in October. However, this dip should not deter us from seeing the forest for the trees.

In the world of cryptocurrencies, Aave [AAVE] has risen as a notable star, gaining attention for its emphasis on decentralized borrowing and lending platforms.

For the past three months straight, Aave’s market trend has been attracting both traders and investors due to its upward momentum.

In July, there was an increase of more than 10% which suggested a change in market opinion. The subsequent two months witnessed even larger growth, as the closing figures exceeded 20%.

Although October has seen a decrease of 8%, historical patterns indicate that it might recover these losses and potentially gain more than 20% by the month’s end.

In light of a projected strong performance by the broader cryptocurrency sector during the fourth quarter, Aave offers a chance for investors seeking to profit from its recent price decline.

Taking a closer look at Aave’s price movements suggests the emergence of a potentially strong cup-and-handle configuration on the weekly graph. Typically, this setup can indicate an upcoming breakthrough could occur.

Following a well-deserved dip, I found myself testing the $140 support again. This event seems to be paving the way for further progression towards the $151 mark, and potentially beyond.

Traders should keep an eye on the breakout confirmation, as it could lead to significant gains.

During prolonged phases of market consolidation, it’s not uncommon for them to surge over a more significant timeframe, and Aave might follow this trend as well.

Aave’s value and 365D ROI

In terms of a comparison between Aave’s and Bitcoin‘s (BTC) performance, it is worth noting that Aave has demonstrated resilience during periods when it undergoes corrections.

The value of Bitcoin hit its lowest point as the general bullish trend for cryptocurrencies came to an end, while Aave continued to stabilize and consolidate.

Only in August did Aave’s token manage to break free from its price range. Given that Aave has been outperforming Bitcoin recently, it seems poised for additional growth.

This latest dip might be perceived as a short-term pause, after which it may resume moving upwards. There’s a possibility that it will end the month with a strong, optimistic finish.

Enhancing the positivity towards Aave, it’s worth noting the impressive 365-day Return on Investment (ROI) that has been achieved so far, amounting to approximately 2.2%.

This suggests that the majority of investors have made a profit so far this year, which strengthens their faith and optimism.

As a researcher, I’m observing that most investors are experiencing profits, which suggests minimal selling pressure. Consequently, the likelihood of a substantial price drop seems to be diminishing.

Read Aave’s [AAVE] Price Prediction 2024–2025

Instead, it’s more probable that traders will maintain their current investments, hoping for greater profits in the upcoming days.

Based on historical trends pointing towards a bullish Q4, there’s an indication that Aave might experience a turnaround and continue to grow, even though it may encounter a short-term decline in October.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-09 21:44