-

AAVE continued to rally at press time, with the RSI at 74 pointing toward surging buying activity.

The price has broken out of the double bottom formation, with the next key resistance level at $154.

As an experienced analyst with a background in both traditional finance and cryptocurrencies, I find myself intrigued by the recent surge in AAVE. The technical indicators are painting a bullish picture, with the RSI at 74 suggesting surging buying activity and the price breaking out of a double bottom formation.

At this moment, Aave (AAVE) is currently trading at $136, marking a 37% surge over the past week as per CoinMarketCap. Additionally, trading volume has grown by 20% within the last 24 hours.

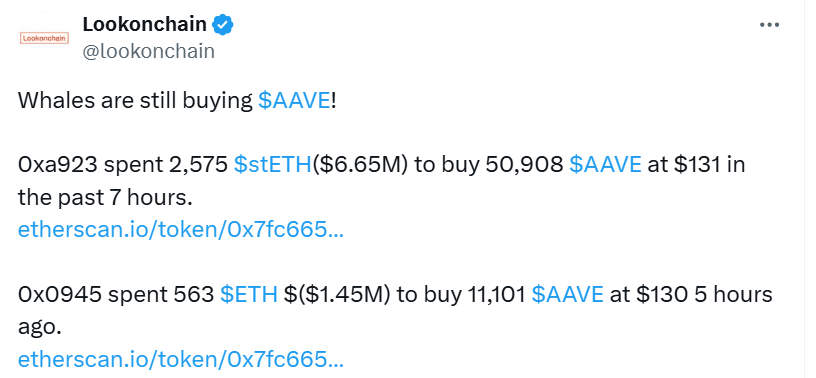

The profits are arising as there’s an increasing market curiosity and trading action related to AAVE. Already, significant investors (whales) have created a stir regarding the token by purchasing approximately $8 million worth of AAVE within the past few hours.

On his previous platform (originally Twitter), analyst Daan Crypto pointed out that now could be an opportune moment to keep an eye on AAVE, since its price appears to be nearing a breakthrough beyond its 2.5-year price range.

So, is AAVE ripe for more gains?

Looking at technical indicators

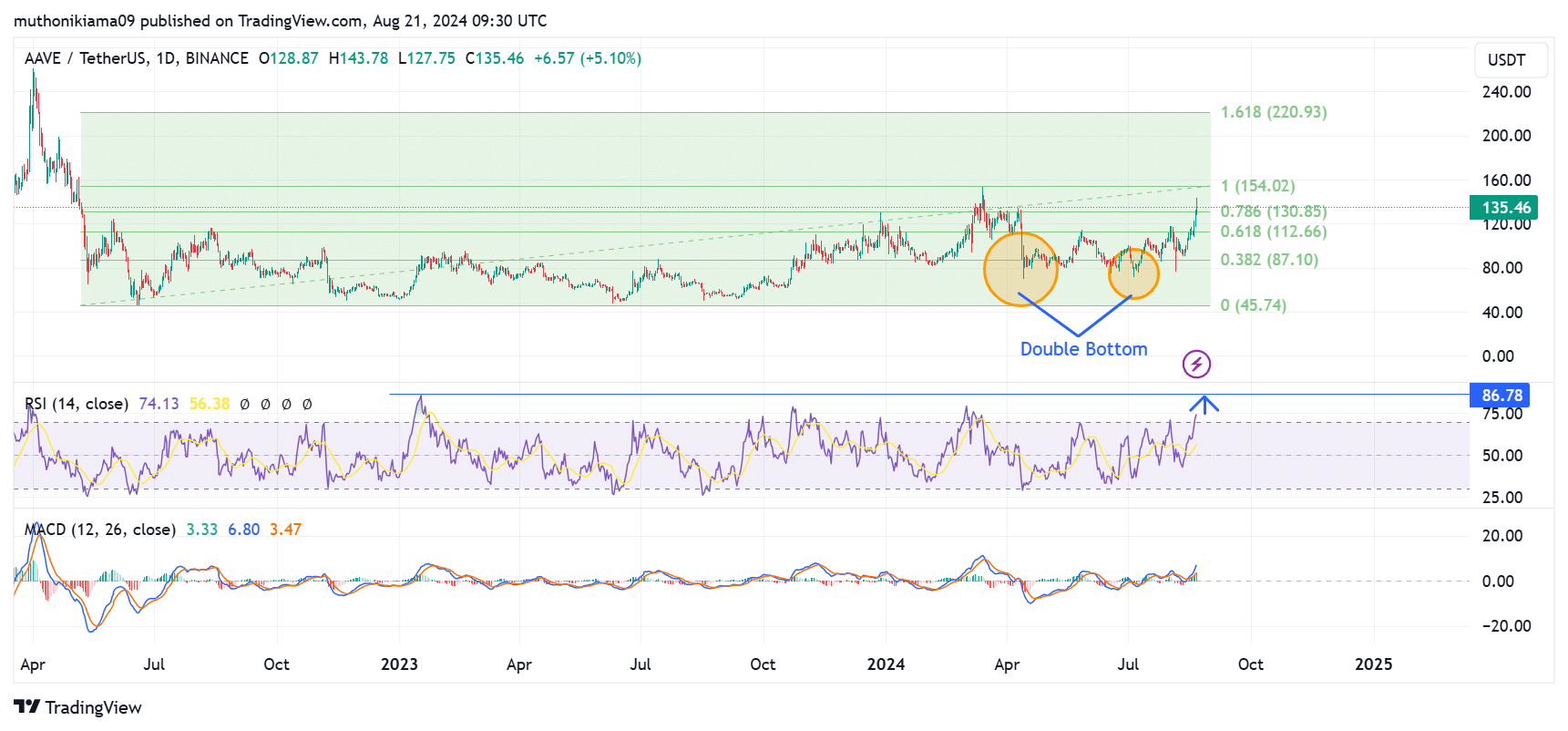

Examining the price fluctuations of AAVE since its two-year low in June 2022 reveals that it has managed to surpass crucial resistance barriers.

AAVE has tested the 0.618 Fibonacci level of $112 twice and held the price above this zone.

As a crypto investor, I’ve noticed that the token has encountered another significant resistance level at around $130. If it manages to surpass this barrier, my expectation is that we could potentially reach a new two-year high targeting approximately $154.

After dipping from its March 2024 peaks, AAVE has formed a double bottom – a pattern that often signals a bullish reversal and may be followed by a strong upward trend.

The token has now surpassed the upper line of its double bottom formation, indicating a potential upward trend towards approximately $154.

As an analyst, I observed that the Relative Strength Index (RSI) for AAVE reached 74, signifying a strong surge in buying pressure that likely fueled its recent upward trend.

As an analyst, I’m observing that the Relative Strength Index (RSI) is trending towards overbought zones, suggesting potential saturation in the market. However, based on historical data from similar market rallies, the RSI peaked at 86 before short-term traders cashed out their profits. This indicates that there might be more room for gains before a possible correction occurs.

1. The MACD line surpasses the signal line, indicating a positive market trend. Additionally, the size of the MACD bars has increased significantly since August 15th, suggesting a growing bullish outlook.

So, if the MACD histogram bars keep extending during periods of increased buying activity, it’s probable that the uptrend will persist.

More bullish signals for AAVE?

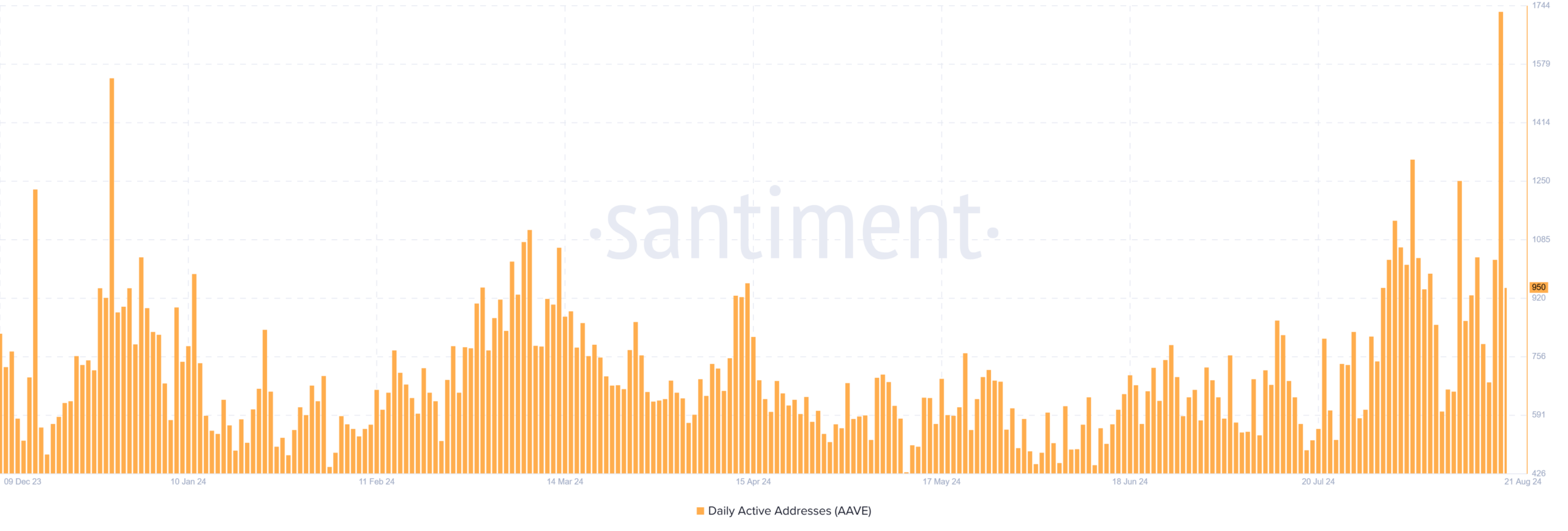

According to data from Santiment, the count of daily active AAVE wallets is currently at its peak since the month of July 2023.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

Based on my extensive experience in the cryptocurrency market, I can confidently say that a bullish indicator is a valuable tool for detecting growing demand and surging market interest around a specific token. As someone who has closely followed the market trends over the years, I have learned to rely on these indicators to make informed investment decisions. In my opinion, a bullish signal suggests a positive shift in sentiment, indicating that more investors are entering the market and driving up the price of the token. This is a promising sign for those who are invested in or considering investing in the cryptocurrency space.

According to AMBCrypto’s analysis using Coinglass data, the Open Interest for AAVE has reached its peak level since 2021. Since August 1st, the Open Interest has significantly increased from $93 million to $191 million as of now.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-22 03:36