-

AAVE has a bearish structure and neutral momentum.

Short-term holders likely added to the price drop with profit-taking activity, and accumulation has not resumed yet.

As a seasoned researcher with a knack for deciphering cryptocurrency trends and a soft spot for DeFi protocols, I find myself rather cautious about AAVE at present. The bearish structure and neutral momentum on the 1-day chart are concerning, especially after its impressive performance earlier this month. It’s as if AAVE took one step forward and two steps back, leaving me reminiscing about the good old days when a $6 million revenue overnight was just par for the course.

Aave (AAVE) stood out in the Decentralized Finance (DeFi) market, skillfully managing decentralized liquidations. As a result of this efficiency, they generated an impressive $6 million income in just one night.

The protocol also saw milestones in July, such as the proposed introduction of a “fee switch.”

Regarding pricing, AAVE maintained its strength against market-wide losses early in August, but that notion changed dramatically during the sell-off on August 5th.

What are the prospects for the token from here on?

AAVE retains bearish promise

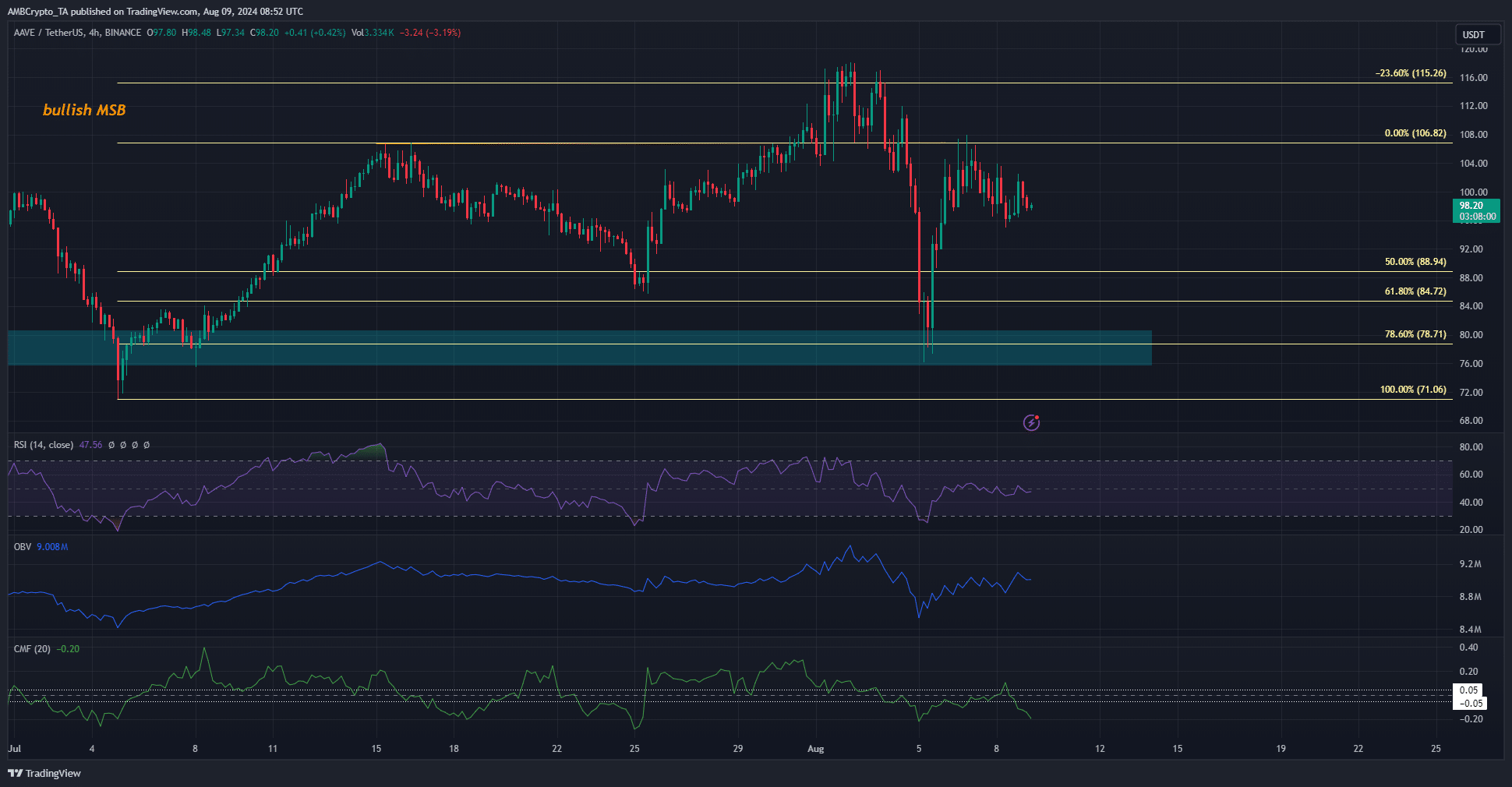

On a one-day scale, the AAVE market maintained a downward trend. It dropped to the 78.6% Fibonacci retracement point at approximately $78.71, but then rebounded to reach around $106.

However, it could not make a new high, and the rejection set a lower high instead.

Over the last few days, the Daily Relative Strength Index (RSI) has hovered around the 50-point benchmark, indicating that so far, the trend hasn’t been in favor of the bulls, suggesting a lack of clear momentum.

Since the 5th of August, the On-Balance Volume (OBV) has been increasing, indicating a bullish trend. However, the Capitals Movement Factor (CMF) dropped to -0.2, suggesting a substantial exit of capital from the market.

AAVE metrics signaled volatility and distribution

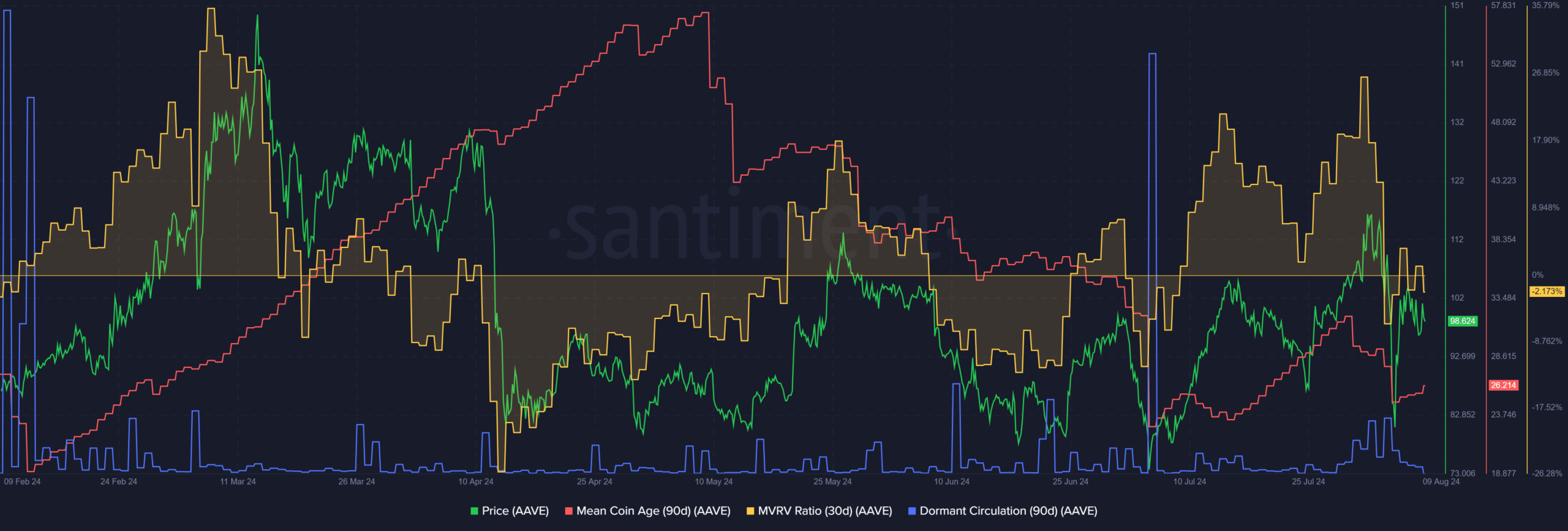

In simpler terms, the Profit-to-Value (P/V) ratio dropped from around 30% to -2%, indicating that short-term investors had been making a profit before the price plummeted below $100. Interestingly, during this price decline, there was an increase in the number of coins that hadn’t been active in circulation.

Collaboratively, this suggests that owners might have withdrawn their investments and pocketed their gains. This notion is further strengthened by the decrease in the average coin age (MCA), which exhibited a pattern similar to AAVE distribution.

The MCA would need to trend higher to signal buyers were accumulating the token.

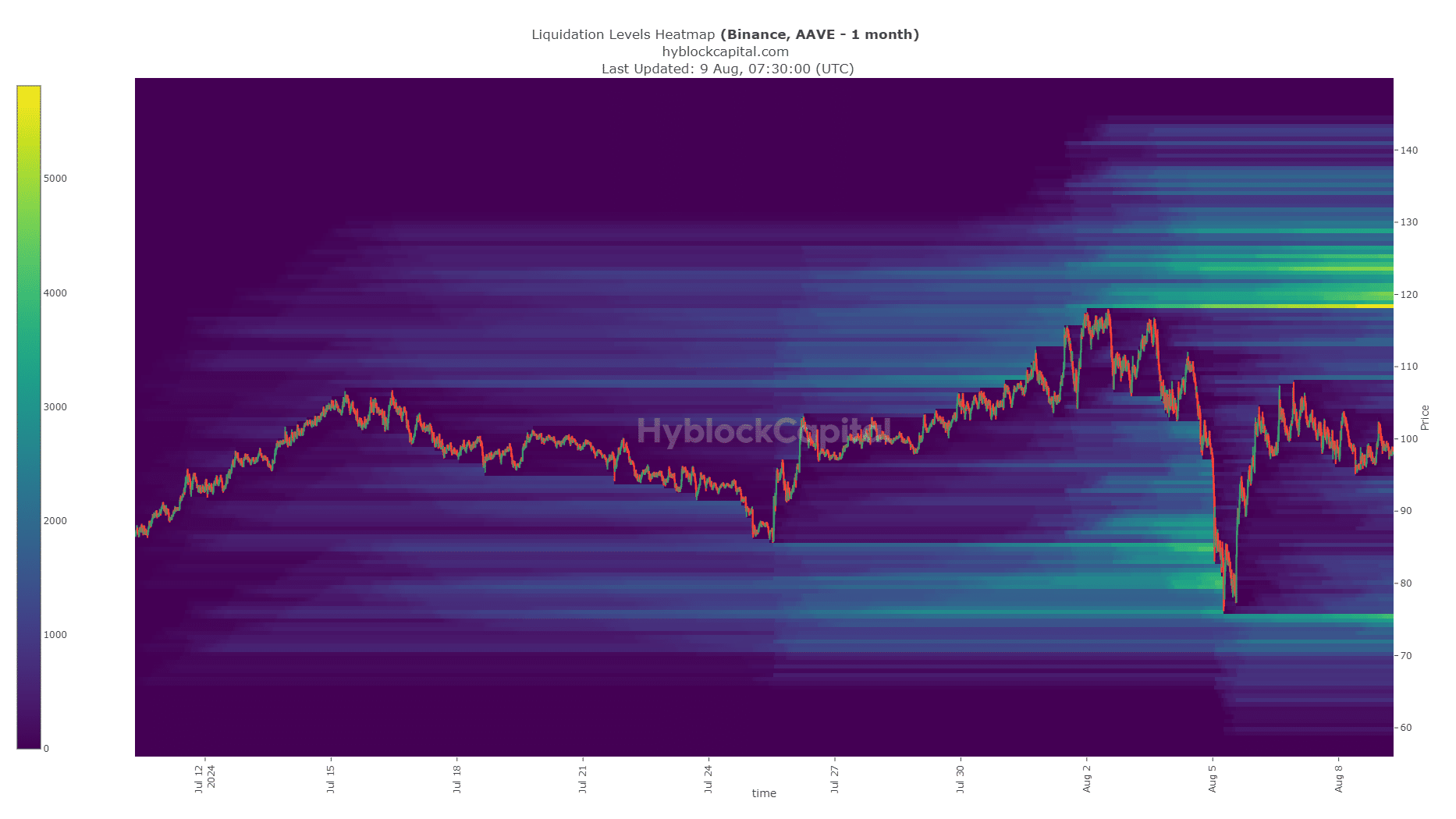

The heatmap showing the liquidation points highlights a temporary goal of $108.5 for the AAVE token, followed by a more substantial liquidity zone between $118 and $120 in the immediate future. This area could potentially act as the next target before a possible correction occurs.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

In simpler terms, the display of dominance over Bitcoin [BTC] vanished rapidly, leaving investors less secure.

Despite experiencing network strain, the protocol’s performance remained favorable during this challenging phase, suggesting that its impact on AAVE prices may become apparent as market sentiment evolves positively.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-08-10 01:11