-

Aave founder has dumped $6.67 million AAVE since February.

The altcoin still enjoyed massive social interest and could present more buying opportunities.

As a seasoned researcher with extensive experience in the crypto market, I find myself intrigued by the recent developments surrounding Aave [AAVE]. The founder’s decision to sell $6.67 million worth of AAVE tokens may raise some eyebrows, but it is essential to remember that this move should not necessarily be a red flag for potential investors.

In spite of the market decline, Aave [AAVE] has stood out as one of the top-performing cryptocurrencies. Yet, the significant increase in price has spurred some investors to cash out, with Aave’s founder and CEO, Stani Kulechov, among those selling

As reported by blockchain analysis company LookOnChain, Kulechov has offloaded approximately 55,596 AAVE tokens, valued at around $6.67 million, since February. At present, the founder’s AAVE holdings stand at over 243,900 coins, which equate to more than $32 million in value

Is AAVE’s price overvalued?

As reported by Kaito, the altcoin has gained significant attention on social media platforms since it hit a low of $75 in Q2. This surge in interest corresponds with the recovery of AAVE

As a crypto investor, I’ve noticed a significant surge of market interest that might have played a role in fueling the impressive recovery we’ve seen, which has soared close to 80% since the Q2 lows

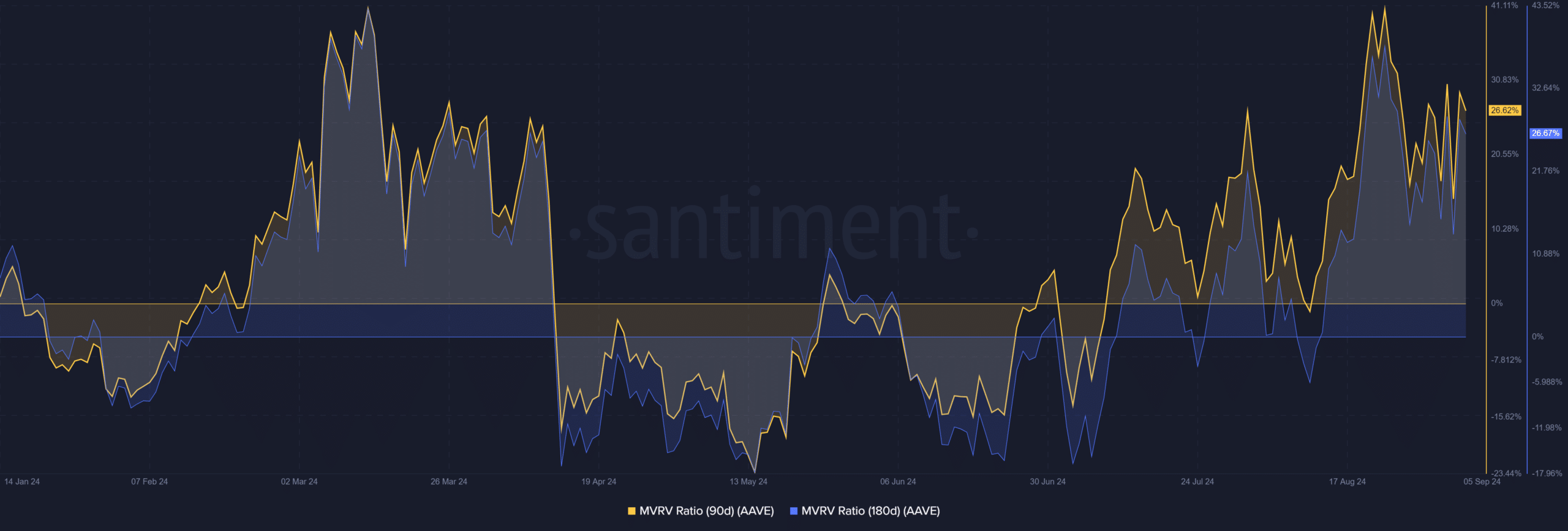

Following a robust price surge, investors who have held AAVE over the past three months enjoyed an average unrealized gain of 27%. Similarly, those who had been holding for six months saw an average unrealized profit of approximately 26%. These figures are derived from the Market Value to Realized Value (MVRV) metric, calculated over a 90-day and 180-day period

As an analyst, I’m constantly monitoring a coin’s value to determine if it appears overvalued. This insight can prompt both short-term and medium-term investors, who have accumulated substantial unrealized profits, to consider cashing in on some of their gains

If that’s the case, the price of AAVE seems to be too high compared to its value, which might lead to significant losses for those buying later, as selling pressure (profit-taking) may increase more strongly

Key levels to watch for AAVE

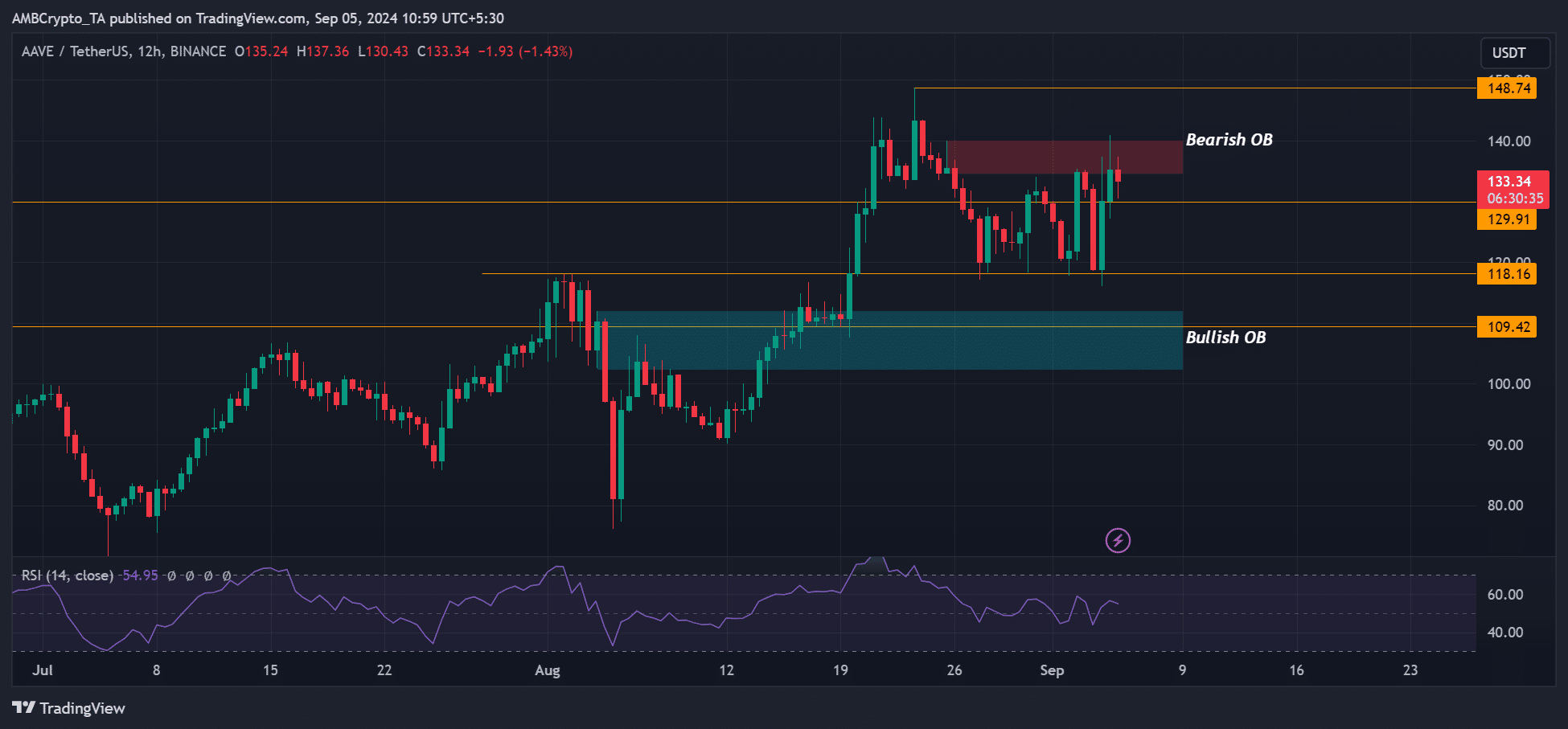

In the past few days on the 12-hour price graph, the upward movement for AAVE reached a temporary resistance area and a bearish sell order cluster around $140

The supply zone further confirmed the recent profit-taking from medium-term holders, including Kulechov’s sell-off.

Over the past few weeks, or since around late August, the price level of $118 has proven crucial for buyers (bulls). Yet, despite significant public attention and repeated attempts, breaking through the $140 mark has proven difficult

If the selling pressure at $140 persists, the short-term supports at $118 and $109 can be great buying opportunities.

Read Aave [AAVE] Price Prediction 2024 – 2025

That said, AAVE could still be a great opportunity, given the rising DeFi mindshare and the strong support from top crypto venture capitalists for the lending protocol.

As stated by Arthur Cheong, the founder and CEO of DeFiance Capital, it is believed that AAVE could hold the highest value among all decentralized finance (DeFi) protocols

‘Unpopular opinion: Aave should be the most valuable DeFi protocol.’

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-09-05 15:04