- Aave reached its highest price in over a year at approximately $172, indicating a strong bull trend.

- The Total Value Locked (TVL) in the network surged to over $13 billion in 2024, nearing its 2021 levels, driven by increased activity.

As a seasoned crypto analyst with over a decade of experience in the digital asset market, I must admit that Aave’s recent surge has caught my attention. The price rally and the bullish signals from on-chain data indicate a robust trend that seems to be far from over.

Over the last several weeks, Aave [AAVE] has been surging, hitting its highest price in more than a year during the most recent trading period. On-chain analysis suggests a strong bullish momentum, reinforced by an uptick in Total Value Locked (TVL) transactions.

Aave sets a new annual price record

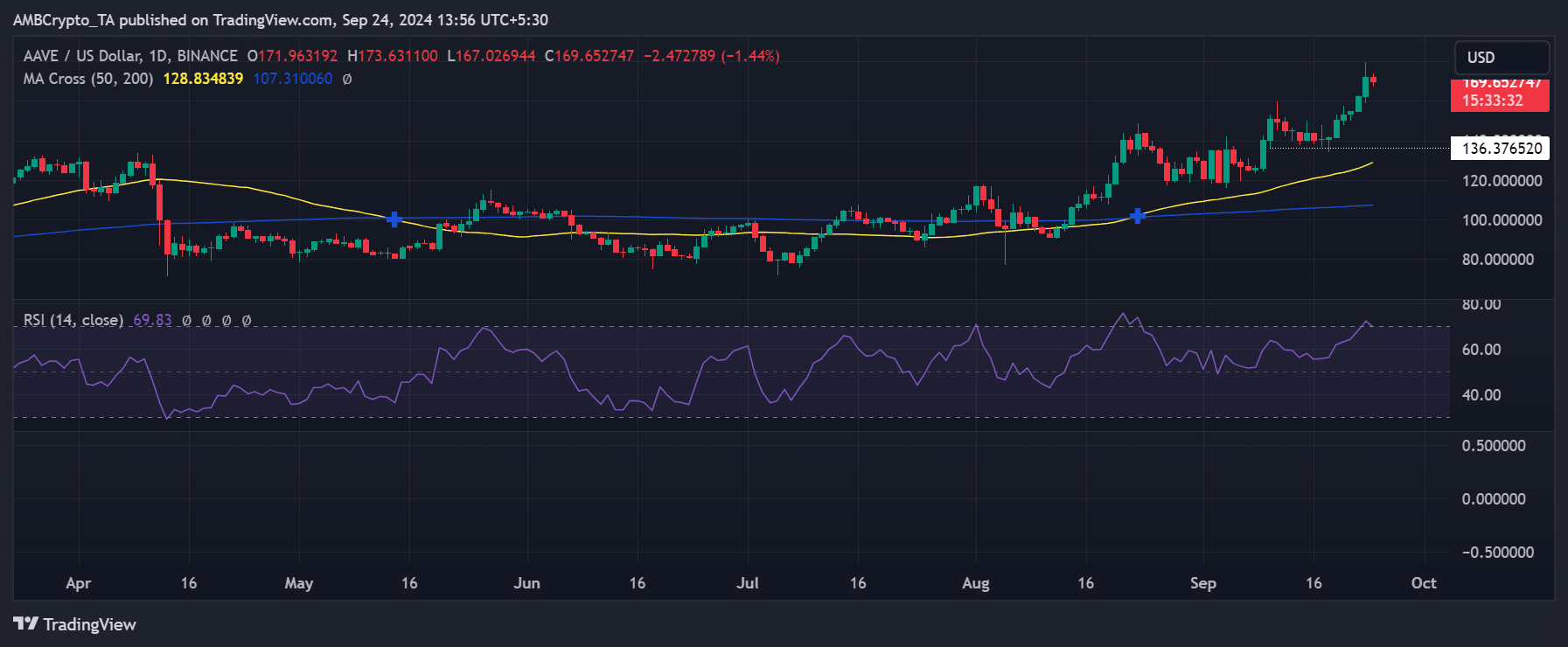

Over the course of a typical day, AAVE ended its previous trade around $172, representing nearly a 6% rise. This is the first time this price point has been seen since May 2022, making it a notable achievement in the journey of this cryptocurrency.

Lately, the price has reached a fresh level of resistance at $136, while there’s a more enduring support at approximately $128 suggested by its short-term moving average (represented by the yellow line).

For over a month now, the Relative Strength Index (RSI) has stayed above its neutral threshold, suggesting a prolonged bullish market phase that started in August. At present, the RSI is hovering near 70, moving into the overbought zone as a result of the recent price surge.

Market capitalization mirrors price trends

AAVE’s market capitalization has climbed in tandem with its price. According to CoinMarketCap, the market cap now exceeds $2.5 billion. This is a substantial increase from a year ago when it stood at around $882 million.

The biggest surge happened roughly around August, climbing up from about $1.3 billion to $2 billion.

Bullish signals from Aave’s on-chain data

Over the last several months, on-chain data suggests an uptick in AAVE hoarding. The number of individuals holding more than zero AAVE has grown from approximately 168,000 to around 170,000, then dipped back slightly to about 169,000.

This uptick indicates that more wallets have been purchasing the asset recently.

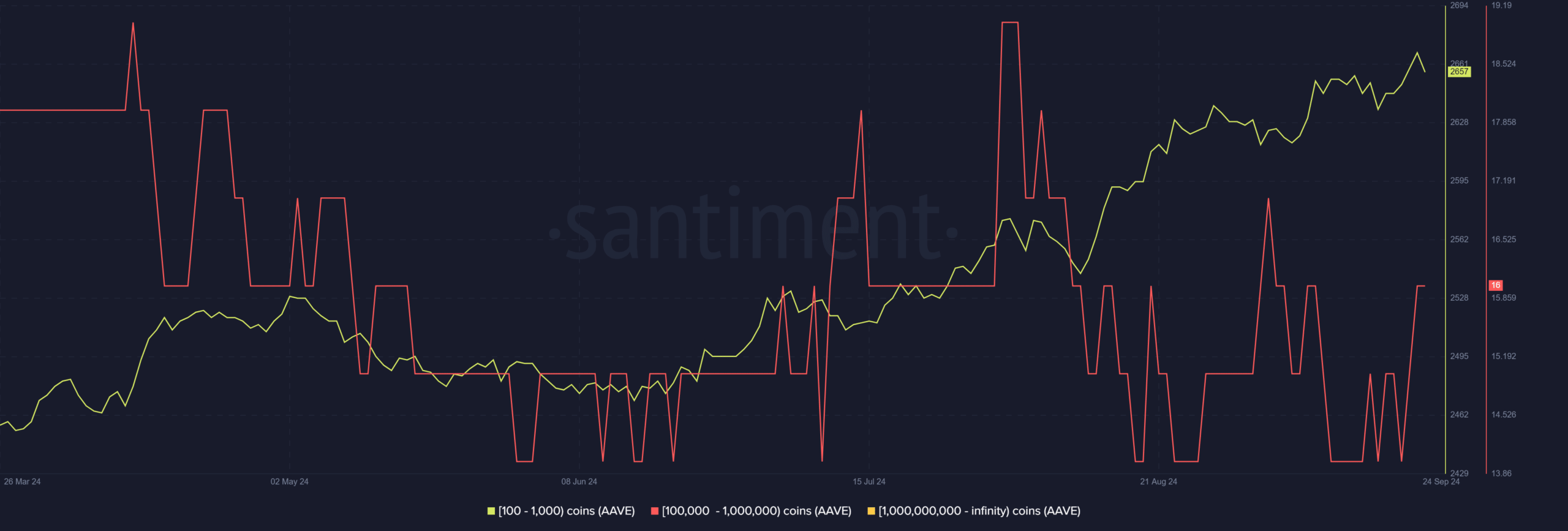

Further analysis shows heightened activity among AAVE sharks and whales. The number of wallets holding between 100 and 1,000 AAVE tokens increased by over 1,000.

Furthermore, there has been a growth of two additional wallets containing between 100,000 and 1 million tokens over the past three days, suggesting a notable increase in holdings by substantial investors.

TVL experiences significant growth

Based on findings from a Santiment report, an uptick in Aave’s activity can be attributed in part to a decline in trust towards Curve Finance, following a significant security incident it experienced in the summer of 2024.

Aave’s expansion into Layer 2 (L2) platforms has also contributed to the uptick in activity.

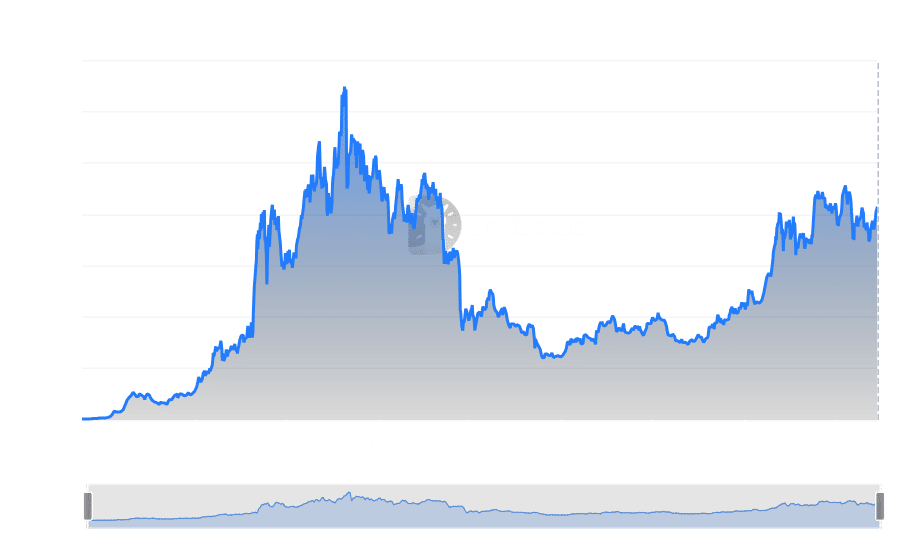

A study of Aave’s Total Value Locked on DefiLlama shows that it has grown significantly, moving towards its 2021 figures. Initially dipping down to about $7 billion in May 2022, it later surged back up to roughly $6.38 billion at its peak in 2023.

By Q1 2024, Total Value Locked (TVL) reached an impressive high of more than $13 billion. As I’m typing this, the TVL is approximately $12.4 billion.

Conclusion

Aave’s exceptional price increase and the optimistic trends indicated by blockchain data hint at a robust positive trend, implying it could be heading higher.

It seems clear that Aave is solidifying its status, as indicated by the escalating market value, swelling user base, and substantial surge in Total Value Locked. This trend may persist for some time.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-25 02:15