-

Bullish indicators form, but breaking $146 is crucial for a rally toward $180 or higher.

Analysts are predicting a potential consolidation phase for AAVE.

As a seasoned crypto investor who has navigated through multiple market cycles, I find myself cautiously optimistic about Aave [AAVE]. The bullish indicators are indeed intriguing, but breaking that crucial $146 resistance is an essential step for a rally toward $180 or higher.

Attempt by Aave’s [AAVE] to surpass the crucial $146 barrier met with opposition, signifying yet another refusal at this significant turning point.

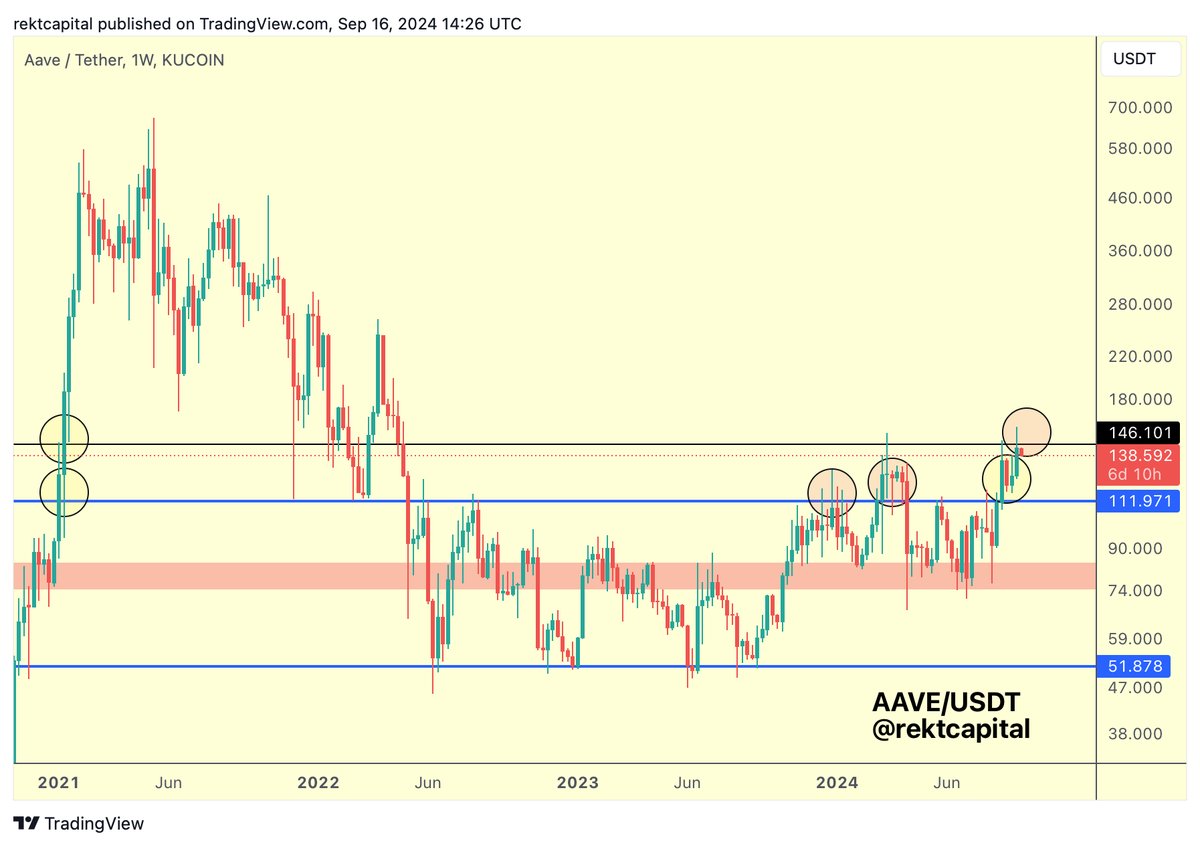

According to crypto expert Rekt Capital, it’s significant that Aave (AAVE) needs to surpass $146 in order to trigger a bullish breakout. However, this critical weekly close was overlooked, indicating repeated unsuccessful attempts to exceed this level. This persistent struggle indicates that AAVE might not be primed for a strong, prolonged upward trend just yet.

Since the beginning of 2022, the $146 price level has proven to be a considerable hurdle, as numerous efforts to surpass it have ended unsuccessfully. The recent rejection suggests that buyers are still facing difficulties, leading investors to worry that the market might stay within its current range for an upcoming period.

Consolidation likely between $111 and $146

Based on the recent decline, experts are forecasting that Aave might enter a period of consolidation. This could mean the price holding steady between the strong support at $111 and the challenging resistance at $146, a level it has yet to surpass successfully.

In simpler terms, it’s possible that AAVE‘s trading will remain within this current price range until there’s a significant push past the resistance level above or a drop below the support level below.

To verify a bullish surge, AAVE must manage to end its trading session above $146. Should this happen, potential future price objectives might reach as high as $180, suggesting a resurgence of positive market sentiment.

If AAVE doesn’t manage to keep its value above $111, there might be a downward trend towards $90 or even lower prices, suggesting ongoing market instability.

Although previous efforts didn’t yield success, there are emerging optimistic technical indicators for AAVE. The graph of AAVE demonstrates an inverse head and shoulders configuration, a well-known bullish reversal pattern. Furthermore, the price is escaping from a falling wedge, a pattern often preceding an upward trend.

Positive indicators point towards a potential breakthrough, but it’s important to note that surmounting the $146 barrier is necessary before this can occur.

Technical indicators signal mixed momentum

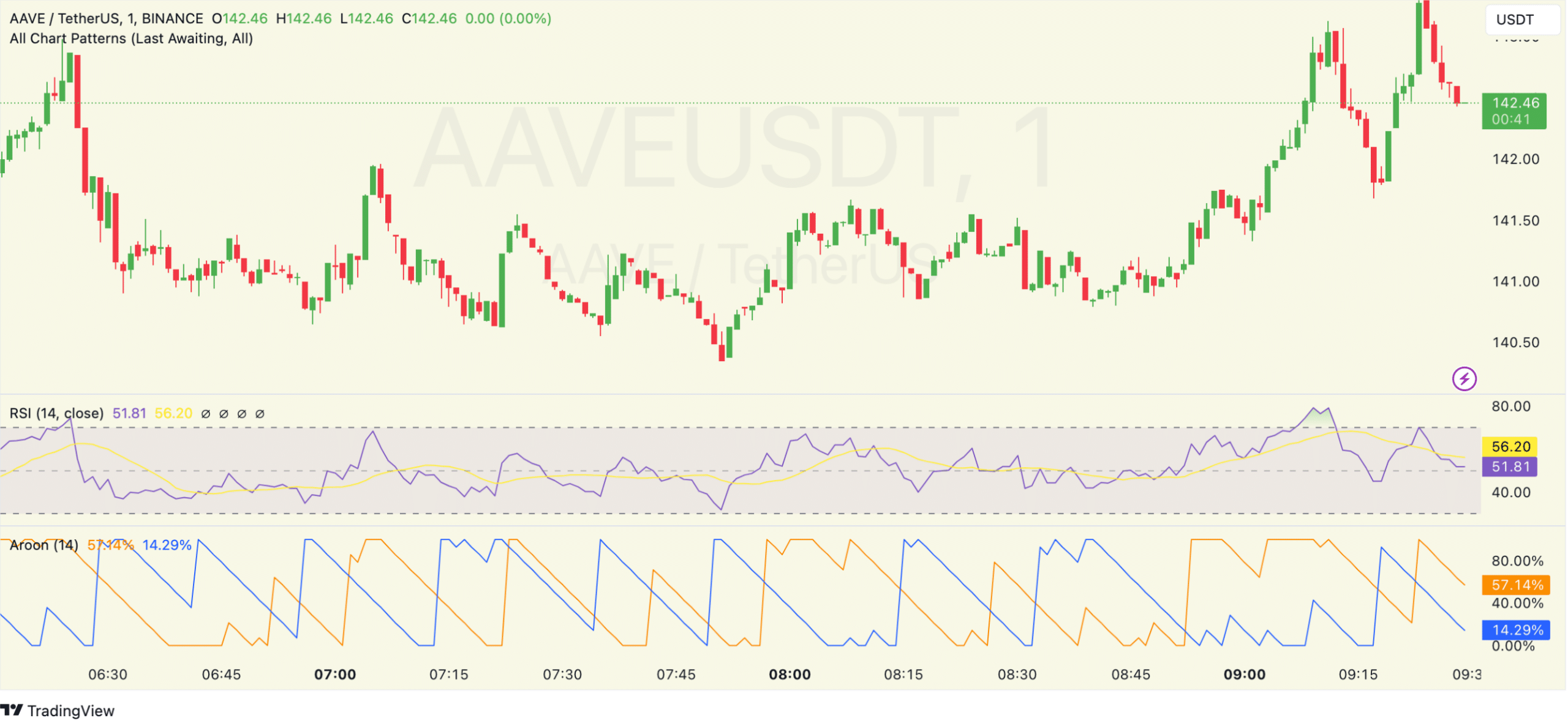

Although AAVE’s rejection at $146 is concerning, technical indicators point to some bullish momentum. The Relative Strength Index (RSI) currently sits at 65.09, indicating that buying pressure is building but has not yet reached overbought levels.

This suggests that there is still room for upward movement if the bulls regain control.

Furthermore, the Aroon indicator displays a robust upward trend, as the Aroon Up line stands at 100%, indicating a decisive surge in an upward direction.

Currently, the Aroon Down line stands at 14.29%, suggesting that the selling pressure is quite low. This information could offer a glimmer of hope to traders anticipating a potential surge past the resistance level, as it implies there might be an opportunity for a breakout.

Currently, one AAVE coin is being traded for approximately $141.56. Over the past 24 hours, a total trading volume of about $327.46 million has been recorded. There are currently around 15 million AAVE tokens in circulation, which equates to a market capitalization of approximately $2.11 billion.

Read Aave’s [AAVE] Price Prediction 2024–2025

As the market hints at a potential bullish flip, overcoming the significant barrier at around $146 is crucial for Aave to convincingly establish an enduring uptrend.

Investors are keeping a keen eye on these particular price points, as surpassing the $146 mark might initiate an upward trend that extends to around $180 and potentially even further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-09-18 13:44