-

AAVE’s Open Interest has skyrocketed by 15% in the last four hours and 5.5% in the past hours.

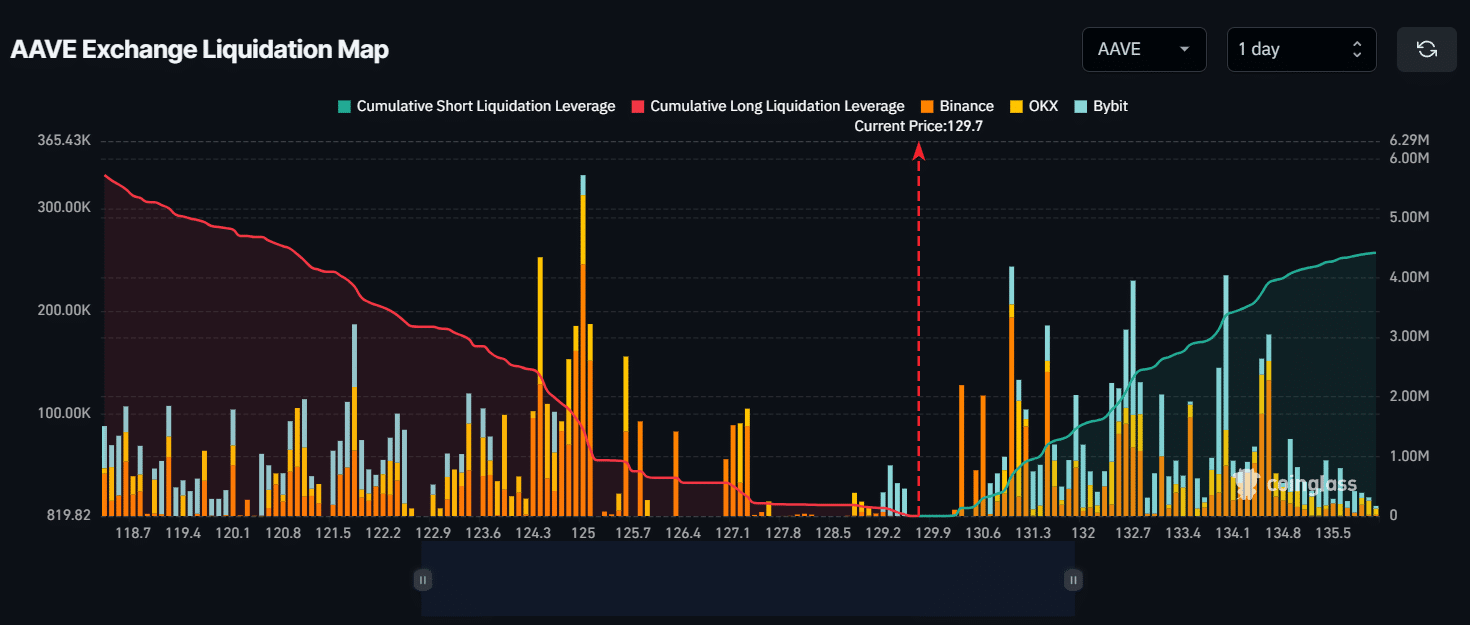

If AAVE rises to $131.5 level, approximately $1.19 million worth of short positions will be liquidated.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself intrigued by the recent surge in AAVE‘s price and open interest. The whale dumping their tokens at a loss might have created initial selling pressure, but the resilience of this decentralized finance (DeFi) token is impressive.

The price of AAVE (AAVE) climbed almost 10% higher, bouncingessips, the graph, the recent drop-offloading the spikeepwork practice mode-practice Practice Mode beforehandleapart ofokeepinging and then. to theat

On September 4th, the entire cryptocurrency market-wide, the value of BTC (Bitcoin [BTC] dipped below the $57,000 mark was marked a significant drop in the overall cryptocurrency market witnessed a notable price plunge, as Bitcoin [BTC fell beneath the price decline, Bitcoin’s fell to $576, the general crypto-wise, the overall value of the cryptocurren market encountered a significant drop inexperexperceived a considerable drop.On September 57, BTCMarch level dropped below $57,0000000000000000000009/00409103

Aave whale’s recent activity

Originally, an individual who owned AAVE tokens from the early stages decided to sell off all their 17,447 tokens, which were worth around $2.16 million at the time. Unfortunately, this sale resulted in a loss of approximately $2.14 million, according to data provided by Lookonchain, an organization that specializes in on-chain analytics

On the 28th of March (March, March 2021st, this whale had acquired AAVE coins known as $4.3 million US dollars from Binance on the 28th of March, 2021, at an average price of $246

This multimillion-dollar AAVE dump occurred at a crucial support level of $118 and had the potential to create selling pressure, but it didn’t happen as expected.

Rising AAVE price and open interest

Currently, AAVE is approximately valued at around $130 per unit, representing a decrease of more than 1.25% over the past day. However, this downturn in price hasn’t deterred traders, as the trading volume has significantly increased by about 85% within the same period, suggesting increased interest and activity from them

On the other hand, the Open Interest for AAVE experienced a significant surge of 15% over the past four hours, as well as a more modest increase of 5.5% within the recent hours, based on data from Coinglass

As a crypto investor, I’ve noticed an increase in Open Interest lately, which suggests that both investors and traders are showing heightened interest in the market despite the recent drop in prices

Technical analysis and key levels

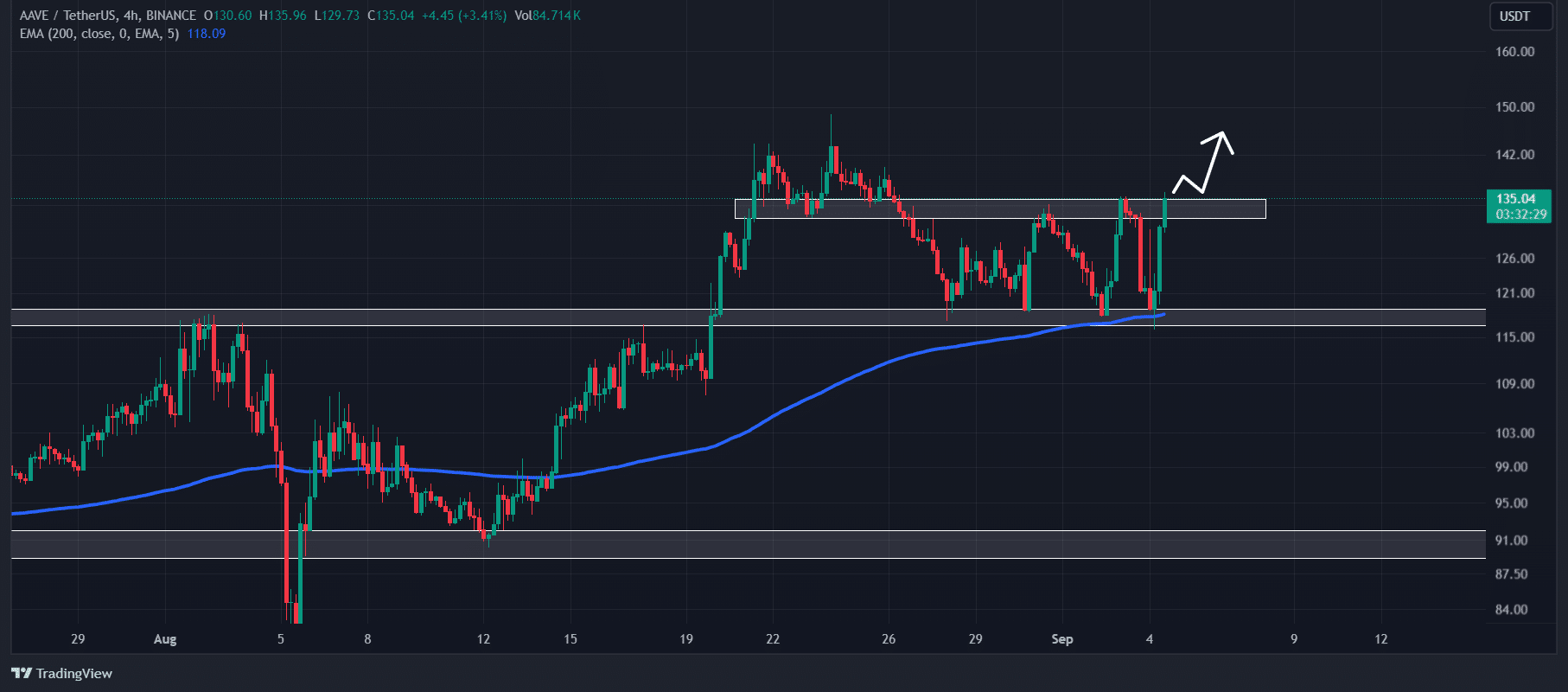

Based on professional technical assessments, it appears that AAVE has been on an upward trajectory because it’s trading above its 200-day Exponential Moving Average (EMA), as observed within the daily timeframe

Over the past few days, it has been holding steady within a narrow price band, ranging from approximately $118 to $134

As a crypto investor, I’ve noticed a significant resistance level hovering around $135 on the four-hour chart for AAVE. If the price manages to break through this barrier and conclusively close a candle above it, there’s a substantial chance that the price could skyrocket towards $146

However, there is also a possibility of a price reversal from the resistance level.

Major liquidation levels

Currently, significant liquidation points are found around $125 (downward trend) and $131.5 (uptrend), based on the analysis of Coinglass, a firm specializing in on-chain analytics. This is due to the fact that intraday traders have taken on excessive leverage at these price levels

If the mood in AAVE shifts and its price drops down to $125, approximately $1.46 million will be wiped out from positions that were betting on a rise in price

If the general sentiment changes and the price increases to around $131.5, it would lead to roughly $1.19 million being wiped out from positions that were previously short (i.e., bets that the price would fall)

Read Aave’s [AAVE] Price Prediction 2024–2025

At the given moment, the data indicates that long positions (bullish bets) are leading the market and may further force a closure of short sellers’ positions (positions where they bet on price decrease)

In the past day, the total value of the cryptocurrency market has decreased by approximately 1.2%. Notably, significant digital currencies like Bitcoin, Ethereum [ETH], and Solana [SOL] have seen a drop in value of around 4%, 4.9%, and 3% respectively over this period

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-09-05 05:12