-

AAVE among top performers, with positive patterns.

Stablecoin market cap and whale activity on the rise.

As a seasoned analyst with over a decade of experience in the crypto market, I must say that the current performance of AAVE is quite intriguing. The coin’s consistent top-performer status and its recent breakout from a multi-year downtrend are strong indicators of its potential for further growth.

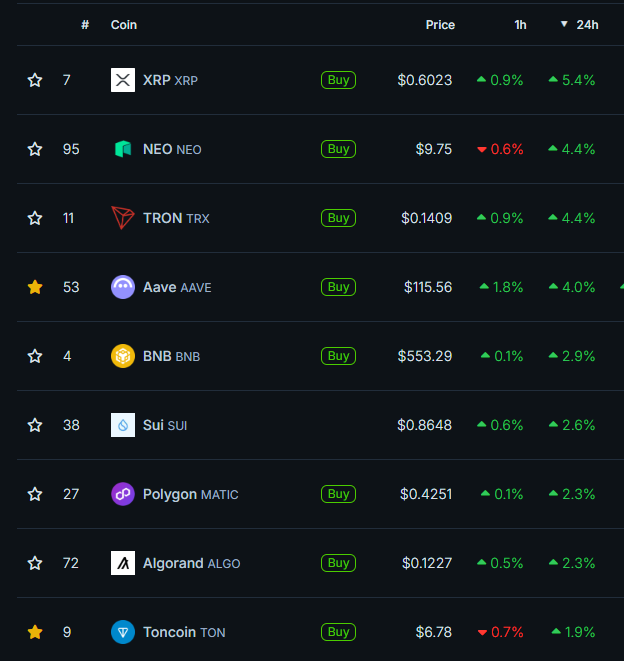

Over the past day, high-performing cryptocurrencies have been mature coins and large capitalization ones. This is a promising indicator for the overall crypto market, suggesting that it may be transitioning out of its recent stagnant and negative trend.

It’s preferable for Bitcoin and large-cap cryptos to lead, maintaining liquidity rather than random meme-coins.

According to Daan Crypto’s observation on X, Aave [AAVE] experienced a 4% increase in value, placing it fourth among other cryptocurrencies. There are predictions that Aave will keep climbing as the crypto market recovers following the downturn caused by the Japan stock market crash.

Initially, African American Vernacular English (AAVE) appears to have promising prospects across longer trading intervals. Lately, AAVE has demonstrated exceptional performance and may exceed the $260 mark if it manages to surpass the $153 barrier.

Following an escape from a descending wedge formation, AAVE reached a fresh short-term peak, revisited the breakout area, and honored the value gap, paused, and now it’s experiencing a significant uptrend.

As an analyst, I’m observing that AAVE is currently trading at $129 and exhibiting a bullish weekly candlestick pattern. If the current momentum persists, I anticipate AAVE to climb even further in value.

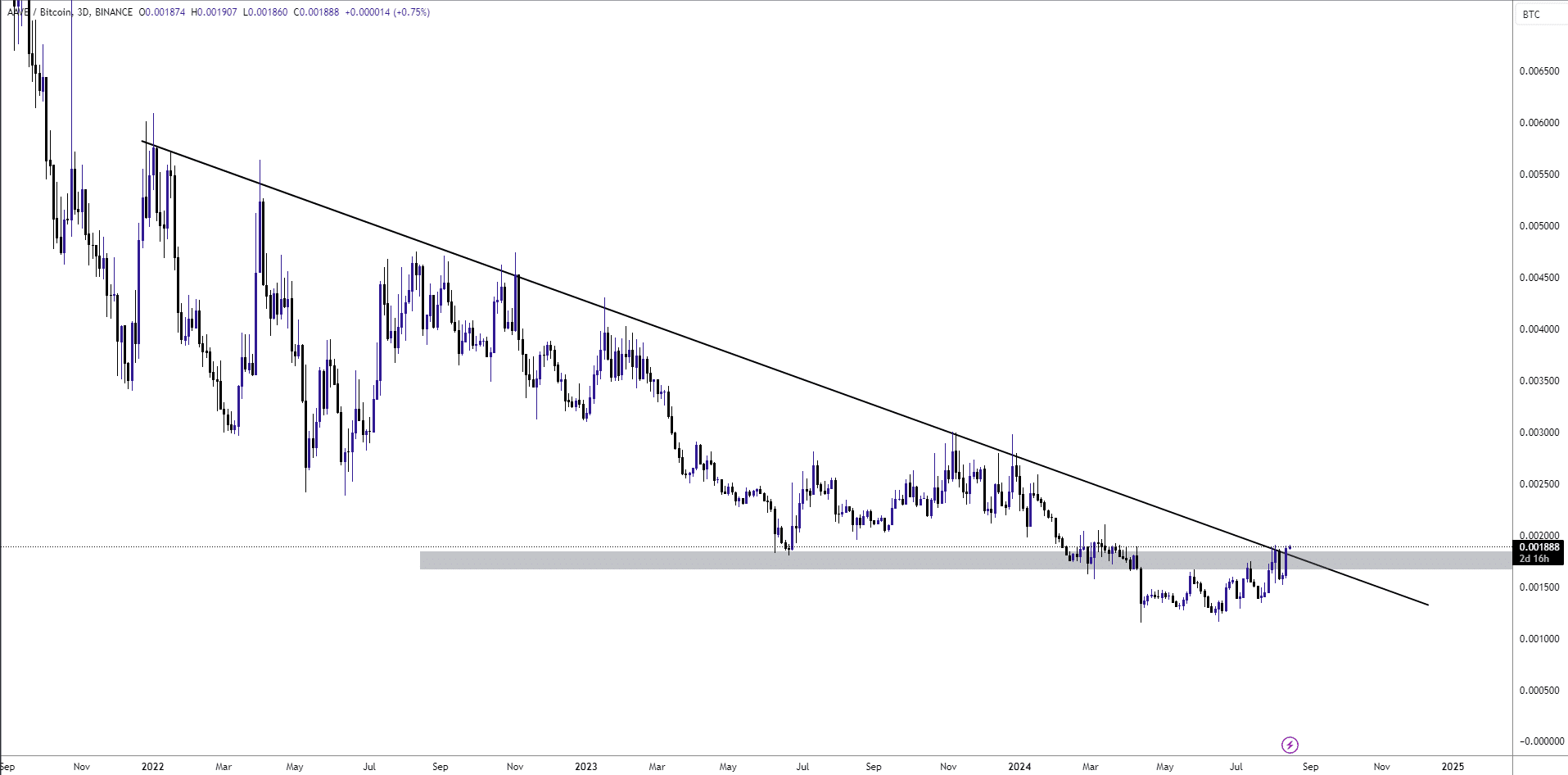

AAVE/BTC breaks out as stablecoin market cap grows

The robustness of AAVE is upheld due to its prolonged period of consolidation within a span of approximately 900 days, yet it consistently failed to break through the significant resistance at $113 on four separate occasions before eventually doing so.

Meanwhile, the AAVE/BTC pair has broken out of a 3.5-year downtrend and flipped bullish.

Given predictions that AAVE‘s value could reach and exceed $153, there is a possibility it might continue climbing to the next significant resistance point at around $260.

Spot trading will be crucial as traders and investors scale up during breakouts or pullbacks.

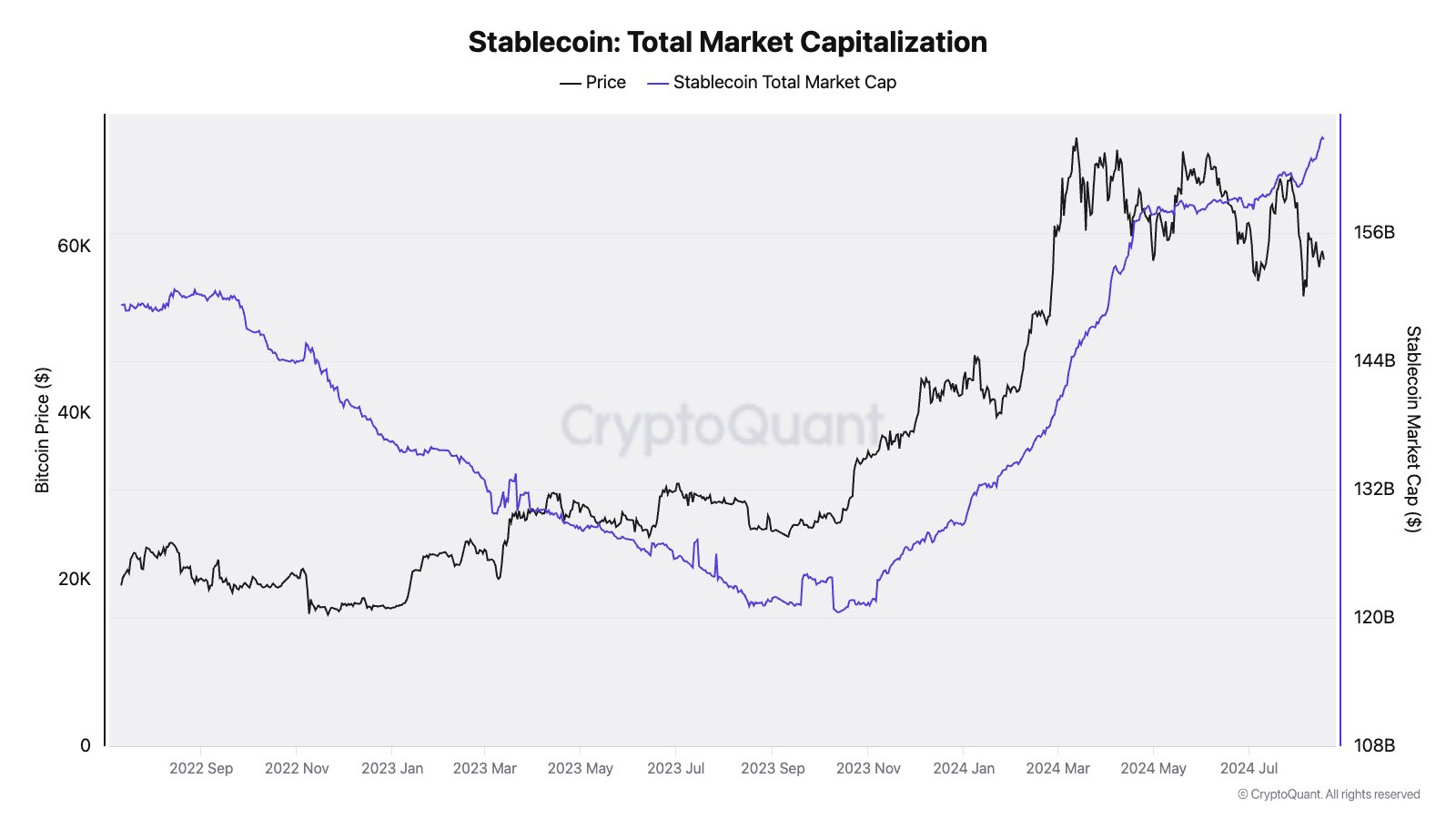

As a researcher delving into financial dynamics, I’ve noticed a trend where the spotlight often falls on the global M2 increase. However, it seems that the surge in the stablecoin market capitalization, now standing well above $165 billion, has been somewhat overlooked. This new high is certainly a significant development worth further exploration.

Based on my personal experience and observation of the crypto market over the past few years, I believe that this increase in liquidity signifies a stronger and more stable crypto market. As someone who has closely followed AAVE‘s growth, I can say that higher liquidity is crucial for supporting its anticipated upward trend. In my view, increased liquidity allows for smoother transactions, greater efficiency, and reduced volatility – all of which are important factors for long-term success in the crypto world.

An increasing sum of funds moving into the cryptocurrency markets is suggested by the growing aggregate market value of alternative coins (altcoins), thereby enhancing the general market trend.

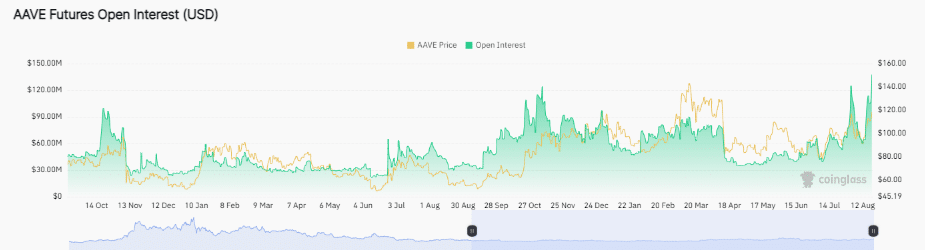

Increase in wallet activity and open interest

In simpler terms, the use of Automated Clearing House (AAVE) is growing more popular as transactions in digital wallets increase and the total value locked in these contracts (open interest) has reached a new high of $137.62 million, which is the highest it’s been since June 2022.

Trading activity within wallets escalated significantly as a savvy investor exchanged approximately 675.5 Ethereum Wrapped (equivalent to $1.79 million) for around 14,777 Aave tokens at $121.2 each, data from SpotOnChain on X revealed. Interestingly, this was the trader’s initial purchase of Aave tokens.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

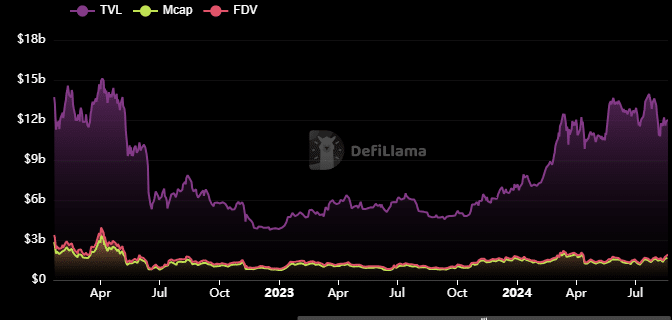

The current market value of AAVE stands around 1.9 billion dollars, while its daily trading volume amounts to approximately 321 million dollars. Additionally, the total amount of assets locked within the AAVE platform is currently estimated at 11.5 billion dollars.

In simpler terms, the maximum number of shares that could be available (fully diluted market capitalization) is $2 billion. Out of this, 14.9 million shares are currently in circulation, while there’s a total of 16 million shares. This suggests a high level of liquidity for AAVE, as evidenced by a volume-to-market cap ratio of 12.57%.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-20 19:04