- AAVE established a bullish market structure after last week’s drop below its local support

- A rally beyond $200 appeared likely in the short term

As a seasoned crypto investor with a knack for spotting trends and market structures, I must say that AAVE is looking quite promising right now. The bullish momentum post the drop below local support last week has been impressive, with the altcoin rallying by almost 50% in just five days. While I’m not one to jump into a bull run without due diligence, the current market structure does suggest a potential rally beyond $200 in the short term.

In the past five days, the price of Aave [AAVE] surged by an impressive 49.7%, reaching beyond its previous local peak at $180.74. After setting the $137-$140 range as a supportive foundation, it dipped below this level on November 4th.

After this departure, there was a rapid upward surge, signifying the bullish tendency in AAVE. It’s likely that more growth will occur, with the $206 level being the next objective. However, it’s possible that the bulls may be held back temporarily within the $190 area.

AAVE flips $180 to support

On the 7th of November, AAVE surpassed its previous peak in September at $180.7. However, it exhibited increased price fluctuations on the 8th. Nevertheless, the bullish investors successfully held the $180-mark as a barrier of support.

If we follow the Fibonacci pattern, potential bullish targets for the price could be around $206 and $248. The Relative Strength Index (RSI) on the daily chart has risen above 50, suggesting a bullish trend. However, the On Balance Volume (OBV) is finding it hard to exceed the peak from mid-September, which might indicate some resistance to further price increases.

It appears this could serve as a heads-up that we need continued buying activity to boost the likelihood of an upward trend in AAVE. At the moment, though, the current market behavior is looking promising for the bulls, making it potentially advantageous to hold long positions.

Liquidity pools could induce volatility

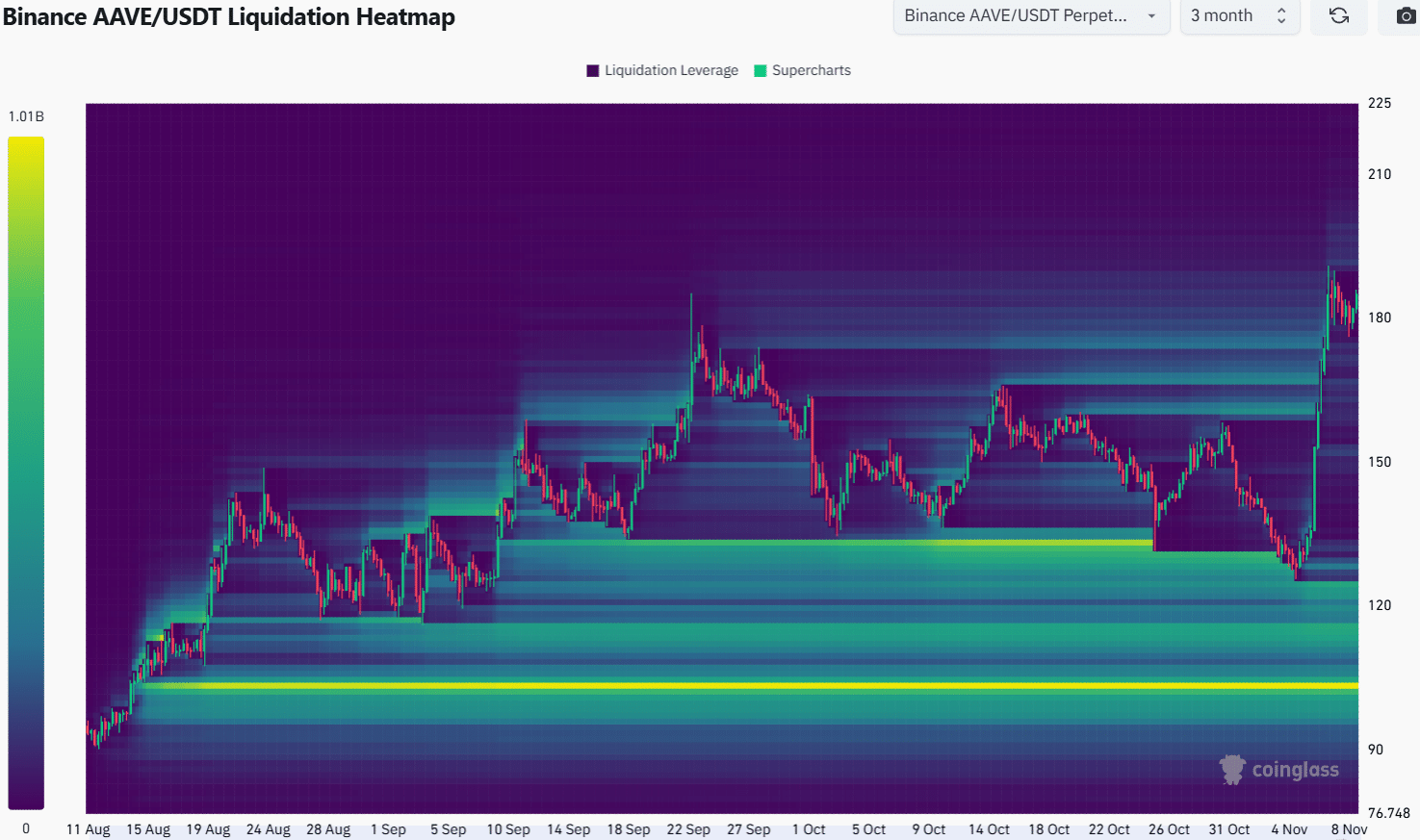

During the past three months, a heatmap showcased specific areas – $133, $128, and $121 – that had substantial liquidity. Notably, these zones were impacted in the latter part of October.

As a crypto investor, I observed a surge in optimism surrounding Bitcoin [BTC], which played a significant role in boosting AAVE’s recovery when it dipped below $130.

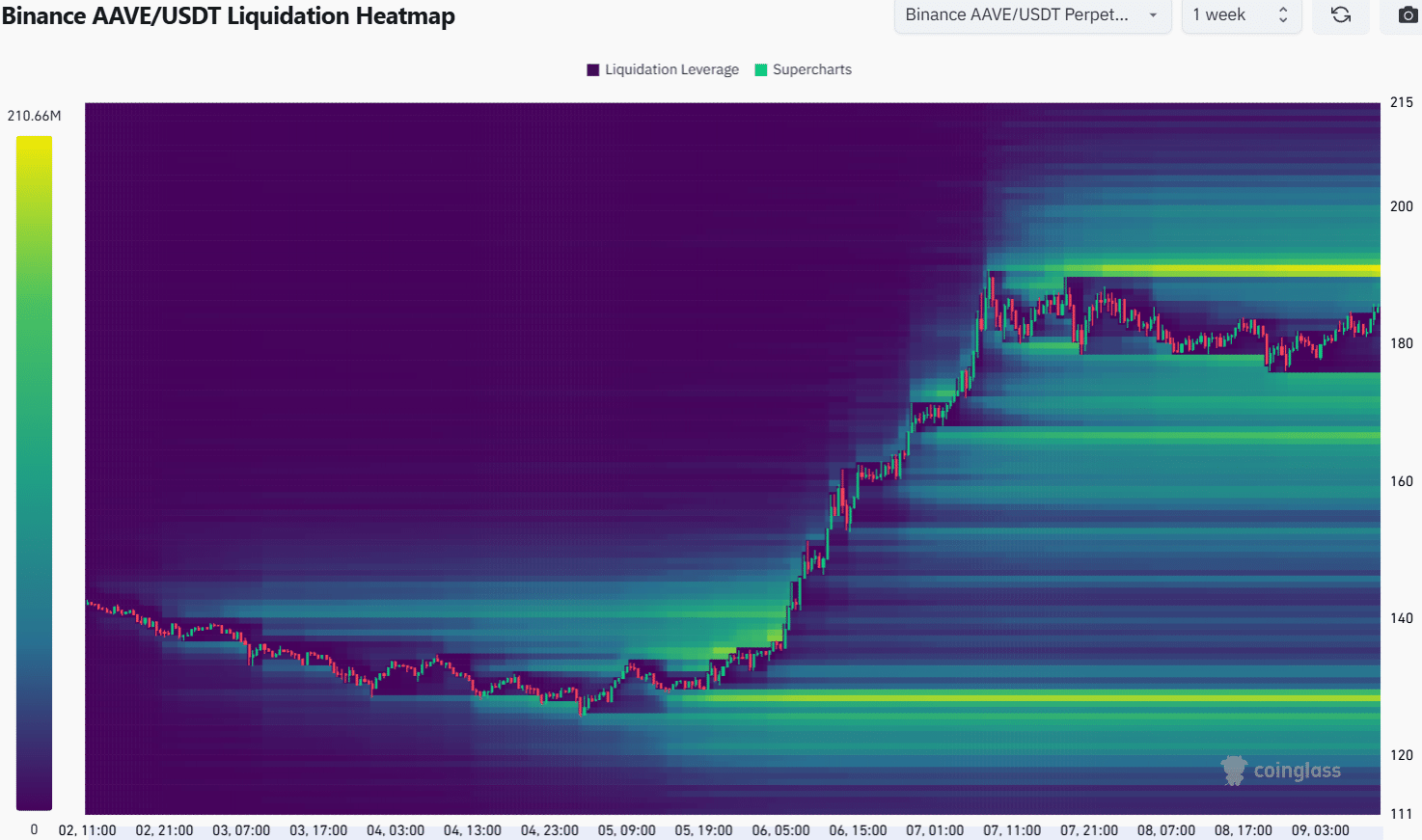

Over the last two days, there’s been a significant build-up of short positions in the region around $190, as shown by a one-week heatmap. This suggests it could be a location where market activity might occur soon. Additionally, there’s a possibility that the price range between $171 and $175 may be revisited.

Read Aave’s [AAVE] Price Prediction 2024-25

In simpler terms, it’s possible that prices may increase more in the future, but due to temporary market conditions around $190 and $170, there might be fluctuations in the price before it surpasses $200, which could happen after the weekend has passed.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-09 16:07