- Aave posted gains at a time when Bitcoin and the rest of the large-cap coins struggled to stay afloat.

- The on-chain metrics were bullish but price dips and volatility could heighten next week.

As a seasoned analyst with over two decades of experience navigating the cryptocurrency market, I must say that the recent performance of Aave [AAVE] has been quite intriguing. While Bitcoin [BTC] and the larger-cap coins have struggled to stay afloat, AAVE’s resilience and exceptional relative strength against the market leader are a testament to its underlying strength.

Over the last seven days, Aave (AAVE) has shown outstanding performance, in stark contrast to Bitcoin [BTC] which plummeted approximately 11.25% since its peak on Monday, 29th July. Remarkably, Aave prices have climbed by a robust 11% from that same high point.

Displaying remarkable tenacity and significant strength compared to Bitcoin amidst a week filled with pessimistic cryptocurrency news is fantastic for Aave holders. Here are some key points traders and investors should keep an eye on.

Aave saw a firmly bullish performance in July, starts August on the right note

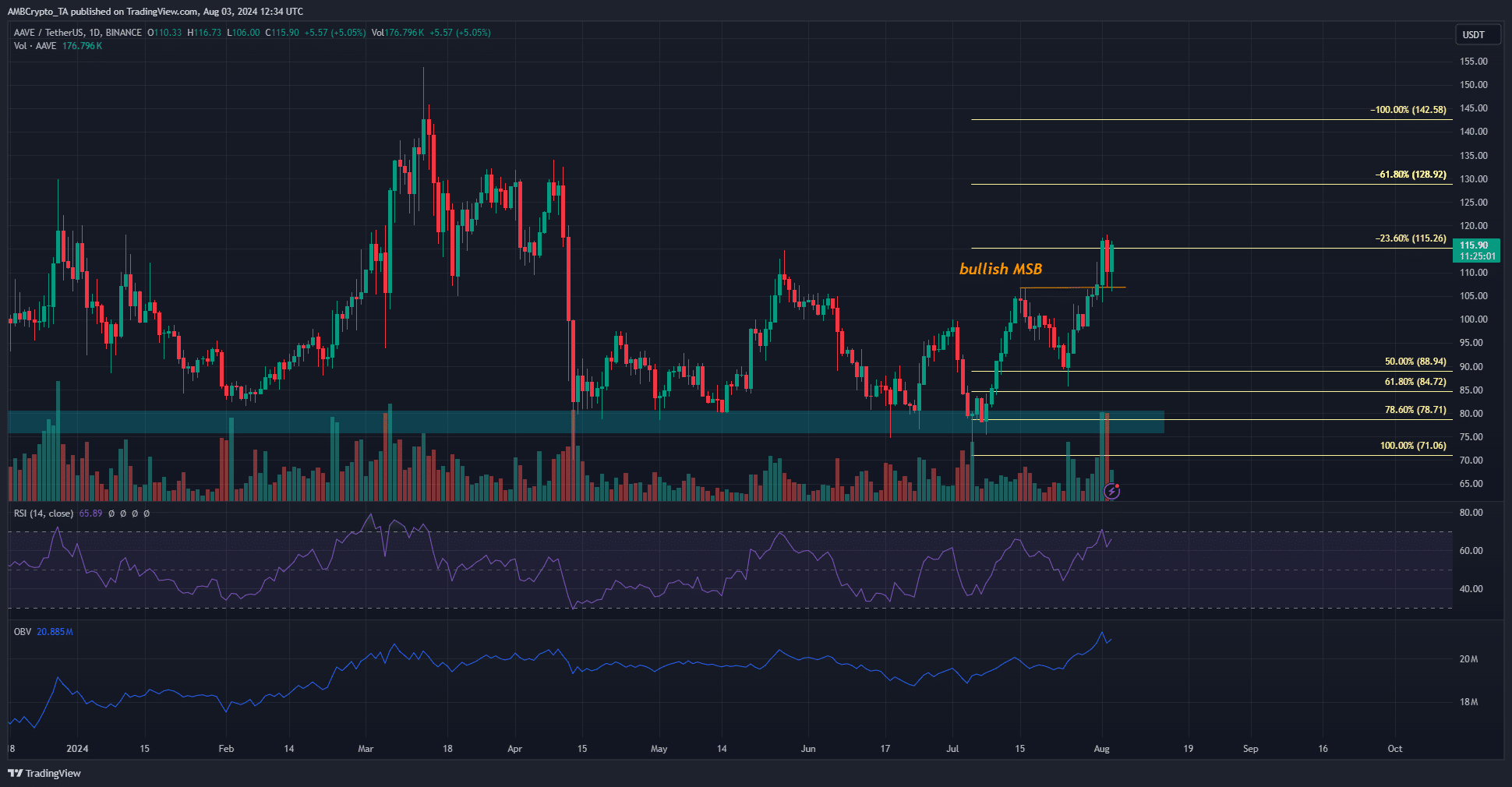

In simpler terms, a series of Fibonacci levels – both retracement (bouncing back points) and extension (extending beyond the initial move) – were drawn based on the price surge from $71 to $106.7 in July. On the 24th of July, the midway point or 50% retracement level at approximately $88.94 was tested as a potential support (a level where the downward trend might halt and potentially reverse). However, following this test, the bulls managed to recover the losses they had experienced earlier.

Over the past nine days, AAVE surged higher and made a bullish market structure break in the 1-day timeframe. The daily RSI was at 65, signaling hefty upward momentum but no overbought conditions yet.

It’s possible that there is potential for further growth, as the Overbought Band (OBV) is rising, indicating continuous buying activity. The Fibonacci extension levels at approximately $129 and $142 align with the highest points reached in the past three days, suggesting these could be the next profit-taking points.

On-chain metrics show volatility is likely

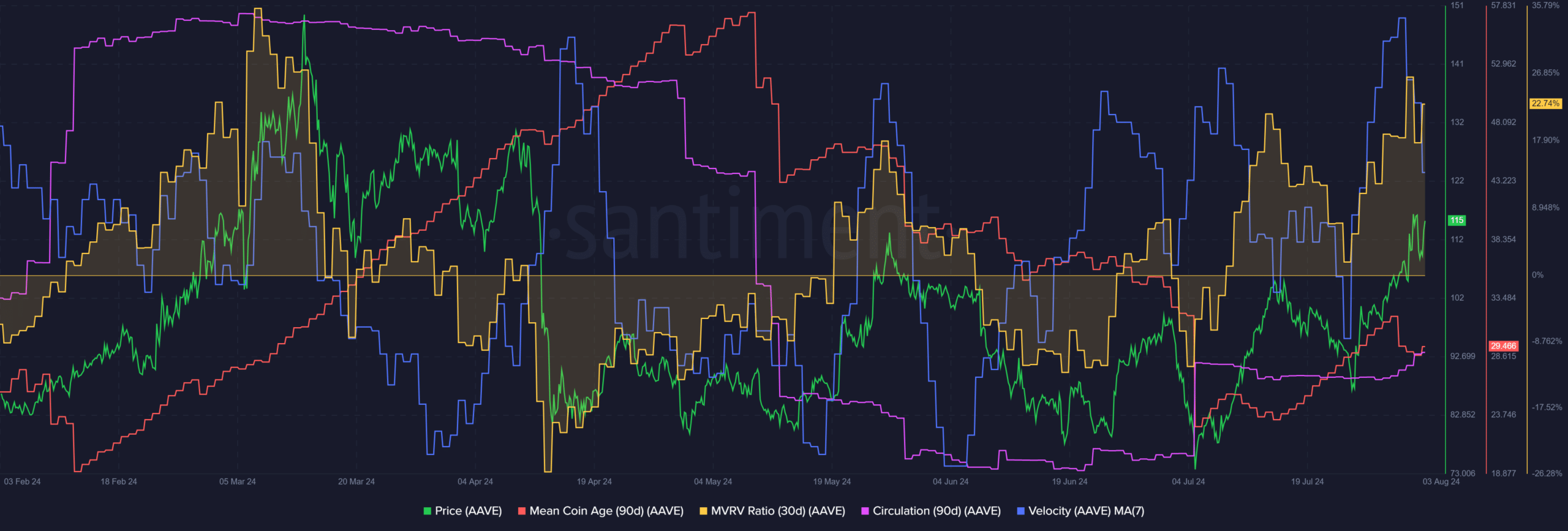

Over the past few weeks since early July, the average age of coins has been steadily increasing, suggesting an accumulation trend. Conversely, the 30-day MVRV (Market Value to Real Value) ratio has reached levels not seen since March, indicating a high market value for these coins relative to their actual worth.

With my years of trading under my belt, I have learned that a surge in profits among short-term holders can often signal a wave of selling to lock in gains. This has been a pattern I’ve observed many times throughout my career, and it’s always wise to keep an eye out for such signs. A sudden increase in profit margins could indicate that these traders are ready to cash out, potentially leading to a downward trend in the market. It pays to stay vigilant and adapt one’s strategy accordingly.

Read Aave’s [AAVE] Price Prediction 2024-25

Over the recent days, there has been a noticeable increase in the flow rate (circulation metric), and its pace has been accelerating too. This combined pattern suggests optimism, but at the same time, it indicates potential for heightened short-term market fluctuations.

Hence, traders can anticipate a move toward $142 with a few price dips thrown in along the way.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-08-04 16:07