- Aave has declined in the last 48 hours.

- Despite the decline, it saw more cash inflow in over a year.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by the recent developments surrounding Aave [AAVE]. Despite witnessing a slight decline over the past 48 hours, Aave has demonstrated remarkable resilience and outperformance in the broader market.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastOver the last few weeks, I’ve been quite impressed with how well my Aave [AAVE] investments have done. In fact, they’ve managed to surpass not only Bitcoin [BTC] but also Ethereum [ETH] in terms of returns, making for a very promising portfolio addition.

This price surge has attracted a significant inflow of funds into the platform.

Over the last couple of days, I’ve noticed that Aave has been on a downward trend, which has got me and other analysts curious about where this may lead in the near future. We’re taking a closer look at its recent performance to try to make an informed prediction about its trajectory.

Aave nears a golden cross

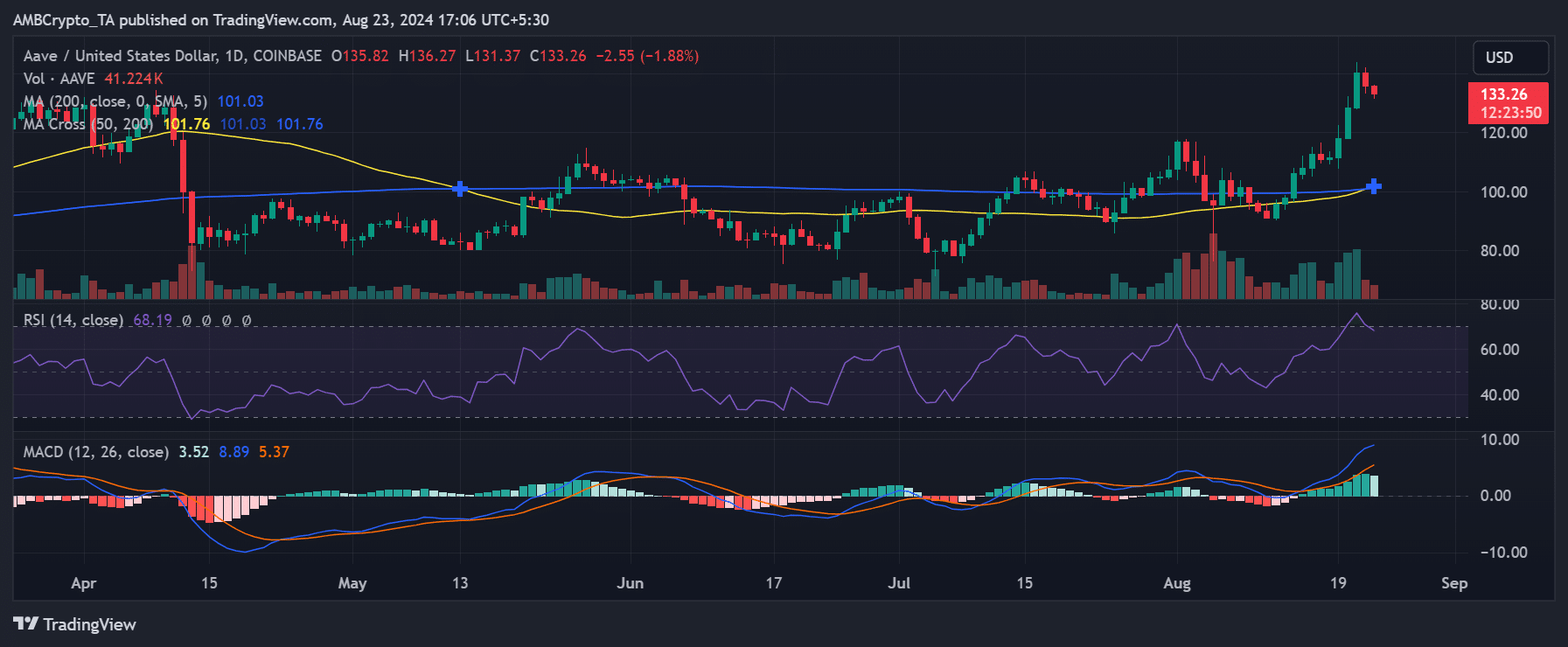

According to AMBCrypto’s examination, Aave’s price has experienced a substantial upward trajectory during the recent weeks.

As reported by AMBCrypto, Aave began the month with a value roughly equal to $116. At present, its value is around $133. Surprisingly, this price increase took place even amidst the downward trends observed over the past 48 hours.

In the last month, Aave has significantly surpassed key assets such as Ethereum, boasting a remarkable 90% growth.

By examining both its short-term and long-term average lines (represented by yellow and blue), it seems Aave might soon create what’s known as a ‘golden cross’.

As a researcher studying market trends, I’ve observed an interesting pattern that often signals a positive outlook: the short-term moving average crossing above the long-term one for a particular altcoin. This bullish indicator suggests that the altcoin might continue to gain momentum upwards, lending support to a optimistic viewpoint in the near future.

Traders show more positive interest

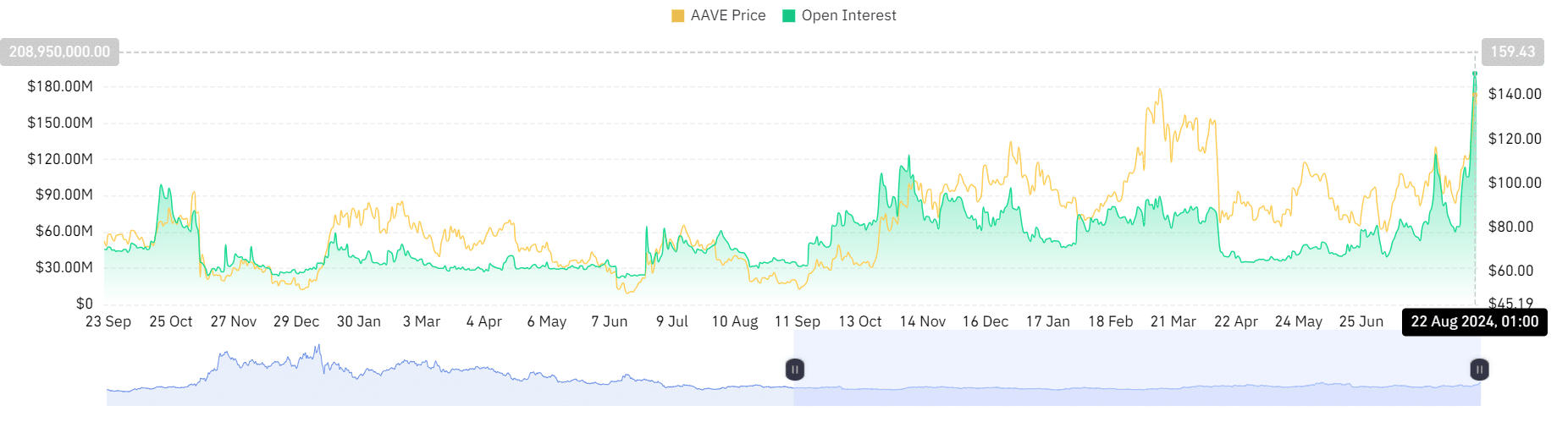

Analysis of Aave’s Open Interest on Coinglass revealed that it recently surged to its highest point in over a year, reaching approximately $191 million on the 22nd of August.

Currently, Aave’s value is approximately $177 million, which is among its highest points recorded over the past year.

The rise in Open Interest suggests that a substantial amount of capital is flowing into Aave, which appears to be due to the current market trends in its pricing.

Furthermore, as reported by AMBCrypto, the funding rate for Aave has persistently stayed above zero and currently stands at approximately 0.0027%.

Despite the recent drops in price, the ongoing Funding Rate indicates a generally optimistic attitude among investors regarding Aave in the last few weeks.

Consequently, there was a steady and robust optimism surrounding AAVE, which mirrored traders’ faith in its ongoing success.

Aave’s trend remains volatile

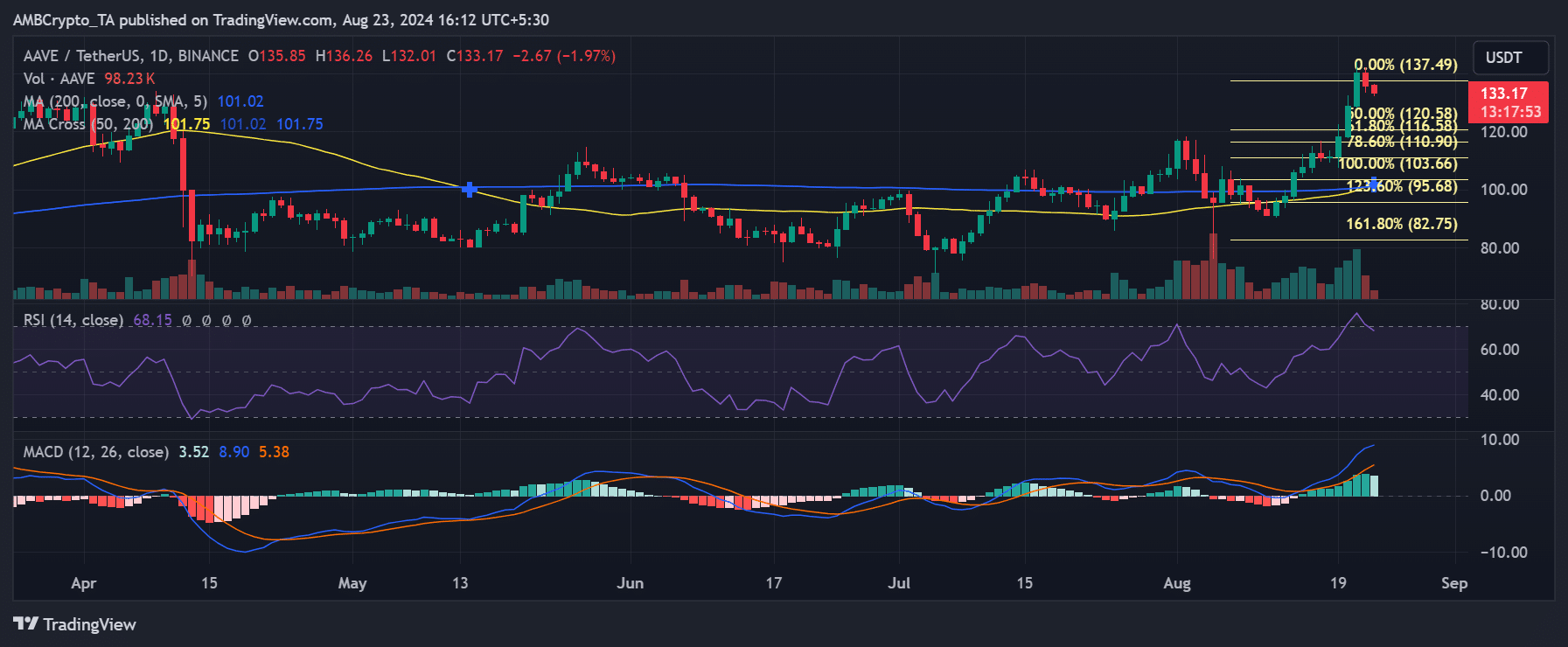

On the graph, the Fibonacci retracement lines suggested that the price point around $137.49, which was the peak in the recent trend, functioned as an immediate barrier to further upward movement due to acting as potential resistance level.

Meanwhile, the 38.2% level, around $120.58, stood as a crucial support point.

If AAVE‘s price stays higher than the 23.6% Fibonacci Retracement level, which is approximately $129.68, and its Relative Strength Index (RSI) continues to be below 70, thus keeping it from entering the overbought region, it may suggest a potentially positive trend for AAVE.

In that case, the price may consolidate before attempting to surpass the recent high of $137.49.

If AAVE surpasses the price of $137.49, it may drive the token towards higher Fibonacci extension levels, possibly soaring as high as $150 or even beyond, subject to market fluctuations and general investor sentiment.

If the Relative Strength Index (RSI) moves into the overbought region and subsequently reverses, and the Moving Average Convergence Divergence (MACD) weakens, there’s a possibility that Aave could see a drop to approximately $120.58 – which represents the 38.2% Fibonacci level.

If the price falls below $120.58, it might lead to a more significant decrease, potentially causing the price to touch the 50% Fibonacci level around $116.58 or even the 61.8% Fibonacci level at approximately $110.96.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

If the negative trend gains strength, there’s a possibility that the price might revisit the 200-day and 50-day moving averages, which are approximately $101.

If the price dips beneath this crucial support area, it might indicate a shift in the trend, possibly causing a downward movement towards the Fibonacci level of 100%, which is approximately $103.66. There’s also a possibility that the descent could continue even lower than that.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- New PS5 Console Bundle Leaks Prior to Reveal

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- ANKR PREDICTION. ANKR cryptocurrency

- Meghan’s Sweet Kids Tribute in Latest Vid!

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Solo Leveling Arise Tawata Kanae Guide

2024-08-24 06:16