-

AAVE is set to continue its dominance in the DeFi protocols.

Aave expanding in stablecoins and multichain integration.

As a seasoned crypto investor with a knack for spotting potential in digital assets, I can confidently say that Aave [AAVE] is not just a contender but a dominator in the DeFi protocols. Having closely followed its growth since its early days, it’s remarkable to see Aave reaching new heights and consolidating its position as a market leader.

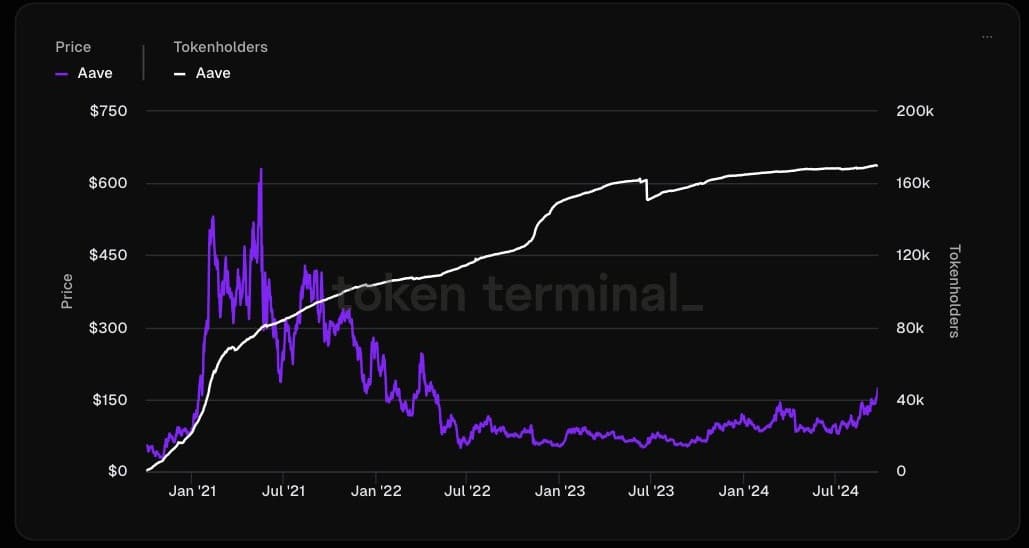

The popular decentralized finance (DeFi) platform, Aave [AAVE], recently hit a record number of token holders and is now managing nearly $20 billion in customer deposits. Aave is steadily strengthening its status as a leading player in the market.

Regardless of the intricacies within Decentralized Finance (DeFi) and the brief dip caused by the collapses of Terra Luna and Celsius, Aave still presents a top-tier investment choice within the cryptocurrency market.

On Aave’s versatile platform, users can store, lend, and accrue interest on their digital assets. Its tokens motivate users, while its standardized on-chain financial statistics consistently show an increase in deposits and loans, thereby strengthening Aave’s position in the market.

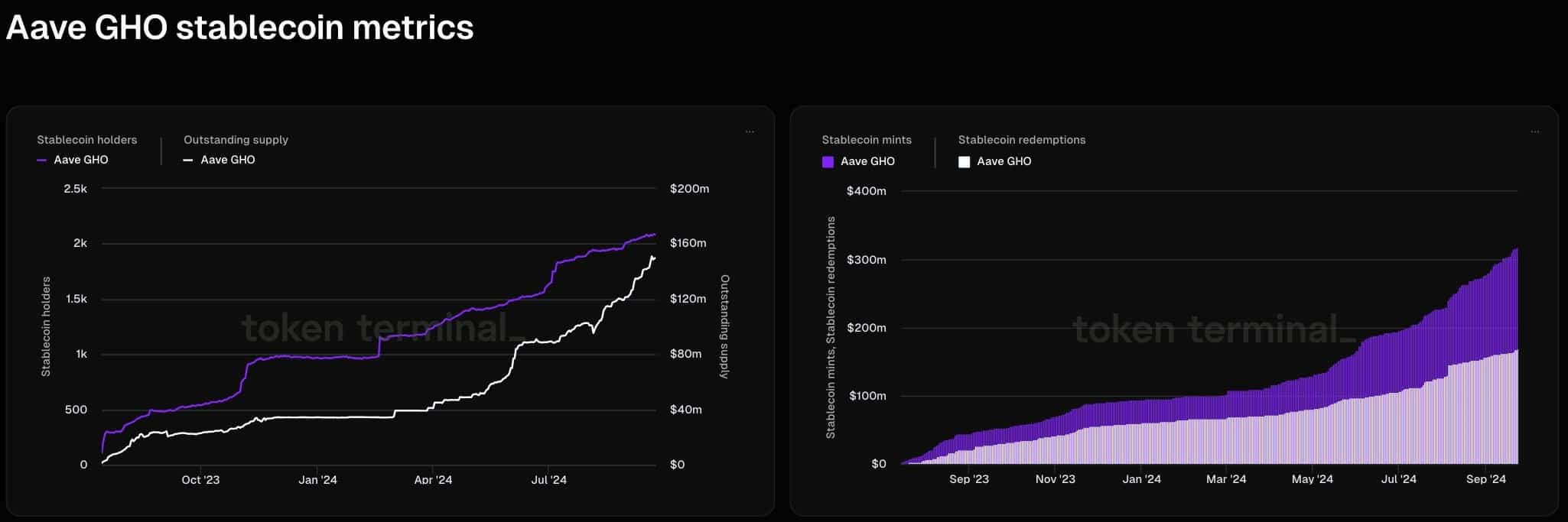

Bullish GHO stablecoin metrics

The Aave’s GHO stablecoin keeps demonstrating robust performance, hitting record-breaking metrics. Notably, the circulating amount of GHO, along with its monthly transaction volume and active senders, have persistently grown.

This shows a favorable attitude and reinforces the optimistic viewpoint on Aave. The increasing prosperity of Aave’s secondary venture, GHO, significantly contributes to the protocol’s ongoing ability to thrive and grow over time.

With more traditional financial institutions moving into Decentralized Finance (DeFi), the cryptocurrency stands poised to maintain its dominance in the market.

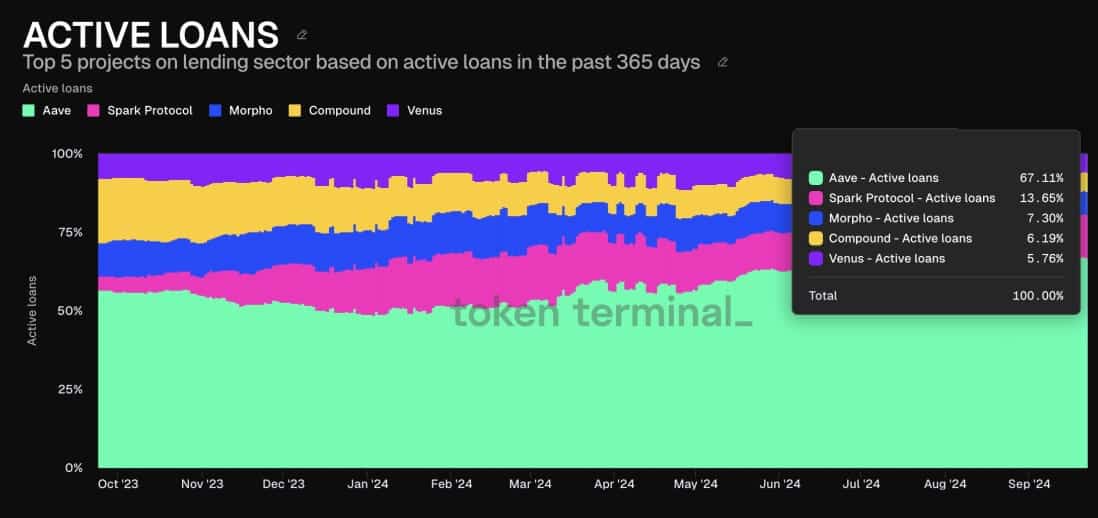

Aave leading in lending sector

Active loans in the DeFi sector have reached $11 billion, with $7.4 billion coming from Aave. The sector is steadily approaching its previous all-time high of $20 billion from 2021.

At present, Aave controls approximately 67% of the market in the lending sector, and analysts predict this dominance will persist. In contrast to conventional finance, which boasts margin loans amounting to about $800 billion, Aave and Decentralized Finance (DeFi) show great potential for expansion.

Using assets like Bitcoin (BTC) or Ethereum (ETH) as a pledge, people can obtain loans on Aave. Those who are optimistic about the market’s growth tend to use these digital assets as collateral to borrow stablecoins. Subsequently, they exchange the borrowed stablecoins for other cryptocurrencies, aiming to profit when the prices surge upward.

In my analysis, as cryptocurrency usage expands, Aave’s influence within this sector is expected to strengthen, potentially allowing it to claim a more substantial piece of the financial market pie.

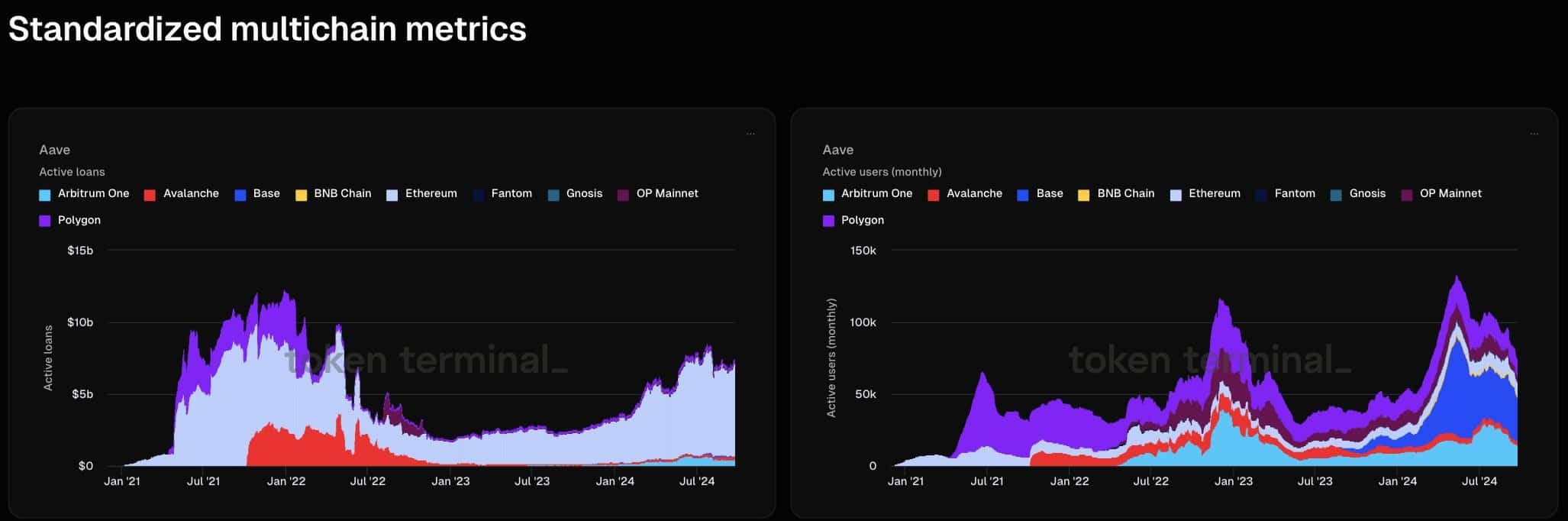

Aave’s multichain expansion

Aave’s reach extending to various platforms such as Arbitrum, Avalanche, Basis, Binance Smart Chain, Fantom, Optimism, and Polygon underscores its capacity for continued development.

Across various blockchain networks, key indicators like the number of unique savers, lenders, and those who pay back loans are all showing positive trends – a sign of optimism for Aave. Adopting a multi-blockchain strategy broadens Aave’s influence and strengthens its role within DeFi, ensuring it remains prosperous in the long run.

To sum up, Aave’s leading role, coupled with the increasing use of its GHO stablecoin, strengthens its hold within the Decentralized Finance (DeFi) sector.

Given strong performance indicators, plans for growth across multiple blockchains, and increased attention from institutional investors, the value of this altcoin may continue to climb, further solidifying its position as a frontrunner during this crypto market surge.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-25 19:03