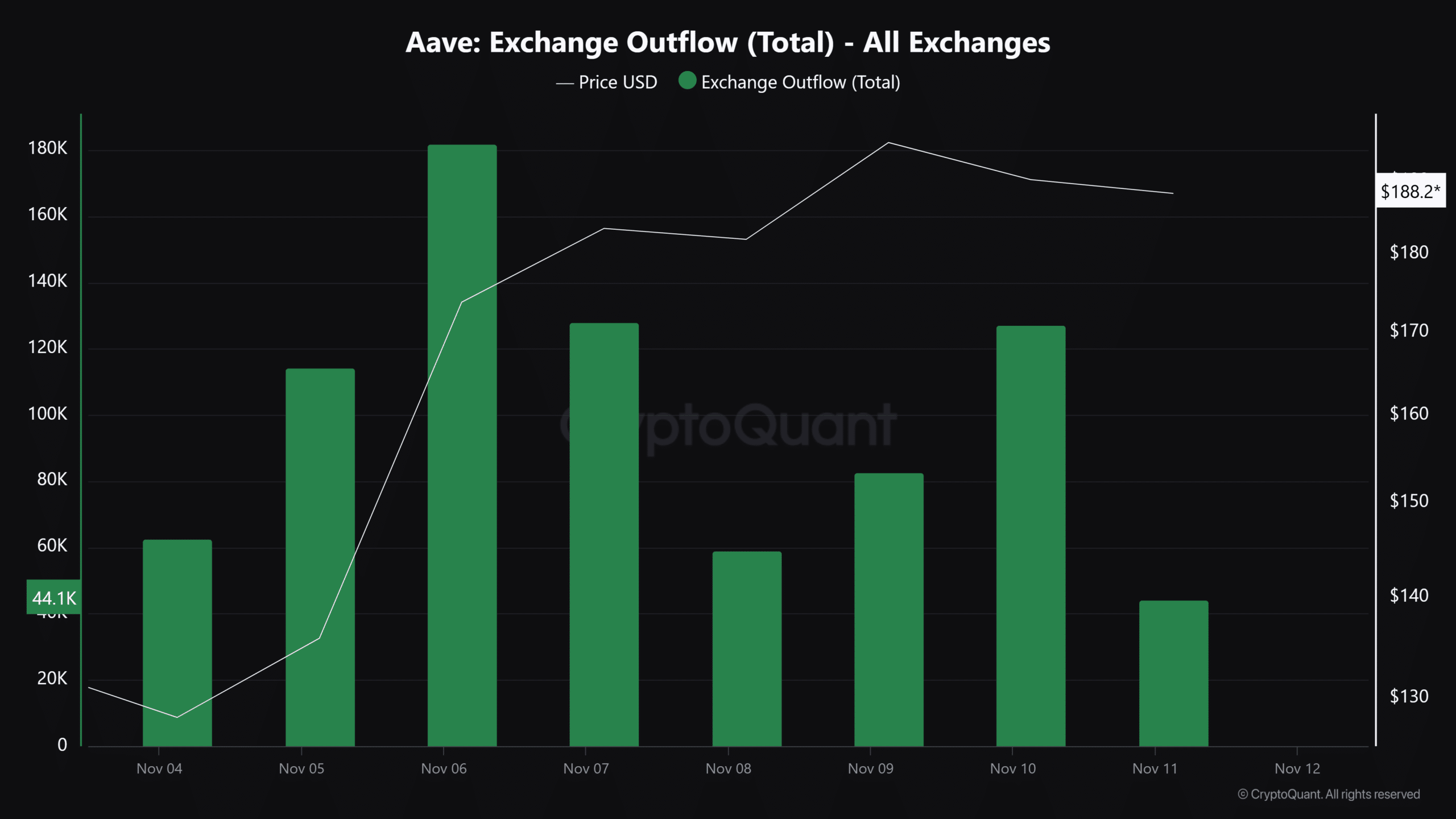

- AAVE exchange outflows were gradually rising after U.S. election results.

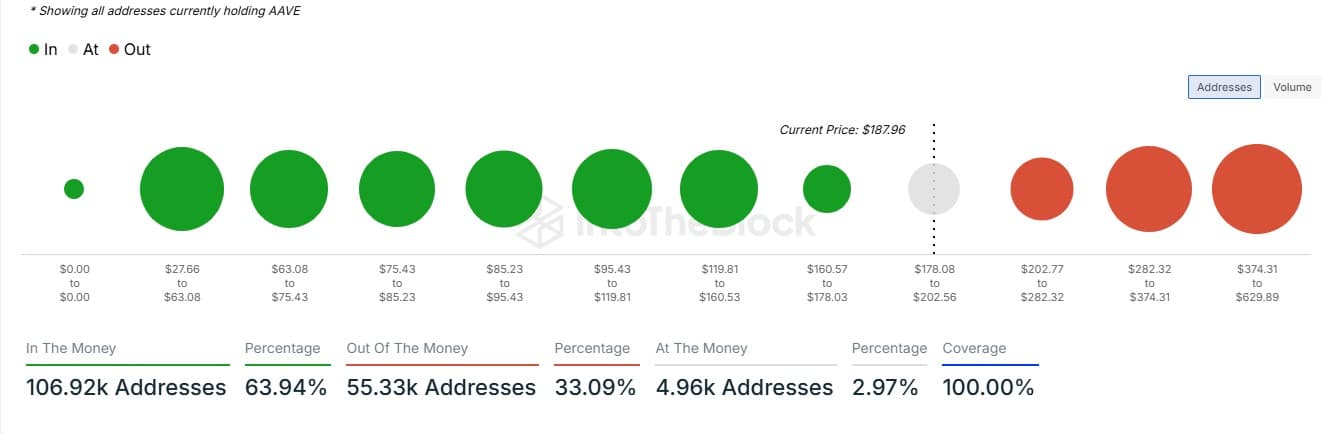

- A shift towards long positions hints at growing market optimism, with 64% of active addresses currently in profit.

As a seasoned analyst with over two decades of market observation under my belt, I find myself intrigued by the current trends in AAVE’s market. The gradual increase in exchange outflows suggests a cautious optimism among investors, reminiscent of the pre-dawn twinkle that signals the promise of a bright day ahead.

After the U.S. election, there was a significant decrease in the number of Aave’s [AAVE] tokens being transferred out from the exchange. This drop suggests that investors are adopting a more conservative approach due to potential concerns about future regulatory adjustments.

On the other hand, AAVE exchange withdrawals have been gradually increasing over the past three days. This rising pattern might suggest increased activity and potentially growing confidence among market players.

Additionally, an increase in funds leaving exchanges might indicate that traders are withdrawing their earned profits temporarily, only to reinvest in potential long-term trading possibilities later on.

Bulls gradually taking control

According to AMBCrypto’s examination of Coinglass long/short ratio data, the AAVE market has shown various ups and downs. Earlier, there was significant uncertainty among traders regarding whether to hold long or short positions, but more recently, there’s been a clear preference for long positions.

As a researcher, I’m observing a significant shift that signals the emergence of optimistic sentiment within the market. This transformation is fueled by the growing anticipation among traders that prices may soon escalate, following the recent market adjustments.

The slow shift indicates a shared feeling of expectation that the value might continue to rise.

Holders prepare for strategic positions

In the ever-changing landscape of this market, the fact that over two out of three active AAVE addresses are currently making a profit offers an additional depth to the picture. As reported by IntoTheBlock, this stands at approximately 64%.

Based on my years of trading experience, this robust market performance is a clear sign that the market remains resilient even amidst recent volatility and widespread fear. Despite the turbulent conditions, most participants seem to be reaping benefits from their positions, which suggests a healthy market overall. This gives me confidence in the market’s ability to weather any storms that may come its way.

Piecing it all together

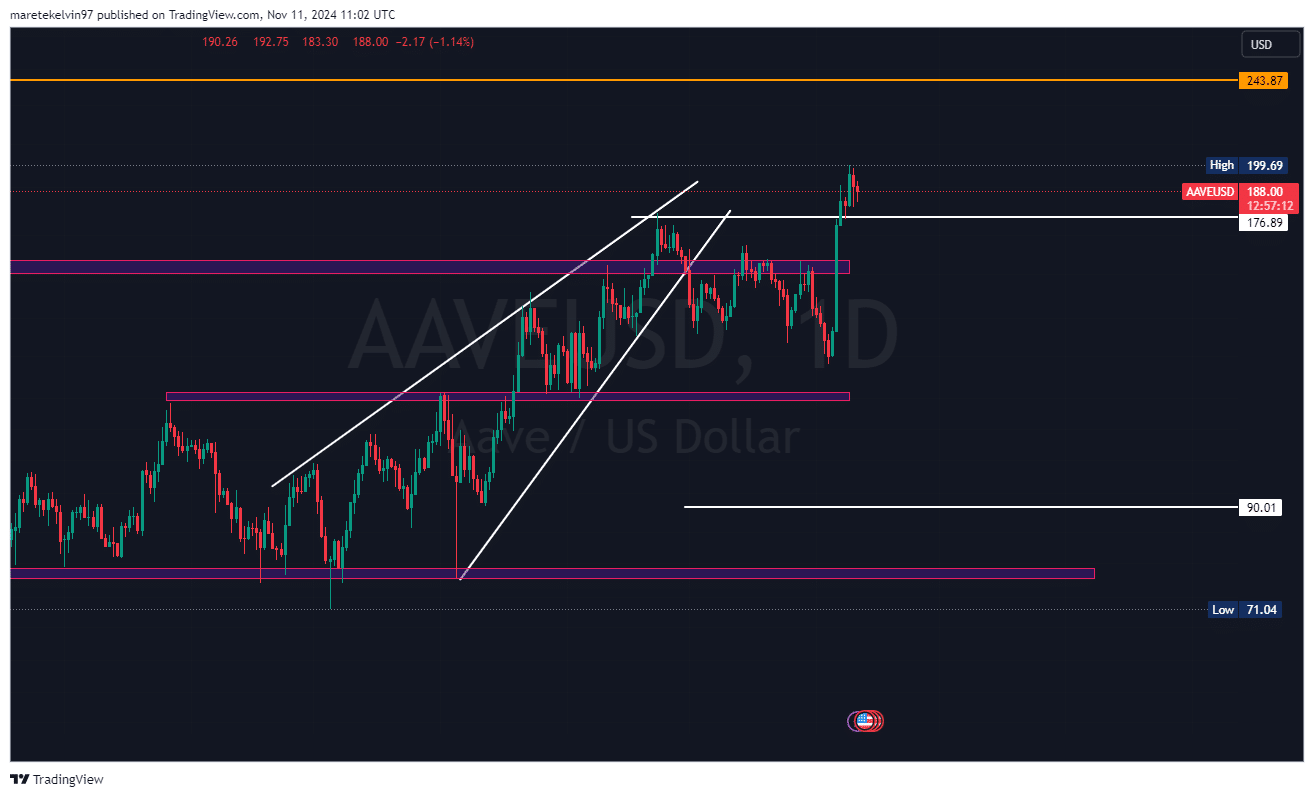

The relationship among increasing withdrawals from exchanges, moving into long-term investments, and high profits among active users influences the price movement of AAVE. Following the election, AAVE’s market initially dropped, but recently it has started to show positive signs.

Read Aave’s [AAVE] Price Prediction 2024–2025

This blend of signs implies a tentative positivity, as traders incrementally venture into calculated risks. The robustness and strategic readiness of the AAVE community hints at potentially thrilling developments that might be imminent.

The price of AAVE could temporarily dip down to the significant support point at $177, followed by a potential surge as we aim for breaking through higher resistance points.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- LUNC PREDICTION. LUNC cryptocurrency

2024-11-12 10:17