- As the number of active addresses spiked, AAVE’s total value locked (TVL) dropped

- On the contrary, technical analysis suggested a potential rally for AAVE

As a seasoned researcher with a knack for navigating the complexities of the cryptocurrency market, I find myself at a crossroads when analyzing AAVE’s recent performance. On one hand, the sell-off and investor withdrawal have painted a grim picture, hinting at further declines. However, technical analysis points to a potential reversal, suggesting that we might be witnessing a classic case of ‘buy the dip’.

Over the past 24 hours, there has been an aggressive 11.27% sell-off in AAVE’s market. However, this recent downturn might not end anytime soon, with other market developments indicating a sustained decline on the charts.

Despite the hint of a potential reversal suggested by technical analysis, AAVE appears to be at a critical juncture. Therefore, we at AMBCrypto examined potential future directions for AAVE, taking into account these contrasting signals.

Investor withdrawal drives AAVE’s decline

As per DeFiLlama’s report, there has been a significant decrease in the Total Value Locked (TVL) within AAVE. In simpler terms, this suggests that investors are choosing to remove their funds from the protocol.

Currently, at the moment we’re updating, the Total Value Locked (TVL) in AAVE stands at approximately $11.941 billion. Should these patterns continue, it seems probable that AAVE may experience additional decreases.

In this context, TVL (Total Value Locked) indicates the combined worth of assets stored within Decentralized Finance (DeFi) systems. These figures generally reflect the total engagement in the market as well as the collective investment commitment.

The increase in investor withdrawals can be highlighted by a rise in active addresses. Currently, this figure has climbed by approximately 6.85% to more than 1,020, indicating an uptick in activity, largely consisting of sell-offs, as the price of AAVE has decreased on graphs.

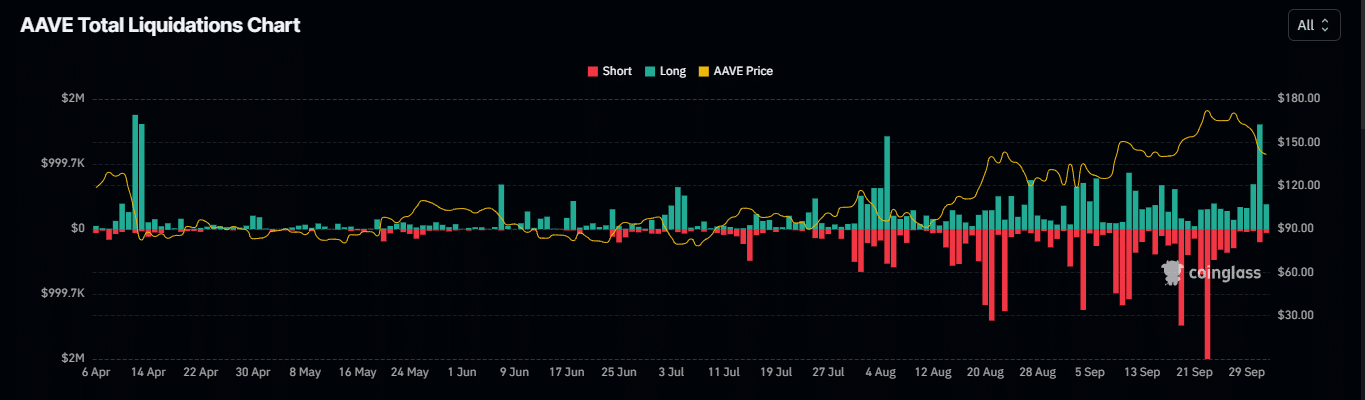

Major losses for long traders on AAVE

Investors who wagered on a continuous rise for AAVE have experienced significant setbacks since the market has been unfavorable to them.

Based on Coinglass’s report, a total of $1.91 million has been lost by traders who speculated on AAVE’s price increase.

Furthermore, it appeared that the distribution of trades leaned more heavily towards long positions experiencing losses, as opposed to short positions, suggesting an asymmetry in their outcomes.

In this context, the pessimistic feeling was echoed by the Open Interest. A significant drop of 20.23% in Open Interest was observed, implying that AAVE holders might continue selling off, as suggested by the charts.

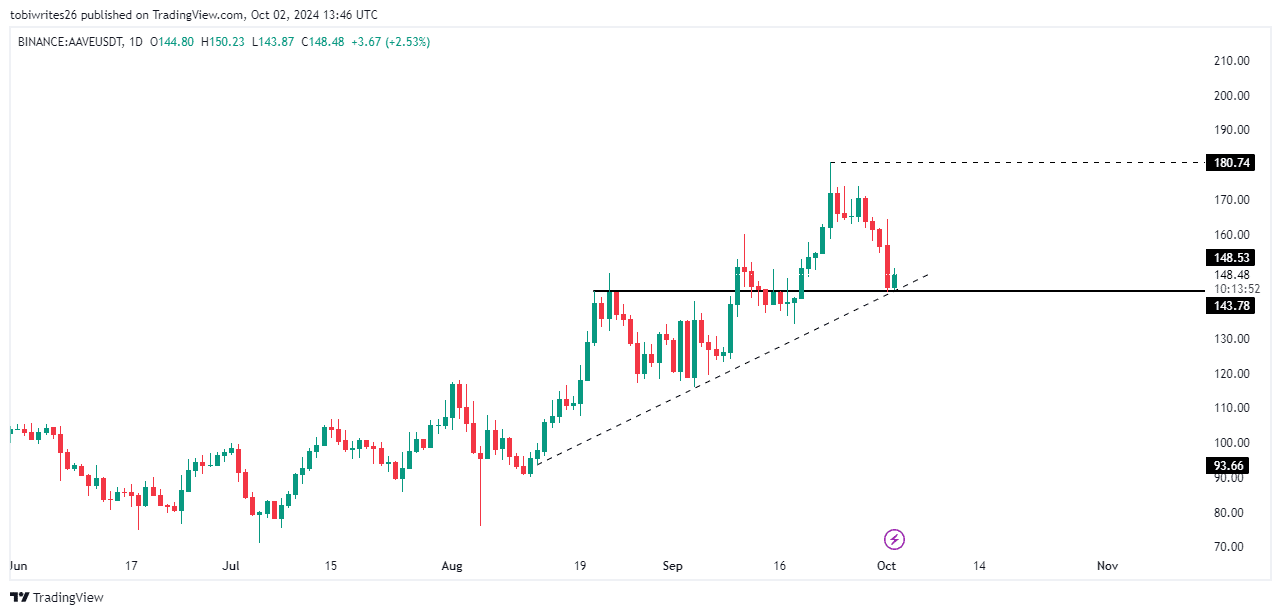

Technical analysis points to potential reversal for AAVE

The technical analysis of Aave’s chart indicates a potential increase in its value. This is due to it hitting crucial convergence points, which might propel its price upwards.

In easy-to-understand language: The price of AAVE reached a significant point on its chart where a flat resistance (a level where it has struggled to rise in the past) intersects with a sloping one. However, instead of dropping as it usually does at these points, AAVE started to increase, indicating a possible upward trend. If this resistance holds firm, AAVE could potentially climb up to around $180.74.

In a different scenario, should this resistance level not be maintained, the price of AAVE might drop, possibly going down to approximately $119.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-03 09:11