“Aave’s $200 Drama: Bulls, Bears, and Inevitable Chaos 😬💸”

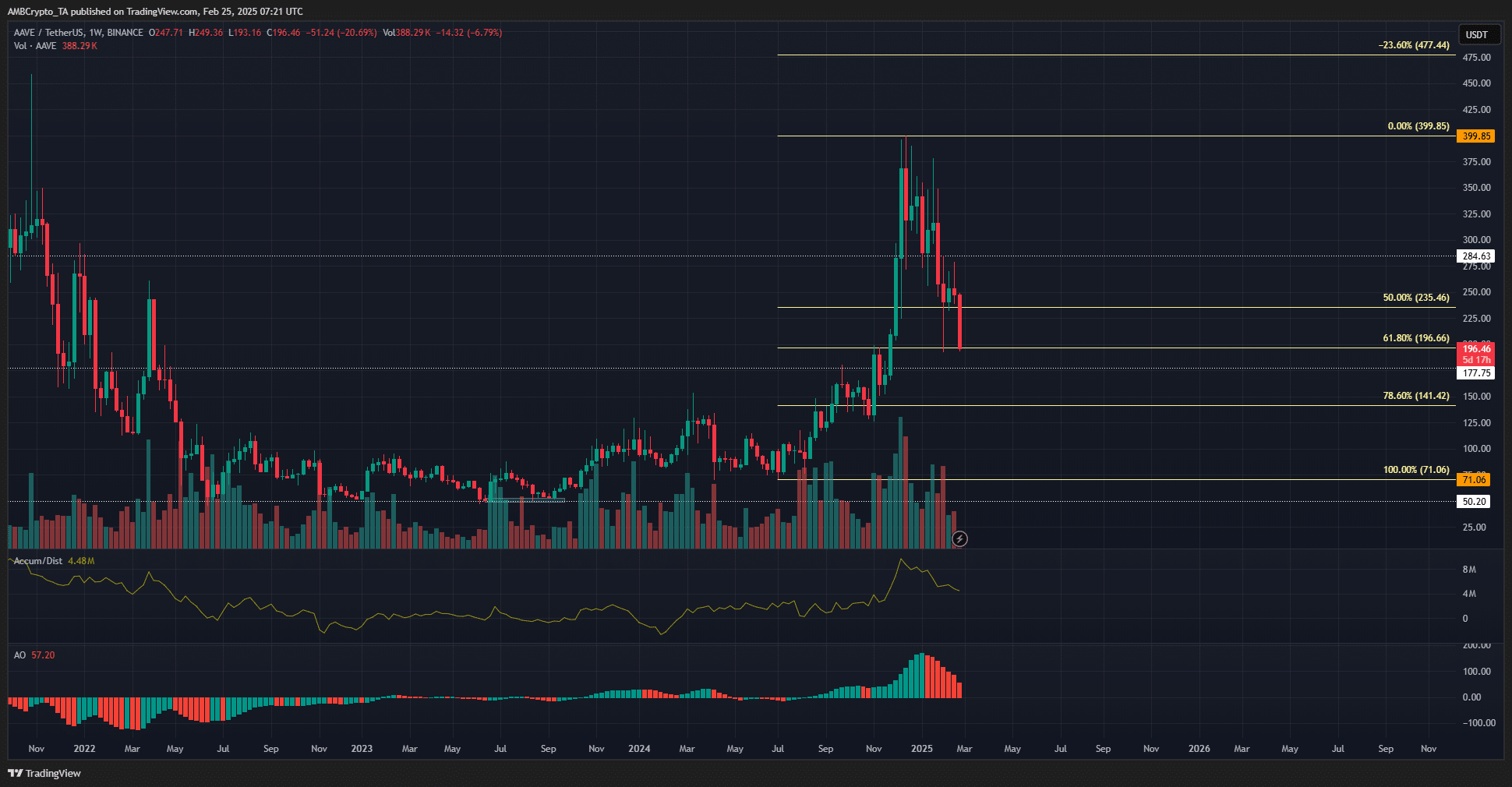

- Aave has a bullish weekly structure, but more losses are expected in the coming days. 💀📉

- A drop below the psychological $200 level could take prices to $141. Yikes! 😲

Oh, Aave [AAVE], how the mighty have stumbled! Gaining 465% from July to December had traders cheering louder than a tavern full of Cossacks. But, alas, the frosty hand of retracement has been unusually cruel. Market sentiment? It’s like the gloom of a winter without vodka – unbearable.

Ambitious bulls hoping to stock up on more AAVE might want to set their sights on $141 and $177. But let’s not get ahead of ourselves—better wait for a cozy range to form, or risk ending up as a cautionary tale. 📉🤦♂️

Meanwhile, in the short term, AAVE is acting more volatile than Aunt Maria after too much tea. Watch out for a dramatic entry into $216 territory—a sinister plot to lure traders with false hope before resuming its theatrical plummet.

Will Aave Bid Farewell to the $200 Support Level? 🧐

Two months—that’s all it took for Aave to go from prince to pauper, shedding gains left and right like a tree losing its autumn leaves. First, $284 fell to the ground. Then $235. Now smirking bears are eyeing the $196 level like scavengers circling their prey.

If it tumbles further, brace yourself for an avalanche that might not stop until $141—or perhaps $125, if things get particularly melodramatic. 💔

However, let’s not dismiss the A/D indicator too hastily—it suggests buyers haven’t entirely fled the battlefield. The Awesome Oscillator chimed in around mid-January, whispering hints of diminishing momentum. But whispers won’t stop this storm, will they? 🌀📊

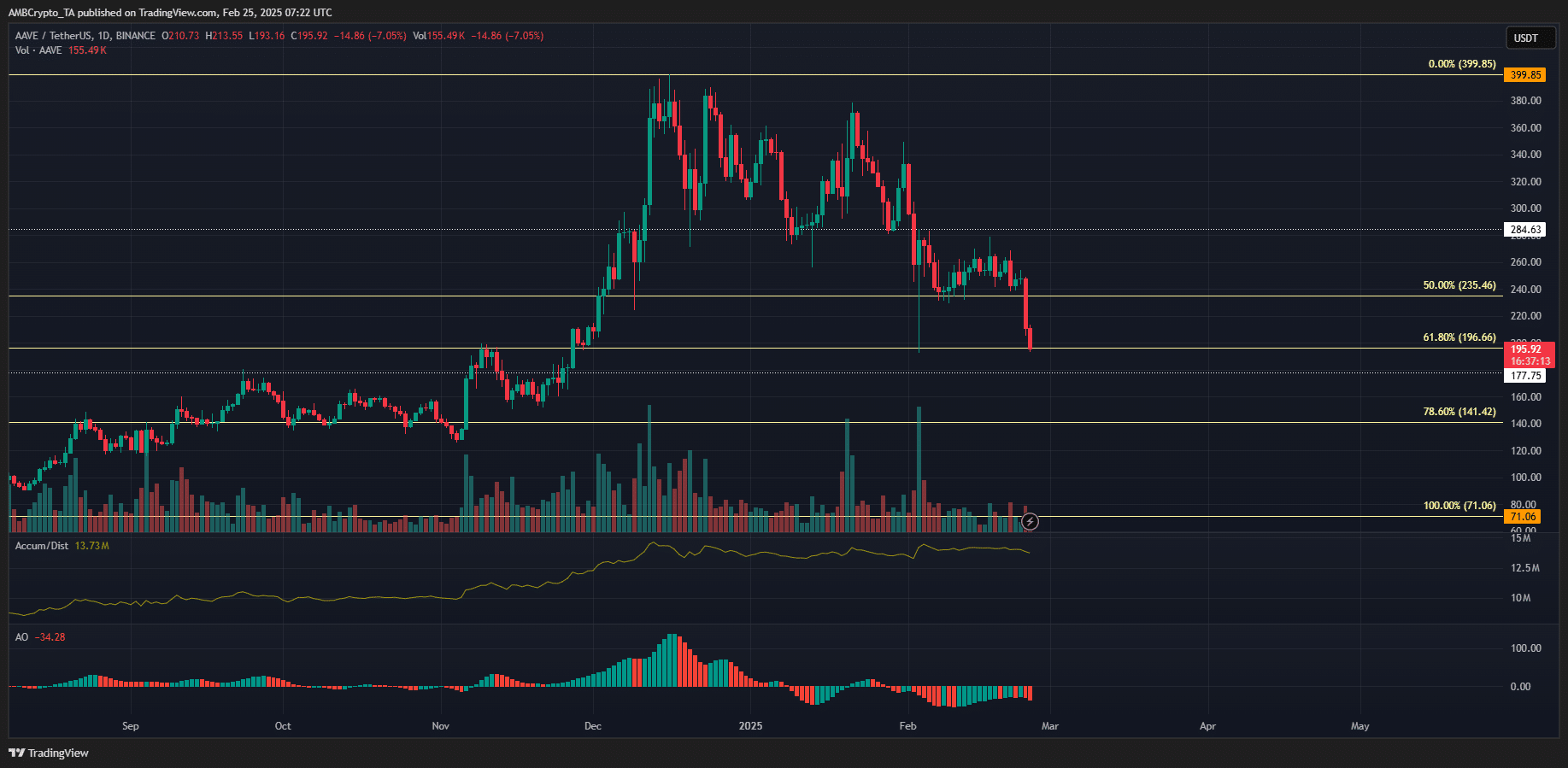

Zooming into the daily chart offers traders more grim revelations. The structure screams “bearish,” yet trading volumes are as quiet as a church on a Tuesday. So, while the A/D indicator flutters near January highs, the Awesome Oscillator suggests bears are firmly at the helm. 🐻🚩

Support glimmers faintly at $196, $171, and $155, but if you’re looking to buy—wait. Let the pullback simmer until there’s a clear sign of consolidation. Patience, young grasshopper. 🕰️📉

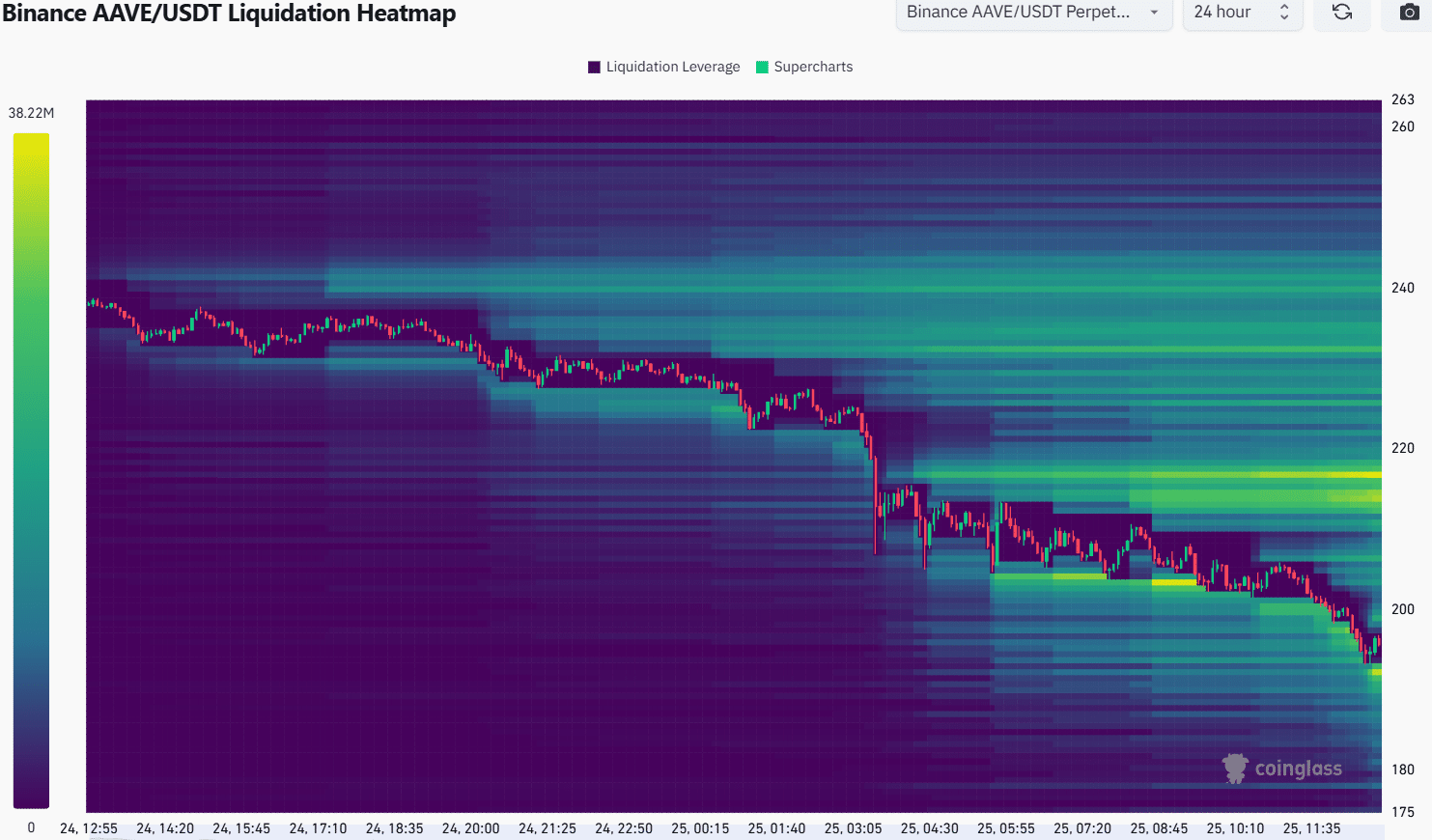

Ah, the short-term vision—so tempting, so deceptive! The $192 and $216 zones have become a battlefield where liquidation levels cluster like nervous recruits. On one hand, $216 whispers promises of liquidity, but lest you forget, such whispers often lead straight into a trap. 📈🚨

The heatmaps are clear: volatility is rising, and liquidity is luring. Don’t be surprised if AAVE briefly bounces 12% just to crush dreams and hunt orders before resuming its trek into the abyss. In other words, gird your loins and keep your stops tight—this is no time for heroics. 🛡️💀

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2025-02-26 00:09