-

In the last 24 hours, AAVE has appreciated by 4.25%, signaling potential market momentum.

However, analysis predicts that this recent uptick is temporary and expects a downturn.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I have seen trends shift like tides and volatility spike like a roller coaster ride. The past 24 hours have been no exception, as AAVE has appreciated by an impressive 4.25%. However, my analysis suggests that this recent uptick may be more of a temporary blip than the start of a new bull run.

In recent times, Aave’s [AAVE] market performance has been nothing short of impressive. It has experienced an upward surge of approximately 32.08% in just the past month, outperforming numerous other tokens. This favorable trend is also evident over the weekly timeframe, with a growth of 16.42%.

Even though AAVE has experienced substantial growth recently, new findings indicate that the upward momentum may begin to wane, possibly resulting in a steep decline in its market value.

AAVE’s recent market momentum appears to be temporary

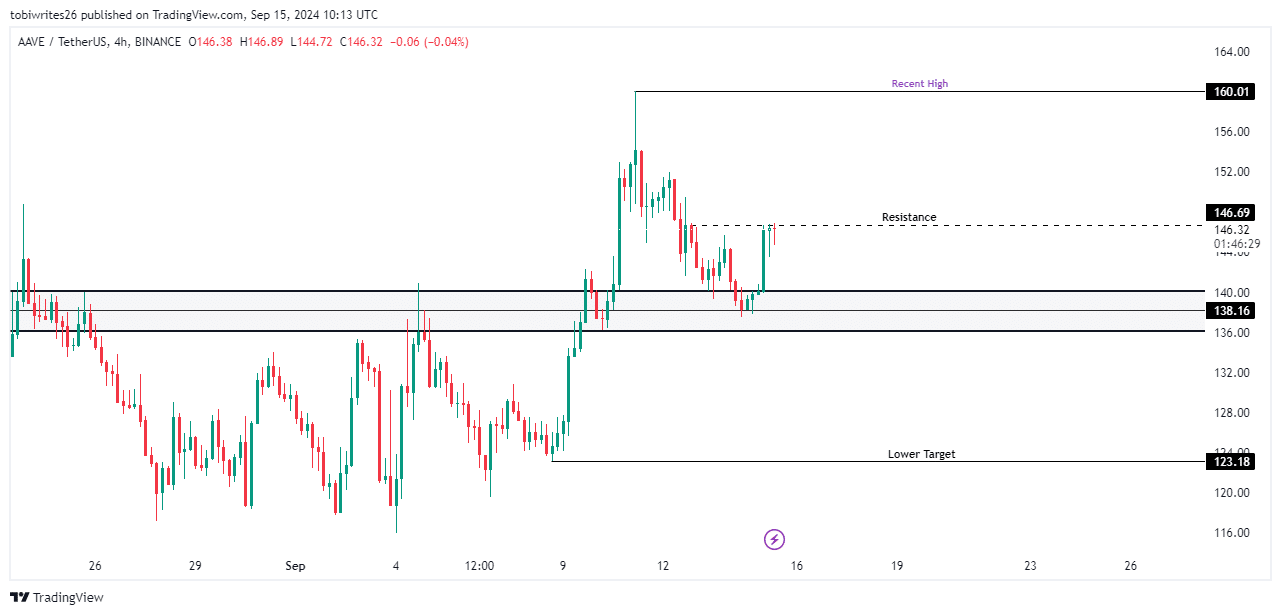

At the moment, Aave is trading at $145.80, barely $14.21 below its previous peak of $160.01. According to AMBCrypto’s analysis, the recent surge in Aave was initiated by its bounce back from a significant support level at $138.16.

Nevertheless, AAVE has faced a significant barrier at around $146.69, where it aligns with strong selling activity. This could potentially push the price downward, perhaps even below the support zone that spans from approximately $140.06 to $136.12.

If the support for AAVE weakens, it’s possible that its price may drop even more, possibly reaching a low of $123.18. This is particularly concerning given the increased selling activity in the market.

Rising supply could negatively impact AAVE

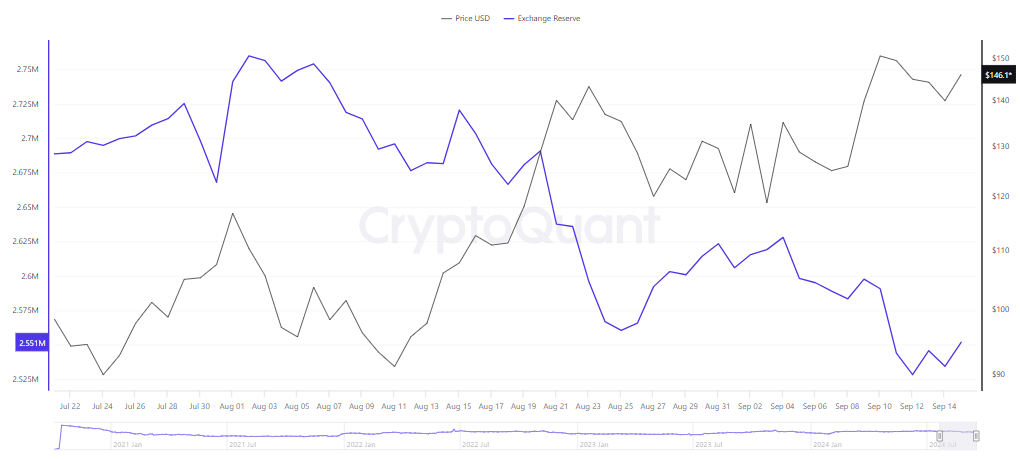

Over the past day, data from CryptoQuant revealed a rise in the exchange-held AAVE supply. Now, approximately 2.5 million AAVE tokens can be found on various digital currency platforms.

A rise in the availability of exchanges for trading AAVE implies that market participants might be putting their AAVE tokens up for sale. This could suggest an excess in the market.

The increase in supply occurred at the same time as an optimistic change in Exchange Outflow, indicating that investors might be transferring their AAVE to exchanges to either cash out or trade for different tokens. This action could potentially lead to a decrease in demand.

The increase in supply and trading activity over the last day has led to a large number of forced liquidations of Aave long positions, totaling approximately $260,550. This information comes from Coinglass, indicating that adverse market conditions have played a role.

Market conditions signal challenges for bulls

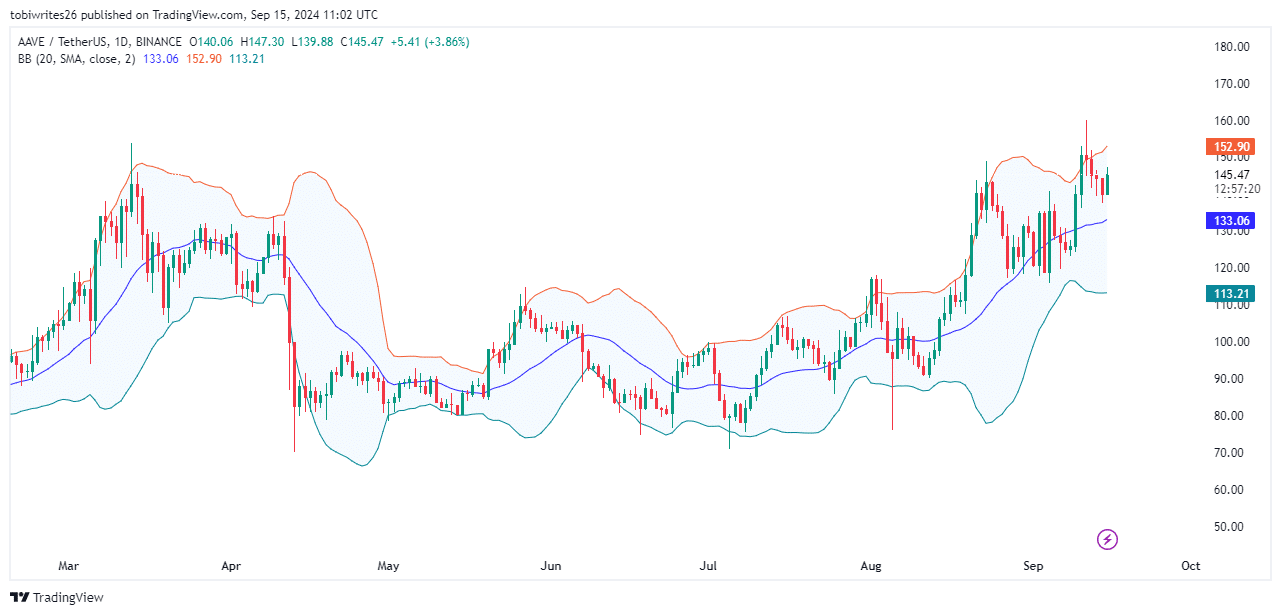

In simpler terms, the Bollinger Bands – a tool used to gauge market volatility and detect when a market is overbought (too high) or oversold (too low), are suggesting that AAVE has moved into an overbought state. This implies that AAVE might experience a downward trend as it looks to recover from its current position.

In simpler terms, when the red line (upper band) is crossed, it usually means the market is overbought, indicating a potential decrease in value. Conversely, if the green line (lower band) is crossed, it suggests the market is oversold, signaling a possible increase in value. The blue line (middle band) represents a neutral position in the market.

In addition, a decrease in open interest indicates that there’s less optimism (or bullishness) among traders because it mirrors the amount of ongoing, unresolved derivative contracts.

The demand for AAVE has dropped, with open interest decreasing from $214.71 million to $164.56 million as of September 11. This decline suggests less money flowing into the market, and it may lead to a continued decrease in asset prices, potentially reaching or even falling below $140.06.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-16 05:11