Well, butter my biscuit and call me a wizard, but it seems the mighty Cardano has taken a tumble down the financial rabbit hole! 🕳️✨ The price has plummeted to depths not seen in 90 days, and the market’s reaction? Oh, it’s a full-on capitulation fiesta, complete with despair and hand-wringing. But fear not, dear reader, for history has a knack for repeating itself-like a bad joke at a troll’s tea party. These deep pullbacks are where Cardano, like a phoenix with a spreadsheet, tends to rise from the ashes and start its most glorious recoveries. 🦅📈

Sentiment in the Gutter, But Hope Floats Like a Rubber Duck 🛁

Market sentiment? It’s about as cheerful as a dwarf with a hangover. Alex is in full despair mode, and retail investors are fleeing like ants from a dropped ice cream cone. But here’s the kicker: these are the moments when patient buyers-the ones who’ve read the fine print on Cardano’s long-cycle behavior-start licking their lips. 🤑💼 It’s like a fire sale in a dragon’s hoard, and the smart ones are grabbing their shopping carts. 🛒🔥

Social media? It’s a carnival of fear and low conviction, with short-term emotions running wilder than a goblin at a candy store. But these phases are as fleeting as a wizard’s temper-they don’t last, but they do leave behind a trail of accumulation opportunities for the long-term thinkers. 🧠💎

On-Chain Metrics Scream “Buy!” Like a Banshee in a Bargain Basement 🛍️👻

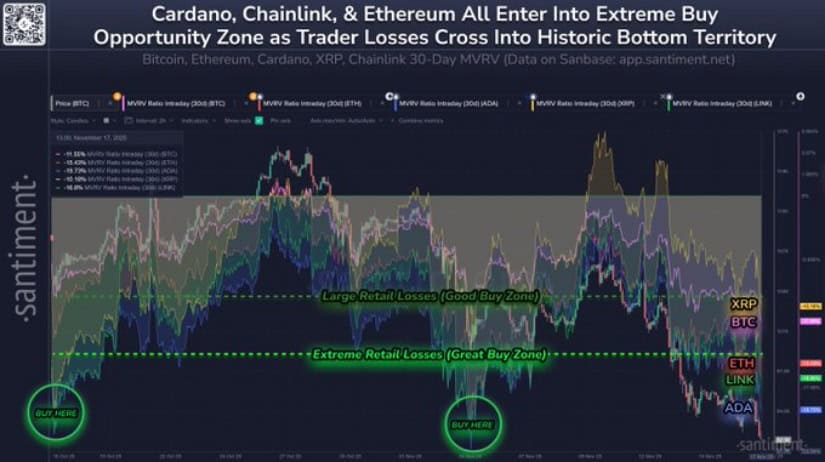

Santiment’s 30-Day MVRV metric has ADA in the “Extreme Buy Zone,” a place so ripe for opportunity it’s practically glowing. 🌟 Previous visits to this zone have resulted in recoveries so outsized they’d make a giant’s wallet blush. Most recent buyers are underwater-a classic bottom-building scenario where selling pressure dries up faster than a puddle in the desert. And when ADA hits this zone, volatility tends to follow, often with an upside twist. 🎢🚀

This isn’t about fundamentals, mind you-it’s about market positioning. Altcoins like LINK and ETH are also dipping into negative MVRV zones, creating a synchronized value pocket across major L1 ecosystems. ADA? It’s sitting at the deep end of the pool, ready for a cannonball. 🏊♂️💦

ADA Meets Its Long-Term Support: A Match Made in Crypto Heaven 💑✨

TapTools’ chart shows ADA pressing into a long-term structural support around $0.45, a level that’s been more reliable than a dwarf with a grudge. Price is below the 25-day and 99-day moving averages, but the multi-year support band just below is like a safety net woven by the gods of finance. 🕸️💰 This is where long-term participants start accumulating, especially when the stars align across moving averages, volume behavior, and historical trend reversals. If this support holds, ADA could stabilize and build a base for its next grand adventure. 🏰🚀

The Next Target? A Textbook Cycle Repetition, Of Course 📚🔁

Smcapitalclub’s chart reveals a key demand block just beneath the current price, aligning perfectly with the long-term accumulation zone. Even a small bounce from here would be a nod to the macro trend, unless buyers decide to charge in like a cavalry at dawn. 🏇⚔️ The next major level? Between $0.36 and $0.40, where previous consolidation and liquidity buildup have set the stage for a potential trend shift. If ADA taps that region, it’ll be a cycle repetition so textbook it’ll make the wizards of academia proud. 🧙♂️📖

Community Voices: Selling at Lows is Like Kicking a Puppy 🐶😢

ADA’s community sentiment is stabilizing, and analyst Sssebi is waving a big red flag: selling at these levels is a one-way ticket to Regretville. The chart shows ADA grinding down a descending structure, but oversold conditions and weakening downside momentum hint at exhaustion, not a fresh bearish romp. 🏃♂️💨 The conversation is shifting from panic to accumulation, with long-term stakers and analysts reminding everyone that Cardano’s sharp cycles often see the deepest sell-offs right before a trend reset. 🌪️🔄

Final Thoughts: ADA at the Crossroads of Opportunity and Chaos 🌪️🚪

Cardano now sits at the intersection of macro support, on-chain value zones, and sentiment capitulation-the same ingredients that brewed previous mid-cycle reversals. There’s room for one more liquidity sweep towards the $0.36-$0.40 zone, but the broader structure is ripe for a reset. 🌱🔄 The key? Stabilization, reclaiming short-term moving averages, and rebuilding structure in this high-value region. With a negative MVRV flashing opportunity and long-term support approaching, the risk-reward profile is looking tastier than a dwarf’s stew. 🍲💰

Read More

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Wallace and Gromit creator reveals whether Aardman Animations will use AI in future – and what they won’t compromise on

2025-11-20 01:34