-

Aerodrome hit a new all-time high in TVL while its revenue soars.

AERO price action breaks out of a symmetrical triangle.

As a seasoned analyst with over two decades of experience in traditional finance and crypto markets, I have seen my fair share of market cycles and trends. However, the growth trajectory of Aerodrome Finance [AERO] has genuinely piqued my interest.

⚡ URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastAs a financial analyst, I’m observing the significant strides made by Aerodrome Finance (AERO) within the cryptocurrency market. This promising project is holding its ground against heavyweights such as Ethereum (ETH) and Uniswap (UNI).

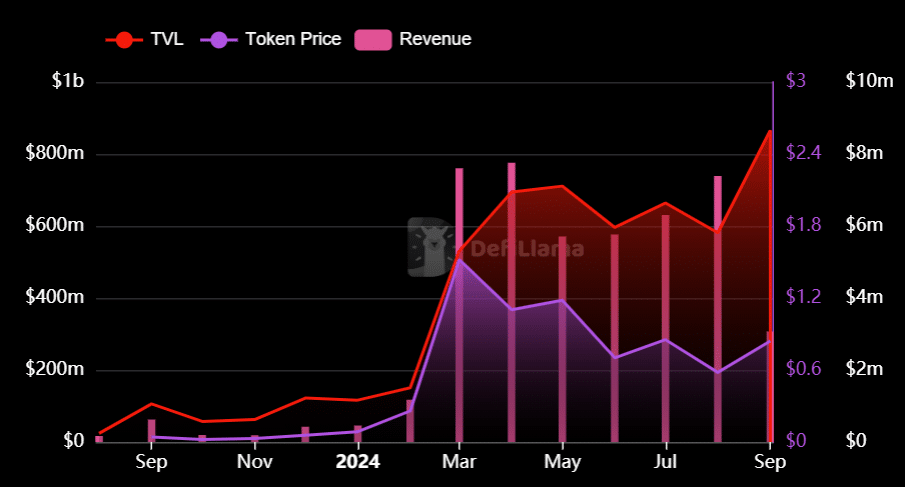

Regardless of currently being in a correction period following a peak at $2.36, AERO‘s underlying strengths imply that its value may ascend further. The token’s Total Value Locked (TVL) has reached a fresh record high of $869.73 million, and its market capitalization stands at $524.3 million.

In simple terms, the total trade value over the past 24 hours is approximately $30.22 million, giving the company a maximum valuation of about $1.069 billion if all potential shares were issued. As this trading volume (TVL) increases, it might encourage wider use and potentially drive up the price for AERO.

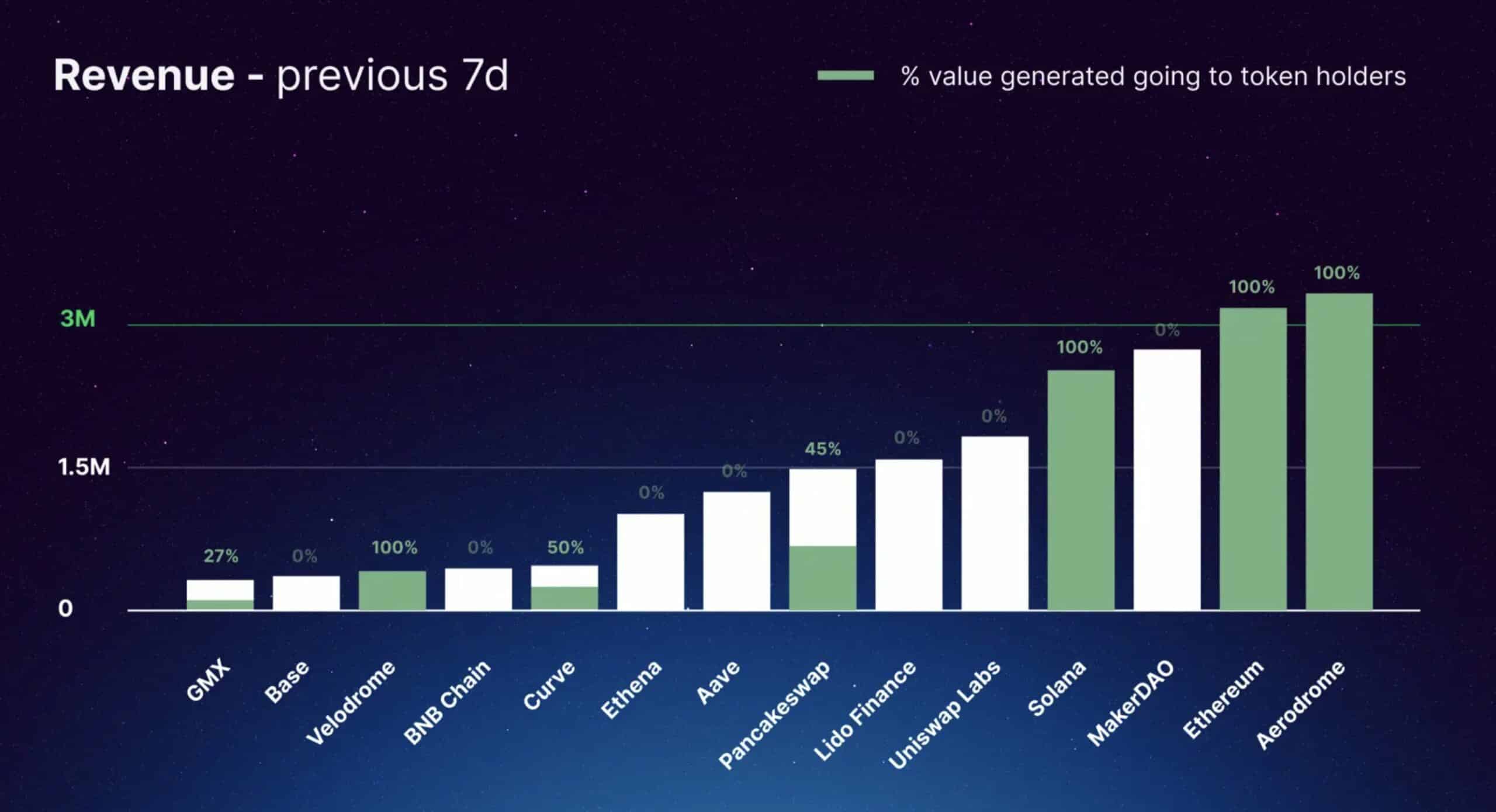

AERO revenue distribution

The distribution of AERO‘s earnings is another important aspect contributing to its growth. A substantial amount of this income is allocated to token owners, making AERO stand out when compared to Ethereum and Solana because a higher percentage of their total values are returned to the token holders.

This change showcases a fresh approach to the open, consentless, and transparent dissemination of tokens, offering genuine, unalterable on-blockchain functionality.

By adopting similar characteristics as cryptocurrencies such as Bitcoin and Ethereum, AERO becomes more analogous. These fundamental aspects serve as key drivers propelling the value of AERO higher.

Is a reclaim of $1.5 price possible?

AERO price action looking good…

The behavior of the AERO token has become more positive, as it’s surged past a symmetrical triangle formation and is currently being traded at approximately $0.85, demonstrating significant power in its movement.

In simpler terms, the Moving Average Convergence Divergence (MACD) graph is showing an upward trend, as its momentum bars are now appearing in a green color.

It seems likely that AERO may return to the $1 mark in the near future, and under advantageous market circumstances, it could strive to hit $1.5 by the end of Q4 in 2024.

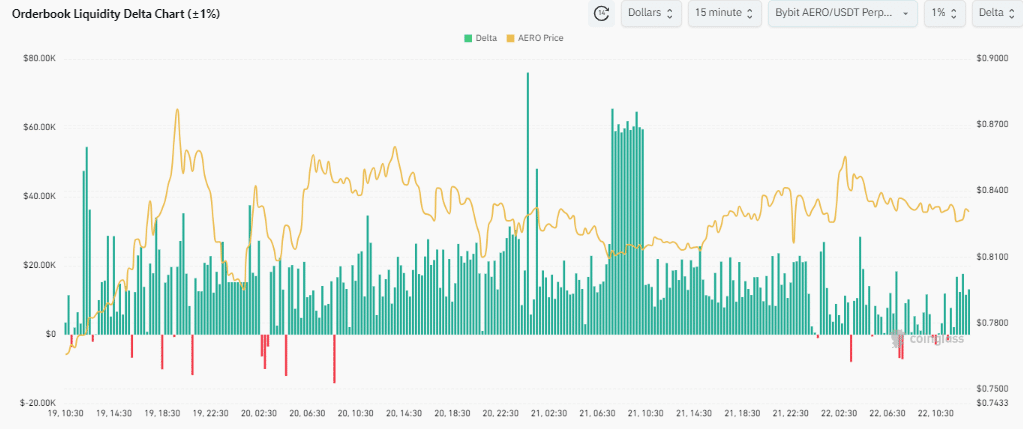

Orderbook liquidity delta

The bullish order book liquidity delta chart, which shows the strength of buy orders compared to sell orders, provides additional evidence for a higher price for AERO as it suggests there are more buyers than sellers in the market.

Although orderbook liquidity doesn’t determine the price, it adds confluence to the likelihood of AERO rising. This positive liquidity environment could further support AERO’s upward trend.

AERO shows promising signs of expansion, backed by robust foundations, a rising Total Value Locked (TVL), and an uptick in earnings distributed to token owners.

With both favorable market movements and plentiful buying interest, it’s quite feasible that the price will recover to around $1.50. As market conditions strengthen, there’s a good chance that AERO‘s price will keep rising.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-23 11:35