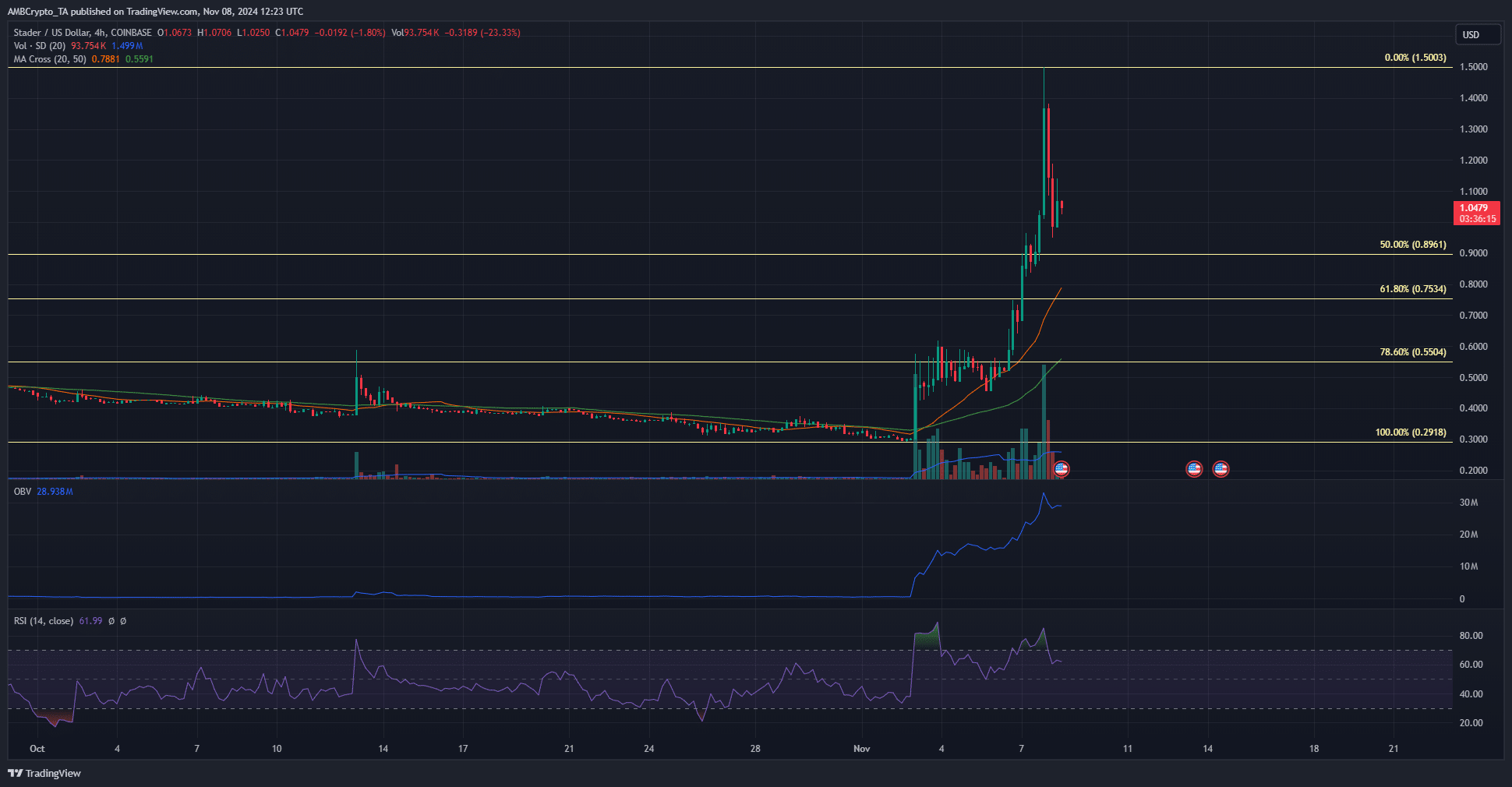

- Stader crypto retained its bullish structure on the 4-hour chart.

- Short-term holders in profit could contribute to SD’s drop below $1 support.

As a seasoned researcher with a decade-long experience in the cryptocurrency market, I have seen my fair share of bullish and bearish trends. The recent surge of Stader crypto, or SD as it is popularly known, has been nothing short of spectacular – a 250.7% rally in just six days! However, I’m not one to ignore the red flags that might be lurking around the corner.

From the 7th of August until the 2nd of November, Stader cryptocurrency experienced a continuous drop and accumulated losses amounting to approximately 47.5%. However, since then, the value of Stader crypto has surged dramatically by an impressive 250.7% over a six-day period.

Reaching an all-time high of $1.5, Security D (SD) had amassed impressive gains totaling 414.1% within roughly six days. However, the recent dip over the last 12 hours is a normal part of its upward trajectory, but how far could this correction extend?

Stader set to decline below the $1 mark?

Currently, significant milestones at $1.5 and $1 were crucial during the reporting period. The price of $1.5 served as a resistance level that Stader crypto had to surpass to continue its upward trajectory. In the past few hours, the $1 support level was tested but subsequently bounced back to reach $1.14.

This rebound indicates that buyers were quite active at the $1 mark, but they may struggle to maintain their positions. Following such a significant triple-digit percentage increase in just a week, a substantial pullback could provide investors an opportunity to jump back into the market.

If the price drops under $1, it could signal a shift towards a bearish market trend, yet this dip might be beneficial for an upcoming price increase. Currently, the 4-hour chart’s technical setup and momentum are leaning toward a bullish stance.

Profit-taking likely to push Stader crypto southward

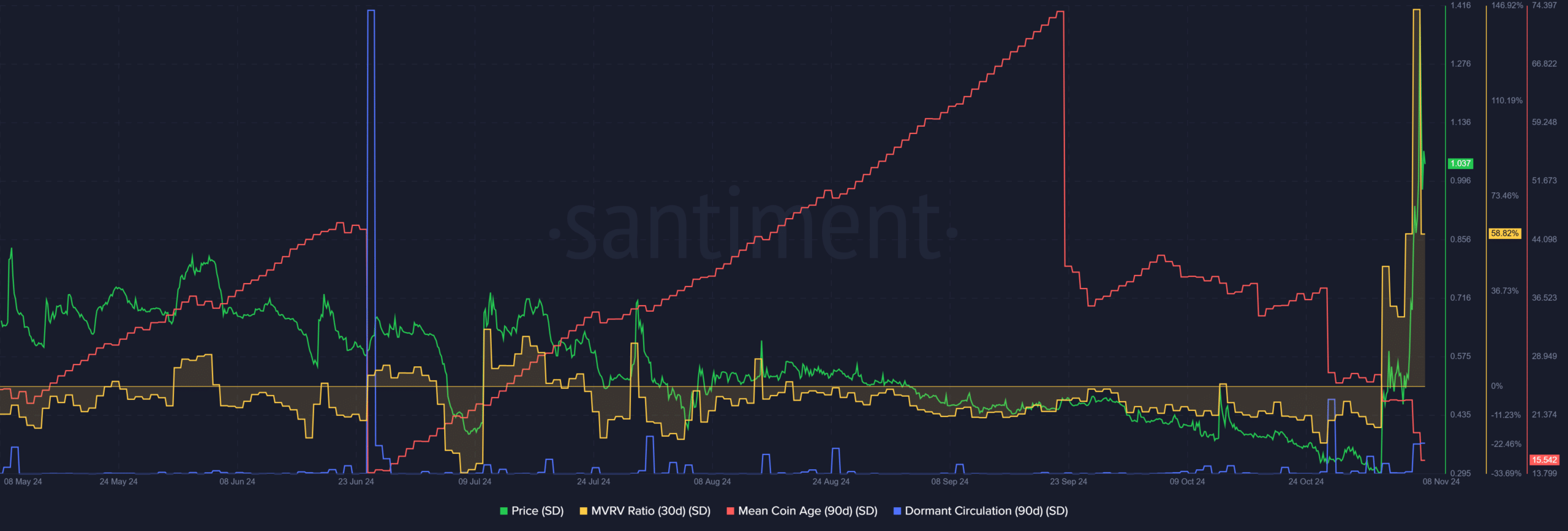

In the last week of September, on-chain statistics indicated a decrease in the average age of coins, over a month prior to SD’s surge above $1. This suggested that coins were being distributed rather than accumulated, as prices had been falling for the past two months.

Is your portfolio green? Check the Stader Profit Calculator

Despite the price increase, there wasn’t a notable rise in sellers, as indicated by the absence of major spikes in recent transactions. On the other hand, short-term investors have made substantial profits, with an average return of approximately 58.6%.

Such a situation might result in increased selling, causing the value of Stader cryptocurrency to dip below $1 and approach the support levels provided by its moving averages, which are around $0.75 and $0.55.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-09 02:15