- ETH has corrected as much as 17% over the week, and could fall further below $2,400.

The market sentiment for ETH was neutral as of this writing.

In the past 24 hours, the cost of Ethereum [ETH] dropped under $3,000, resulting from a 3.24% decrease as reported by CoinMarketCap.

Over the past week, the second largest digital currency experienced a decline of approximately 17%, with buyers finding it challenging to push prices up against the market-wide volatile downturn.

Some investors are selling off their Ethereum holdings during the downturn, while others are buying more at reduced costs.

To buy or to sell?

Based on information from the on-chain monitoring tool Lookonchain, a large investor, recognized for purchasing during market dips, acquired 3,279 Ethereum tokens, equating to approximately $9.75 million at current market values, on Wednesday.

Recently, the prominent investor has significantly increased their purchases of Ethereum tokens, owning an impressive amount of 86,457 ETH tokens by the 17th of April.

In opposition to that, a whale who took part in the 2015 Initial Coin Offering (ICO) sold off 2,000 ETH for approximately $2,997 each, according to Spot On Chain’s records.

During the ICO, a whale bought 33,213 Ethereum tokens for approximately 10,865.73 ETHED ($33,213) each at a price of $0.31. This recent sale significantly increased their earnings.

How did the broader market react?

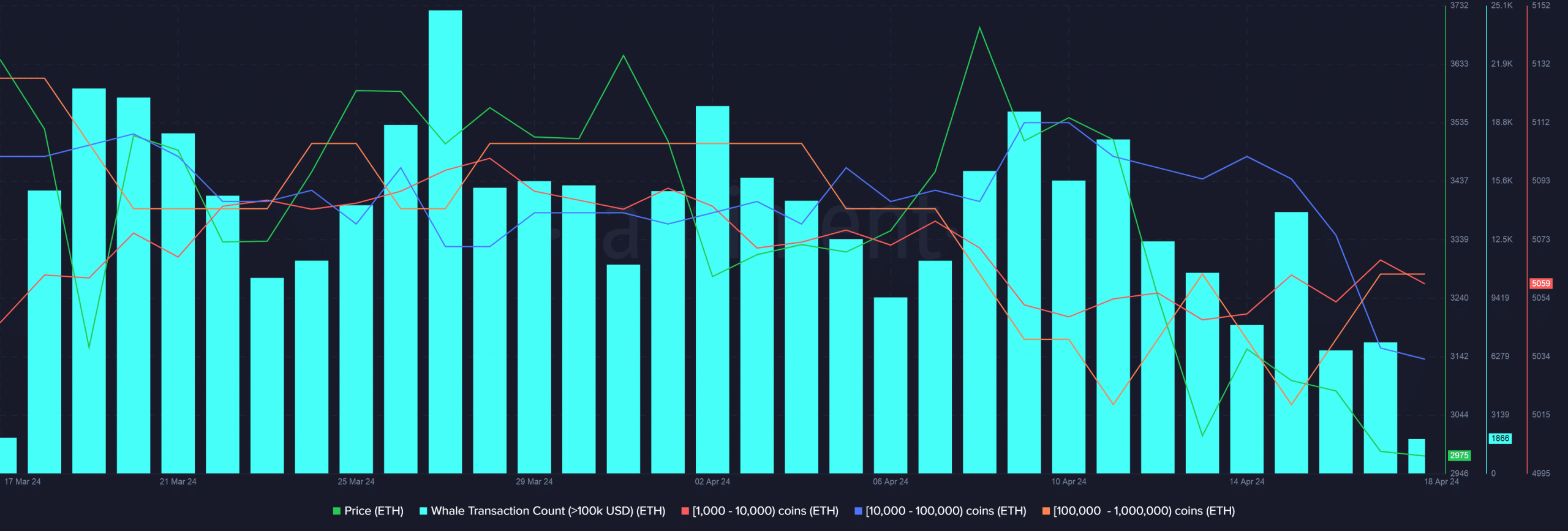

To gain a deeper insight into why Ethereum (ETH) was experiencing a negative response from the market, AMBCrypto analyzed the whale activity data provided by Santiment.

Significantly, the two groups of whales – one consisting of 1,000 to 10,000 individuals and the other of 100,000 to 1 million – experienced growth during the week, implying that they were gathering or amassing in numbers.

During this period, wallets containing 10,000 to 100,000 ETH experienced a decrease, suggesting that some sellers were offloading their Ethereum holdings.

The previously mentioned signs added weight to the “mixed response” storyline presented in the article before.

Gauging ETH’s next moves

The Ethereum Fear and Greed Index supported the observations made earlier to a certain degree. As of the latest data, the sentiment toward Ethereum was considered neutral, indicating an equal preference neither to purchase nor sell.

Previously, AMBCrypto warned that Ethereum could potentially drop to a range between $2,000 and $2,400.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-18 16:07