-

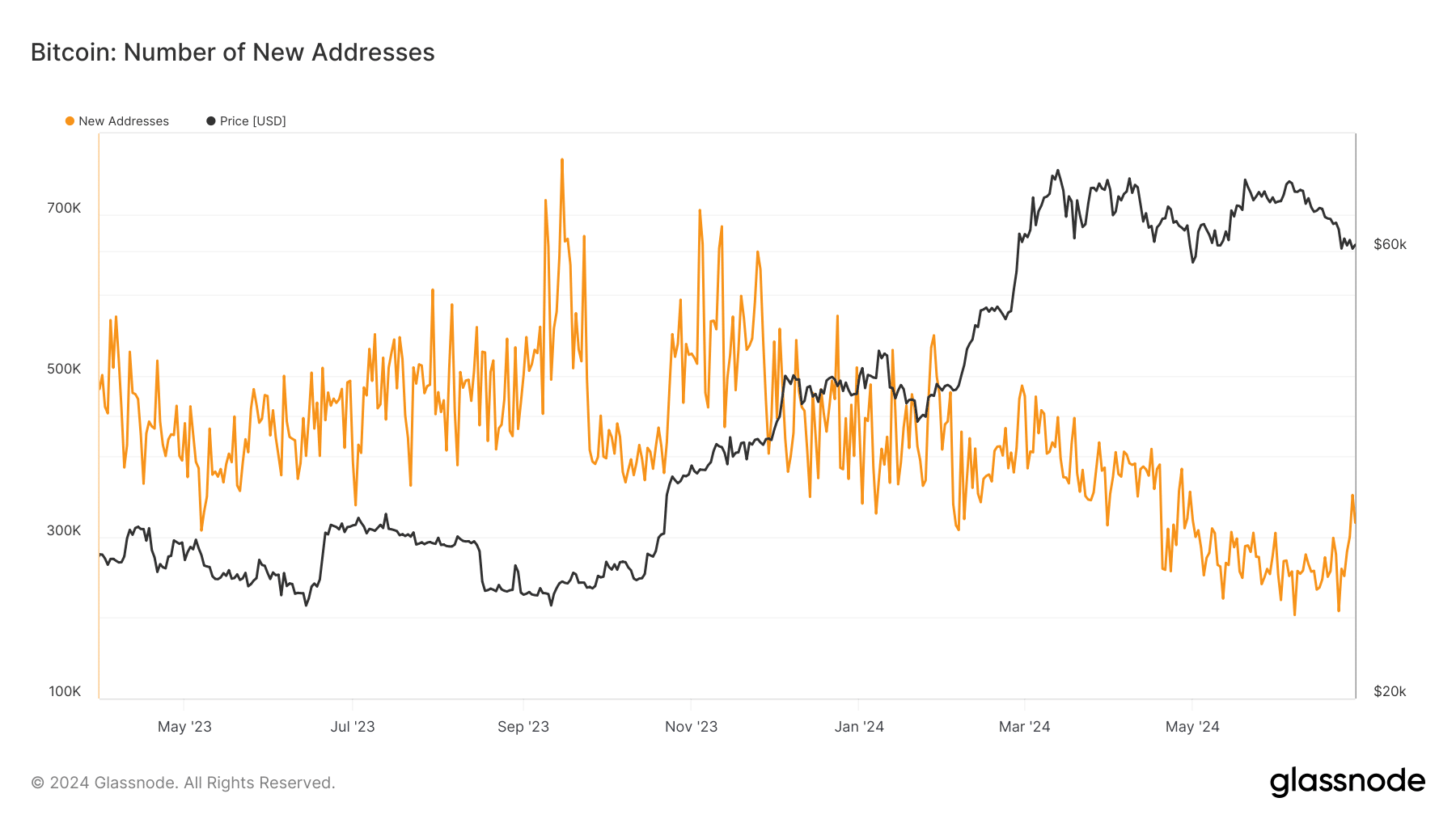

BTC saw its highest number of new addresses in months.

BTC has maintained the $60,000 price range.

As a seasoned crypto investor with a keen eye on Bitcoin’s [BTC] price trends and market dynamics, I find the recent developments both intriguing and somewhat concerning.

As a crypto investor, I’ve noticed that Bitcoin‘s [BTC] price dipped beneath the $60,000 threshold on two different instances over the past week. Simultaneously, there was a minor uptick in the Bitcoins stored in exchanges.

As an analyst, I’ve noticed an intriguing trend: while Bitcoin (BTC) quantities were rising on exchanges, there was also a substantial surge in the generation of fresh Bitcoin addresses.

Bitcoin falls below $60,000

As an analyst examining Bitcoin’s price movement over the last week based on AMBCrypto’s report, I identified notable price fluctuations.

On the 24th of June, Bitcoin saw a significant decrease of 4.60%, ending the day’s trade around $60,263.

As an analyst, I’ve observed that the price of Bitcoin came very close to touching the $60,000 mark but dipped as low as $58,411 during the day. On the 28th of June, I noticed a similar trend with the price once more testing lower levels.

It declined to $59,868, and closed at around $60,313, marking a decline of over 2%.

From my perspective as an analyst, at the moment, Bitcoin’s price stands approximately at $61,400 with a minimal gain of below 1%. Notably, the Relative Strength Index (RSI), which is a significant indicator of the price trend’s momentum, hovers around 38.

As a researcher studying Bitcoin’s price trends, I would interpret a Real Simple Moving Average (RSI) reading below 40 as suggesting a strong bear trend for the cryptocurrency. Values closer to 30 indicate increasingly bearish momentum and may signal an oversold condition.

The move might thus precede a potential price rebound.

The recent fluctuations in prices this week have influenced wider market trends as evidenced by the surge in new Bitcoin wallets and shifts in exchange deposits.

Commonly, substantial drops in price may lead to heightened trading action on cryptocurrency exchanges as investors respond by either selling or purchasing Bitcoin at supposed pivotal points.

As a market analyst, I would rephrase that sentence as follows: Whenever new market players join the fray or existing ones expand their presence, they seize the opportunity to capitalize on price fluctuations by creating new addresses.

Bitcoin on exchanges increase

According to AMBCrypto’s examination of data from CryptoQuant, there has been a noticeable increase in the amount of Bitcoin being stored on cryptocurrency exchanges.

The amount of Bitcoin held in exchanges has typically hovered around the 2.8 million mark, but there have been small variations. More precisely, there’s been a recent addition of roughly 14,000 Bitcoins to these reserves within the past few days.

With Bitcoin’s present market value, the addition to reserves equates to approximately $851 million being transferred to exchanges in Bitcoin terms.

As of this writing, the total BTC held in exchange reserves was around 2.841 million BTC.

An enhancement in the quantity of Bitcoins held on exchanges may signal various consequences. Generally, such an expansion is viewed as a possible indication of sellers readying themselves, potentially leading to price declines.

As a researcher studying financial markets, I can express it this way: Another interpretation is that a higher bid-ask spread signifies more fluid market conditions, possibly resulting in elevated trading activity.

Notable on-chain growth takes place

New Bitcoin addresses have seen a significant uptick in formation for the first time in almost three months.

Based on Glassnode’s data analysis, there was a significant increase in the number of new cryptocurrency addresses formed each day, exceeding 350,000.

As a crypto investor, I’ve noticed an unusual surge in market activity lately. In fact, the last time we saw such a high volume of transactions was back in April.

Read Bitcoin’s [BTC] Price Prediction 2024-25

An intriguing possibility is that the surge in newly created Bitcoin addresses indicates growing enthusiasm for Bitcoin, possibly among fresh investors entering the market. Alternatively, it might be current users expanding their holdings by creating new addresses.

A substantial increase in this magnitude typically signals larger trends or changes in investor attitudes within the marketplace, potentially influencing Bitcoin’s transaction volume and pricing patterns.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-01 03:04