-

Hong Kong Bitcoin ETFs will start trading this week.

Australia joins the BTC ETF mania; will APAC demand boost BTC prices?

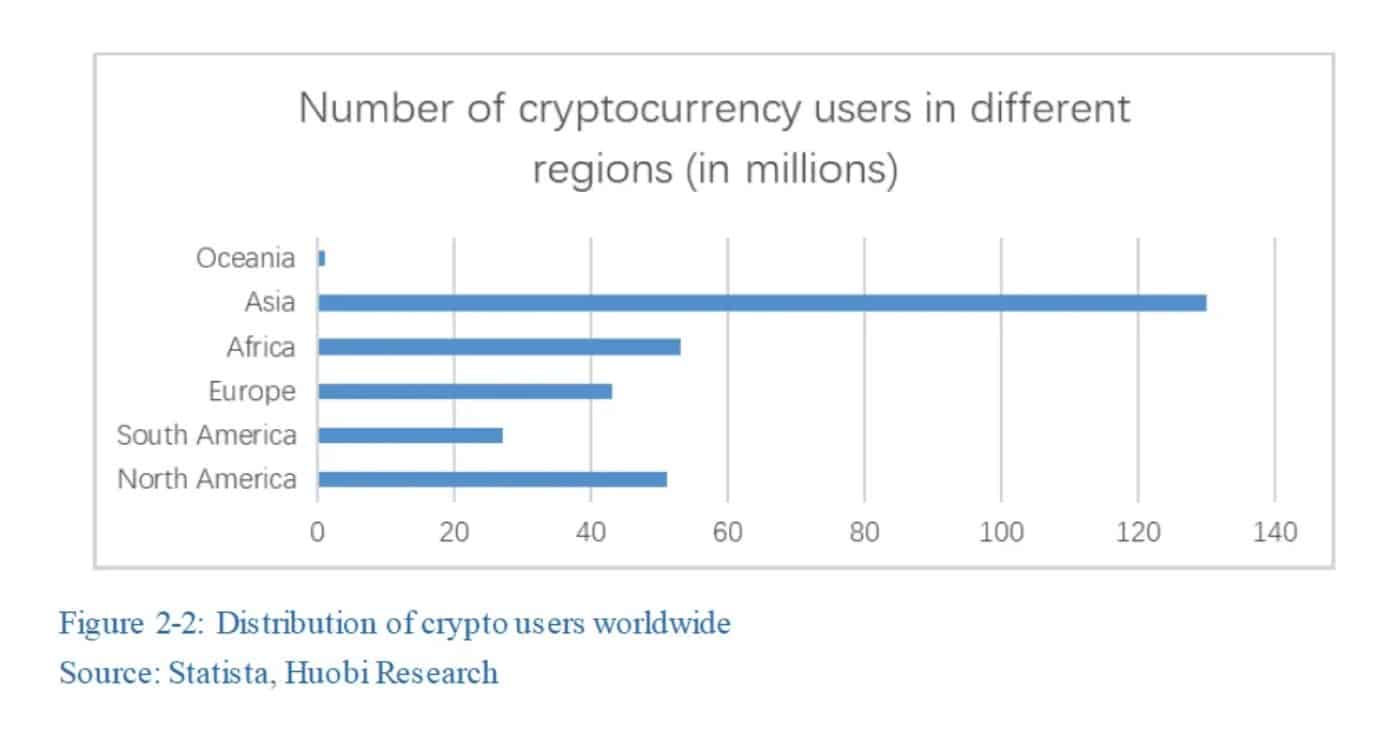

As a seasoned crypto investor with a deep understanding of the market dynamics in Asia, I am thrilled to see the much-anticipated Hong Kong Bitcoin ETFs finally launching this week. The significance of these ETFs in the region cannot be overstated given that Asia is home to the largest number of crypto users. With the user base being bigger than both the US and European markets combined, the potential demand for BTC prices could be substantial.

Excited investors look forward to the launch of distinctive “in-kind” Bitcoin [BTC] ETFs from Hong Kong, set to begin trading on April 30. This event is considered a pivotal moment for Asia’s financial markets.

One market analyst, Willy Woo, highlighted the importance of the Hong Kong crypto ETF by referencing Asia’s top crypto user demographics.

“The Asian market in user count is BIGGER than the US and European markets combined.”

Hong Kong Bitcoin ETFs fee wars and market size

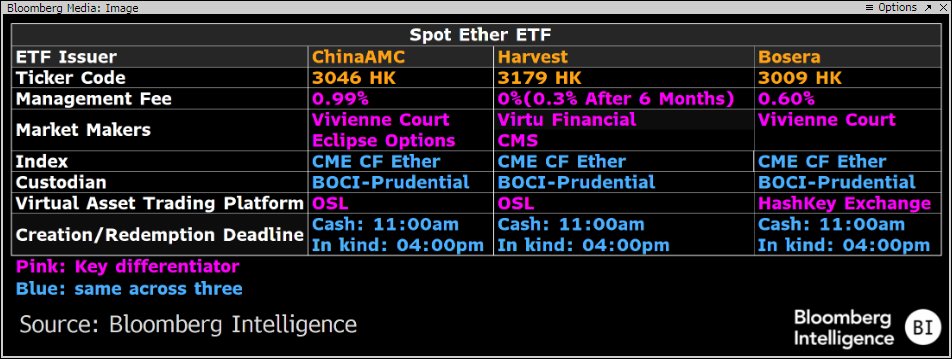

As an analyst, I can share that starting from the 30th of April, the initial offerings of approved securities from Bosera, ChinaAMC (both based in China), and Harvest Fund will debut on the Hong Kong Stock Exchange.

As a researcher examining financial trends, I’ve observed an intriguing pattern: on average, Hong Kong issuers have established relatively low fees. This could potentially spark fierce competition among market players, resulting in a fee war.

As a crypto investor, I’m keeping a close eye on the potential fee competition that may ensue in Hong Kong regarding Bitcoin and Ethereum ETFs. Harvest Funds is making a bold move by offering a full fee waiver, resulting in the lowest fees after the discount at 0.3%.

As a crypto investor, I was initially thrilled at the prospect of Hong Kong’s BTC ETFs commencing trading and its potential influence on Bitcoin’s price.

As a crypto market analyst based in Singapore, I recently estimated that Hong Kong’s Bitcoin Exchange-Traded Funds (ETFs) could potentially draw in approximately $25 billion in investments by mid-April.

As a researcher, I’d rephrase it this way: I, myself, took note of Bloomberg’s analysis by Eric Balchunas. However, his estimates seemed overly optimistic to me as the realization set in that Mainland China was facing potential restrictions.

The analyst revised his earlier estimation of $200 million in assets under management (AUM) upward to a new estimate of $1 billion.

“The value of our assets is currently projected at $1 billion during the initial two-year period. While this is a promising start, it falls significantly short of the $25 billion suggested by others. However, it’s essential to note that the pace of infrastructure development will have a substantial impact on our future growth.”

The report pointed out that the total amount of Bitcoin ETFs in the Asia Pacific (APAC) region was approximately $250 million, with funds based in Hong Kong and Australia holding this amount.

As a financial analyst, I would express it this way: “Approximately $251 million is currently managed by Bitcoin Exchange-Traded Funds (ETFs) in the Asia-Pacific region. This amount is allocated across three funds based in Hong Kong and two funds situated in Australia.”

Australia follows U.S., Hong Bitcoin ETF frenzy

Australia is reportedly making significant progress in bringing more Bitcoin (BTC) Spot ETFs to its major stock exchange, the Australian Stock Exchange (ASX).

I’ve come across a noteworthy Bloomberg article from the 29th of April. This piece reveals that companies such as Van Eck, BetaShares, and DigitalX have submitted proposals for Bitcoin Spot Exchange-Traded Funds (ETFs) in Australia.

An official timeframe for approval from ASX has yet to be announced. Nevertheless, a swift approval could lead to increased institutional investment and bolster the position of Bitcoin ETFs in Hong Kong and the entire APAC region.

In the meantime, BTC’s price hovered slightly above its range-low of $60.8K.

As a financial analyst, I would anticipate significant market volatility in the coming days, especially leading up to the US Federal Reserve’s interest rate decision scheduled for Wednesday. The current market conditions, with an abundance of liquidity and positions stacked on the upside, increase the likelihood of wild price swings.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-04-29 15:04