-

Despite outperforming many altcoins, NEAR’s price risked falling below $5

On-chain data showed that FET and RNDR could be in line for a rebound

As a crypto investor with experience in the market, I’ve seen my fair share of ups and downs when it comes to investing in AI coins. Despite the recent dip in the total market cap of AI coins, I remain optimistic about their potential.

Unlike the significant growth experienced in the first quarter of 2024, the current market capitalization of AI coins has been decreasing. The total value now stands at approximately $28.86 billion.

Despite experiencing significant price drops and decreased market capitalizations, it is undeniable that tokens such as Render (RNDR), Bittorus (TAO), and Fetch.ai (FET) have stood out during this market cycle with impressive performances compared to many other altcoins.

The reason for AI’s recent advancements is quite apparent. Over the past year, we have witnessed significant progress in this field. This includes increasing requests for GPUs, the widespread use of ChatGPT, and the remarkable growth in Nvidia’s market value.

In this article for AMBCrypto, we will examine the performance and potential future developments of the leading artificial intelligence (AI) cryptocurrencies in 2024: NEAR Protocol (NEAR), FET, and RNDR. Let’s take a closer look at their achievements thus far and speculate on what may transpire in the remainder of the year.

NEAR faces another round of decline

As a blockchain and AI expert, I’d describe NEAR as follows: I work with NEAR, a foundational project that bridges the gap between blockchain technology and artificial intelligence. This intersection enables NEAR to provide scalability for applications and enhances overall network performance.

As of now, the cost of NEAR was $5.06 at the time this article was published. In the early part of the year, the price of this token surged from $2.64 to a high of $8.90 between January and March. However, over the past month, there has been a significant decrease of 30.02%, causing most of those earlier gains to be erased.

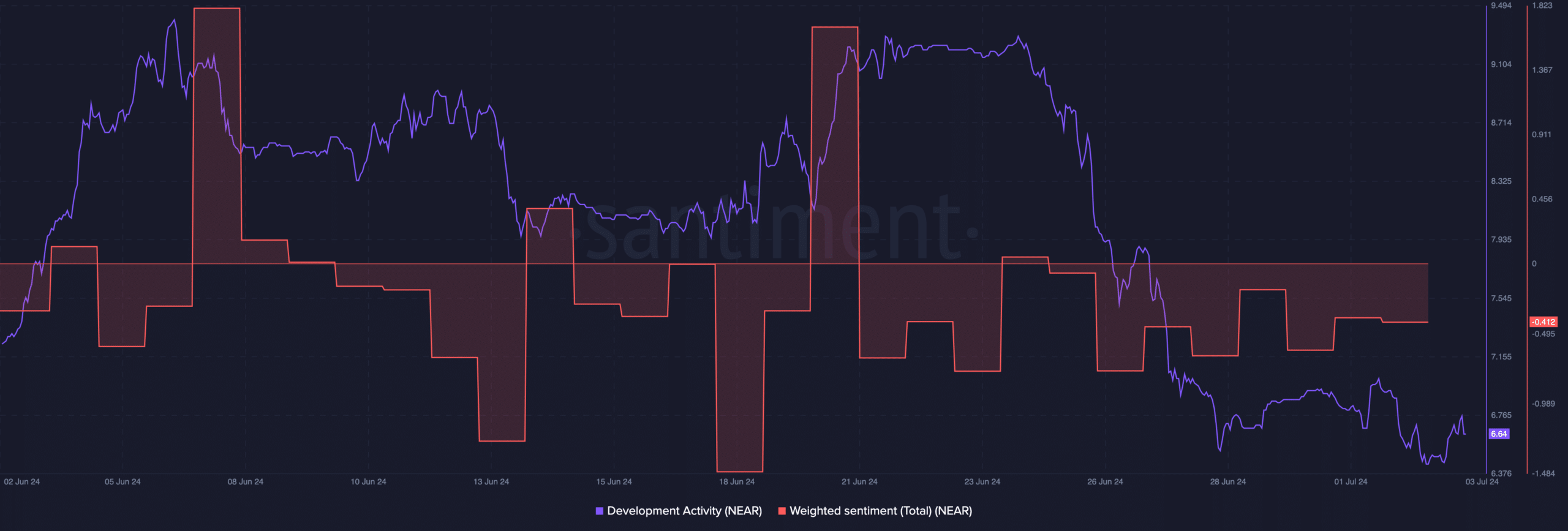

As a crypto investor in NEAR, I’ve observed that the level of development activity on the network significantly impacts the token’s price. Based on AMBCrypto’s analysis, every time development is robust and progressing well, the value of the NEAR token tends to increase.

In simpler terms, developing for a blockchain involves maintaining and enhancing its performance. An increase in development activity signifies that new improvements or additions are being released.

As one of the leading AI cryptocurrencies, a decrease in this metric sends a warning signal that could negatively impact its price. Currently, the metric is down and significantly below its previous highs.

If the current trend persists, the NEAR token’s value may dip below $5 in the near future. Moreover, the sentiment analysis reveals a predominantly negative attitude towards this token, suggesting a greater volume of pessimistic remarks compared to optimistic ones.

Should the current situation persist, the need for NEAR may prove challenging to meet, potentially leading to a drop in price. Yet, this forecast could be rendered obsolete by significant advancements in artificial intelligence or a surge in purchasing interest.

Activity on Fetch.ai’s network soars

As an analyst, I can share that in 2024, FET, which is now part of the Artificial Superintelligence (ASI) Alliance, reached a new peak price for me. This occurred on March 28th when the value of FET hit $3.47.

Although FET has been merged with other artificial intelligence tokens, the excitement surrounding it has noticeably dwindled. Consequently, this downturn in enthusiasm has negatively impacted the token’s worth. Currently, FET is being traded at a price of $1.24, marking a significant decrease of 29.76% over the past week.

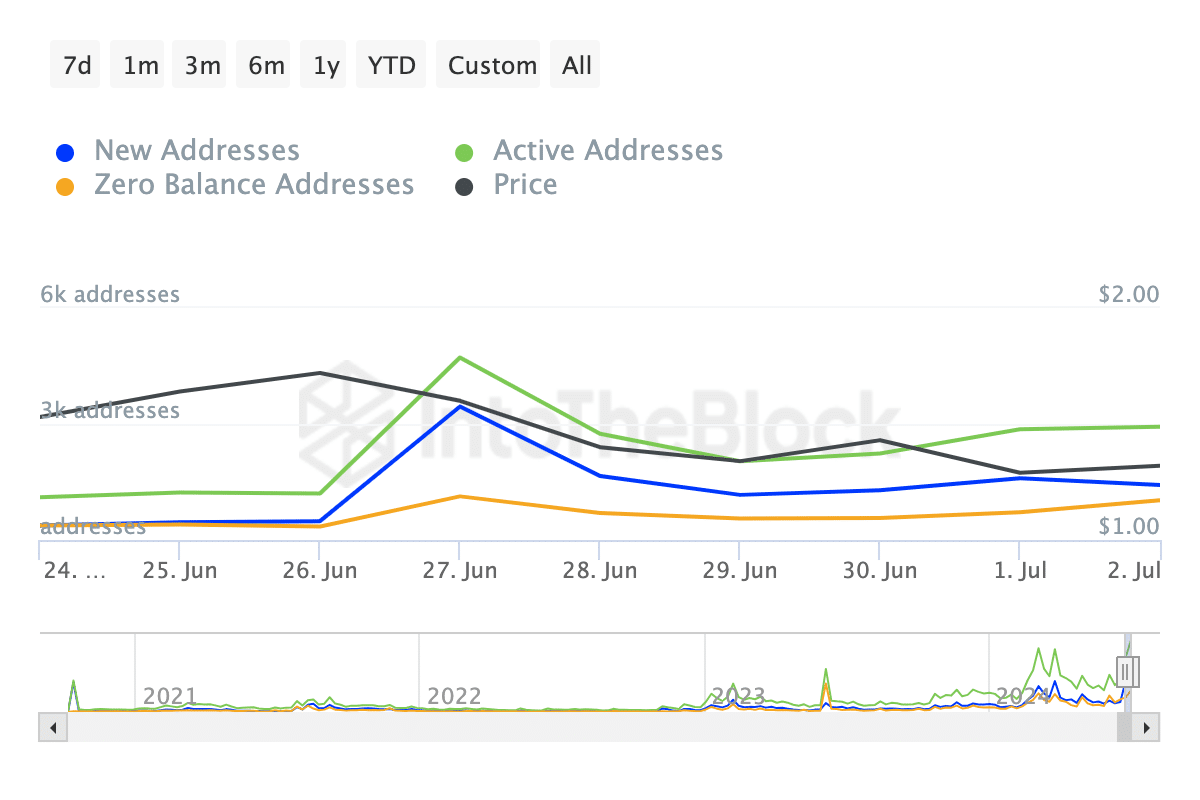

As a crypto investor, I’m hopeful that the price of Fetch.ai (FET) may rise again in the future based on recent developments. After examining Fetch.ai’s network activity, AMBCrypto discovered some promising signs. Specifically, according to IntoTheBlock, there has been a significant increase in the number of new, active, and zero-balance addresses for FET over the past few days. This trend could potentially indicate growing interest and engagement within the Fetch.ai community, which might lead to an increase in demand for the cryptocurrency and subsequently drive up its price.

The network’s expansion at this rate indicates strong popularity and a significant user base. If the number of addresses keeps increasing, it could potentially lead to an uptick in FET‘s value due to heightened demand for the token.

If continued, FET‘s value may prevent it from dipping under $1. On the contrary, there are indications that it could advance towards $2 within the next few weeks.

Is it time to buy Render [RNDR]?

During this cycle, RNDR emerged as a notable standout among newcomers. Given that it’s a GPU rendering network operating on the Ethereum blockchain, the surge in interest and investment around the dynamic GPU market contributed significantly to RNDR’s price growth.

Similar to FET reaching a new peak at $13.60 in March, RNDR hit an all-time high. However, since then, its price has dropped significantly from that height, down to $7.08 – representing nearly half of its previous value. AMBCrypto analyzed if this decline presented a potential buying opportunity.

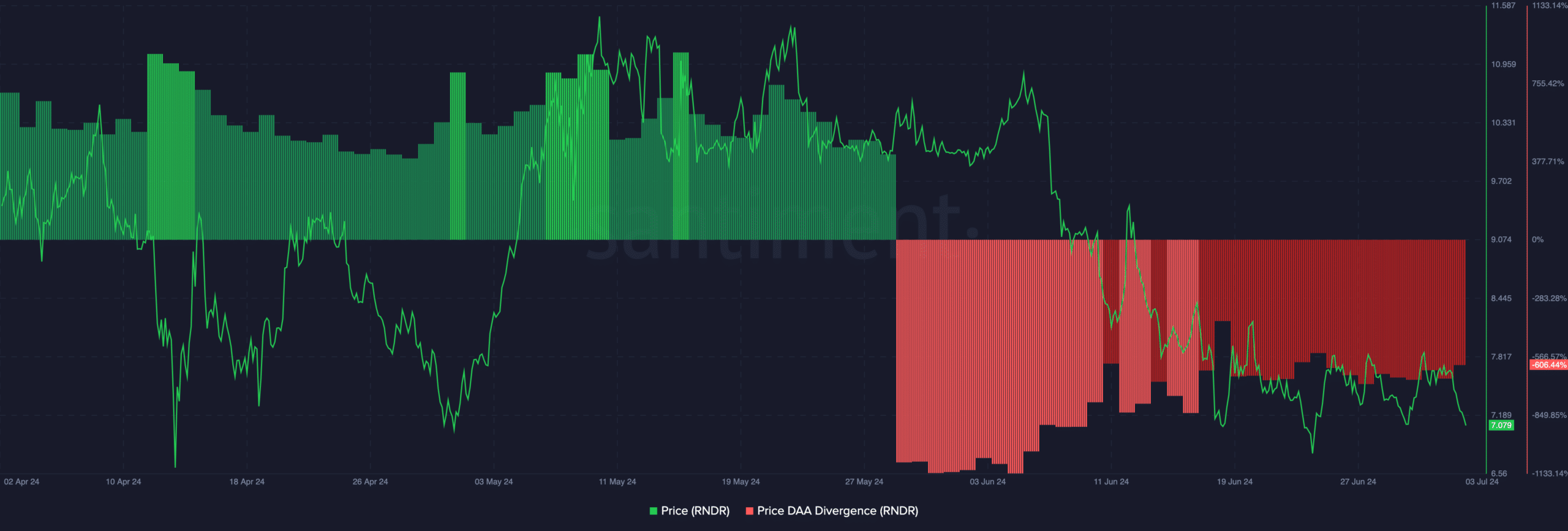

As a researcher studying blockchain data, I examined the price-DAA (Daily Active Addresses) divergence to gain insights into the token market. The DAA metric represents the level of user engagement on a specific blockchain by tracking the number of daily active addresses. By comparing this figure with the token’s price trend, we can determine whether the value is growing faster than network activity or not.

If the indication shows an increase in price outpacing the level of activity, this situation is favorable. However, when this disparity becomes significantly large, it serves as a warning to sell.

At the moment when the prices were being reported, the difference between the price and the DAA (Digital Asset Agreement) stood at -606.44%. This signifies that the engagement rate on Render’s network was more elevated than the pace of price decrease. In simpler terms, this large negative figure might have indicated a rare buying opportunity for RNDR.

Realistic or not, here’s NEAR’s market cap in RNDR terms

Should this trend continue, RNDR‘s value could potentially rise above $9, increasing its worth. On the other hand, coins like Injective (INJ) and The Graph (GRT) have recently gained attention in the AI sector.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-07-04 10:16