-

Exploring the rise of AI coins as FET and TAO lead charge.

The price action of Fetch.AI and BitTensor looking good.

After spending years observing the ever-evolving crypto landscape and witnessing countless bull runs and bear markets, I have learned to keep a keen eye on the sectors that outperform others during uncertain times. As an analyst with this background, I can confidently say that the current rise of AI coins is a trend worth paying attention to.

Over the past month, a review of the cryptocurrency market has shown that areas focusing on Artificial Intelligence (AI), Decentralized Finance (DeFi), and Meme coins have exceeded the performance of Layer 1 and Layer 2 technologies.

At the forefront of these advancements are Fetch.AI [FET] and BitTensor [TAO], both demonstrating substantial growth since August. Despite a general air of market apprehension, investors are seeking out past trends that may regain momentum.

If the market gains momentum, investing in AI technology and memecoins appears to be the simplest options for potential growth, with other narratives possibly arising at a later time.

Price action analysis of FET & TAO

Given that AI coins are performing well, let’s examine the price action of FET and TAO pairs.

The strong financial performance shown by Nvidia in August has increased trust in AI-related cryptocurrencies, suggesting a favorable future for such digital assets.

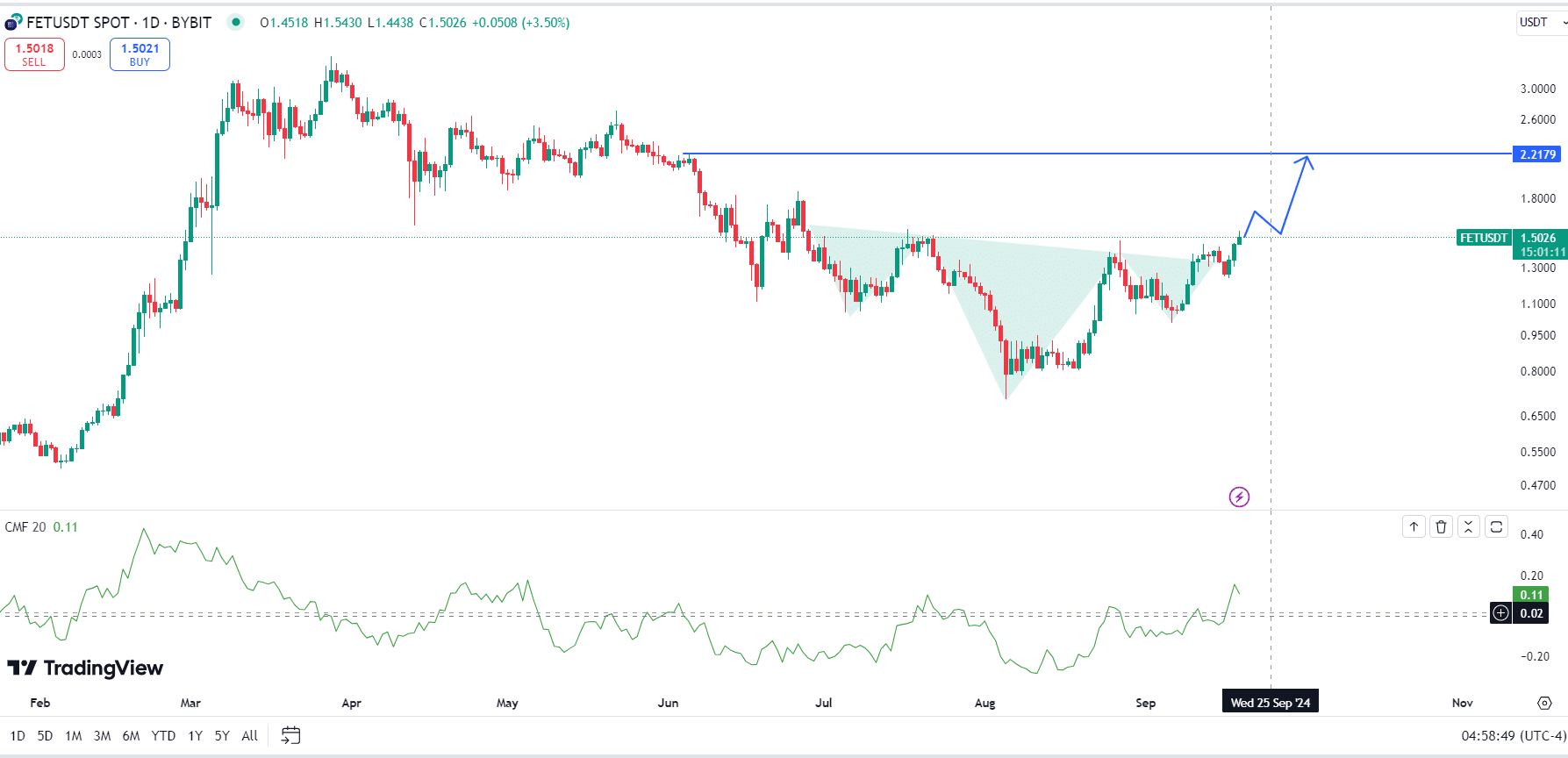

For Fetch.AI, the price action of the FET/USDT pair indicates a potential surge. It has recently broken out of an inverted head and shoulders pattern, which typically signals a bullish reversal.

Moreover, the Chaikin Money Flow (CMF) is on an upward trajectory, indicating a surge in buying actions within the market. If this pattern persists, there’s a possibility it could reach $2.21 before the end of the year or at the beginning of the next one.

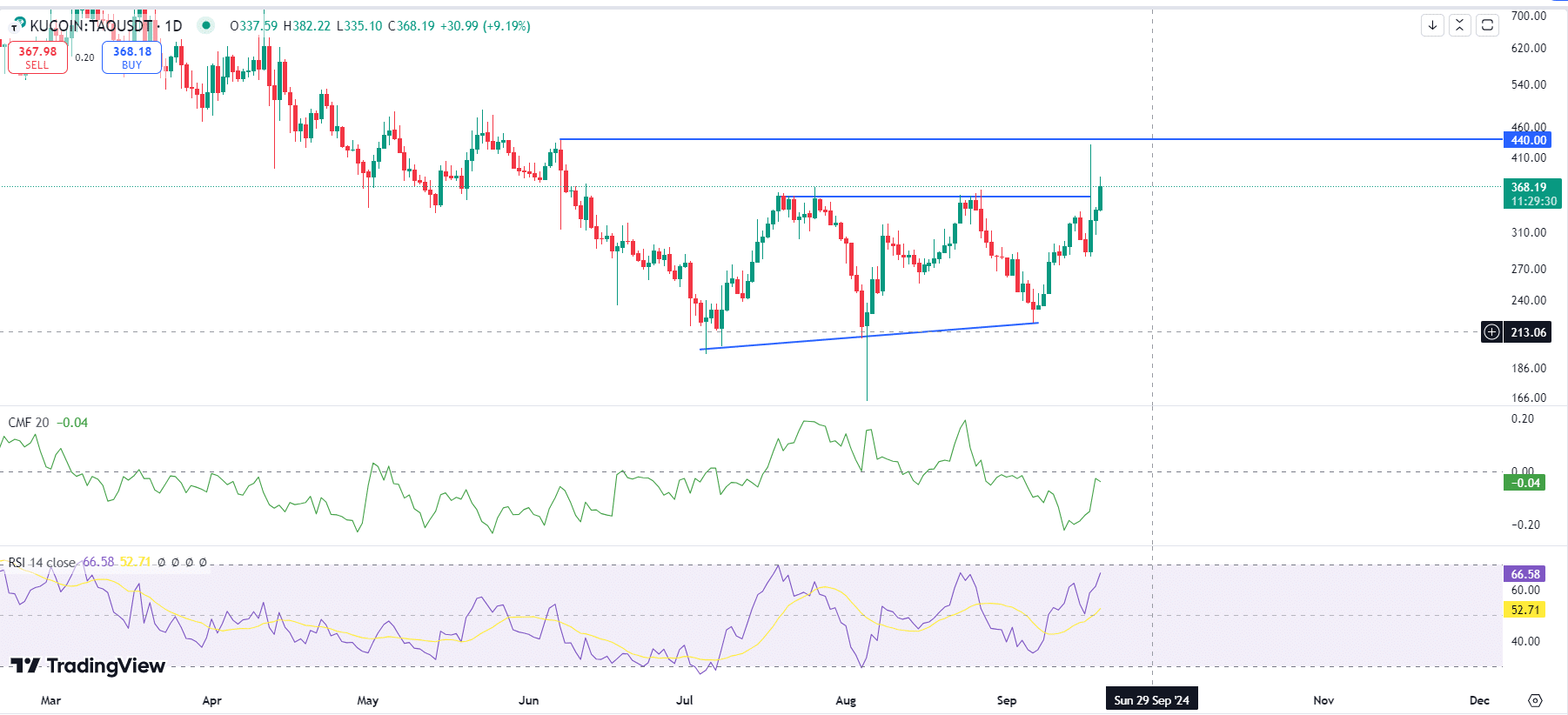

In a similar vein, BitTensor is showing optimistic signs. Lately, TAO encountered resistance at the $440 mark following its surge past two equivalent highs in liquidity.

On the other hand, TAO/USDT continues to show positive momentum, with its price trending upwards to potentially fill the gap caused by a large wick in the candlestick chart.

The Cash Flow Margin for TAO is nearly shifting to a positive state, suggesting an influx of funds towards this AI investment. Meanwhile, the Relative Strength Index (RSI) stands in an area that signifies it’s overbought, indicating excessive buying activity.

In other words, when Relative Strength Index (RSI) is overbought, it may signal a possible market adjustment. However, it usually reflects robust bullish energy, particularly in the context of TAO.

The Futures Funding Rates

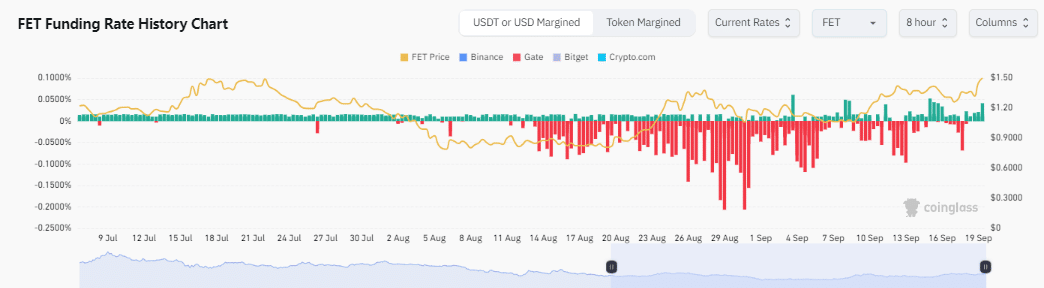

A promising sign is the recent change in Futures Funding Rates for Fetch.AI, now showing a positive value following previous negativity.

This shift suggests a rise in the number of traders opting for long trades on FET and similar AI-focused coins, usually resulting in an increase in their respective prices.

Increased funding rates signify that long-term traders are paying a premium to keep short-term traders in the market, indicating a growing interest in FET and similar assets, as well as a higher demand.

Conversely, if the market experiences a decline, it could potentially lead to liquidation problems for those holding long positions.

Coin comparison

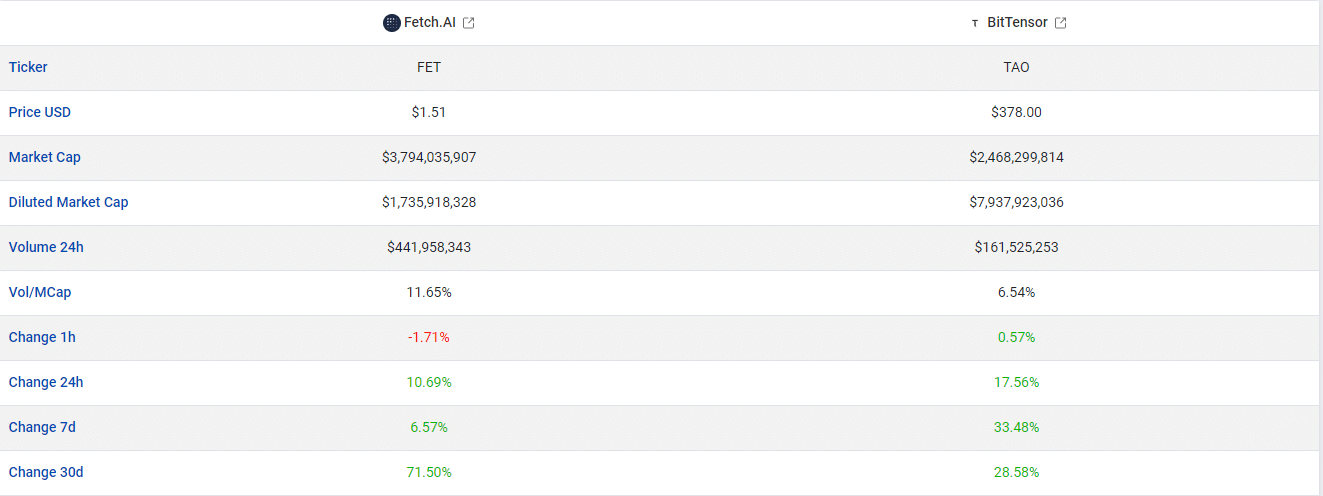

When it comes to choosing an investment, FET seems to be a better option as it has performed significantly better than TAO over the past month. In fact, FET has seen a remarkable increase of 71% compared to TAO’s 28% growth during the same period.

Moreover, it’s worth noting that FET has a larger market capitalization of approximately $3.79 billion, compared to TAO with $2.46 billion. This difference translates into a volume-to-market cap ratio of around 11.65% for FET and about 6.54% for TAO. In simpler terms, this means that a greater proportion of FET’s market value is being traded daily compared to TAO.

A higher FET‘s volume-to-market cap ratio might indicate that it could be a more secure investment, especially when considering its potential for price fluctuations.

The AI sector, led by FET and TAO, shows promising potential for higher prices.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Under advantageous market situations and encouraging price trends, both traders and investors should closely monitor these cryptocurrencies while they adapt to the ever-changing crypto environment.

In the rapidly growing AI sector, investments in FET and TAO might prove profitable for individuals seeking to capitalize on this vibrant market trend.

Read More

2024-09-20 06:16