- Bitcoin’s mining sector is struggling, with revenue declining sharply

- Transitioning to AI data centers might present significant cost and logistical challenges for Bitcoin miners

As an analyst with over two decades of experience in the tech and finance industries, I’ve seen my fair share of transformations and disruptions. The current state of Bitcoin mining is no exception, and it seems like we’re witnessing yet another interesting chapter unfold.

As a researcher, I’ve observed some notable fluctuations in Bitcoin [BTC] throughout August. During this month, it traded between roughly $64,000 and $57,000. Despite the volatility, Bitcoin continued to dip in September, with its current price standing at $56,816.75 as I speak.

Although CoinMarketCap reported a slight 0.38% increase in the last 24 hours, technical signs pointed towards a continuous downward trend, suggesting bears are still in control.

Bitcoin mining’s AI bet

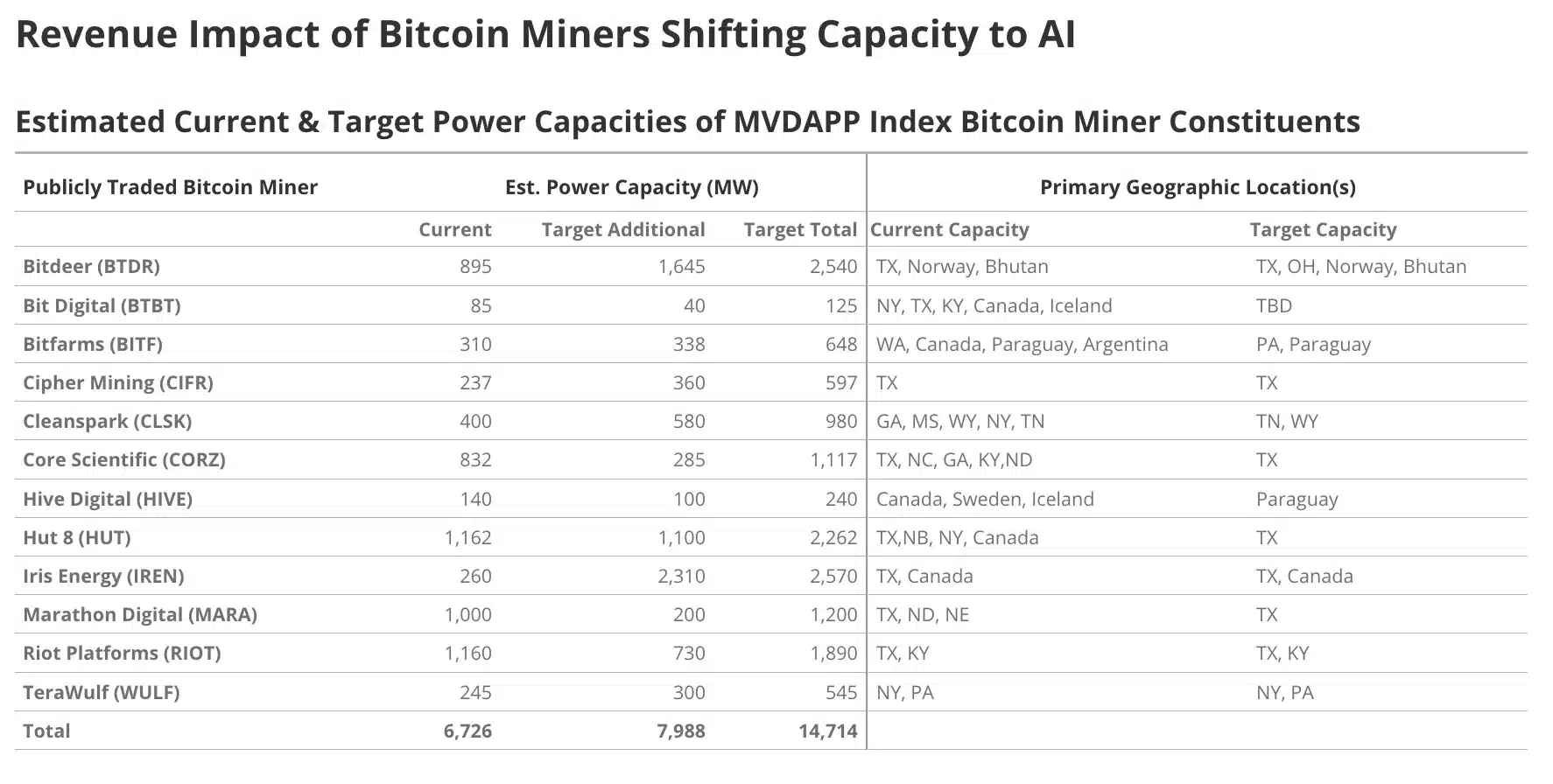

Beyond that point, it’s important to note that Bitcoin mining businesses are also considering expanding their operations into data centers for high-performance computing. This move aims to increase their income during these unpredictable times.

On the other hand, Phil Harvey, the CEO of Sabre56 – a company specializing in blockchain data centers consulting – thinks that making this shift could encounter numerous obstacles, making it questionable how realistic it might actually be.

In conversation with a news agency, the executive stated that converting a cryptocurrency mining operation into an Artificial Intelligence (AI) or advanced computing data center comes at a much higher price point.

He pointed out that while running a typical mining operation costs between $300,000 and $350,000 per megawatt, AI data centers demand a much higher investment. Somewhere along the lines of $3 million to $5 million per megawatt— An increase of 10 to 15 times.

Additionally, Harvey pointed out that despite having a gigawatt of power available, it would only be practically possible to divert approximately 200 megawatts towards high-performance computing applications.

He said,

Approximately 20% of a miner’s holdings are likely to possess essential qualities such as power, data, and territory, enabling them to support Artificial Intelligence (AI) operations.

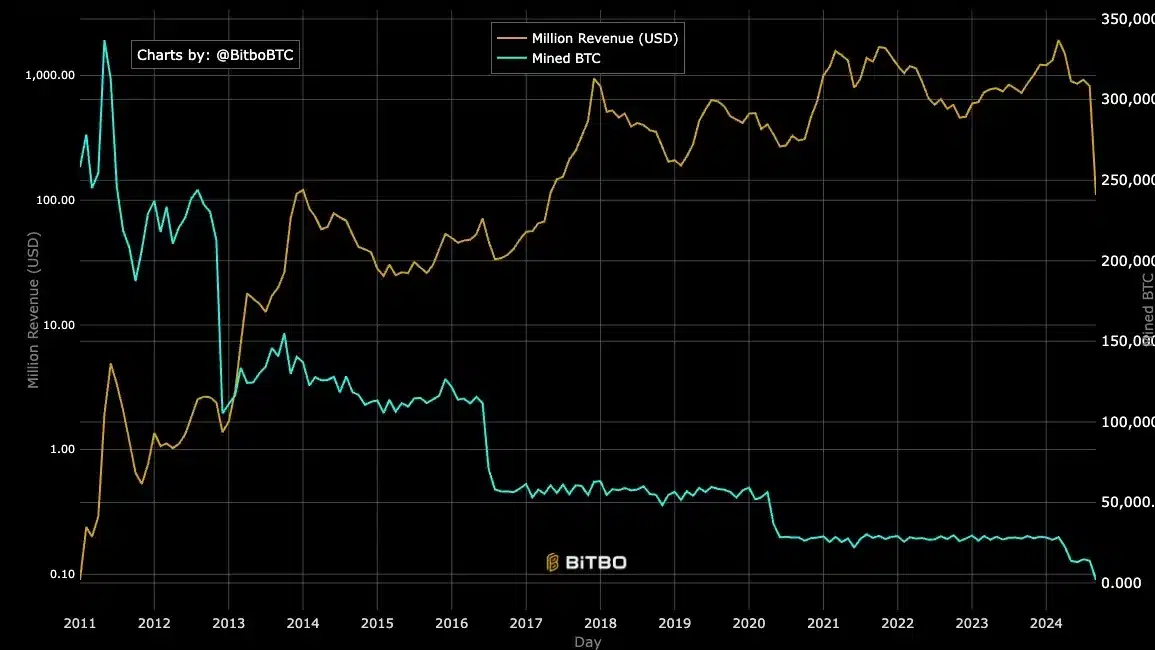

Bitcoin’s revenue slump

It seems that the current trend among Bitcoin miners to shift focus towards Artificial Intelligence (AI) data centers could be due to the financial difficulties they’ve been experiencing.

In August, Bitcoin miners experienced their most unprofitable earning period in close to a year, with profits reaching levels last seen in September 2023. This was particularly noticeable due to a decrease in the amount of coins being mined.

High mining costs made the problem even worse. If these costs exceed the benefits, miners might have to give up. (Simplified and clear paraphrase)

Due to this financial strain, numerous individuals are investigating various income sources, including high-performance computing, to maintain the stability of their operations.

As a crypto investor, I’ve noticed that a recent analysis by AMBCrypto has pointed out a substantial decline in miner revenue, dropping down to approximately $820 million in August.

The drop was more than 10% compared to the $927 million recorded in July, and this decline also signified a significant 57% decrease from its highest point of around $1.93 billion back in March.

As an analyst, I found March to be particularly striking. Not just due to the impressive revenue figures we saw, but also because the record high of Bitcoin exceeded an astounding $73,000.

VanEck has a different perspective to share

It’s noteworthy that VanEck predicts that by 2027, publicly-traded Bitcoin mining companies might significantly boost their income if they divert 20% of their energy output towards Artificial Intelligence and high-performance computing.

“Total additional yearly profits could exceed an average of $13.9 billion per year over 13 years.”

The report added,

“AI companies need energy, and Bitcoin miners have it.”

Consequently, with the Bitcoin mining sector considering transitioning to advanced computing and artificial intelligence facilities, the road ahead appears unclear.

However, the manner in which this transition progresses will significantly impact its ability to sustain and boost mining earnings, especially considering the present financial strains.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-09-06 10:16