- Bullish analysts’ estimates on Nvidia earnings report tipped wild rally in crypto AI tokens.

- Can the AI tokens sustain the momentum of the uptrend after the earnings report?

As a seasoned crypto investor with more than a decade of experience under my belt, I have witnessed countless market fluctuations and learned to navigate through them with cautious optimism. The recent surge in AI tokens ahead of Nvidia’s earnings report has piqued my interest, but it also serves as a reminder that the crypto market can be unpredictable.

During the lead-up to Nvidia’s [NVDA] highly anticipated earnings call on August 28th (post New York market hours), there was a significant surge in trading activity for Crypto AI tokens, which appears to be indicative of preemptive trading or front-running.

Investors, particularly those focusing on artificial intelligence-related tokens such as Artificial Superintelligence Alliance [FET], Near [NEAR], and Render [RENDER] among others, significantly increased the market value of these tokens, pushing it to double-digits, resulting in an additional $8 billion over a week.

This was contrary to the overall market downturn seen earlier in the week as Bitcoin [BTC] reversed recent gains.

According to cryptocurrency analyst Paul Barron, the company specializing in GPU computing for AI applications, RENDER, is predicted to have significant growth opportunities.

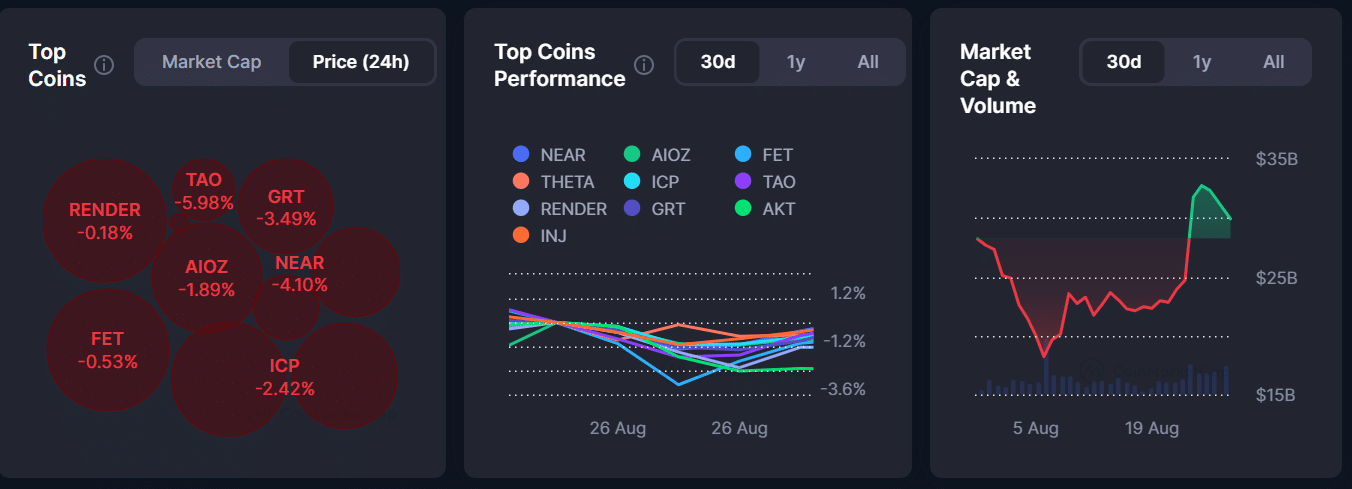

However, several AI tokens were slightly down at the time of writing, with NEAR declining by 4% in the past 24 hours. Will the recent AI tokens rally cool off?

What’s next for AI tokens?

According to QCP Capital, options data was pricing a 10% rally for NVDA stock and could induce volatility in the crypto market.

“We’re keeping a watchful eye as there’s a possibility US stocks could reach another high point, considering the decrease in trading activity and tonight’s announcement of NVDA earnings. The value of NVDA options suggests a potential increase of up to 10% in the coming hours.”

However, the crypto trading firm added that potential short-term pressure could be short-lived as the market expected liquidity injection from Fed rate cuts in September.

“We believe that any dip in equities (and crypto) will be short-lived.”

After Nvidia’s earnings conference, market analysts are curious about how the momentum of AI tokens will fare. They speculate that the earnings report could serve as a litmus test to determine if the hype around AI will persist.

In the last four financial statements, the artificial intelligence technology company surpassed predictions made by financial analysts. Despite optimistic forecasts for NVIDIA, the value of AI-related cryptocurrencies saw a minor decline following the release of the results.

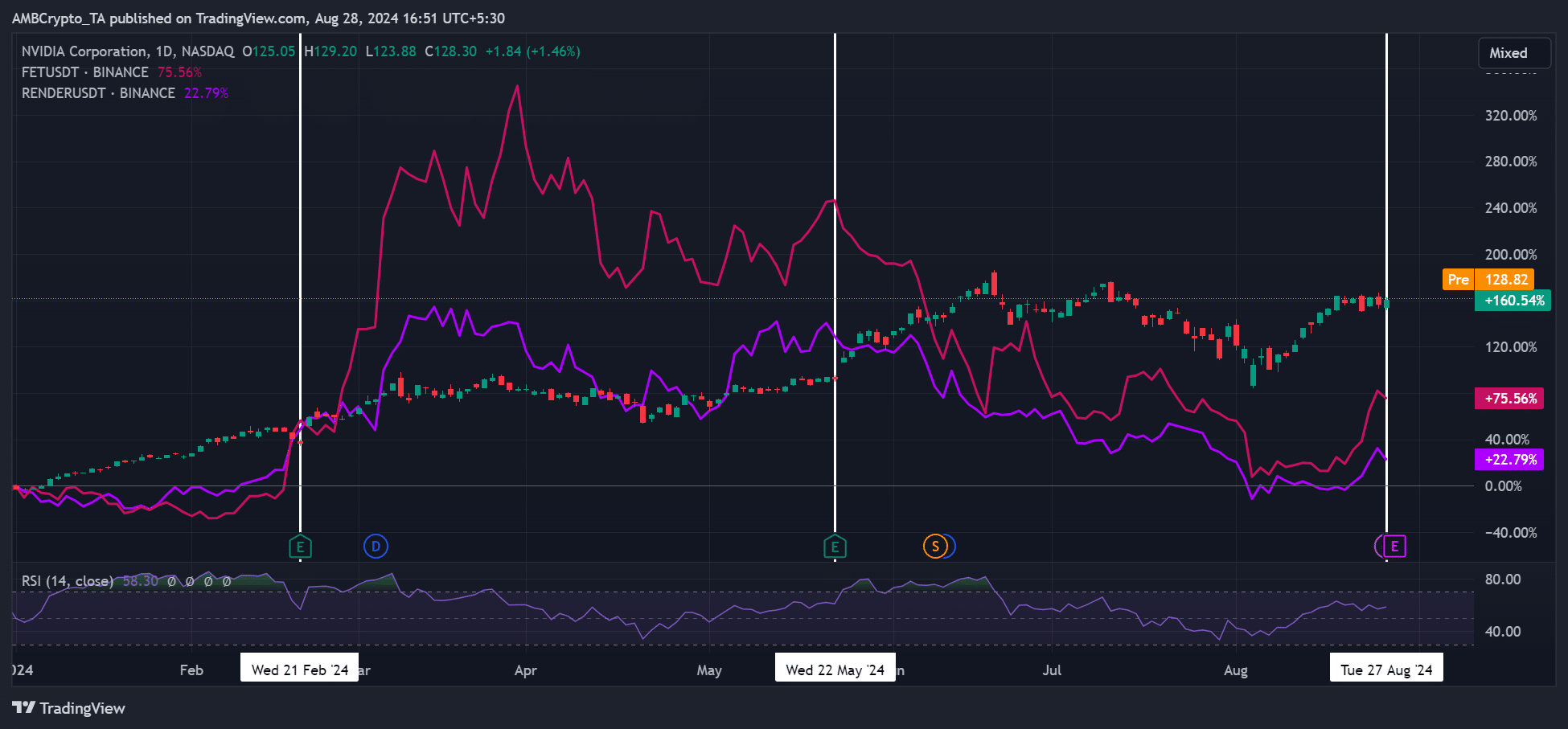

2024 marked a significant rise for both FET and RENDER stocks, peaking prior to their respective earnings reports in February and May. However, following the announcement of their financial results, the stocks experienced a cool-down period.

A similar trend played out earlier in the week as FET, RENDER, and the rest of AI tokens rallied.

It’s uncertain if the drop in AI token prices following the NVDA earnings report will persist. The mood of the market after NVDA’s Q2 earnings release may influence the future trend for Bitcoin and other AI tokens.

Read More

2024-08-29 06:15