- A whale withdrew 5.64 million ai16z tokens, valued at $6.37 million, from Gate.io.

- On-chain data revealed an increase in active ai16z wallet addresses by 12% over the past week, reflecting growing user engagement.

AI16z’s recent large-scale transaction within the crypto market has sparked interest, highlighting the increasing relevance of its associated token.

5.64 million AI16Z tokens, equivalent to approximately $6.37 million, were taken out from the cryptocurrency exchange Gate.io by a whale entity. This action raised their overall AI16Z holdings to 15.95 million tokens, which are currently valued at around $17.86 million.

This massive pullout hints at possible strategic actions, suggesting that the investor may be convinced about the token’s future worth or planning to use the assets for other investment opportunities.

While I closely watch the market’s movements, my focus has been increasingly drawn towards the recent performances of AI16z. I’m eagerly waiting for more data points like technical indicators that can provide me with valuable insights to better navigate my crypto investments.

Current market performance

16z AI’s trading activity has seen a slight uptick during the last 24 hours, suggesting an elevated market interest. Currently, its token trades at approximately $1.16, holding steady within a limited price range.

Besides the overall market circumstances, factors such as Bitcoin‘s price consistency and a positive shift in the altcoin mood might also be influencing ai16z’s success.

It’s worth pointing out that the field of AI-related cryptocurrencies, such as ai16z, has taken a significant hit in recent times, leading to substantial drops in the value of many tokens.

Even though it seems so, the latest whale transactions might cause fluctuations, given that such significant moves tend to impact market patterns.

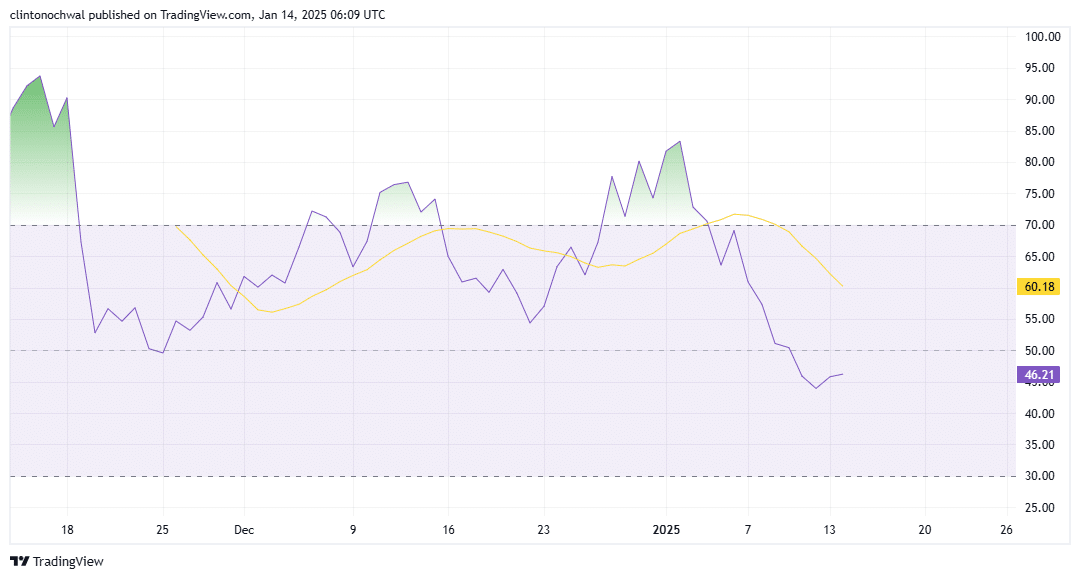

ai16z price analysis suggests…

16z’s current trading price is fluctuating in a significant zone, attempting to break through resistance at approximately $1.18 and holding up at support around $1.05.

Lately, the increase in whale holdings implies a possible strengthening trend, as a surge beyond current resistance might signal a bullish market movement.

At present, technical indicators such as the Relative Strength Index (RSI) are signaling a lack of clear market direction or momentum, suggesting that investors might be uncertain about future trends.

If the token falls below its current support, there’s a possibility that it might enter a downtrend, aiming for approximately $0.95.

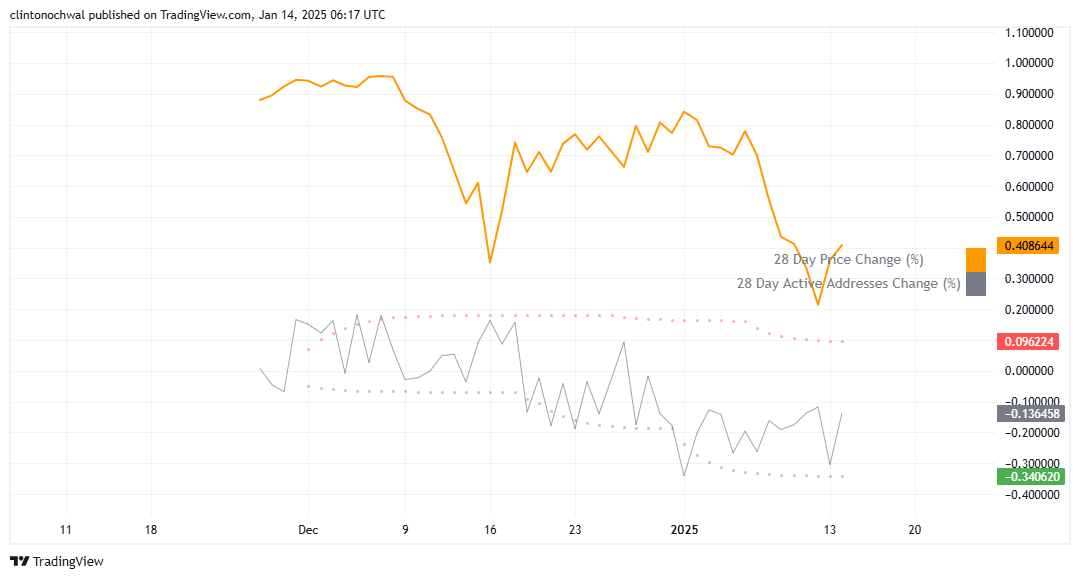

Active addresses analysis

Over the last seven days, there’s been a 12% rise in active a16z wallets that are directly linked to the blockchain, signifying a surge in user interaction.

Frequent activity spikes are usually connected to growing speculative attention, since traders tend to adjust their positions in expectation of substantial price fluctuations.

If the number of actively used addresses continues to increase, this trend may foster optimistic feelings among investors and enhance market liquidity. On the other hand, a decrease in activity might suggest waning curiosity, which could result in a slowdown or even decreases in prices.

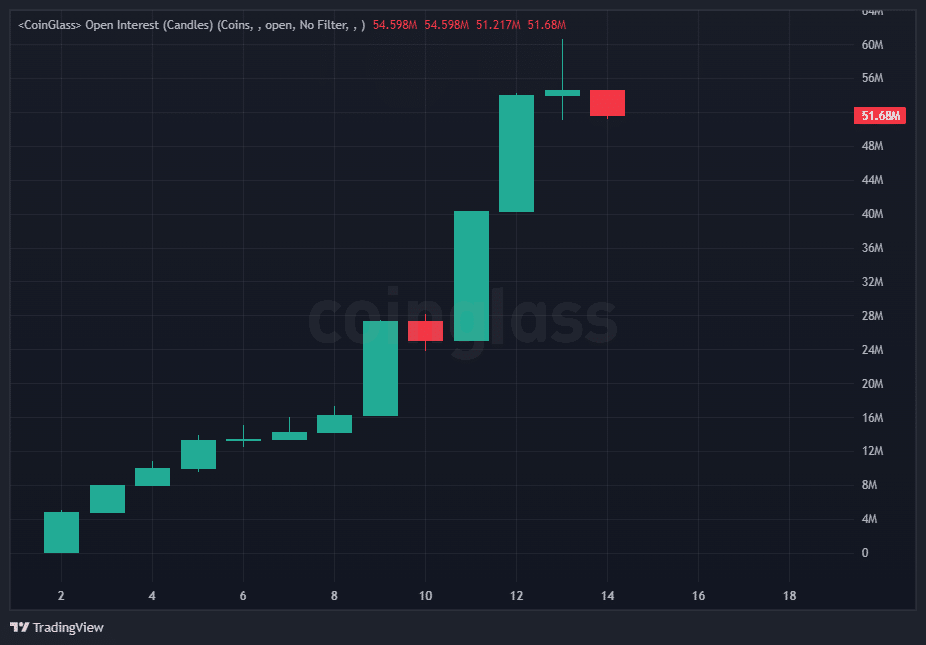

Open Interest analysis of ai16z

In the past few days, there’s been a 20% increase in the number of open positions (Open Interest or OI) for ai16z futures contracts, suggesting an uptick in speculative trading activity. It’s worth noting that long positions are more prevalent than short ones, implying a general optimism among traders about these contracts.

If the price of ai16z remains stable at its current level or surpasses resistance, Open Interest (OI) may grow even more, potentially sparking an upward trend.

Conversely, failure to maintain support may result in liquidations, amplifying downward pressure.

Currently, the neutral funding rates indicate a generally even outlook among participants. However, it’s essential for traders to keep an eye out for any shifts in these rates, as such changes might signal adjustments in market strategies.

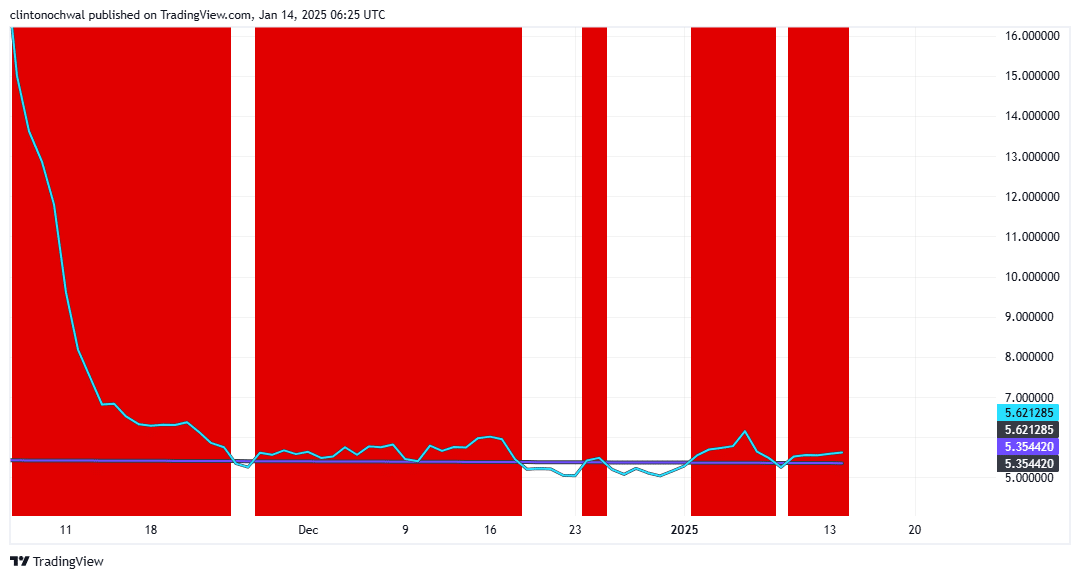

Reduced sell pressure from investors

The MVRV ratio for ai16z reveals a gap between holders with short-term and long-term perspectives. Short-term holders are currently enduring small losses, while long-term investors continue to see profits, indicating that there’s less urgency among dedicated investors to sell their assets.

If the temporary MVRV ratio becomes positive, it might indicate growing investor interest, possibly pushing prices up. Yet, a significant market downturn could intensify losses for brief-term traders, causing wider unpredictability.

This metric remains a vital tool for assessing $ai16z’s market health.

Read ai16z [AI16Z] Price Prediction 2025-2026

At a critical juncture, AI16z’s market standing is demonstrating heightened involvement, as evidenced by the increased whale activities, growing number of active users, and escalating open interests.

Even though technical indicators suggest possibilities for both rising and falling trends, it’s wise for traders to exercise caution, keeping a close eye on crucial benchmarks and overall market patterns as they unfold.

Maintaining strong backing at crucial cost levels is vital for ai16z to keep going forward and keep drawing investors’ attention in the trading market.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-14 14:16