- While profit-taking could trigger a minor price dip in the short term, the broader trend suggests a potential rally.

- Chart analysis indicates that the asset is likely to test support levels before resuming its upward trajectory.

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself optimistic about AIOZ‘s potential trajectory. The asset’s remarkable performance over the past month and its continued robust market activity are clear signs of bullish sentiment that persists within the community.

In recent times, AIOZ has been one of the standout performers in the cryptocurrency market, experiencing a significant increase of approximately 178.45% in its value over just a month. The market’s energy and activity levels suggest that optimistic feelings towards this asset are still strong.

Over the past 24 hours alone, the asset has gained 16.06%, further reinforcing its strong performance.

As I’ve been analyzing the market trends, I find it significant that we’re currently experiencing positive returns. However, there seems to be an indication of a minor correction on the horizon, which could pave the way for a more significant upturn. This potentially sets us up for another potential high point in the future.

Profit-taking may temporarily slow AIOZ’s momentum

Traders specializing in short-term transactions are cashing out their gains on AIOZ, thanks to its outstanding market performance. The value of this asset’s total market capitalization swelled by 16.08%, reaching $1.34 billion. Moreover, the trading volume experienced a significant surge of approximately $166.60 million, marking an increase of around 71.13% according to CoinMarketCap.

Profit-taking refers to the action taken by traders when they decide to sell some or all of their investments to lock in profits following a significant increase in price. This practice often becomes more prevalent after a strong upward trend, such as what happened with AIOZ.

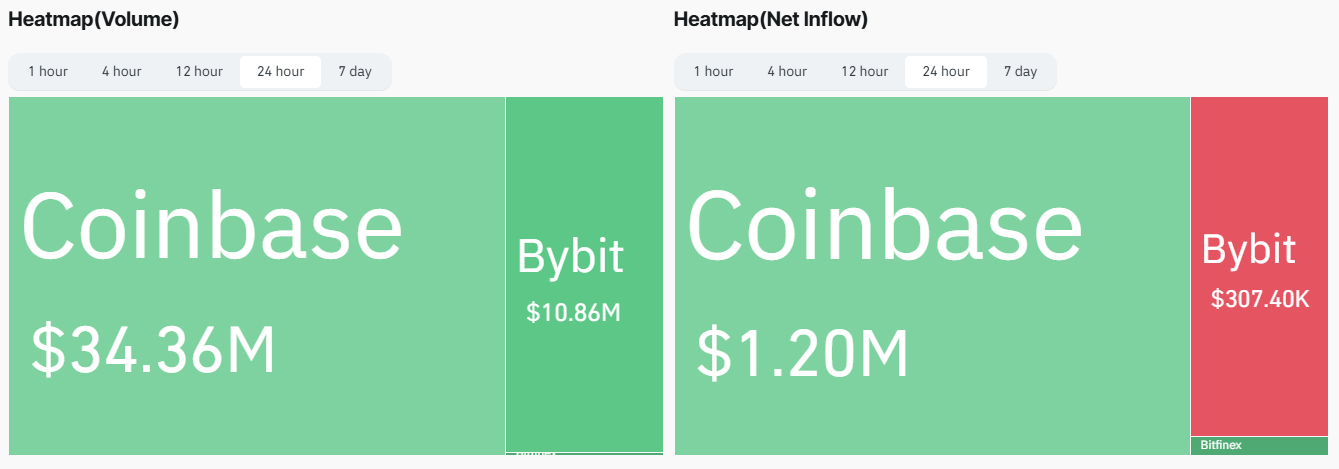

One indicator of profit-taking is a rise in Exchange Netflow, where significant amounts of an asset are transferred from wallets to exchanges in preparation for sales. At the time of writing, over $1 million worth of AIOZ has been moved to exchanges within the past 24 hours.

Increasing the availability of assets generally leads to a decrease in prices, unless there’s an accompanying surge in demand. As reported by AMBCrypto, if this pattern persists, AIOZ may encounter its next potential support level.

AIOZ tests lower support levels

In simpler terms, if there’s strong selling activity, AIOZ might drop. However, it will likely seek a point where buyers show increased interest, at which stage it could potentially resume its climb back up.

Examining the graph of AIOZ using Fibonacci retracement lines indicates that the asset might fall towards the 0.9472 region. This area could potentially have enough buying interest to initiate a rebound.

As a researcher examining the performance of AIOZ, I’ve noticed that if the current support doesn’t hold strong, it could be possible for AIOZ to retrace approximately 50% of its recent gains. This might lead to a potential dip, reaching the Fibonacci level at 0.8297 before any notable upward movement is likely to occur.

As an analyst, if AIOZ recovers from any of these points, it might set the stage for a fresh record high within the short term.

Strong bullish sentiment persists

According to data from Coinglass, it appears that more long traders than short traders currently have positions that have not been settled in the derivatives market, as indicated by the high Open Interest.

Over the last day, we’ve seen a significant rise in the Open Interest, with a 13.07% jump that now stands at approximately $9.41 million.

In a similar fashion, we’re seeing more and more long-term agreements being signed. As of now, the Long-to-Short ratio stands at approximately 1.0028. When this figure surpasses 1, it typically indicates that long traders have a stronger grip on the market, which could lead to prices increasing.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-03 00:07