So, the crypto world’s hit this insane $4 trillion market cap milestone in late July. Altcoins are basically strutting towards their all-time highs like they own the place. But let’s be real, it’s all a bit too shiny, isn’t it? 😏

In this mad rush, a few altcoins are playing with fire, thanks to short-term traders slapping on leverage like it’s going out of style. Liquidations could be messy – and hilarious, if you’re not the one losing your shirt. 🤷♀️

1. XRP

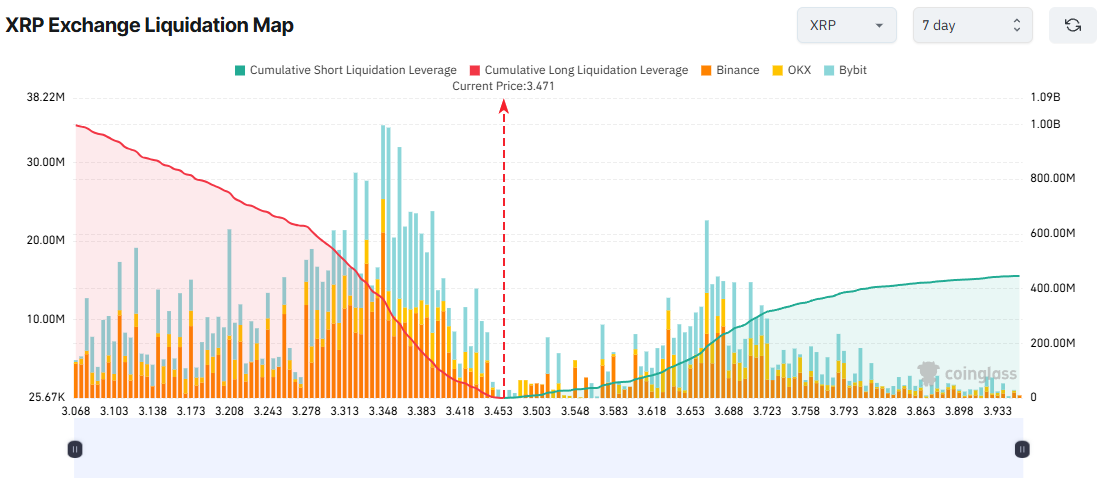

Coinglass says XRP’s Open Interest smashed an all-time high of $10.9 billion in July. The Funding Rate? Positively perky, highest since New Year’s resolutions. That means traders are all “price is gonna skyrocket!” and piling into long positions. But oh, the imbalance – it’s like a teetering Jenga tower. If XRP tumbles to $3 this week, long liquidations might hit nearly $1 billion. Yikes, talk about a bad hair day. 😂

The 7-day liquidation map is screaming overkill on the long side. We’ve got warnings of a possible dip, with new investors ghosting the party. But hey, XRP’s market depth is looking buff, second only to ETH. So maybe it bounces back quick – or not. Rapid swings could leave traders crying into their crypto wallets. 😅

2. DOGE

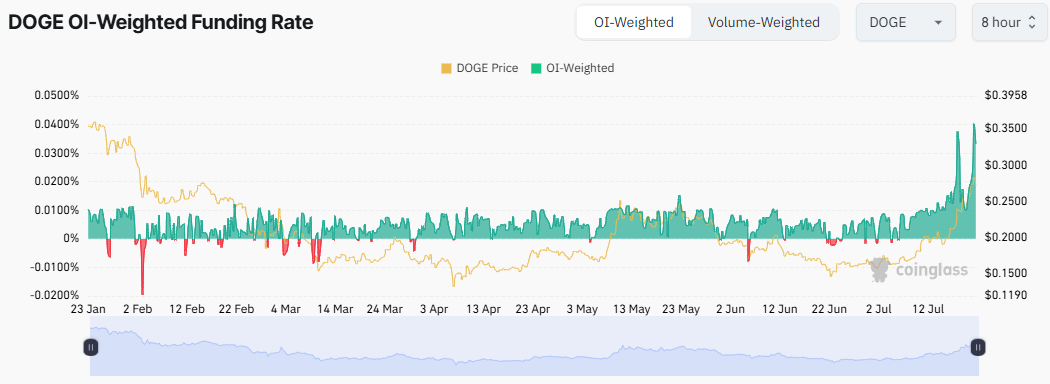

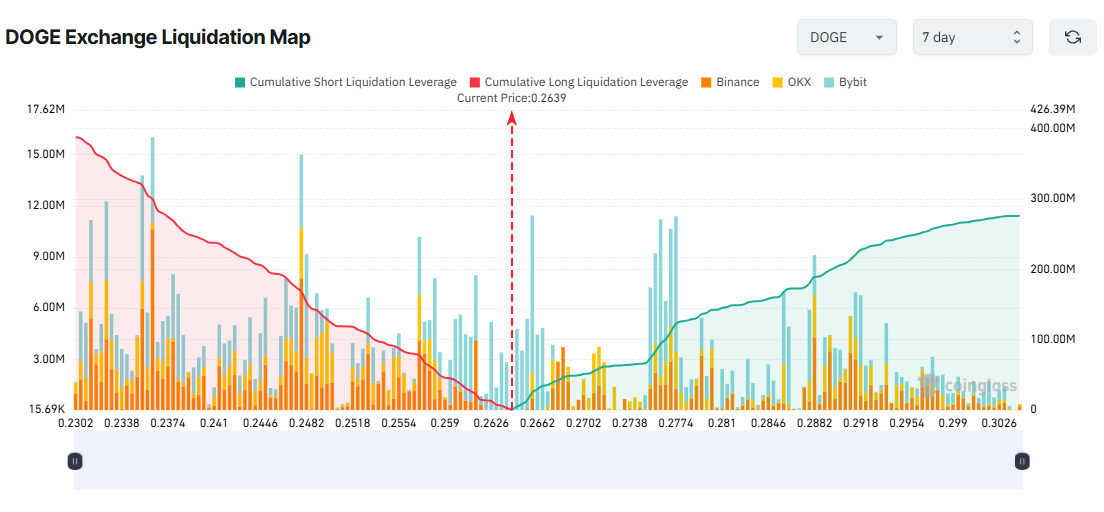

DOGE’s got everyone’s hopes up in July, what with Bit Origin eyeing a $500 million treasury and whispers of meme coin mania returning. Funding Rate hit a yearly peak when the price flirted with $0.28. Traders are leveraging like mad, betting on more gains. But if it drops? Long liquidations could stack up to $300 million if it hits $0.236. Ouch, that’s a meme I don’t want to see. 🤦♀️

Even a big-shot trader like James Wynn is cashing out part of his position. At writing, DOGE’s slumped to $0.266 from its high. And long-term holders are sneaking away with profits – classic move, leaving the noobs to the wolves. 😜

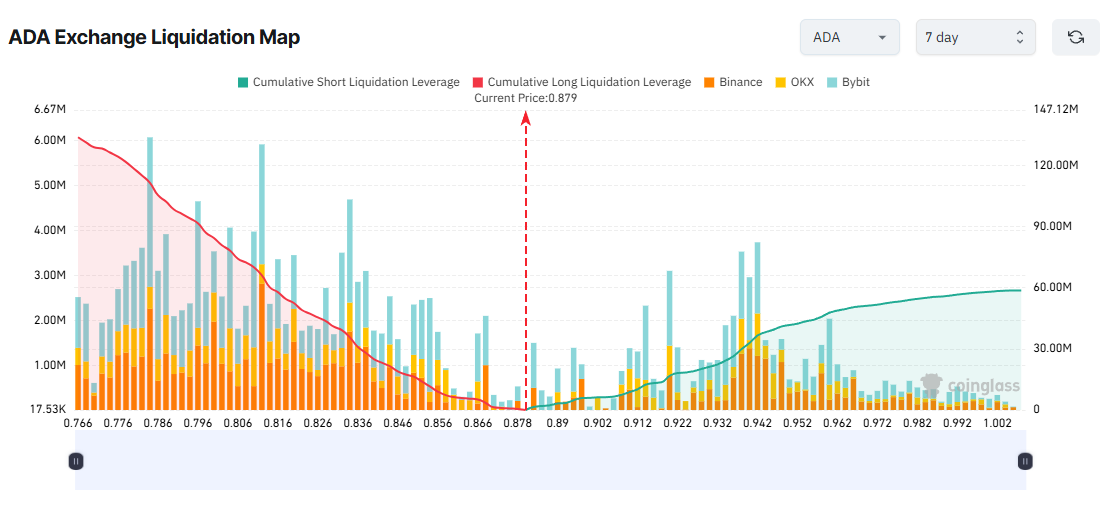

3. ADA

ADA’s Open Interest is at a new peak of $1.74 billion, riding a five-week price wave. Analysts are all bullish, dreaming of $1, with on-chain stuff suggesting more ups. But the liquidation map? Brutal. If ADA dips to $0.78, long liquidations could be $120 million. And if it hits $1, shorts get hammered for $58 million. Plus, Charles Hoskinson’s audit report is looming – because what’s crypto without a dash of drama? 😱

Overall, Open Interest is ballooning past $213 billion. Coinglass spills that in the last 24 hours, 152,419 traders got liquidated for a whopping $553.68 million. Of that, over $370 million was longs biting the dust. So, yeah, liquidation party might rage on. Buckle up, folks. 🎢

“In the past 24 hours, 152,419 traders were liquidated, with total liquidations amounting to $553.68 million,” Coinglass reported.

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Get the Bloodfeather Set in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- 7 Long-Awaited Anime That Surpassed Expectations

- MOUSE: P.I. for Hire delayed to early 2026

- The Legend of Zelda Film Adaptation Gets First Photos Showcasing Link and Zelda in Costume

2025-07-22 14:23