-

ALGO token has shed 36% of its value since the start of the year.

A price breakout above the 200-day EMA sets the stage for traders to take long positions.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by Algorand’s [ALGO] recent performance. Despite the token shedding 36% of its value since the start of the year, it’s fascinating to see how the growing adoption of ALGO seems to be unfazed by the price struggles.

Algorand (ALGO) is once again attracting attention, with its price increase drawing focus to an important resistance level near $0.15. The recent surge in market activity during the middle of the week, evident by seven consecutive days of green daily candles, comes after a week of decreasing prices at the end of August.

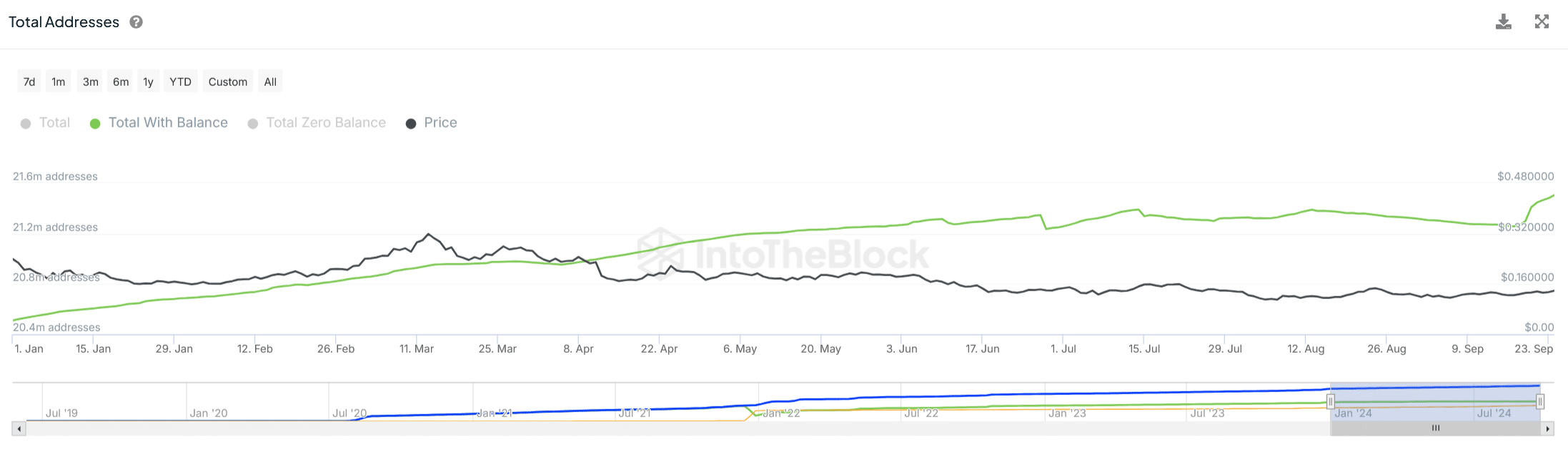

ALGO wallets show accelerated growth amid price struggles

Even amidst the turbulent market conditions, I’ve noticed that my Algorand holdings have seen a consistent growth in the number of associated wallets throughout this year.

This year, the number of ALGO addresses holding some balance has increased by approximately 990,000, according to data from IntoTheBlock. Remarkably, the network has experienced rapid growth in just the last seven days. As of now, the total number of addresses with a balance has risen from 21.26 million on September 17th to 21.51 million at this moment.

This growing adoption of ALGO suggests rising interest in the blockchain’s ecosystem despite an overwhelming majority of token holders being at a loss. IntoTheBlock’s data shows only 1.87 million addresses are in profit, representing 9.01% of holders.

ALGO technical outlook

Currently, Algorand’s (ALGO) price stands at $0.14, and it’s experiencing a drop due to resistance below its 200-day moving average (EMA).

Looking at the technical perspective, the value of Algo against USD is nearing a crucial resistance area between $0.149 and $0.152. This zone aligns with the 200-day moving average, which has historically posed a challenging barrier for over three months now. Since the price of Algo fell beneath this moving average on June 7th, it has served as an obstacle.

To show strong upward movement for ALGO/USD, the currency pair should successfully surpass the current resistance line. Earlier in July, the pair attempted to breach the resistance area but was unsuccessful. However, from July 14th to 22nd, it managed to go beyond this zone briefly.

In the most recent attempt, ALGO’s bullish momentum was thwarted at the height on 26th August.

In simpler terms, the specified area functions as a significant boundary that traders are keenly observing. If this level is surpassed successfully, approximately 140,000 wallets will reap profits.

Under the present submerged condition, these addresses collectively store approximately 743.62 million Algos, according to IntoTheBlock data. Clearing out this area could offer significant relief for Algo bulls, possibly opening up possibilities for additional growth beyond $0.160.

Improved stablecoin market capital

In August, Algorand observed substantial growth in the market cap of stablecoins, according to the recent Algo report. The total market capitalization of stablecoins on the platform, expressed in USD, increased from $85.53 million to $109.90 million, representing a 28.5% increase or expansion.

Total USDC transactions also increased from 557K to 690K in the same period.

As an analyst, I find it significant to highlight that Binance introduced cross and margin USDC pairs for ALGO on August 30th. Given recent developments, Algorand’s stablecoin market capitalization has predominantly moved towards USDC, following Tether’s decision to discontinue its support for USD₮ on the blockchain.

As a researcher delving into the world of digital currencies, I’ve recently discovered an intriguing fact: Tether’s transparency site reveals that a staggering $119.2 billion worth of USDT is in circulation across multiple blockchains. Notably, the lion’s share of this figure, approximately 70%, can be found on Ethereum and Tron networks.

The net circulation of USDT in Algorand is $2 million. The stablecoin issuer said it will freeze all remaining USD₮ on Algorand by September 2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-26 08:07