- Algorand had a bearish market structure on the daily chart

- Reduced speculations and spot demand suggested further losses may be likely in the short-term

As a seasoned analyst with years of experience under my belt, I must say that Algorand [ALGO] seems to be losing its bullish momentum and headed for a potential bear market in the short term. The daily chart structure is undeniably bearish, and reduced speculations and spot demand suggest further losses may be imminent.

Algorand (ALGO) was among the cryptocurrencies that performed well during the previous market cycle, experiencing a resurgence only last month and embarking on a strong upward trend. Remarkably, it increased by an impressive 480% within a single month; however, it started to decline in early December.

Additionally, the altcoin’s volume indicators outlined trouble ahead on the price front.

Algorand losing bullish momentum

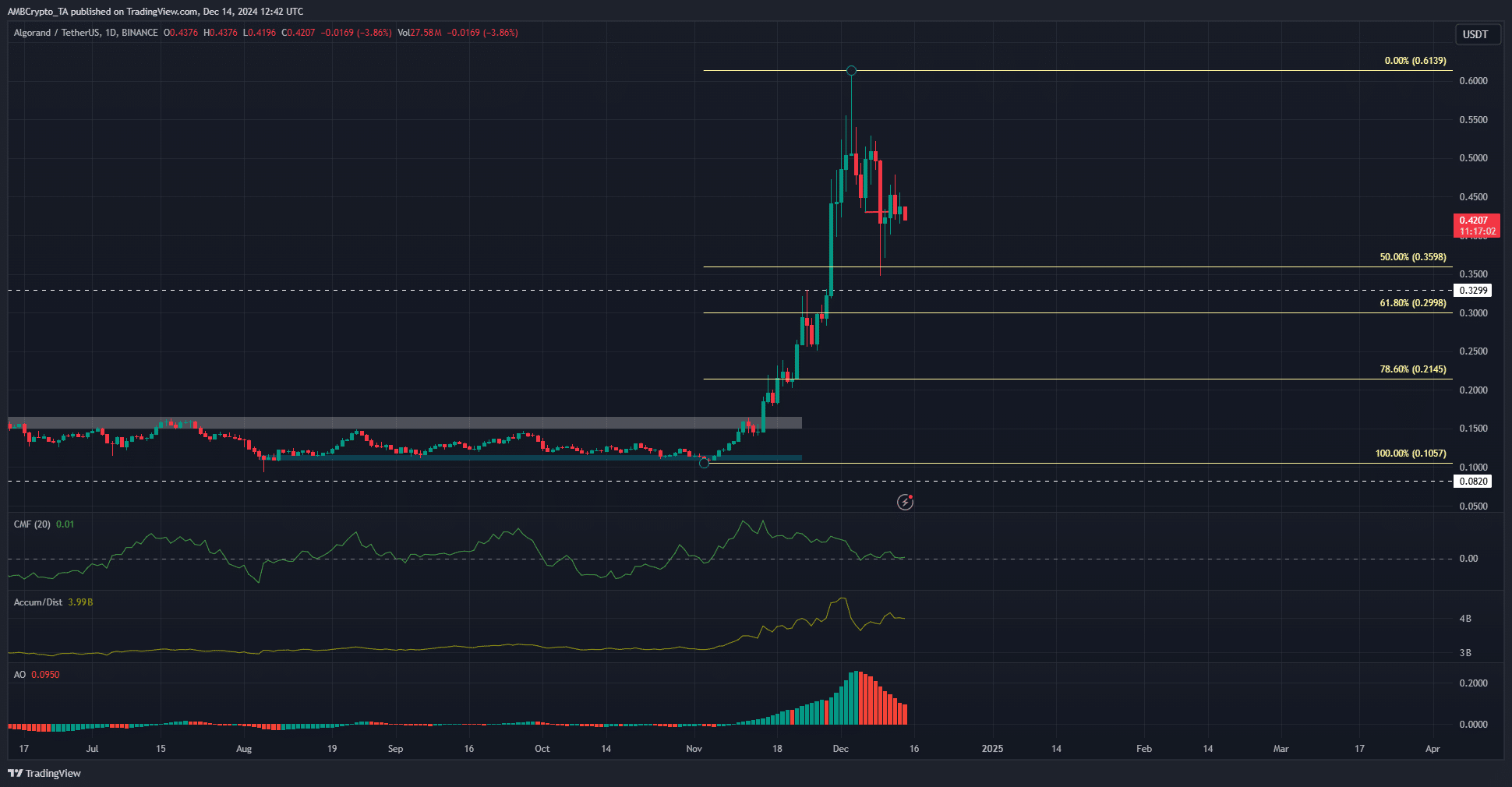

Initially, ALGO pulled back from its peak price of $0.613, with this retreat starting in the early days of December. At that time, Bitcoin [BTC] remained within its short-term trading band. However, over the past three days, BTC surpassed the range and soared above $100k once more. Despite BTC’s upward trend, ALGO has been experiencing another decline as of press time.

On December 9th, the market dynamics of Algorand shifted bearishly as shown on the daily chart. Since then, the Chaikin Money Flow (CMF) has been moving downwards, suggesting a decrease in capital inflows. At present, its reading of +0.01 indicates a neutral state, and it hasn’t yet regained enough strength to reestablish a bullish structure.

On the charts, the A/D indicator showed a downturn as well. Over the past ten days, the two volume indicators revealed that Algorand’s bullish strength was weakening significantly. Furthermore, the Awesome Oscillator indicated a decrease in momentum as well.

As a researcher studying the Algorand (ALGO) market trends, I’d like to draw your attention to the potential support levels based on Fibonacci retracement. The 50% level, currently at $0.36, has already been tested as a support point. However, considering the current market dynamics, it’s plausible that ALGO may revisit this level again in the near future.

Positive sentiment on its way to…

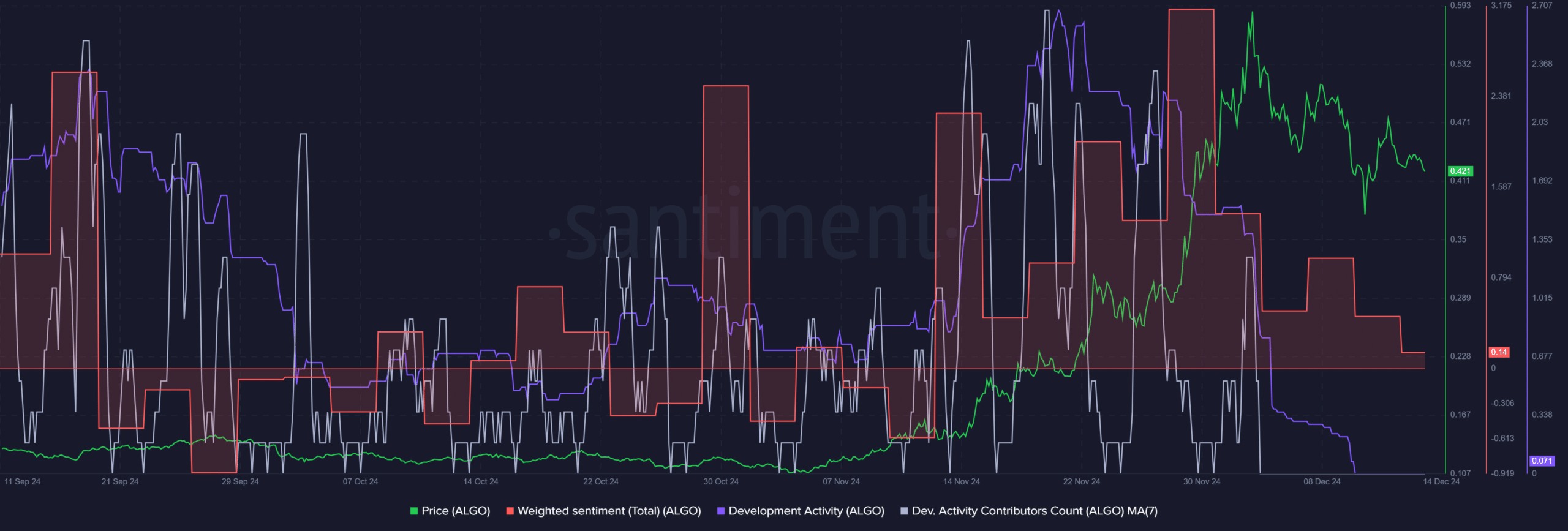

According to data from Santiment, a shift has occurred in the past two weeks, with the positive sentiment score starting to decrease, and the development activity slowing down significantly, as indicated by the charts.

Indeed, there hasn’t been any development activity or new contributors since December 10th. While it might be attributed to the holiday season, this lack of activity is unusual compared to past years and appears to be an exception.

Is your portfolio green? Check the Algorand Profit Calculator

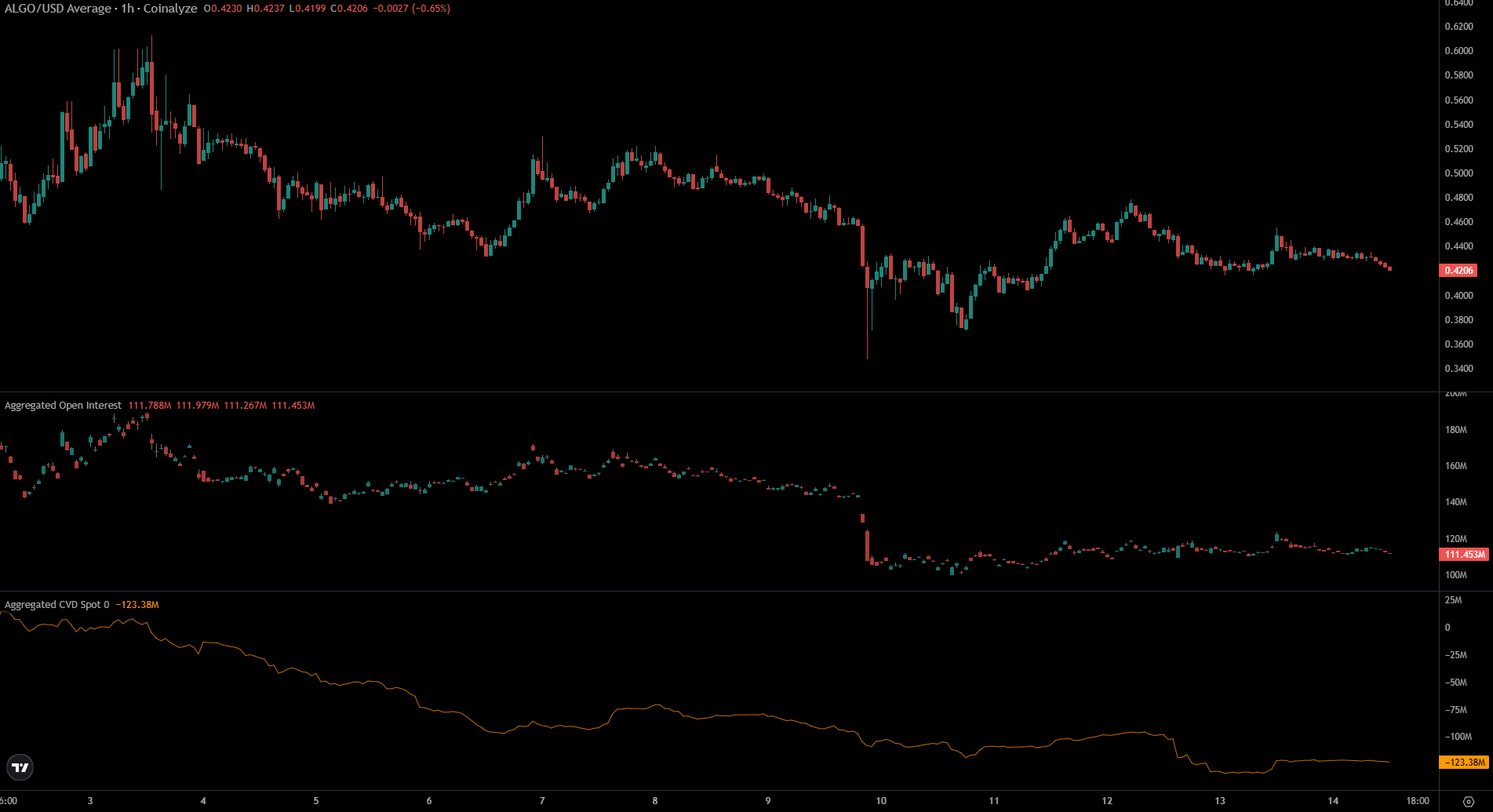

In summary, the Open Interest and the spot CVD have been gradually decreasing. Over the last day, they’ve remained stable, leading us to wonder if the downward selling pressure might be easing off. However, it’s still early to make a definitive conclusion on this matter.

Overall, further losses appeared likely at press time.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-15 04:07