- ALGO’s downtrend maxed out at 34%, but hit the key $0.40 demand zone

- Will the trend reverse itself at the support amid weak demand?

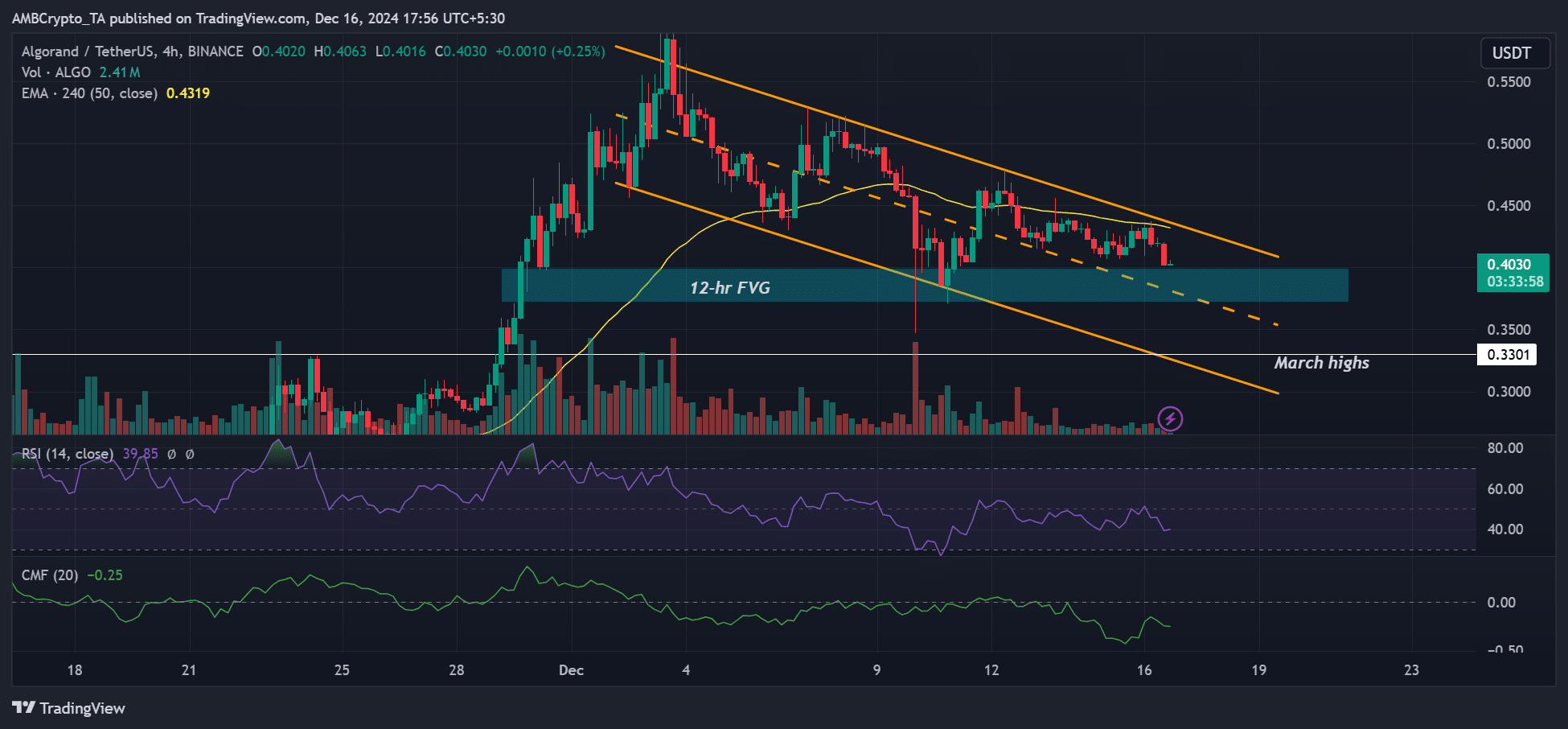

As a researcher with years of experience in the dynamic world of crypto, I’ve seen my fair share of market fluctuations, and the current situation with Algorand [ALGO] is no exception. The 34% downtrend, while concerning, has found a footing at the crucial $0.40 demand zone – a zone that has proven its resilience in the past. However, history doesn’t always repeat itself, and the current technical indicators suggest a potential rejection at the upper channel if demand remains low.

The price drop for Algorand’s [ALGO] coin fell by approximately 34%, going from $0.61 to $0.40. This decline came after a slight increase in Bitcoin‘s [BTC] influence, which slowed down the temporary momentum of many altcoins on the market.

Despite the significant sell-off incidents in early December that heavily impacted the altcoin market, ALGO managed to hold steady above $0.40. Could this level potentially halt the current bearish trend?

ALGO – Will $0.40 hold?

In late November, a significant increase in price to around $0.40 not only occurred but also functioned as a crucial area of demand. Yet, the most recent substantial surge originating from this region, indicated by the cyan color, was unable to overcome the peak of the channel’s range.

Currently, the price movement has returned to a specific area and might persist there due to reduced demand, as suggested by the subpar Relative Strength Index (RSI) values displayed below.

As a crypto investor, I noticed that while there was an improvement in capital inflows, they didn’t quite reach the critical threshold needed to halt the downward trend. Sadly, during December, these inflows actually dipped below the zero mark, as per the CMF (Chaikin Money Flow) indicator, suggesting a continued outflow of funds from the market.

If these technical indicators continue to be subdued, a drop down to $0.4 could encounter resistance and potentially get rejected again near $0.43, which represents the upper channel of the price movement.

If the selling pressure continues and ALGO falls below the $0.40 support level, its next potential stop might be at the price it reached in March, which was around $0.33.

Will shorting yield gains?

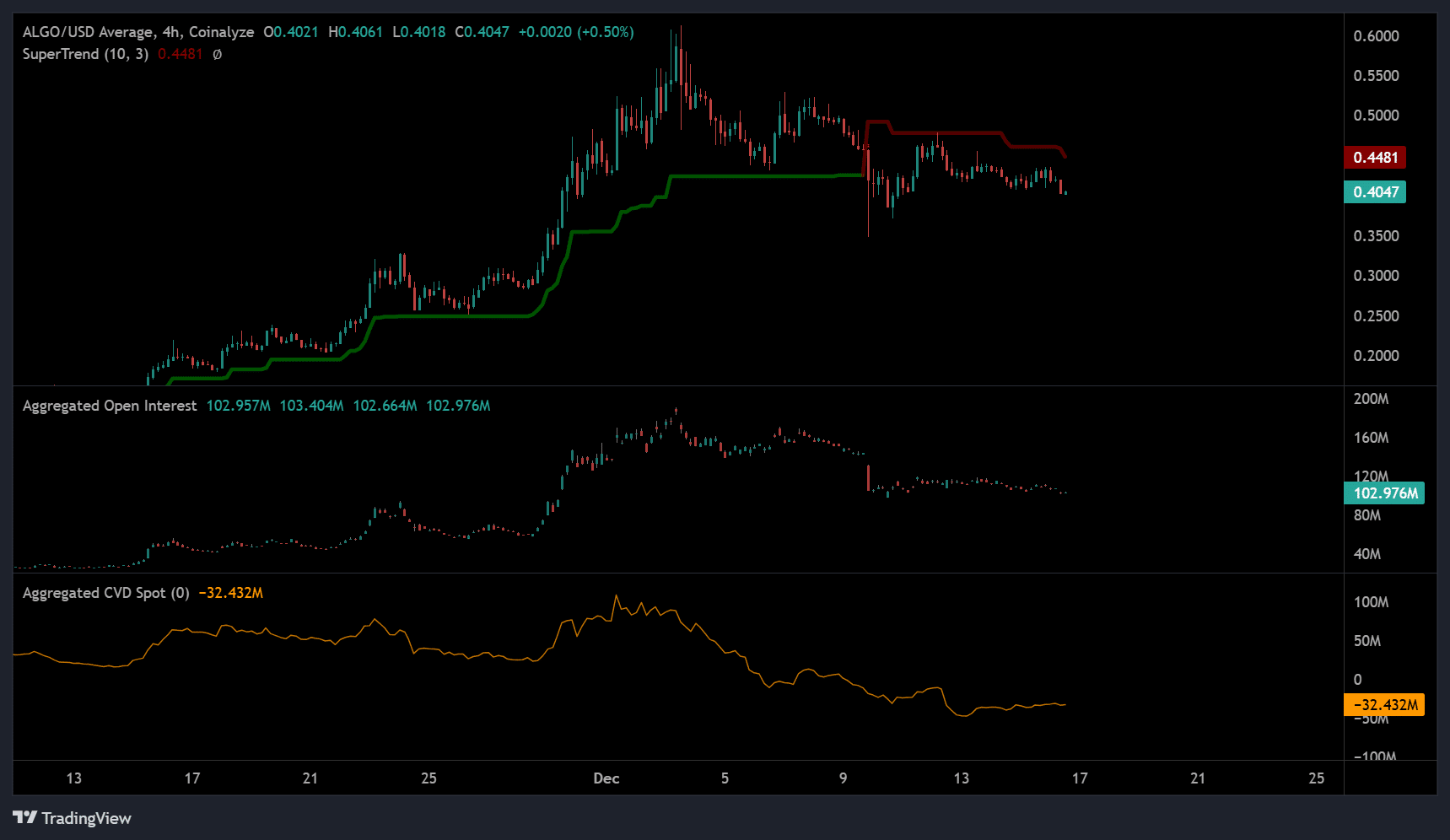

For four hours, the SuperTrend indicator has not reverted the sell signal it gave on December 9th. This implies that selling ALGO might have been a wiser choice rather than buying it, given that its downward trend continued.

In simpler terms, when the immediate market demand for flats was low (as indicated by a weak CVD spot), it gave an advantage to those traders who were selling short in the market.

Read Algorand [ALGO] Price Prediction 2024-2025

In conclusion, ALGO weakened over the past two weeks as sellers piled into the market.

If you’re considering investing in bullish assets, a significant jump around $0.40 or $0.33 might indicate a shift in the price trend. But for this to be a reliable sign, it should be accompanied by robust demand, positive market flow, and a clear break above $0.43.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-17 08:07