- ALGO’s recent performances have grabbed many eyeballs lately

- Analysis of Active Addresses revealed increasing network activity – A sign of growing interest among traders

As a researcher with years of experience in the dynamic world of cryptocurrencies, I find myself consistently intrigued by the latest developments in the market. Recently, Algorand (ALGO) has caught my attention due to its impressive performance and growing bullish potential.

The double bottom pattern on ALGO’s charts is a technical indicator that I’ve seen before, but it never fails to excite me – it’s like watching a phoenix rise from the ashes! The uptick in active addresses and network activity further strengthens my conviction in Algorand’s growing appeal among traders and investors.

The MVRV Ratio of 0.45 suggests that ALGO is undervalued, which aligns with the recent breakout from the double bottom pattern. This undervaluation, combined with rising activity and improving sentiment, makes Algorand an attractive option for those seeking long-term upside potential.

However, as always in this wild ride called crypto, let’s remember to keep our eyes on the road – or rather, the charts! After all, even though ALGO might seem like a phoenix rising from the ashes, it could also turn out to be a cat playing with a laser pointer – unpredictable but endlessly entertaining!

Currently, Algorand (ALGO) is generating buzz among cryptocurrency traders due to its notable bullish tendencies shown on trading charts. Its unique governance structure, DeFi incentive systems, and reinforcing technical signals have propelled it into a significant role within the market.

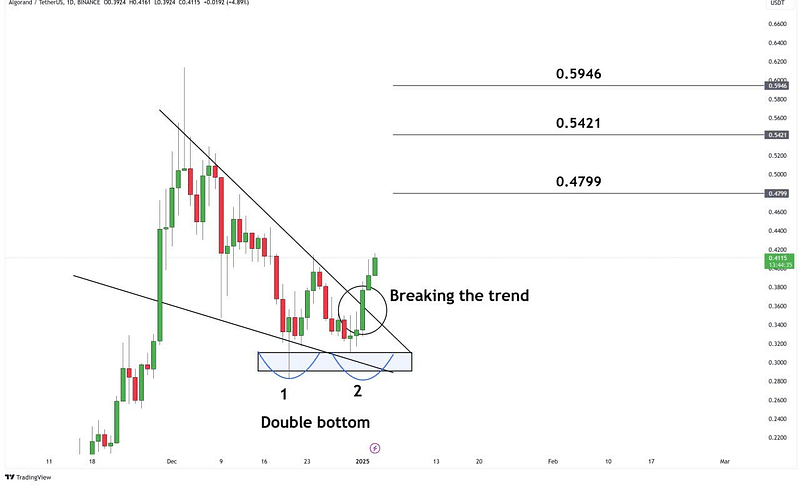

A double bottom pattern!

Lately, the chart of ALGO has shown a double bottom formation, which typically signals a robust bullish turnaround. This pattern, characterized by two successive low points near the same price level and then a surge over the resistance line (neckline), is a well-known technical signal in trading.

Regarding ALGO, a double bottom pattern emerged at the $0.34 price point, establishing a solid foundation of support. Subsequently, ALGO surpassed its downward trendline, signaling a bullish breakout. This was followed by an increase in price momentum, suggesting increased buying activity among traders.

According to our study, the current potential resistance points for Algo are located at $0.4799, $0.5421, and $0.5946. Overcoming these barriers may lead to a continuous bullish trend.

As a financial analyst, considering the surge in global liquidity and the expanding Algorand ecosystem, I anticipate that my personal projected next price target for Algorand could reach approximately $0.5946, subject to adequate trading volume and favorable conditions within the wider market.

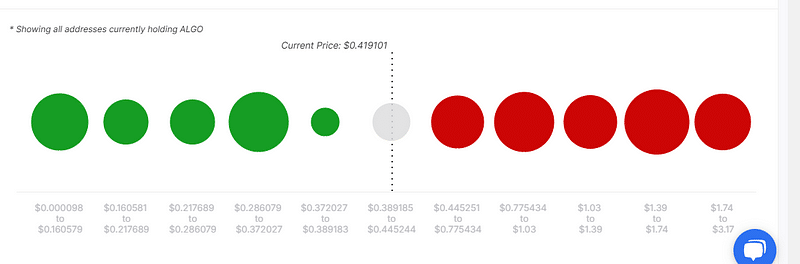

Active addresses and network engagement

Over the past few weeks, we’ve seen an impressive increase in the number of active Algorand addresses. This growth coincides with the altcoin regaining its value as reflected in the chart.

This trek sparked renewed enthusiasm among traders and investors, suggesting increased network usage. Active addresses usually serve as a precursor for bullish trends, indicating rising trust in the asset.

This trek coincided with a surge in worldwide liquidity, a factor that traditionally boosts blockchain transactions. If the number of active addresses keeps rising, it suggests persistent optimism among investors.

On the other hand, a decrease might indicate uncertainty or selling for profits among market players. Therefore, it’s essential to keep a close eye on this indicator because it frequently predicts substantial price changes in the graphs.

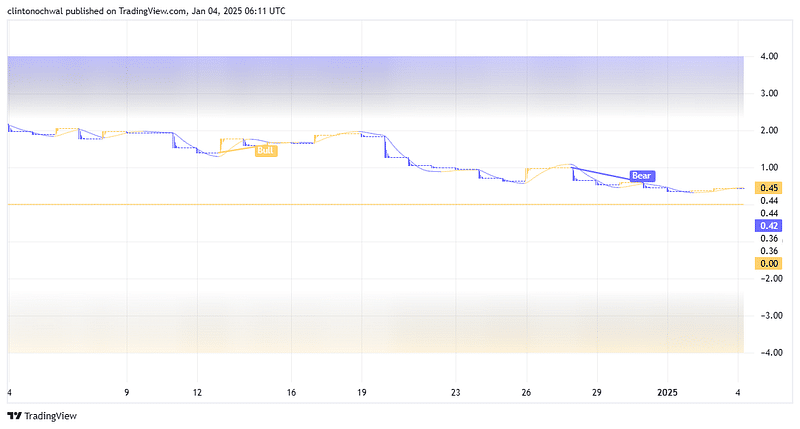

MVRV (Market Value to Realized Value)

According to the MVRM Ratio, which compares Algo’s current price to its historical performance, it appears that Algo might be underpriced, as the reading was 0.45.

A Multi-Versioned Realized Value (MVRV) ratio of less than 1 suggests that, generally, investors are currently underwater with Algorand (ALGO), meaning they’re holding the cryptocurrency at an average loss. In the past, this area has often seen accumulation and subsequent price fluctuations or reversals.

It appears that the previously discussed reading supports the idea that Algo might experience substantial growth in the future. In other words, its current valuation is lower than it should be, which coincides with its recent breakthrough from a double bottom pattern – an indicator suggesting a promising chance for further bullish trends.

A lower MVRV suggests a reduced likelihood of intense selling, given that most investors may not be inclined to incur losses at the current point.

In the upcoming weeks, if the MVRV (Market Value to Realized Value) ratio nears 1 or surpasses it, this might signal that Algorand’s price is aligning with its actual worth. This pattern could foster a strengthening bullish outlook, particularly as DeFi incentives and escalating network activity draw in more participants, boosting optimism.

As a crypto investor, I always find it prudent to exercise caution when the MVRF (Maker Value Ratio) spikes suddenly. This sudden increase might indicate possible market overextension or widespread profit-taking, which could potentially impact my investments negatively.

In simpler terms, the current underestimated condition of ALGO, along with increasing action and more favorable opinions, makes it a tempting choice for traders who are looking for potential long-term growth opportunities.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-01-05 00:08