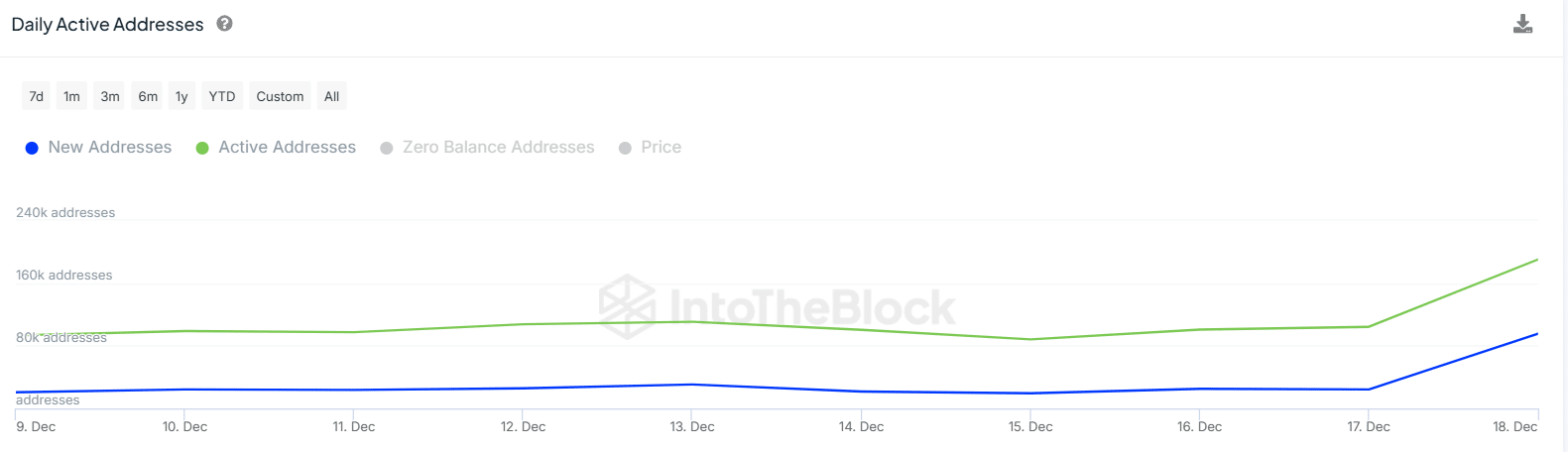

- ALGO’s active addresses have risen from 104,000 to 190,000 in just 24 hours

- These addresses could be selling, following a 20% decline in the altcoin’s price

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen countless bull and bear runs, and the current situation with Algorand (ALGO) is one that warrants careful attention. The surge in active addresses and new addresses could be a double-edged sword – on one hand, it might indicate increased selling pressure due to traders trying to cut their losses. On the other, it could signal fresh speculative activity by newcomers.

In the past week, Algorand’s (ALGO) price has fallen by over 20% and is currently trading at $0.371. As we speak, there appears to be a shift from the bullish trend that was observed earlier this month, which peaked with ALGO reaching a high not seen in years of $0.613.

Amid this dip, however, the number of active addresses has risen, according to IntoTheBlock. These addresses surged from 104,000 to 190,000 addresses in just 24 hours. At the same time, the new addresses rose from 24,000 to 95,000.

The spike in active addresses could be a result of traders selling ALGO to minimize their losses during the dip. Consequently, the spike in new addresses could be new traders engaging in speculative activity.

If ALGO doesn’t manage to reverse its current downward trend as more addresses keep increasing, this could suggest that selling pressure is intensifying. Such increased selling would potentially spark a volatile drop in price.

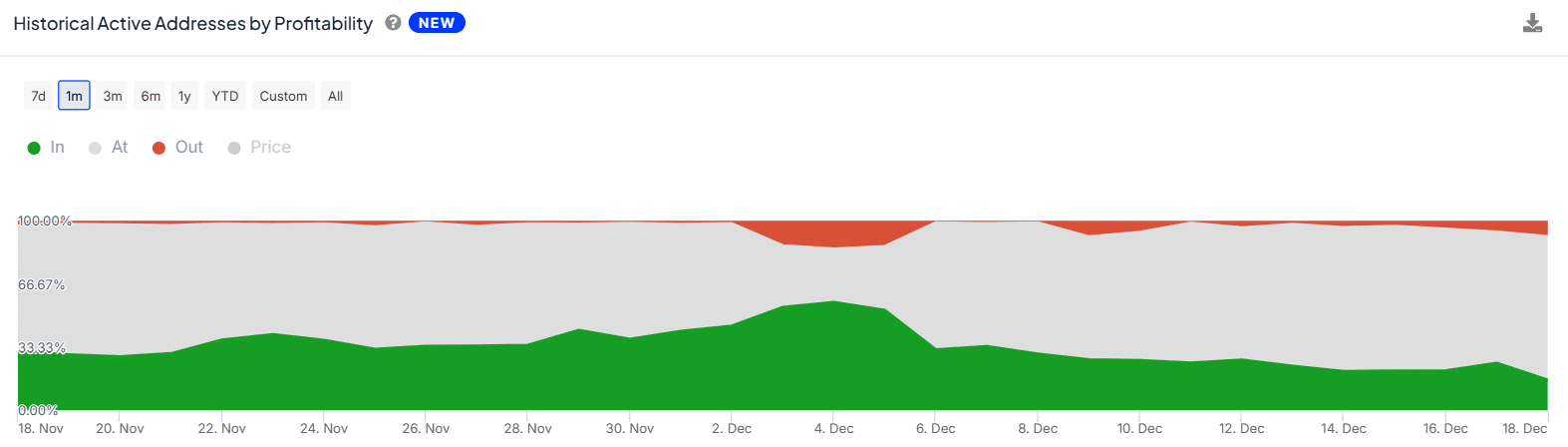

Active address profitability plummets

Active Algo addresses’ profitability plummeted noticeably, reaching a one-month low following an earlier high this month. Currently, their profitability stands at 16%, marking a substantial decrease from the 57% recorded only two weeks prior.

If these addresses show a decline in profitability, it might lead to an increase in sell-offs as traders attempt to limit their losses. This situation may indicate that traders who purchased during the price surge are now cashing out their gains.

If the profitability keeps dropping, it could lead to negative and bearish sentiment that could push the price lower.

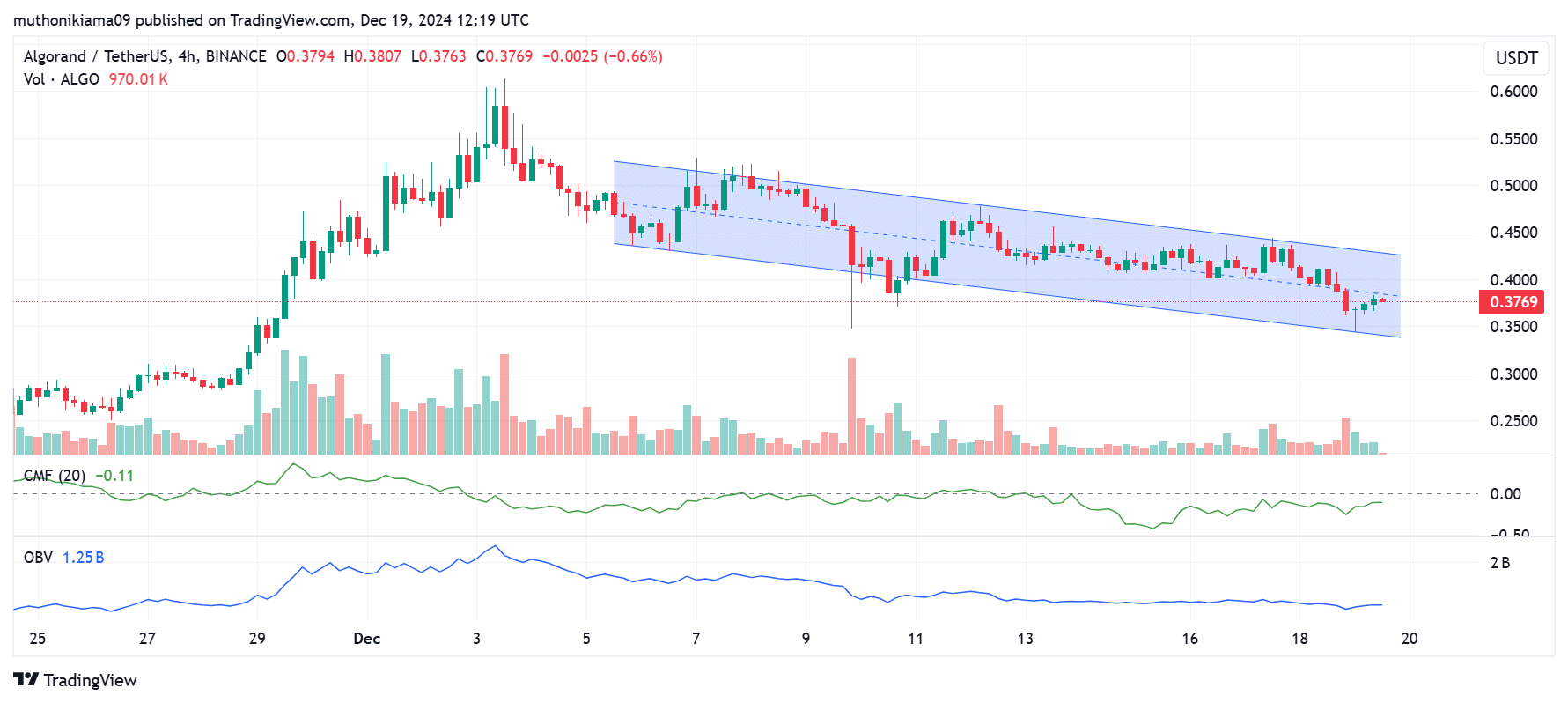

Technical indicators show THIS

On Algorand’s four-hour chart, it appears that there’s an increase in selling actions compared to buying actions, as indicated by the technical indicators. Specifically, the Chaikin Money Flow (CMF) has been fluctuating within areas of lower demand, hinting at a higher sell-off than purchase interest.

In my analysis, I noticed a decrease in trading volumes, as suggested by the on-balance volume (OBV) indicator moving within lower ranges, signifying a reduction in activity.

On the graph, it appeared that ALGO was moving inside a downward sloping parallel channel, suggesting predominant bearish tendencies. Dropping below the lower boundary of this channel might trigger additional declines, whereas surpassing the upper resistance line could lead to further growth.

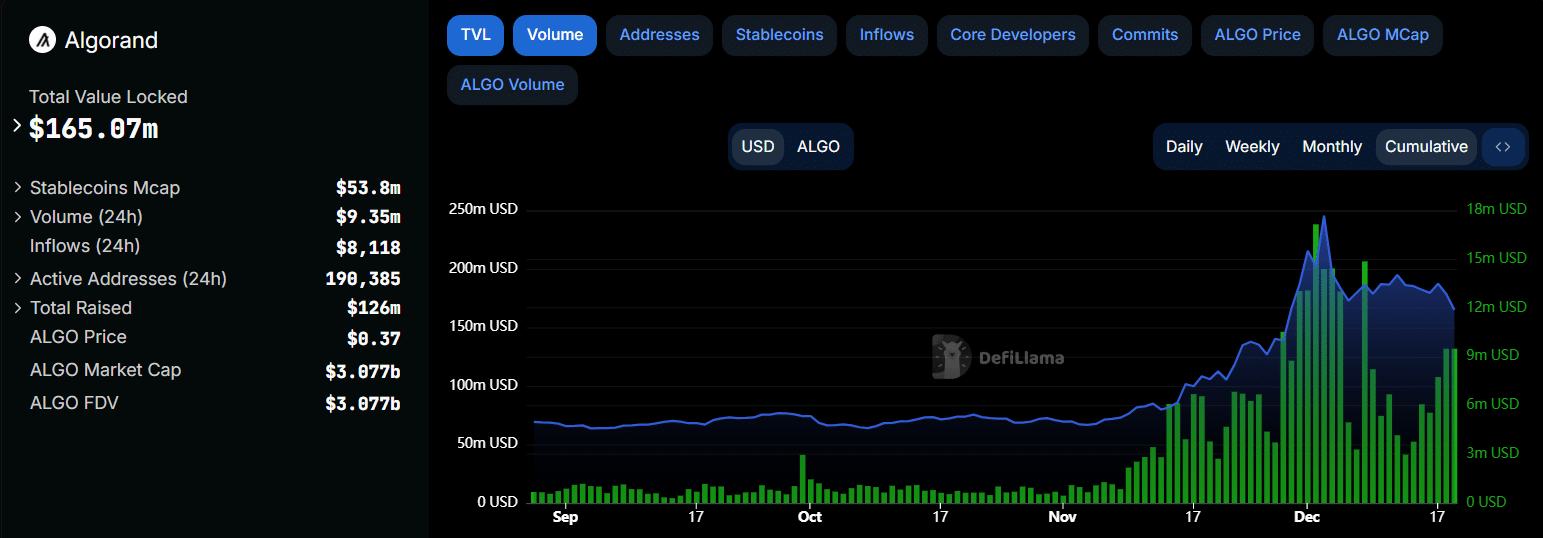

Declining DeFi activity could fuel the downtrend

As a data analyst, I’ve noticed an intriguing trend in Algorand’s Total Value Locked (TVL) over the past few weeks. Based on DeFiLlama’s reports, the TVL decreased from approximately $245 million to $165 million within a three-week period. This decrease appears to align with an increase in selling activity that has contributed to a downward pressure on the price graph.

Keep an eye on the DeFi Total Value Locked (TVL) as its potential increase might signal a shift in market trend. On the other hand, persistently decreasing DeFi trading volumes and activity may prolong the current bearish trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-20 13:11