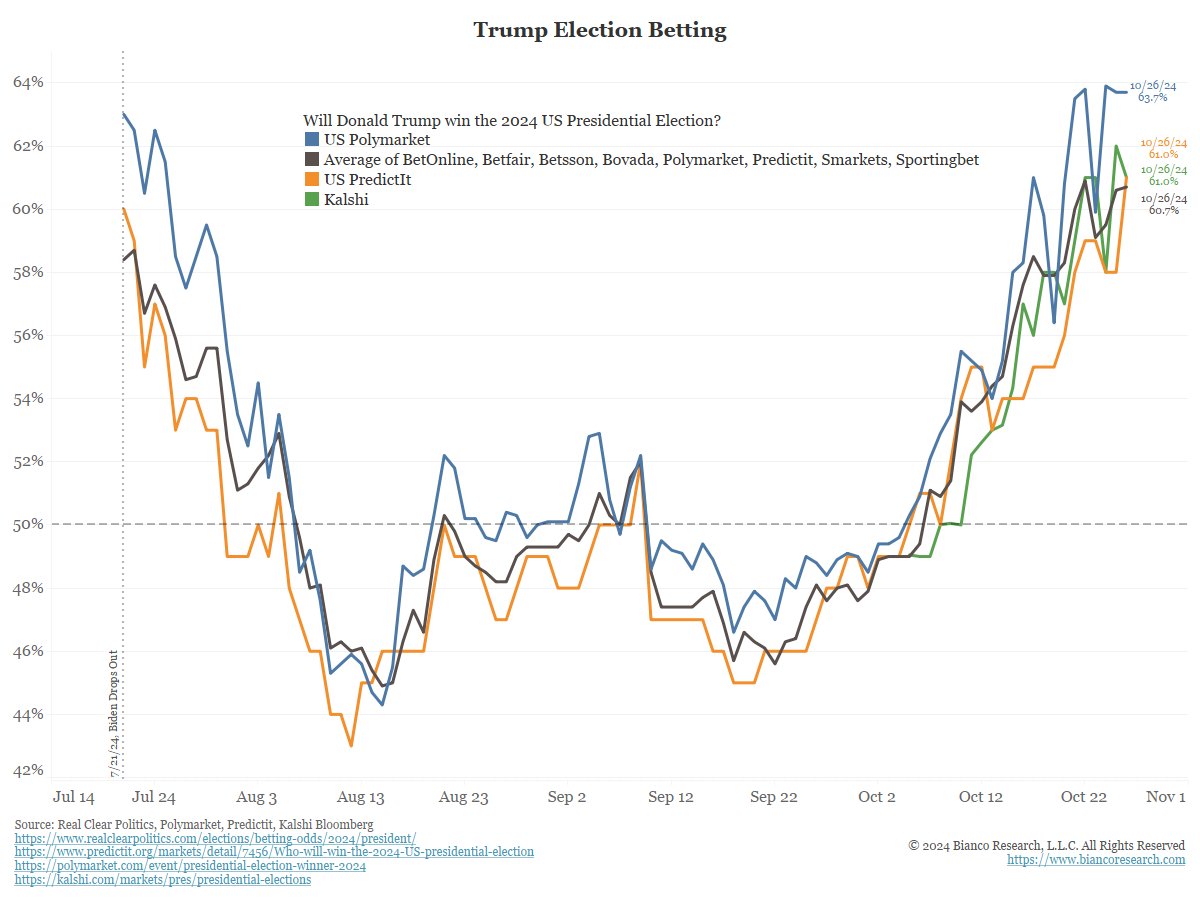

- Trump has maintained a lead over Kamala across all prediction sites and models.

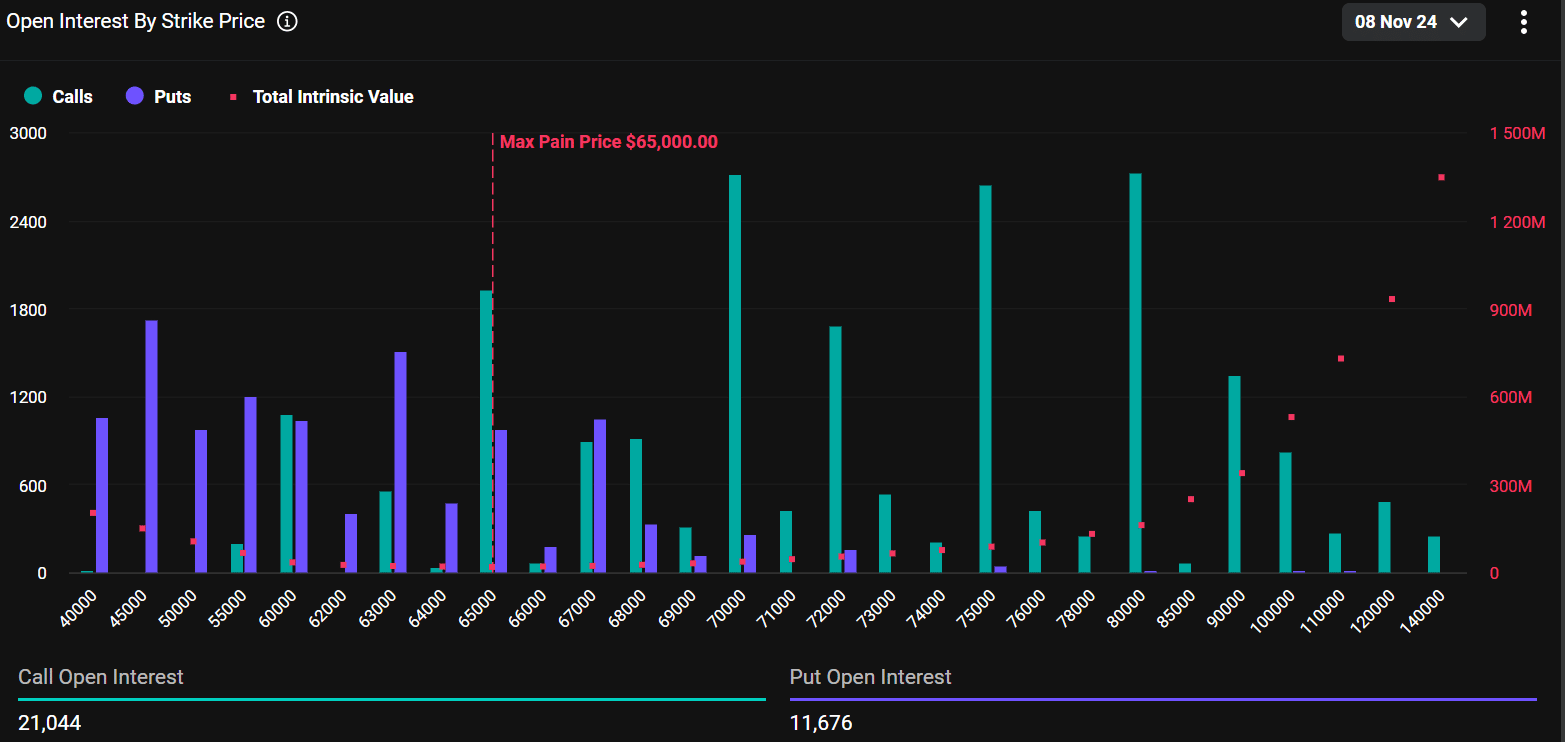

- BTC options traders were heavily bullish on the election outcome expectations.

As a seasoned crypto investor with a knack for deciphering market trends and a keen interest in politics, I find myself intrigued by this unique intersection of BTC and the upcoming US presidential elections. The consensus among top prediction sites and models seems to favor Trump, which has sparked a bullish sentiment among BTC traders.

According to all forecasting platforms and leading analysts, it appears that the candidate favorable towards Bitcoin [BTC], Donald Trump, has a greater likelihood of triumphing in the forthcoming U.S. Presidential election.

As per the most recent analysis by Jim Bianco from Bianco Research, it was estimated that prediction platforms such as Polymarket, Kalshi, PredictIt, and similar ones, had a 60% probability forecast for Donald Trump’s victory.

Potential impact on BTC

Despite platforms like Polymarket receiving criticism for suspected manipulation, other trusted prediction models pointed towards a strong likelihood of Trump’s victory. According to Bianco, top election forecasts such as Silver Bulletin and two additional well-regarded models indicated a 50% probability or higher that Trump would emerge victorious.

Not just Silver has a prediction model; Silver Bulletin, FiveThirtyEight, and The Economist Magazine also employ similar models, suggesting that Donald Trump’s chances of winning are estimated to be more than 50%.

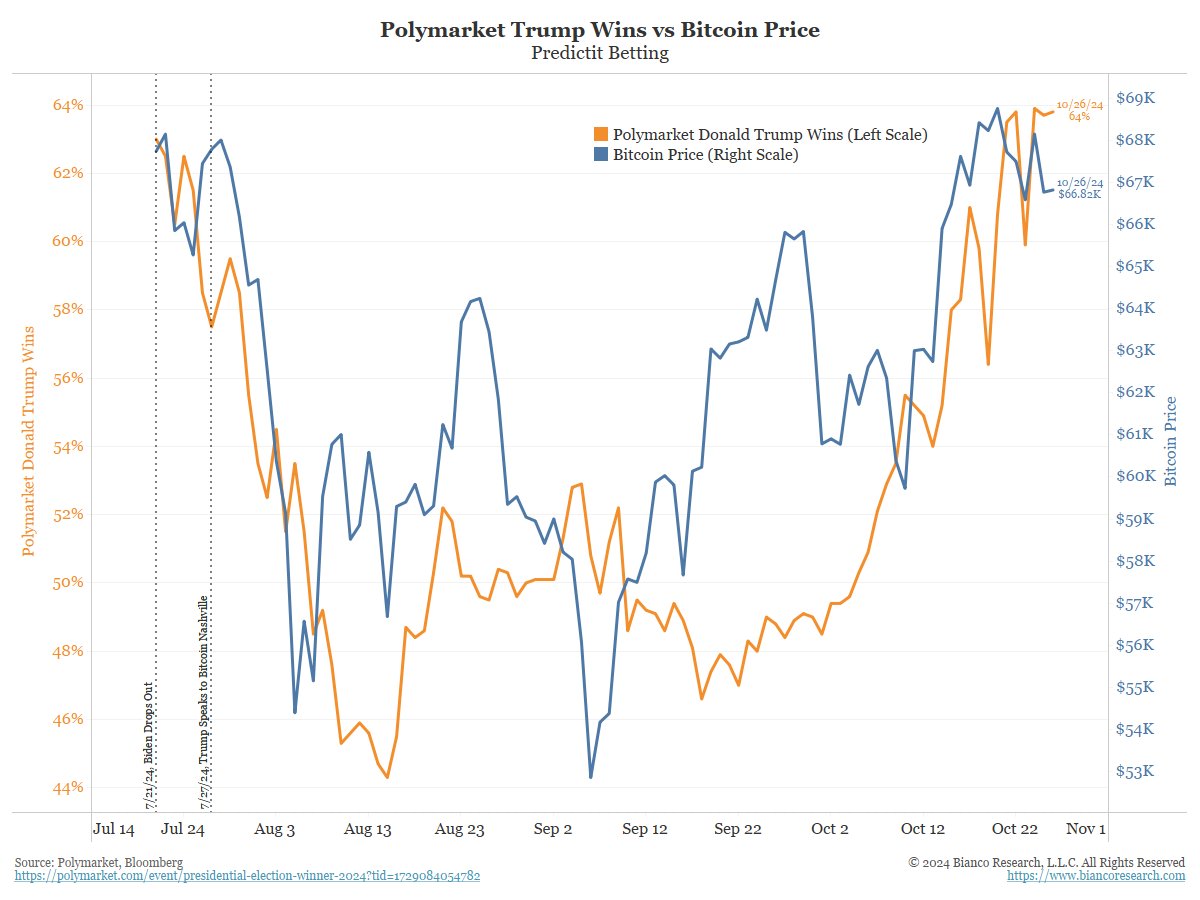

This above expectation has been deemed bullish by speculators in BTC markets.

Remarkably, Bitcoin saw a significant surge within the last few weeks coinciding with Trump’s chances increasing and reaching over 60% on Polymarket. This boost propelled Bitcoin close to $70K. Regarding this connection, Bianco labeled it an ‘election bet.’

“And another election play, although this relationship might be “fraying” in recent days.”

Market positioning

It appears that the optimistic outlook towards Trump’s victory may have had a noticeable effect on the Bitcoin options market. Last week, traders were estimating a 20% probability that Bitcoin could reach $80,000 by the end of November in the options market.

At the time of publication, the sentiment remained consistent. As per Deribit’s data, there was almost double the amount of Open Interest in call options (indicating a prediction of a price increase) compared to put options (indicating a prediction of a price decrease) for contracts ending by November 8th.

Additionally, the put/call ratio (PCR), which tracks options market sentiment, was at 0.55.

If the ratio exceeds 1, it indicates that more put options (options to sell) are being traded compared to call options (options to buy), suggesting a pessimistic or bearish outlook. Conversely, when the ratio is less than 1, there are more call options in circulation, which typically reflects a positive or bullish attitude towards the market.

To put it another way, the high 0.55 PCR reading suggested a very optimistic outlook in the options market, possibly because traders believed Trump had a good chance of winning.

Nevertheless, as Harris’s support for cryptocurrencies grew stronger, options traders in Bitcoin felt assured that the asset would reach a fresh peak (new all-time high), irrespective of the outcome of the US elections.

In the meantime, BTC was valued at $67K at press time, about 9% away from its ATH of $73.7K.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-28 07:03