-

ETH’s underperformance relative to BTC hit a yearly low

Coinbase analysts linked weak performance to investors’ interests and other factors

As a seasoned analyst with a decade of experience in the crypto market, I have witnessed the ups and downs, the ebbs and flows of this dynamic space. The underperformance of Ethereum (ETH) relative to Bitcoin (BTC) is a trend that has caught my attention, particularly given its persistence despite significant milestones such as ETH ETF approvals.

Since reaching its highest point in March, Ethereum (ETH), the world’s most significant altcoin, has consistently lagged behind Bitcoin (BTC).

In March, ETH reached a price point of $4,000, then tried to return to that level following the partial approval of US-based spot ETH Exchange Traded Funds (ETFs) later in the year. However, despite this, ETH has consistently lagged behind Bitcoin in terms of performance.

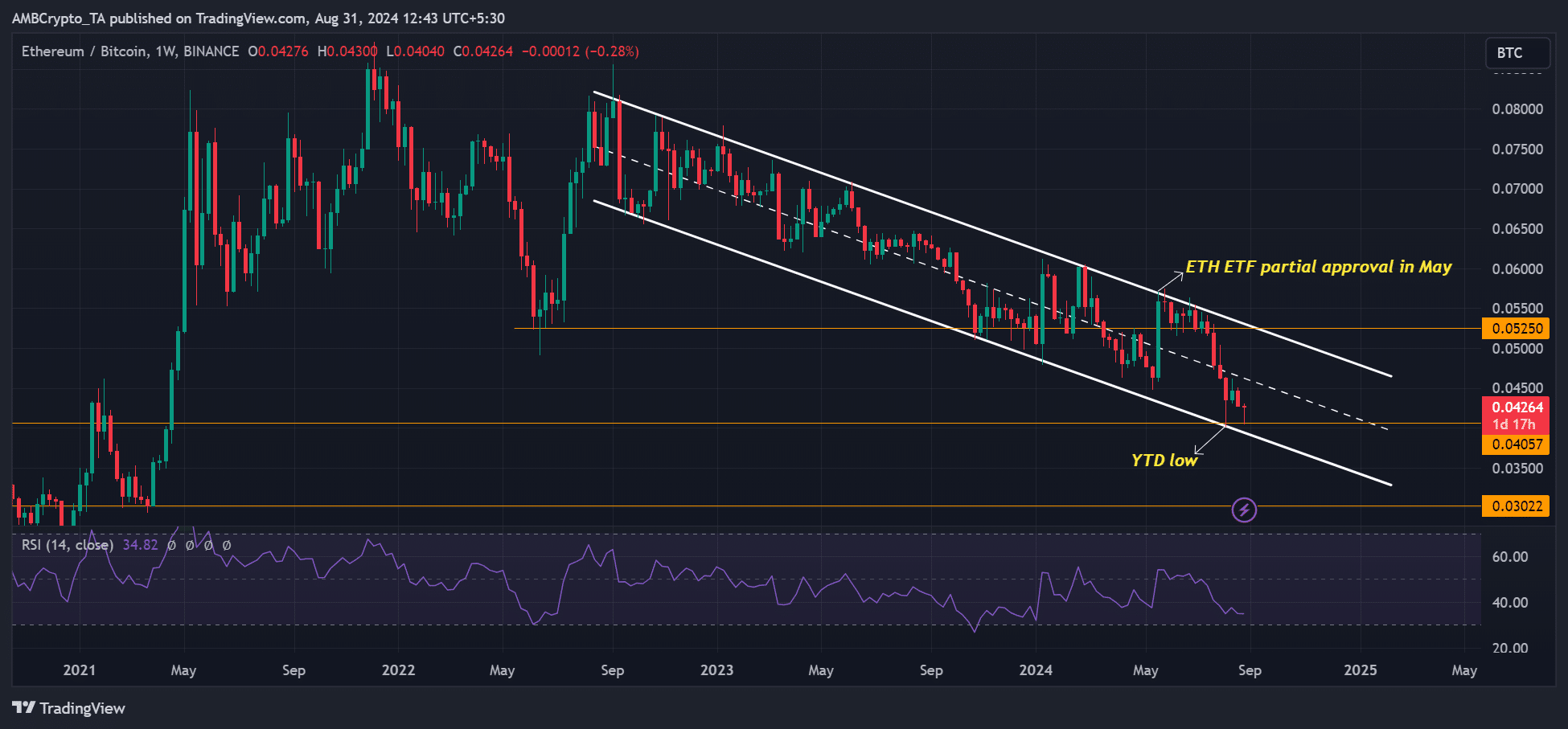

Despite gaining approval for its ETF in July, Ethereum’s performance remained below expectations, as evidenced by its recent all-time low this year on the ETH/BTC ratio at 0.040. This ratio measures Ethereum’s value in relation to Bitcoin.

Reasons for ETH’s dismal performance

In their latest weekly commentary, Coinbase analysts linked ETH’s weak performance to “net buyer interest divergence” based on ETF flows and other factors. Part of the report read,

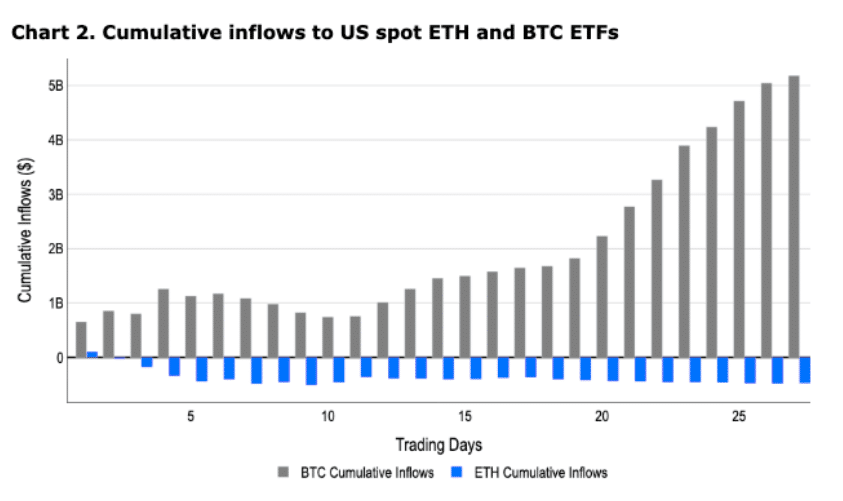

“In simple terms, the difference in investor interest is reflected in the daily flows of US spot ETFs for both Bitcoin (BTC) and Ethereum (ETH). Over a span of 13 days from August 15 to 27, ETH ETFs experienced nine straight days of withdrawals amounting to $115 million, while BTC ETFs saw inflows on eight out of those days, accumulating approximately $427 million.”

According to Coinbase analysts David Duong and David Han, Ethereum Exchange-Traded Funds (ETFs) have experienced a total outflow of about $477 million since they were first introduced. However, Bitcoin ETFs have seen approximately $17.8 billion in inflows since their launch.

The same divergent trend played out when adjusted to the first month of trading. In short, BTC ETFs saw massive demand, unlike weak interest in ETH ETFs.

Nevertheless, analysts pointed out that differences in initial release times could potentially influence the discrepancy observed as well.

In January, Bitcoin ETFs were introduced during a period of high market liquidity. Conversely, Ethereum ETFs debuted in July, right at the height of the summer’s liquidity shortage, when many traders were taking their vacations.

Analysts Han and Duong propose an alternative view, suggesting that the absence of a staking function in U.S. spot ETH ETFs, coupled with stiff competition from alternative smart contract platforms such as Solana [SOL], might have contributed to Ethereum’s setbacks.

1. Furthermore, a unified vision for the ETH ecosystem’s story and path may have dampened investor enthusiasm for the altcoin. In conclusion, the report mentioned recent harsh criticism leveled against Ethereum founder Vitalik Buterin, who has expressed reservations about “pure DeFi” as a primary driver of crypto expansion.

Based on expert opinions, having differing perspectives and a disjointed concept may complicate investors’ ability to grasp Ethereum and its underlying worth.

As a researcher delving into the world of Ethereum, I’ve noticed that the divergent perspectives among key influencers can sometimes complicate the interpretation of Ethereum’s (ETH) story and trajectory. This might be especially puzzling for those new to this particular sector.

Currently, Bitcoin is being traded at approximately $58,900, which represents a 20% decrease from its peak of $73,000 in March. On the other hand, Ethereum’s value stands at around $2,500, marking a 38% drop from its March high of $4,000.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-31 22:15