- AAVE has a significant number of holders in profit, despite fall in large transactions and exchange outflows

- A potential bullish surge has been building as profit-taking addresses hold firm

As a seasoned researcher with years of experience navigating the cryptosphere, I find myself intrigued by the resilience of AAVE amidst the recent market fluctuations. With 60% of holders in profit and maintaining their positions, it’s as if they’re playing a game of crypto-chicken, refusing to blink first.

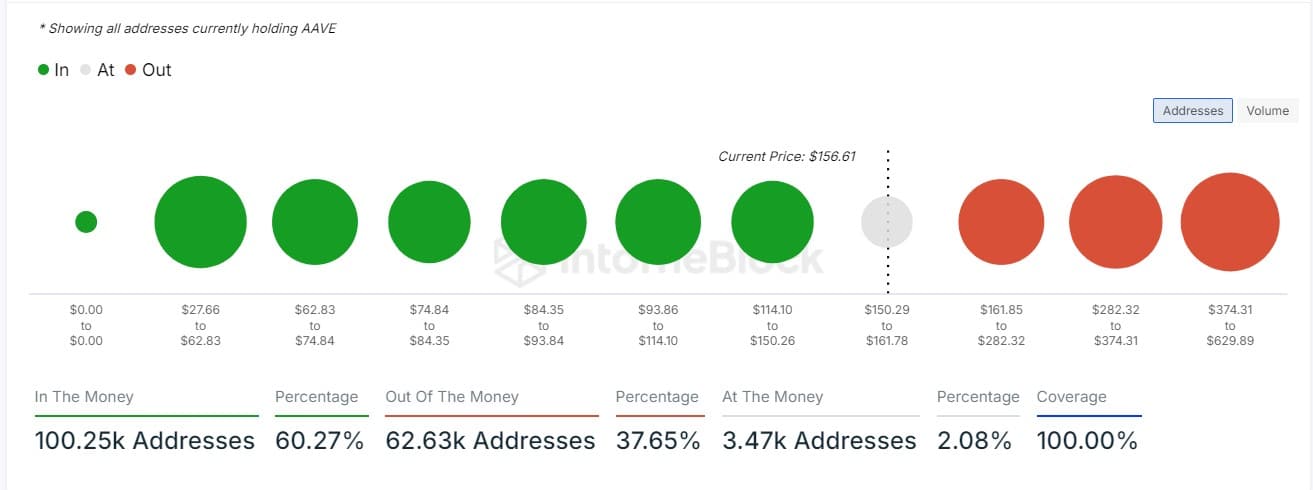

Despite recent shifts in AAVE’s transaction activity, 60% of its holders remained in profit.

Despite a decrease in significant transactions and withdrawals from exchanges within the past day for this cryptocurrency, these aspects could significantly influence the developing market opinion.

Therefore, it’s beneficial to examine more closely how these performance indicators might impact the bullish trend displayed by AAVE on its price graphs.

AAVE profitable holders hold strong

Currently, as I’m typing this, approximately 60% of AAVE holders are enjoying a profit – Showing a remarkable resilience despite the drop in high-volume transactions. This implies that the asset has demonstrated enough strength to maintain the majority of its holders in a profitable position.

Generally speaking, when a greater number of investors are making profits, there’s less urge to sell since they continue to keep their investments.

Declining large transactions – A temporary pause?

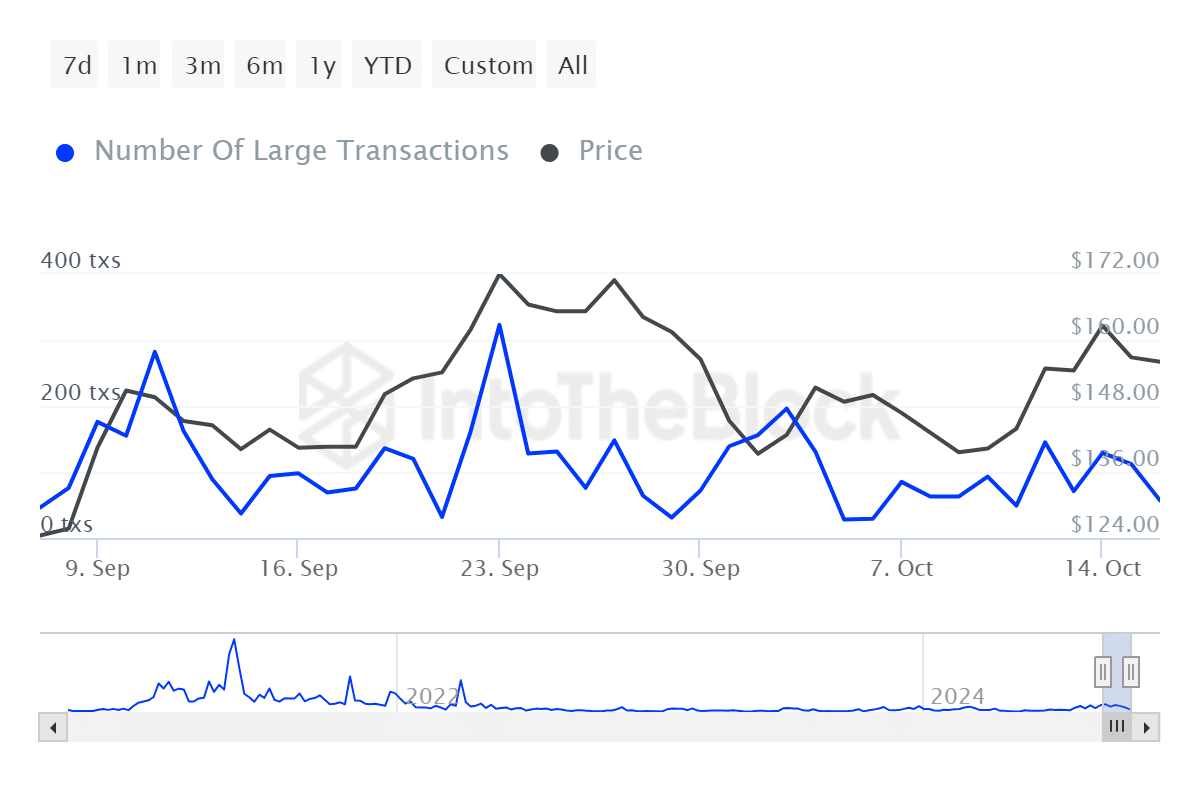

For the past day, large transaction activity within AAVE has decreased by approximately 52%. This reduction could indicate that big players like whales and institutional investors are adopting a more cautious approach.

Significant trades often lead to significant changes in prices, but decreased trading could suggest that investors are adopting a cautious stance and preferring to observe before making further moves.

Exchange outflows slow down

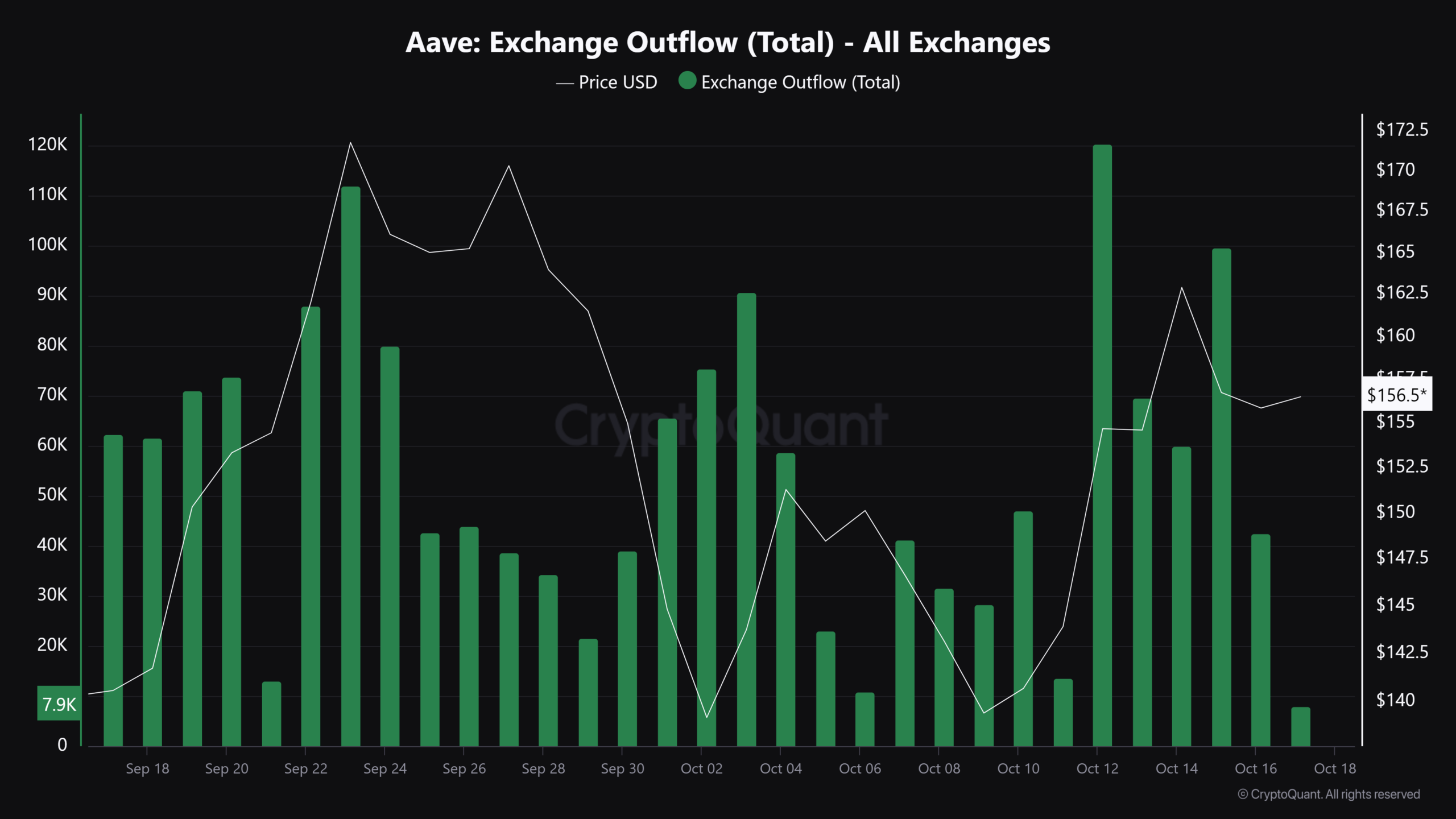

In addition to a decrease in significant transfers, there has been a softening of withdrawals from the exchange. Historically, large outflows have suggested that investors are transferring their assets to offline or “cold” wallets. This trend is often seen as a positive signal for bullish investors who anticipate further growth in the market.

Recently, a decrease in outflows could indicate that investors are adopting a more cautious approach, perhaps choosing to keep their funds on exchanges as they await brief market swings before making further moves.

Will AAVE’s bullish momentum keep growing?

Although many Aave token holders continue to see profits and the flow of exchanges is decreasing, the market indicators for AAVE are not just pointing towards a bullish trend.

A decrease in big deals could temporarily reduce market turbulence, but the ongoing profitability among investors might foster positivity.

The merging of these two powers could potentially establish a solid foundation for AAVE’s continued growth in bullish trends over the coming period.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-18 09:11