- The Coinbase premium gap metric accurately projected another Bitcoin demand zone

- Bitcoin exchange flows and whale activity confirmed that liquidity is once again in favor of the bulls

As a seasoned crypto investor with a knack for interpreting market trends and on-chain data, I find myself intrigued by the recent developments in the Bitcoin market. The Coinbase premium gap metric, a tool I’ve come to appreciate for its accuracy in predicting demand zones, has once again proven its worth. Coupled with the confirmation of strong liquidity in favor of the bulls through exchange flows and whale activity, it seems we might be on the cusp of another short-term rally.

It appears that Bitcoin might soon experience another brief surge in price, even though it’s had difficulties sustaining a bullish trend recently. As we near the end of the first half of October, the anticipated Uptober hasn’t quite materialized, with a counter-trend happening instead.

This week, Bitcoin’s decline and dropping below $60,000 might have dampened hopes for a bullish October. Yet, a recent examination by CryptoQuant indicates a robust bullish trend could still materialize in the near future, potentially starting already.

Based on their analysis, CryptoQuant suggests that Bitcoin is presently experiencing an accumulation stage. This notion stems from the Coinbase Premium Gap indicator. The analysis indicates that whenever the Bitcoin Coinbase premium has fallen below -50, there’s been a significant increase in accumulation.

Could it be possible that the decrease in the Bitcoin Coinbase premium gap to less than -100 indicates a significant increase in accumulation?

Bitcoin demand outweighs sell pressure

Bitcoin’s price action so far this week aligns with the analysis.

At the moment of reporting, the cryptocurrency was being exchanged for approximately $63,667, following a rebound of more than 6% from its lowest point this week on Thursday. This significant recovery underscores robust interest in the market at and below the $60,000 price level.

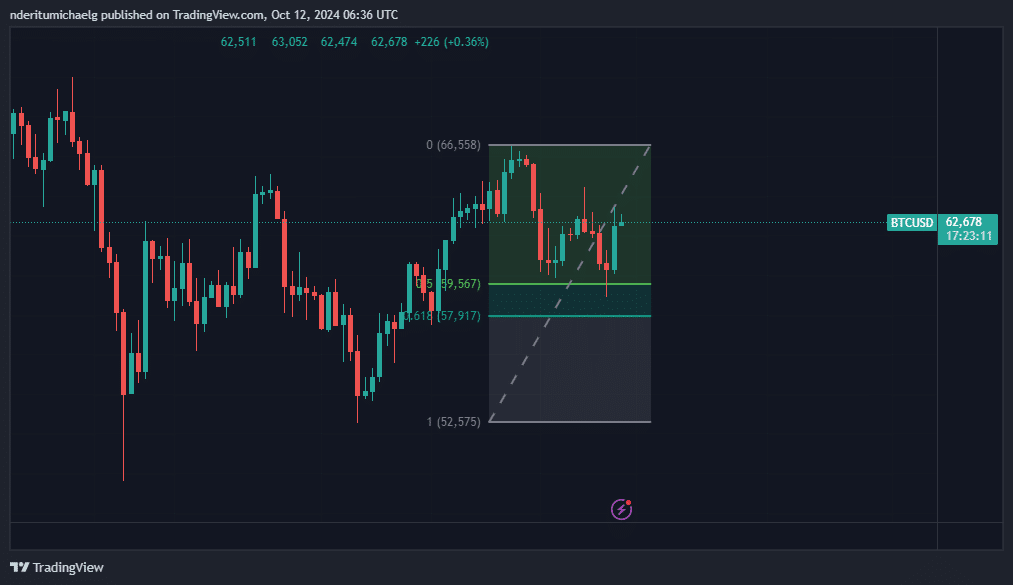

It’s important to mention that the robust bullish trend resumed following the price test at the 0.5 and 0.618 Fibonacci level, which were established by the lowest and highest prices recorded in September.

This implies a strong possibility that the accumulation or demand could resurface following another test of this area.

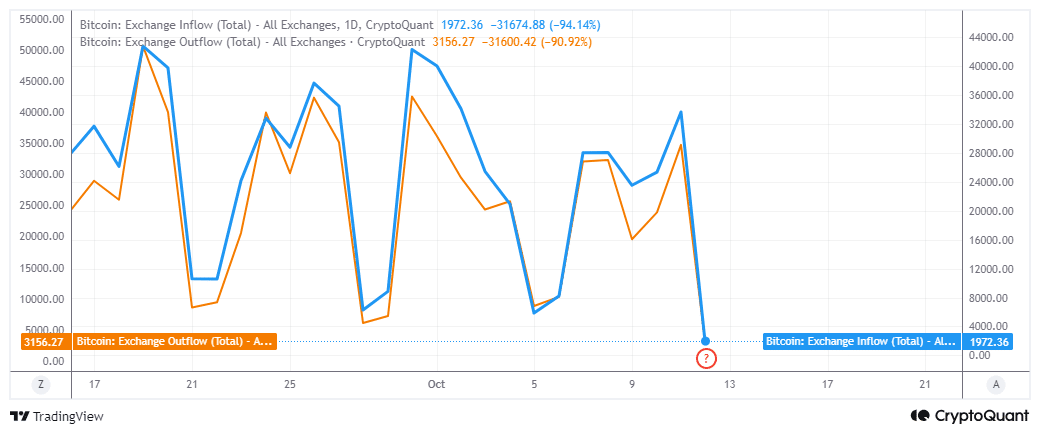

After falling below $60,000, the difference between Bitcoin inflows and outflows increased significantly. In the past 24 hours, Bitcoin exchange outflows reached 3156 BTC, which is a substantial increase compared to the 1972 BTC during the same period. This suggests that there may be more demand for buying Bitcoin than selling it.

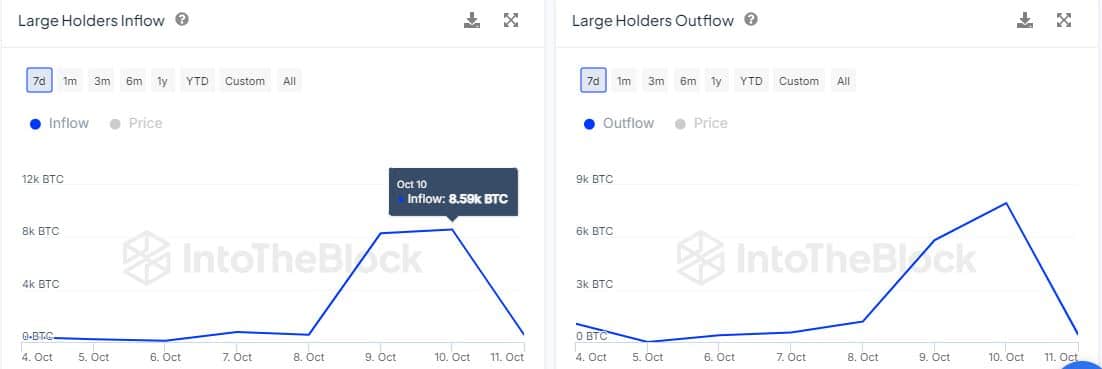

On-chain data also confirmed noteworthy whale activity this week.

During the past week, we noticed a considerable increase in Bitcoin transfers by significant investors, reaching a high of 8,590 BTC on October 10th. This inflow was notably greater than the peak outflow of 7,960 BTC among these large investors during the same timeframe.

Over the past while, there’s been a slight decrease in the size of incoming large-scale funds. Yet, these inflows remain greater than outflows, suggesting an increase in whale liquidity overall.

As a crypto investor, I’ve noticed some intriguing trends suggesting Bitcoin could potentially see another price surge. Yet, it’s uncertain if this upward swing will continue beyond the immediate future. Nevertheless, the recent rebound indicates that prices below $60,000 might still present an attractive discount at this point.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-10-13 00:07