- The altcoin market cap showed a slight recovery to $867 billion after a significant drop.

- The weekly 200 EMA line was tested.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous market cycles and fluctuations. While the current state of the altcoin market may seem daunting to some newcomers, I find it intriguing and full of potential for those who can navigate its complexities.

Over the past few months, there’s been a major change in the altcoin market. Reaching a peak of $1.26 trillion in March, the value of altcoins has since taken a sharp dive, dropping down to around $723 billion.

Although we’re currently experiencing a slump, recent data suggests a revival, as the market capitalization has bounced back to an impressive $867 billion.

Altcoin market movements

As a crypto analyst, I recently delved into understanding the current market dynamics, offering insights that shed light on the ongoing trends.

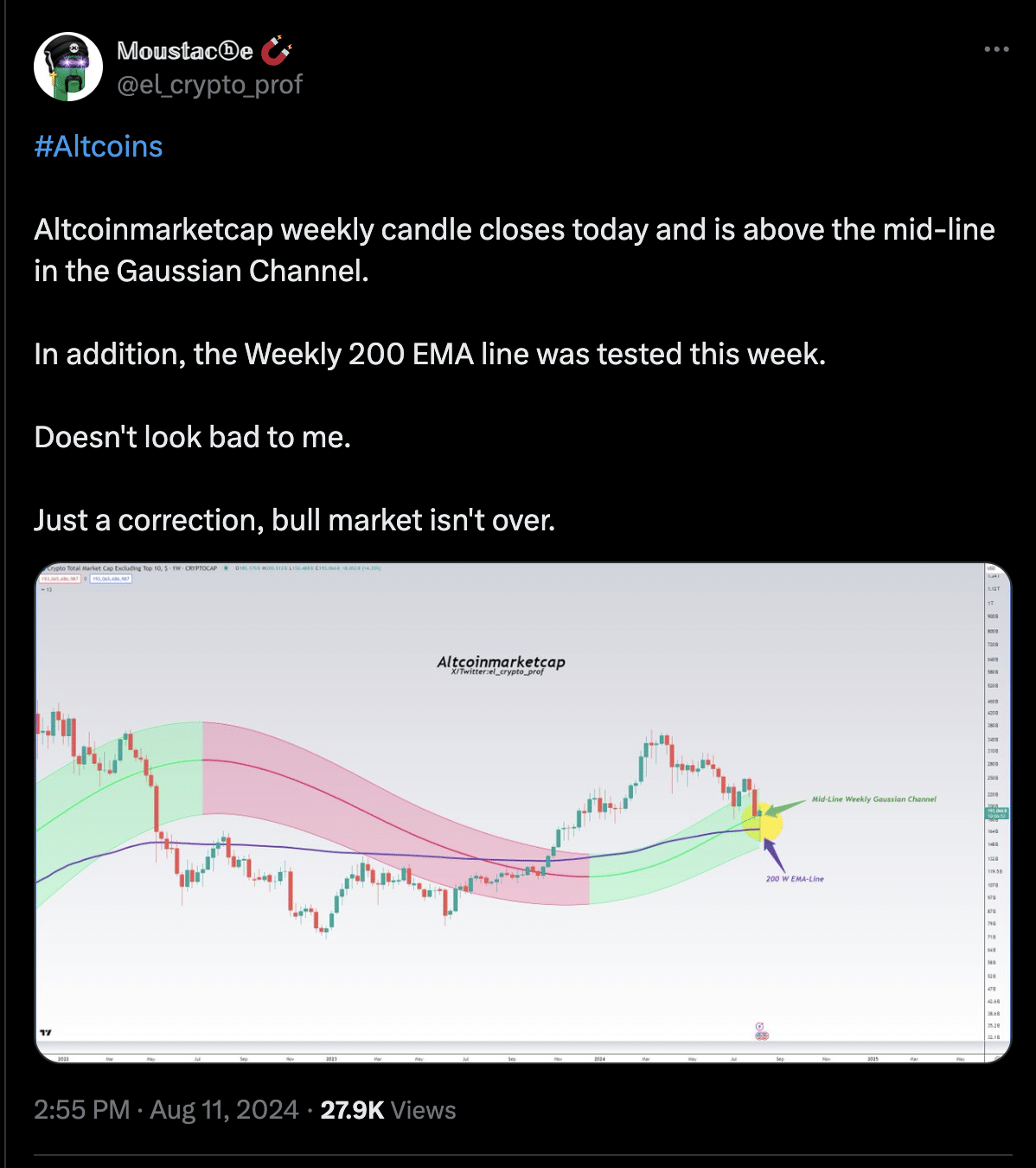

Noticing the weekly trend of altcoins’ total market value, Moustache noted that the closing price for the week was moving above the middle line in the normal distribution channel.

Having spent years in the financial markets, I have come to rely heavily on technical indicators as valuable tools for analyzing price trends and identifying potential opportunities. One such indicator that has proven particularly useful is the moving average, which helps me pinpoint the highs and lows of price movements over a specified period. This allows me to make more informed decisions when it comes to investing in stocks or other assets. As someone who values precision and accuracy in my investment strategies, I find the moving average indicator to be an essential component of my overall approach.

Additionally, the 200-week Exponential Moving Average was examined, indicating a possible trend towards stabilization or potentially a recovery.

As an analyst, I propose that the market’s consolidation above these significant technical thresholds might be suggesting a mere correction, instead of signaling the conclusion of the ongoing bull market.

Case study: Cardano’s market performance

Delving into specific altcoins like Cardano (ADA) can offer a clearer perspective of the overall market movements. Known for its advanced technology and dedicated community, Cardano isn’t exempt from experiencing the ups and downs of the market.

Currently priced at $0.335 as of now, Cardano (ADA) has seen a decrease of 5.7% in the last 24 hours and a larger drop of approximately 20.2% over the past week.

This case highlighted the sharp correction that recently occurred in the overall altcoin market.

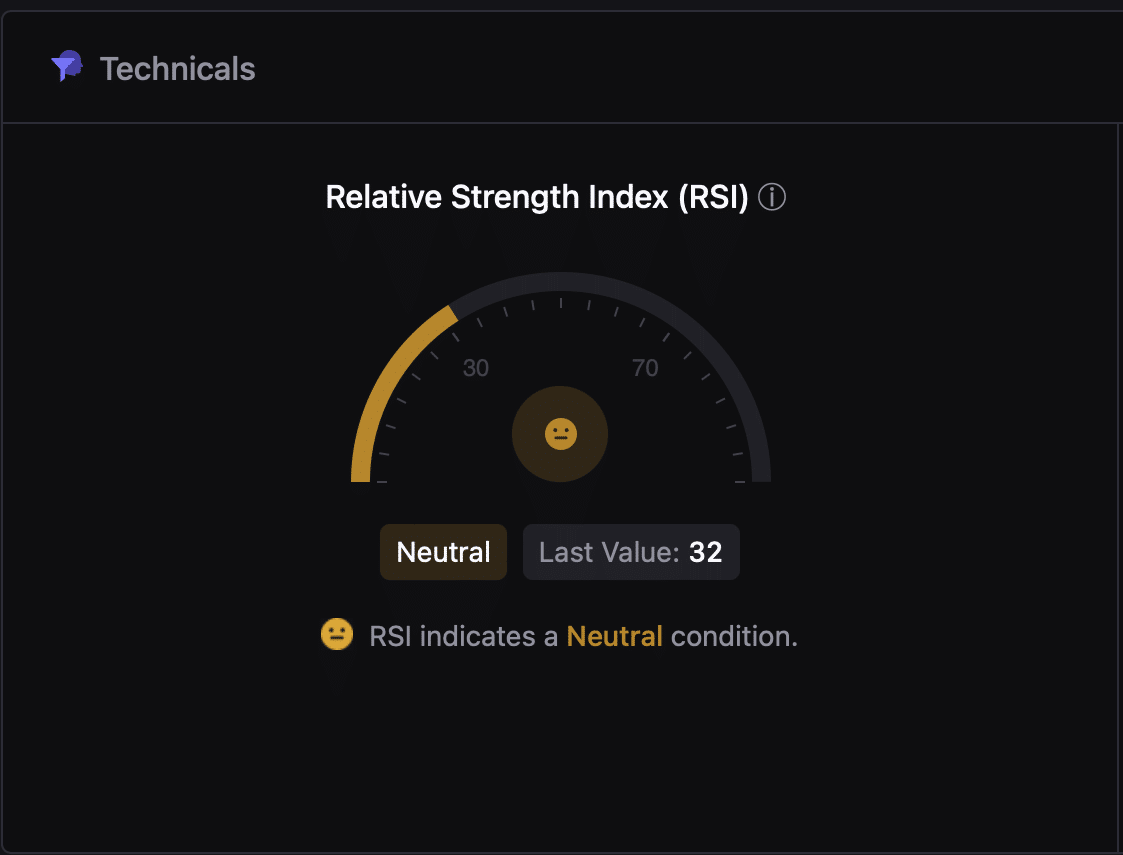

Fundamentally speaking, the Relative Strength Index (RSI) – a tool that gauges the rate and direction of price fluctuations – plays an essential role.

In terms of Cardano, its Relative Strength Index (RSI) stood at 31. Generally speaking, an RSI of 31 suggests that the asset is neither experiencing significant buying pressure (overbought) nor selling pressure (oversold), offering a neutral signal to investors observing the market.

It seems that the current situation may appear pessimistic, but there’s a chance for improvement if we consider larger market trends.

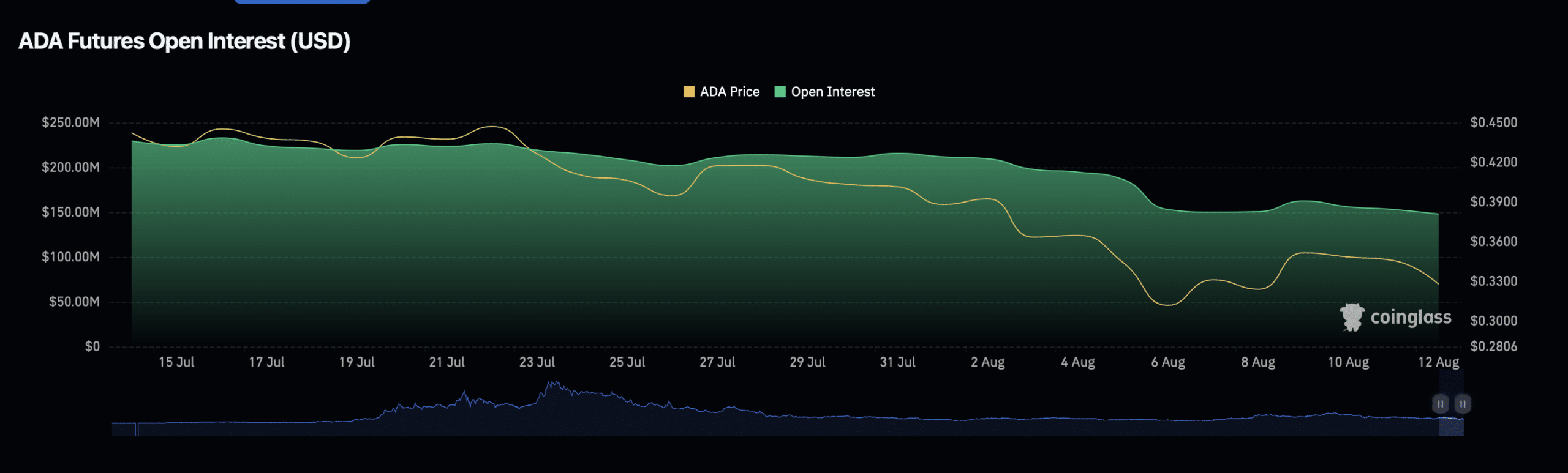

Additionally, it’s worth noting that the Outstanding Contract Positions in Cardano, representing the unresolved derivative agreements like Futures and Options, have experienced a substantial change.

Over the last 24 hours, it experienced a 4.77% growth and now stands at $161.27 million. Concurrently, the value locked within these contracts witnessed a significant jump of 86%, reaching $236.86 million.

As a researcher, I find these measurements serve as signs of escalating trader activity and frequently predict fluctuations in price dynamics.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-13 05:12