-

Altcoin dominance has declined by 15% in the last month.

The demand for ETH remained significantly low, putting the altcoin at risk of a further price decline.

As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of altcoin dominance fluctuations and Ethereum’s price swings. The recent 15% decline in altcoin dominance within the last month has left me wary, especially considering Ethereum’s current situation.

The proportion of the total cryptocurrency market represented by altcoins has dropped significantly over the past month. Currently, their share stands at approximately 9.88%, marking a 15% decrease compared to a month ago, as indicated by TradingView data.

The proportion of the overall cryptocurrency market that is controlled by altcoins, not including Bitcoin (BTC), is referred to as altcoin dominance. A decrease in this measure implies that the collective market value of altcoins has been shrinking in comparison to Bitcoin.

As an analyst, I would interpret this situation as follows: I believe investors are shifting their resources from altcoins towards Bitcoin due to its perceived safety and stability as an investment asset.

Altcoin dominance waning?

As a researcher studying cryptocurrency markets during periods of consolidation, I’ve observed that the dominance of alternative coins (altcoins) tends to decrease in favor of Bitcoin. This occurs when altcoins experience losses in value or struggle to draw investor attention.

From my perspective as a researcher, BTC‘s supremacy hasn’t experienced any substantial expansion over the past month. Currently, its worth accounts for 55.36%, representing a decrease of 1.03% within the last month and 0.69% in the previous week.

As a crypto investor, I’ve noticed from AMBCrypto’s report that Bitcoin’s (BTC) decreasing dominance can be attributed to its encounter with significant resistance at around $70,000 in price.

ETH remains at risk of decline

Currently, Ethereum (ETH) is priced at $3,561 based on market data obtained before this statement was composed. As reported by CoinMarketCap, there has been a significant increase of 14% for Ethereum over the past month, an impressive gain despite the overall decrease in the influence of altcoins within the crypto market.

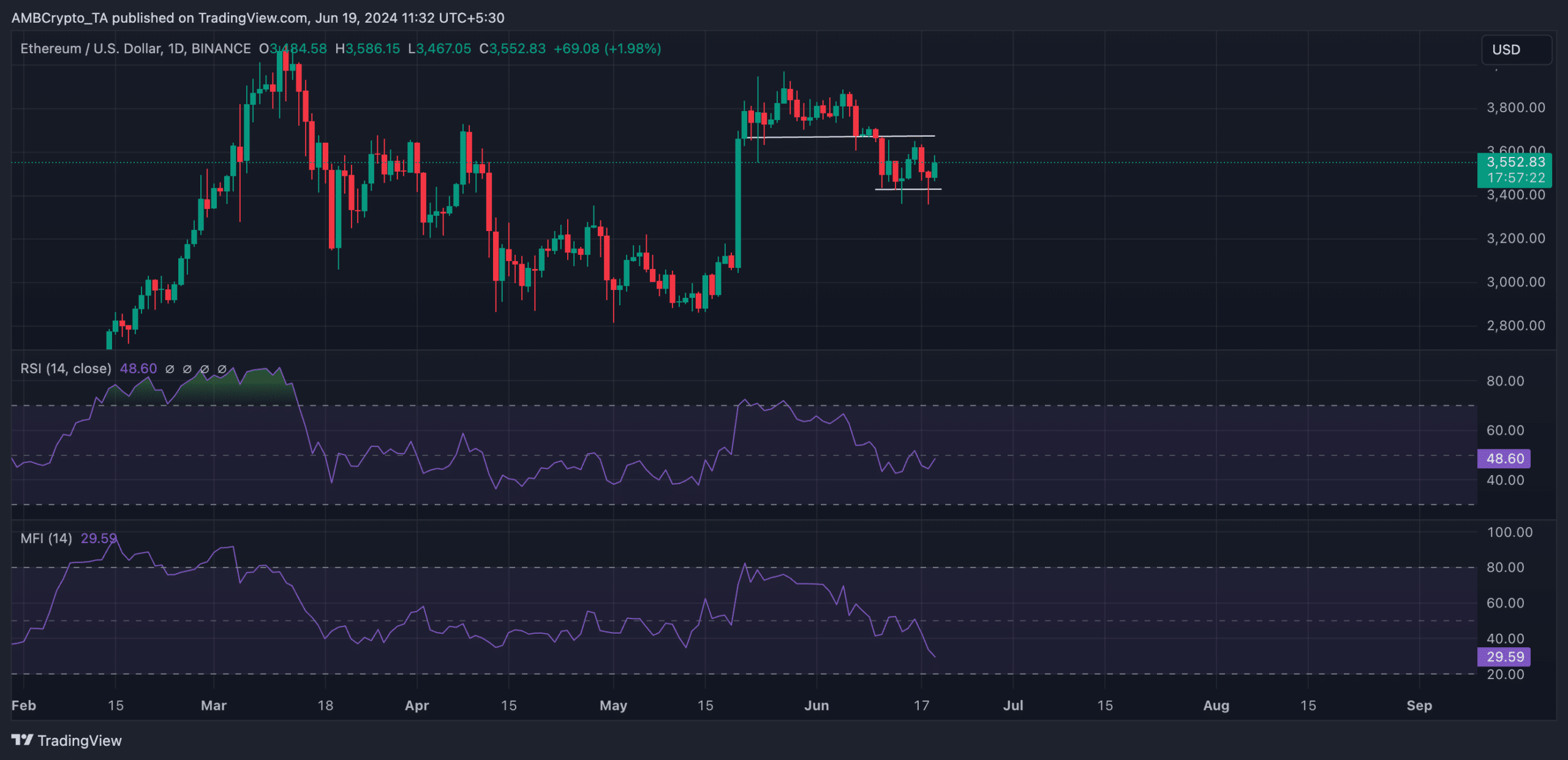

On examining the day-to-day price movement of the coin, it became clear that on June 10th, the coin fell beneath the previous support of $3693, transforming this level into a new resistance.

Despite only experiencing a 1% increase in price over the past week, Ethereum’s value has fluctuated between certain limits. A new resistance point has emerged at $3693, while a support level can be found at $3428.

Affirming the widespread downtrend for Ethereum among market players, its significant momentum signals were situated beneath their median levels at the point of composing this text.

The RSI value for Ethereum stood at 48.60, whereas its Money Flow Index amounted to 29.59.

These metrics monitor market trends by evaluating the recent price fluctuations of an asset, indicating whether it is underbought or overbought.

As a researcher observing the market at this moment, I’ve noticed that selling forces are more pronounced compared to buying forces based on current data.

Read Ethereum’s [ETH] Price Prediction 2024-2025

If the decline continues, ETH risks falling to $3496.

However, if invalidated, its price might rally toward $3658.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-19 13:11